Office

Office

2 & 30 International Boulevard

Modern flex-office near Canada’s largest international airport

A prudent person sees trouble coming and ducks.

A simpleton walks in blindly and is clobbered.

— Proverbs 22:3

King Solomon’s words of wisdom have been passed down to us for 3,000 years. They still resonate, especially in this modern translation,1 even though the “trouble” is no longer invading Assyrians or Babylonians but the type of danger we bring on ourselves through an all-too-human combination of ingenuity, hubris and ignorance.

Watch any movie from the 1930s to the 1960s and you will see actors inhaling tobacco smoke with abandon. We know better now. Like the generational awareness of the harm caused by tobacco products, real estate owners have gradually become aware of the dangers lurking in certain building materials and contaminated soil. Starting in the 1960s, societies have spent fortunes cleaning up “miracle products.” Asbestos, PCBs, dry cleaning solvents, herbicides and lead pipes were all considered state-of-the-art technologies at various points in human history. None of these inventions were designed with the intention of killing people. They all started with a noble purpose – whether suppressing catastrophic fires, insulating transformers, cleaning wool suits or producing a pleasing nicotine buzz that also curbed the appetite. The “externalities” associated with societal damage from the use of these products took decades to discover and billions to eradicate.

Greenhouse gas emissions share a common ancestry with these miracle products. Heating buildings with diesel fuels, running gas lines through city streets, producing electricity with coal-fired plants—these were all logical, economical, and sensible solutions to the problem of bringing energy to homes, businesses and buildings of all types. The industrial revolution accelerated the growth of cities and raised the quality of life for millions of people by dragging them out of rural poverty. As we now know, society’s dependence on fossil fuels creates new problems which must be dealt with.

The recognition that miracle products can carry hidden (or not so hidden) dangers follows a predictable pattern. Here is what the step-by-step process often looks like:

Evidence and awareness. An environmental problem often requires decades of scientific study and mountains of evidence to convince people that a change is necessary. Even as this evidence accumulates, vested interests organize counterattacks to convince society that the problem is non-existent or over-stated. Eventually the harm to human life becomes so obvious that denial becomes a “fringe position.”

Market demand. In many cases, the process of partial “market adjustment” can begin ahead of government action. Voluntary data collection and industry-led reforms start the slow process of change. In the case of greenhouse gases, the marginal contribution of each emitter is so small, and so embedded in society, that government interventions sometimes lag market-led shifts (e.g., the adoption of LED lighting or heat pumps).

Regulatory response. Yet, government interventions are almost always needed to accelerate and complete behavioral change to truly eliminate harm to the environment and to human life created by “externalities.” These regulations and policy responses often get pushback as competing outcomes are debated in the political arena. Economists agree that putting a price on carbon would be the most efficient and effective solution, but a market mechanism for carbon pricing requires government intervention — in the form of a carbon “tax” or to set up an emissions trading scheme.

Benchmarks and best practices. Eventually, the rise of data benchmarks and peer group comparisons begins to shed light on who, where and how successful “treatments” are applied to any environmental problem. Engineering and laboratory science helps inform this stage of the process, as does public health or industry group data. Integration with market investment processes and decisions leads to a focus on reversing years of damage to the environment and compliance with new regulations and guidelines. At this stage, market-driven and regulatory-driven changes start to converge.

Price integration. Feedback loops are established where type 1 errors (false positives) and type 2 errors (false negative—or overlooked problems) are exposed.2 In loosely regulated situations like climate change, the efficient market hypothesis (EMH) takes hold as the change process gets partially or fully priced by consumers and producers. Economists and policy analysts favor the practice of placing a “price” on an externality to compensate society for the harm. In practice, though, compensatory payments to offset environmental damage are often decided through the courts and litigation.

Continued market and regulatory evolution. The enforcement of tighter regulations also follows its own trajectory depending on the governance structure of a particular country or urban jurisdiction and the toxicity of the problem. The discipline of epidemiology, using population data and public health analysis, is especially helpful at this stage of refining the policy solutions.

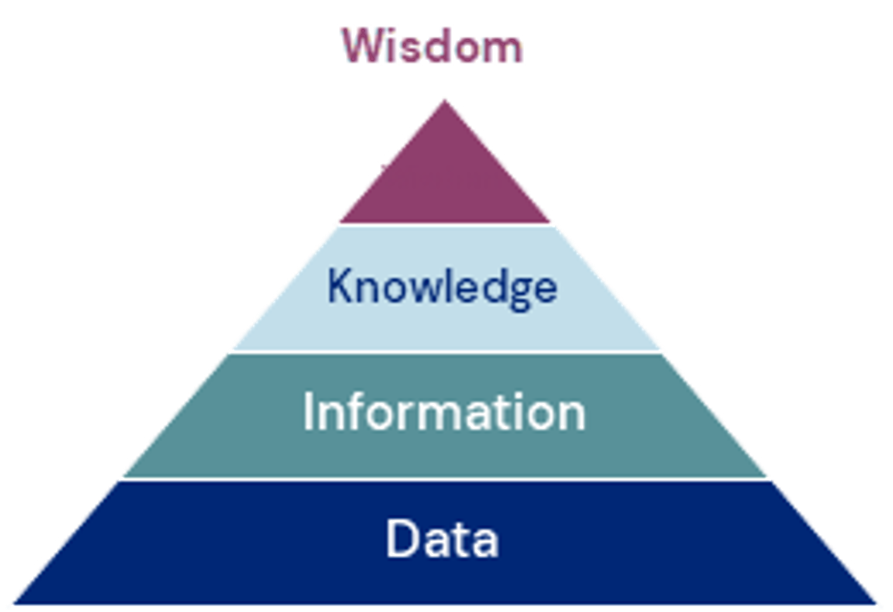

The Transition from “Data” to “Wisdom”

For the de-carbonization of buildings, various markets and countries are well into Step 3 (Regulatory Response) and Step 4 (Benchmarks and Best Practices). In Europe the “theory of change” is focused more on EU-wide or national policies to promote energy disclosures through top-down regulatory solutions. In the United States, the emphasis is based more on voluntary pledges, market solutions and regulations that are based on specific local jurisdictions. In most developed countries, steps 5 (Price Integration) and 6 (Market and Regulatory Evolution) are underway, but both have a long way to go.

The rise of real estate sustainability benchmarks (like GRESB) has accelerated in recent years. In many cases, they have expanded to include social factors and tenant well-being alongside environmental metrics. The next hurdle, though, is to establish materiality tests that infuse meaning, and determine financial impacts based on the volumes of reporting that the industry has started to produce and disclose.

Reading through sustainability reports often reveals the triumph of reporting and public relations over salience or relevance. The conjoint challenges of reducing building emissions alongside improving the well-being of building users and the surrounding communities can be obscured by data denominated in less familiar metrics like tons of CO2 or Kilowatt hours. In time, and with experience, the emphasis will shift to what truly moves the needle on all elements of the “sustainable investing” paradigm—and which metrics give off misleading or meaningless “virtue” signals.

Financial metrics align most closely with the “fiduciary duty” of an investor. Moreover, stakeholders have decades of experience analyzing and interpreting financial data. It will take additional time and effort to convert environmental data into financial terms or to simply raise the consciousness of how to interpret energy and emission data in its own right. (LaSalle’s work on the “Value of Green” synthesizes studies of the evidence linking sustainability metrics and financial outcomes. An update on this work is below.)

In writing Proverbs, King Solomon gathered centuries of wisdom based on experience. In the modern world, we often believe that the steps to wisdom are built on a foundation of knowledge, information, and data. The famous “DIKW” hierarchy has been a mainstay of information sciences since the 1930s. Sustainability wisdom is still in the process of being formulated and likely requires more time to make progress. Fortunately, the foundations of this wisdom are already being put in place—first through data (the modern way to refer to many, many experiences), then information (organized and analyzed data), eventually leading to knowledge (patterns are identified and the “what” and “why” questions are answered) and finally reaching the status of accumulated wisdom (how to respond). This is a path that humans have traveled before. More lives are at stake this time around and the wisdom may not be easily agreed upon by all industries, countries and stakeholders. Nevertheless, the search for sustainability wisdom must continue and time is of the essence.

Revisiting LaSalle’s “Value of Green”

In September 2023, LaSalle published our ISA Focus report What is the value of green? Looking at the evidence linking sustainability and real estate outcomes. The report presents a framework on how sustainable attributes of properties can be viewed as both as drivers and protectors of value, along with showcasing findings from the broader literature. We continue to maintain a Value of Green tracker, monitoring research on this subject as it is produced. Some of the findings that have surfaced since the release of our initial report are worth highlighting:

Beyond the direct links between sustainability and historical investment performance in terms of return, rent and value premiums, more signals are emerging as available data on the topic grows, and becomes increasingly forward looking:

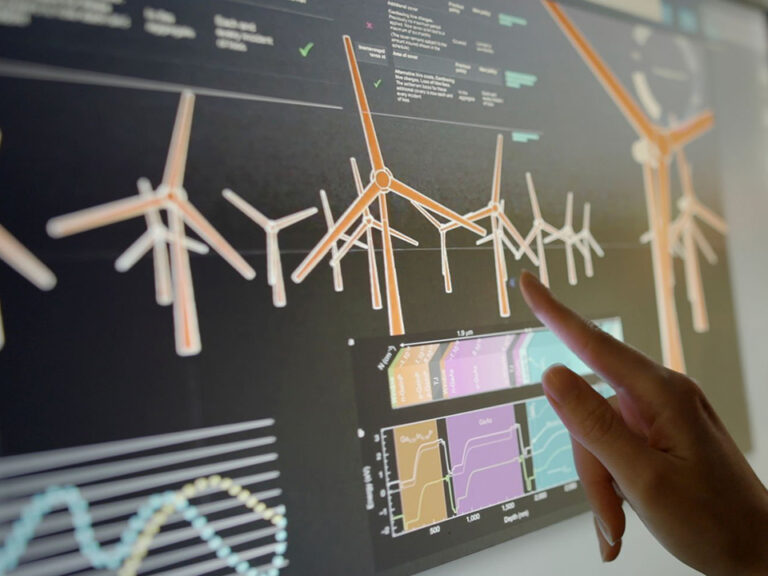

Beyond results based on backward-looking data, detailed case studies of investments into sustainable initiatives are being published. The JLL report “Future-Proof Your Investments“ showcased opportunities for sustainable New York offices; another example is CBRE’s report “The impact of on-site rooftop solar on logistics property values.”

Tobias Lindqvist

Strategist, Climate and Carbon Lead, London

Sources:

CBRE (March 2024) UK Sustainability Index Results to Q4 2023. CBRE

P. Torres, G. Bolino, P. Stepan (2024) The Green Tipping Point. JLL

T.Leahy (2022) London and Paris Offices: Green Premium Emerges. MSCI

P. Torres, J. del Alamo (July 2024) Future-proof your investments. JLL

D. Marina, J. Tromp, T. Vezyridis, O. Bruusgaard (July 2023) The impact of on-site rooftop solar PV on logistics property values. CBRE

O. Muir, Y. Chen, T. Metcalf et.al (Dec 2023) Green premium: Study of New York and London Real Estate finds strong evidence for a ‘green premium’. UBS

What can we learn from simulations?

The de-carbonization of buildings is taking place in a complex and ever-changing environment. It is a multi-dimensional problem replete with uncertain outcomes, regulatory change, shifting societal norms and markets, and the politicization of sensitive issues.

At the June 2024 MIT World Real Estate Forum, Professor Roberto Rigobon unveiled a “sustainability simulation” game patterned on his pathbreaking work on social preferences for the European Commission. The technique shows how the traditional economic conceit that we make “resource trade-offs” does not accurately capture how humans make decisions when faced with multi-dimensional choices.

In the simulation, the audience was given nine choices for different retrofit projects for a commercial building. Each choice resulted in simultaneous movement across three metrics that the audience had already established that they cared about — changes in NOI (profitability), CO2 emissions, and tenant satisfaction/well-being. The cost of the projects was amortized into the NOI calculations and the other metrics were also calibrated based on actual data from the US.

The simulation showed that a knowledgeable real estate audience rarely solves just for “pure profits” at the expense of tenant well-being or CO2 emissions. The simulation also mimicked reality—where sometimes profitability moves in synch with reduced CO2 emissions and other times it moves it moves in the opposite direction. The simulation was designed to show how the co-movement depends on the local market and the type of de-carbonization project. Tenant well-being and CO2 emissions could be implicitly linked to revenue when and if participants believe that occupancy, rents and capital raising are all interconnected.

Through their choices, the audience tried to optimize across all three priorities at once — leading to an interesting result that revealed their average willingness to “pay” to reduce a ton of CO2 emissions of about $200 ton. Yet, if asked directly how much they would pay to reduce a ton of greenhouse gas coming from a building, it seems unlikely that many would have volunteered to pay that much. This finding also shows how the language of profitability and returns is much more advanced than the metrics and concepts associated with either decarbonization or tenant satisfaction. And that all these metrics are linked, but not fully integrated in the minds of real estate professionals.

Only a few participants in the game focused only on reducing CO2 (at the expense of decent profits). And just a few focused exclusively on profitability at the expense of tenant satisfaction or CO2 emissions. This seems like a reasonable facsimile of what enlightened investors will do — especially when they know that their actions are being disclosed. As we learn more from these simulations, it is possible that policy makers will be able to refine the mix of incentives and regulations that govern the real estate industry.

Jacques Gordon

Cambridge, Massachusetts

LOOKING AHEAD >

Footnotes

1 The Message, translated from the Hebrew scriptures by Eugene Peterson (1993-2002).

2 These are all part of the learning that occurs with any “treatment hypothesis.” The science of public health provides solid evidence to weigh whether the “treatment” is helping, hurting or having no impact on the eradication of the underlying disease. In real estate, a good example of this is the gradual discovery that with certain types of asbestos, it is more dangerous to remove it than to “encapsulate” it in an existing structure. The science of “decarbonization” is still being established to determine whether, for example, the mass production of lithium batteries does as much harm as the burning of fossil fuels. For real estate and climate change, the “treatment” will likely focus on energy efficiency/ decarbonization interventions that are a combination of government penalties/incentives and voluntary actions. The effectiveness of these treatments will depend on compliance, market response, and how well interventions find acceptance through the political process.

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

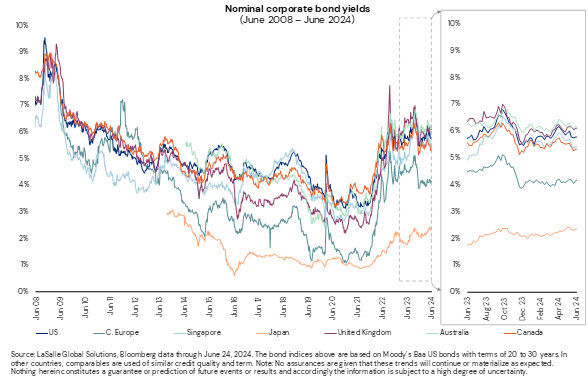

While traditional banks’ appetite for providing commercial real estate loans has declined, other lenders (including investment management firms such as LaSalle) have moved in to fill the funding gap. As a result, we have recently seen increasing interest from institutional investors in real estate debt.

But what is it about real estate debt that makes it a compelling investment? As the second largest of the “four quadrants” of real estate, it has a value in the US and Europe alone of approximately US $4.5 trillion, representing an enormous opportunity. Real estate debt historically has produced competitive risk-adjusted returns in addition to showing low correlation to other assets.

In our latest research, we examine the three-part case for investment, including:

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

“You take the blue pill—the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill… all I’m offering is the truth.”

– Morpheus to Neo, The Matrix (1999)

We published the global chapter of the ISA Outlook 2024 on November 14, 2023, just before euphoria about a potential ‘V’-shaped property market turnaround emerged. Interest rates fell quickly as financial markets priced in several US Federal Reserve (Fed) rate cuts in 2024. For a time, it looked as though our prediction that it would take a little longer for markets to digest a renewed spike in rates would not age well.

In this Mid-Year Update, however, we look back to find an outlook with an uncanny resemblance to that of six months ago. This is not because nothing has changed, but because the mood has gone full circle. The landscape remains characterized by interest rate volatility, soft fundamentals in some markets, and gaping quality divides, but also by pockets of considerable strength. Another factor that has not changed is that financial conditions (i.e., interest rates) remain the dominant driver of the market, and that political and geopolitical uncertainties are in focus in many countries (see LaSalle Macro Quarterly, or LMQ, pages 4-6).1

In this report, we discuss five themes we see driving real estate markets for the rest of 2024 and beyond. At our European Investor Summit in May, our colleague Dan Mahoney argued that—like Neo in the Matrix—we should take the red pill and endeavor to see the market as it is, not as we’d like it to be. Taking the red pill requires a realistic view on property values. It reveals as unlikely a return to an environment of ultra-low interest rates or uniformly benign fundamentals in the “winning” sectors.

But it does not mean that there will not be attractive investment opportunities. Unlike the bleak dystopia of The Matrix, there are many reasons for optimism, as well as signs that the coming months will come to be seen as a favorable investment vintage. That said, investing successfully will require a balance of big-picture perspective and granular discernment, and a mix of patience and willingness to take risk.

Over the past year, we likened the interest rate path in most markets to a strenuous mountain trek: the relentless climb (2022), the range-bound altitude of an alpine ridge line (H1 2023), the unexpected upward turn in the trail (Q3 2023), and the mountain meadow of cooling inflation and expected rate cuts (Q1 2024). More recently, there have been upward turns in the interest rates trail whenever there have been signs of sticky inflation in the US and other key countries.

One thing is for sure: No map exists for this trail. While interest rates have big consequences for real estate capital markets, they are extremely difficult to predict. We continue to caution investors against overconfidence in their ability to forecast the path of long-term interest rates.

Mercifully, falling rates are not a necessary condition for a robust recovery in real estate transaction activity. Despite interest rates remaining elevated, property markets are already showing signs of finding their footing, such as renewed US CMBS issuance and resilient deal volumes in many markets and sectors.2 A key reason for this is that wherever interest rates have spiked over the past two and half years, especially Europe and North America,3 real estate prices have by now adjusted downward significantly. The relativities between expected returns for real estate and those for other asset classes now look more appropriate than they have in many months; in other words, more of the market is at or near fair value.4

That said, while lower rates are not necessary for real estate capital market normalization, greater stability in rates than we have been seeing would no doubt help. Interest rate volatility is the enemy of a smoothly functioning private real estate transaction market. Excessive movement in borrowing costs during due diligence periods can lead to dropped deals and re-trades. Moreover, when rates are volatile, the conclusions of fair value models are also volatile, impacting both buyers’ and sellers’ assessments of appropriate pricing. Looking at recent trends in the MOVE index,5,6 interest rate volatility appears to be gradually easing but is still elevated relative to recent history (see LMQ page 13).

Increasing stability in rates is welcome, but for now it is reasonable to expect continued strains in real estate capital markets that create both challenges and opportunities. Such conditions can represent favorable entry points for debt investors (lenders), distressed equity players and core investors seeking entry points below replacement

Over the past half-year, interest rates have been increasingly influenced by widening divergences between near-term growth, inflation and monetary and fiscal policy outlooks. Most notably, the bond yield gap between the US and other markets, especially the eurozone, has widened. US growth and inflation have surprised on the upside, in the face of softening or stability elsewhere. Markets currently expect only one Fed rate cut in 2024, down from up to four earlier in the year.7 Meanwhile, in early June the Bank of Canada became the first G7 central bank to cut rates since the great tightening cycle began, with the European Central Bank (ECB) following shortly after (see LMQ page 7).

Regional groupings can obscure divergences within them. The key driver of eurozone softness is Germany (see LMQ page 23), owing to its reliance on manufacturing exports and past dependance on Russian energy. Meanwhile, the Spanish economy remains strong due to healthy consumption and tourism. Within North America, Canada’s economy is underperforming the US because the structure of its residential mortgage market makes it more exposed to higher rates.8 These intra-regional variations may have a range of impacts on property markets, for example by shifting the relative short-term prospects for demand and value.

Japan and China represent long-standing divergences that persist.9 In China, a loosening bias remains in effect as inflation hovers at around 0%.10 In Japan, monetary policy is gradually normalizing, but so far without triggering a big increase in interest rates (at least compared to elsewhere). In March, the Bank of Japan (BOJ) abandoned negative interest rates and ended most unorthodox monetary policies, though it has since held policy interest rates at around zero. Japan’s economy becoming more “normal” is generally a positive, but interest rate differentials have pushed the yen to a 34-year low against the US dollar (see LMQ page 14), creating upside risks to inflation.11 But notably, Japan remains the one major global market in which real estate leverage remains broadly accretive to going-in yields.

Aside from reinforcing the potential benefits of diversification, what do these divergences mean for investors? Mechanically, any unexpected relative softening of interest rates should, all else equal, be beneficial for relative value assessments of real estate in that market. But firmer rates in the US have predictably come alongside a stronger US dollar. This points to practical limits to global monetary policy divergences; central bankers are keenly aware that weaker currencies come with inflationary risks. Moreover, it is worth asking how persistent macro divergences will be; current divergences are rooted in timing differences of expected rate cuts, rather than an anticipated permanent disconnect.

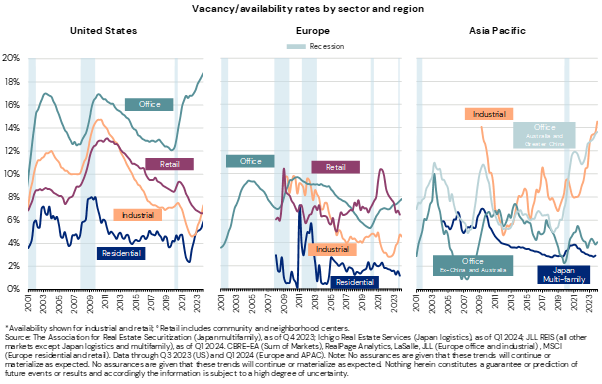

For several years, secular themes and structural shocks have dominated the trajectories of global property markets. But there is a clear cyclical pattern reemerging in the form of a pronounced upswing in vacancy across global logistics markets, and in US apartments. The return of cyclicality in those favored sectors is having significant impacts on their near-term prospects.

The softening trend is not new. In the ISA Outlook 2024, we identified hot sectors “coming off the boil.” Part of this was down to normalizing demand levels, but elevated new supply was also a key driver. As expected, the softening we observed has continued to deepen, leading to outright rent declines in certain markets, especially for apartments in US sunbelt metros.

Softening fundamentals are not to be ignored, but we recommend investors to have the conviction to “ride the wave” of excess supply. Wide variation in supply levels at the market and submarket level means that investors with granular market data and the discipline to incorporate it into their market targeting processes should be positioned to select the most attractive markets and submarkets.

Moreover, the forces that create cycles sow the seeds of their own reversal; we expect the current supply wave to moderate soon, as evidenced by sharply falling construction starts (see LMQ page 25). Many of the projects being completed today broke ground when credible exit cap rate assumptions were several hundred basis points lower than today. Higher interest rates upended development economics; far fewer new developments can now be justified on today’s mix of land prices, construction costs and financial conditions.

Finally, investors should be prepared to think about cash flows in both real and nominal terms. When cooling nominal rental growth comes alongside cooling inflation, as it does today, it is possible for that to be consistent with solid real rental growth, depending on the relative magnitude of each.

Beyond the reassertion of supply cycles in some markets, there is an evolving mix of secular stories that deserve attention. Some of these are so long-standing that they could almost be considered constants. These include structural shortages of housing in most of Europe, Canada and Australia, as well as the widespread changing definition of core real estate in favor of more operational niche sectors and sub-types.12 We continue to be strong advocates for investment in undersupplied living sectors, and for participating in the institutionalization and growth of niche sub-sectors such as single-family rental (SFR) and industrial outdoor storage (IOS).

More dynamic themes that deserve a closer look include the stabilization of retail real estate and divergent office investment prospects:

Other key secular themes driving investment opportunities today include the implications of artificial intelligence (AI) adoption for data center demand, student mobility for student accommodation in Europe and Australia and aging for senior housing.

Past experience of real estate cycles suggests that the best investment opportunities tend to arise in periods marked by significant uncertainty, volatility and pessimism, but also when early signs of improvement and stabilization are present—in other words, moments similar to today’s environment. Experience also reinforces that it is nearly impossible to time the market, so it is best to be selectively active throughout the cycle. By the time the “all clear” signal is sounded after a market crisis, it is too late to achieve the best risk-adjusted returns.

That said, “red pill” thinking means we must recognize that the coming capital market rebound is unlikely to be as sharp as it was after the Global Financial Crisis (GFC), given that central banks are unlikely to usher in ultra-loose policy. Seeing the market as it is requires accepting the likelihood that interest rates could remain sticky, and a realistic view of near-term fundamentals as a wave of supply impacts some sectors.

Footnotes

1 Also see our ISA Briefing, “Elections everywhere, all at once: Geopolitics and risk”, April 2024. In that note, we highlighted the various sources of political uncertainty this year and outlined how we recommend investors consider these risks. At the time of writing, political developments are particularly salient for short-term movements markets in France and the UK, given elections that have been called in those countries.

2 Source: MSCI Real Capital Analytics and Trepp

3 Japan and China are key exceptions that we cover in greater depth under the “deciphering divergence” header.

4 Of course, there is considerable variation embedded in this and any assessment of fair value. As always, the devil is in the detail on the assumptions that go into expected and required returns; at LaSalle, specific fair value inputs and conclusions remain a proprietary output.

5 The Merrill Lynch Option Volatility Estimate (MOVE) is a market-implied measure of volatility in the market for US Treasuries. It calculates options prices to reflect the expectations of market participants on future volatility. Observation made as of June 24, 2024.

6 Source: Bloomberg as of June 26, 2024.

7 For more discussion of the Canada-US divergence and the consequences of mortgage rate resets, see our ISA Briefing, ”The impact of residential mortgage resets”.

8 For more detailed discussion of the unique factors in the Japanese and Chinese macro environment, see our ISA Briefing, “Key economic questions for China and Japan”.

9 Source: Oxford Economics; Gavekal Dragonomics as of June 26, 2024.

10 Economic theory suggest that weak currency may contribute to inflationary forces because it pushes up the cost of imported goods.

11 See our PREA Quarterly article on “The Changing Definition of Core Real Estate” for a discussion of how the characteristics considered desirable in core properties is moving from traditional metrics like lease length, to observed qualities like the stability of cash flows. This shift elevates the appeal of niche sectors sub-sectors versus traditional sectors such as conventional office.

12 See our ISA Focus report “Revisiting the future of office”, published March 2023.

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Report Summary: Physical climate risk data can be a powerful tool for managing asset and portfolio risk and returns. Learn what strategies leading firms are using to manage physical climate risks and navigate market challenges. The latest report from the Urban Land Institute and LaSalle Investment Management builds on their previous report, How to Choose, Use, and Better Understand Climate Risk Analytics, to describe how leading firms are leveraging physical climate-risk data in underwriting practices. With insight into asset- and portfolio-level risk becoming increasingly easy to obtain, new challenges lie in effective interpretation and integration of information into investment practices. Relying on research and interviews with industry leaders, this report provides a nuanced exploration of this emergent issue.

Physical Climate Risks and Underwriting Practices in Assets and Portfolios is structured into three sections, each addressing different aspects of the industry’s response to climate-risk data:

Section 1. Explore the current state of the industry, finding that:

• Leading firms actively coach their teams on physical risk.

• Regulatory trends affect, but do not motivate physical risk assessment.

• Different geographies approach physical with their own level of urgency.

• Investment managers tend to focus on fund risk, capital providers on portfolio risk.

• Tools to understand and price physical risk are still in a nascent stage of development.

Section 2. Examines the application of climate data in decision making. Key findings include:

• Aggregate physical risk is a screening tool; individual hazard risk is actionable information.

• Climate value at risk remains opaque; the utility of the single number offers value but needs increased transparency.

• Atypical hazard risk (e.g., flood in a desert) merits increased attention.

• External consultants can frequently fill skill gaps, especially for firms with less in-house expertise.

• While no predominant timeframe or Representative Concentration Pathway (RCP) emerged as industry standard, the 2030 and 2050 benchmarks were the most commonly referenced time horizon.

Section 3. Assess the impact of physical climate risk on acquisition, underwriting, and disposition practices; finding that:

• Leading firms start with a top-down assessment of physical risk.

• Market concentration of physical risk is analogous to other concentration risks—a nuanced analysis is required.

• Capital expenditure for resilience projections is a key forecast but rife with uncertainty.

• Local-market climate mitigation measures are important to understand but difficult to forecast.

• Exit cap rate discount for estimated physical risk is an increasingly commonly used tool, frequently 25 to 50 basis points.

• Firms infrequently disclose physical risk but the market needs increased transparency.

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Roughly 60% of the world’s population lives in countries facing major elections in 2024, markets representing 65% of the institutional investable real estate universe.1 Elections are, of course, the cornerstone of the democratic process, which in turn underpins the appeal of the most transparent, investable markets; that said, elections come with the possibility of policy changes that may impact returns. Today’s geopolitical risks, whether they be this continuing election super-cycle (see LaSalle Macro Quarterly, or LMQ, page 4), or the various ongoing conflicts and trade disruptions, prompt important questions about how to manage investment risks related to these themes.

One of the protagonists in the Oscar-winning film Everything Everywhere All at Once says that being “’right’ is a small box invented by people who are afraid.” LaSalle’s risk management philosophy emphasizes optimizing risk/return trade-offs rather than minimizing risk-taking, while recognizing the limitations of point-estimate predictions and base-case scenarios — that is, attempts at “being right.” Today’s geopolitical events are especially likely to confound any forecaster seeking to be exactly right.

How should an investor manage their assets in the context of “unknowables” about which engaging in guesswork is tempting, but being “right” is elusive? What frameworks do we have to mitigate geopolitical risks? We propose six recommendations to keep in mind for investors taking stock of the many elections, and several conflicts, that may impact markets in 2024.

There are many examples of ex ante predictions of elections’ investment implications having been overstated. For instance, leading up to the 2016 US presidential election, there were widespread predictions that the US economy would be significantly negatively impacted by Donald Trump’s anti-immigration and protectionist stance were he elected.2 In the event, equity markets rebounded strongly after a short-lived hit and the US economy proved resilient to the changes in rhetoric and policy that came with a new president.3

Looking ahead to the US elections later this year, almost certainly a rematch between Biden and Trump, coverage of the candidates’ differences should be accompanied by awareness of their similarities. Both candidates seek to prioritize domestic production, which could lead to greater levels of on- or near-shoring of supply chains.4 Moreover, election prediction odds (see LMQ page 6) suggest divided control of the two houses of Congress and the presidency is likely; divided government has typically been associated with relative stability in domestic policy, which is generally positive for markets.5 Both of these factors — at least in isolation — point to the potential for news cycle hype to overstate long-term market impacts of this particular election.

Financial theory tells us that systematic risks are undiversifiable.6 Systematic factors are those with significant, far-reaching implications that affect the price of all assets. But financial theory also entertains that different assets may have different sensitivities to the same set of factors; an asset’s “beta” signifies the responsiveness of its price to a given factor. This is a useful way to think about an investment’s sensitivity to political and geopolitical events. For example, a property in a metro area whose economy is heavily driven by government spending would likely have a high sensitivity to political changes. Another example could be that a property located in the Baltic States, ex-Soviet countries on the border with Russia, is likely to be especially sensitive to developments concerning relations between Russia and the West. Investors should be mindful of assets’ expected sensitivities to geopolitics, whether assessed empirically or, as is more often the case given a lack of data, estimated through intuition.

Systemic risks go beyond systematic factors; they involve severe shocks that have the potential to re-align entire markets in unpredictable ways. An example of such an extreme event is the remote but non-negligible potential that today’s so-called “proxy wars”7 escalate into a broader active conflict between great powers.8 The challenge of incorporating such eventualities into investment decision making is not only estimating appropriate probabilities that such events may occur, but establishing ideal strategic responses should they do so. Catastrophic shocks are exceedingly rare and have the potential to create winners and losers in asset markets that are difficult or impossible to predict.9 It may be more fruitful for investors to focus on more incremental — and more likely — eventualities that have the added benefit of being easier to model.

Media coverage naturally tends to focus on the national and trans-national arenas, but local political developments can be especially impactful for real estate investments. Such issues can fly under the radar, especially given many of the most relevant ones are only of interest to a specialist audience. For example, changes in policy around topics like the planning process, property taxes and transfer taxes (a.k.a. stamp duty) can have direct, measurable and immediate impacts on property cash flows and thus values. The distraction of the bright shiny lights of global geopolitics should not be allowed to excessively overshadow the critical local issues that impact real estate.

To a certain extent, political risks can be managed through diversification. This is especially true when they involve isolated events that impact one country or subnational division such as a specific city, province or state. But often political events are part of a broader arc with potentially far-reaching consequences. A smattering of small seeds can grow from obscurity into a thicket. Nothing illustrates this better than the rise of populism, nationalism and protectionism around the world, themes set to dominate elections this year and beyond. The very notion of “globalized nationalism” may sound like an oxymoron, but it has become a fact.10 While diversification is an essential portfolio construction concept that helps manage many types of risk, including political risk, care must be taken to recognize when what may appear to be “specific” risks are part of a broader pattern that is difficult to “diversify away.”

Geopolitical and political risks are difficult to incorporate into traditional financial analysis. We find that thinking through scenarios can be helpful in identifying investment themes that may emerge from geopolitical trends. These can point to strategies to avoid — as well as potential new ones to pursue. The “Looking Ahead” section of this note expands on some of the key themes we have been tracking.

As geopolitical events are difficult to control and plan for, one may conclude, similarly to that same protagonist in the Everything Everywhere film, that “nothing matters.” But uncertainty is no excuse for ignoring geopolitical risks. We do stop short of directly feeding geopolitical themes into our formal risk management program, where the focus is on the specific risks that can actively be managed for our clients.11 However, it remains important to observe and understand macro conditions from a holistic perspective. The work done in our regional research teams — particularly that focused on capital markets, the signals that foreshadow potential inflection points and the local political themes that impact real estate — is critical to this effort.

We have argued that political and geopolitical risks are difficult to incorporate into investment processes, but that considering “what ifs” can be useful in uncovering relevant investment themes. Below are three potential real estate implications of the current geopolitical backdrop that we are monitoring today:

Footnotes

1 LaSalle analysis of data from Time and our proprietary investable universe estimates. See LMQ page 5 for more detail.

2 Sources: “What do financial markets think of the 2016 election?” Brookings Institution paper, Wolfers and Zitzewitz, 2016. The article predicted that “a Trump victory would trigger an 8-10% sell-off”. See also “The Consequences of a Trump Shock,” a Project Syndicate article by Simon Johnson, 2016. He predicted Trump’s election would “likely cause the stock market to crash and plunge the world into recession.”

3 On the news of the 2016 election result, Standard & Poor’s 500-stock index initially fell 5% but ended the day up more than 1%, according to Refinitiv. The US avoided a recession until the emergence of the COVID-19 pandemic, according to Oxford Economics.

4 Source: “Biden vs Trump: Key policy implications of either presidency,” Economist Intelligence Unit, 2023.

5 Sources: “What to Expect From Divided Government.” PIMCO article, Cantrill, 2022. According to the article, “the equity markets historically have tended to do well in years of split government.”

6 Source: The Handbook of Risk Management: Implementing a Post-Crisis Corporate Culture. P. Carrel, 2012. “Systematic or market risk refers to the inherent danger present throughout the entire market that cannot be mitigated by diversifying your portfolio. Broad market risks include recessions, periods of economic weakness, wars, rising or stagnating interest rates, fluctuations in currencies or commodity prices, and other ‘big-picture’ issues like climate change. Systematic risk is embedded in the market’s overall performance and cannot be eliminated simply by diversifying assets.”

7 According to the Oxford Dictionary, “proxy wars are the replacement for states and non-state actors seeking to further their own strategic goals yet at the same time avoid engaging in direct, costly, warfare.” Various observers have argued that the Russia-Ukraine and Israel-Gaza conflicts are proxy wars. For example, see “IKs the ware in Ukraine a proxy conflict?” Kings College London report, Hugues (2022).

8 According to a research brief by RAND: “Great power wars — conflicts that involve two or more of the most powerful states in the international system. These have historically been among the most consequential international events.”

9 Source: “What a third world war would mean for investors,” The Economist, 2023. The article highlights the virtual impossibility of positioning an investment portfolio to outperform through prior world wars, even if the investor had correctly predicted that these conflicts would occur.

10 For further discussion of the global spread of nationalism, see “How cynical leaders are whipping up nationalism to win and abuse power”, The Economist, 2023; “Demonizing nationalist parties has not stemmed their rise in Europe,” The Economist, 2022; “The new nationalism,” The Economist, 2016.

11 We do, however, utilize tools that correlate to geopolitical risk. For example, the JLL Global Real Estate Transparency Index (GRETI) supports our monitoring of evolving investment conditions around the globe. Whilst the model does not explicitly consider political risk, the two are inexplicably linked through the inclusion of a number of governance and regulation data points.

12 Source: “A global economic policy uncertainty index from principal component analysis,” Finance Research Letters, Peng-Fei Dai, 2019.

13 Source: “What are the impacts of the Red Sea shipping crisis,” J.P. Morgan, 2024.

14 Source: “The Great Rewiring: How Global Supply Chains Are Reacting to Today’s Geopolitics,” Center for Strategic & International Studies, 2022.

15 Sources: “The business costs of supply chain disruption,” Economist Intelligence Unit, 2021 and “Why Deglobalization Makes US Inflation Worse,” Project Syndicate, Moyo, 2022.

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

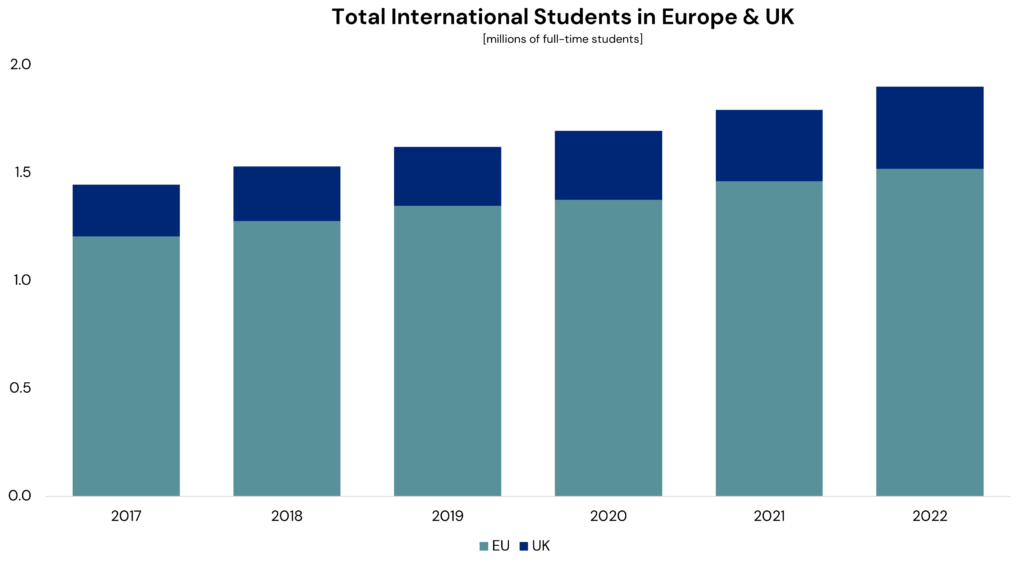

Purpose-built student accommodation (PBSA) in Europe ranks as one of our top-conviction sectors for investment in the coming years. No longer deserving of the “niche” label in the United Kingdom, it is already more institutional than any other type of living sectors property in the country and is rapidly maturing in Continental Europe as well. The rise of student accommodation on investors’ buy lists is for good reason. This ISA Briefing will set out why that is so and discuss how the sector stands out in Europe compared with student housing in the rest of the world.

After a brief, pandemic-induced interruption, in-person learning in Europe is back with more students enrolled than at any point in history. Higher education participation rates in the European Union have steadily risen across recent years, reaching an all-time high of 36% for 20-24 year-olds1 in 2021/22, with the same proportion recorded for the UK in 2023.2 A total of 18.5 million students were studying in the EU as of the 2021/22 academic year, with a further 2.9 million in the UK, having grown by 8% and 20%, respectively, over the previous five years.3

Demand for PBSA varies by profile of student. While domestic students are still crucial as a source of demand, particularly in markets where few students commute from home to study, international students are far more likely to reside in PBSA than domestic students (60% more likely to do so in the UK, as an example4). As shown in the chart below, international student mobility has been on a clear growth trend in recent years, with 2021/22 seeing a record number of foreign students in the EU and UK. European students studying outside their home countries elsewhere in Europe is a longstanding feature of the market, facilitated by freedom of movement within the EU, well-established student exchange programs, the rise of English-language courses and Europe’s dense geography.

A key driver of growth has been students from outside Europe. Europe has an outsized number of highly ranked universities relative to its size,5 a prevalence of English-language courses (which are increasingly no longer limited to the UK and Ireland) at a comparatively cheaper cost of tuition and living compared to North America.6 These attributes taken together can explain the sharp rise in non-EU students studying in the bloc, whose numbers have grown 31% since 2016.7 In the UK, the growth has been even faster, at 59% over the same period.8

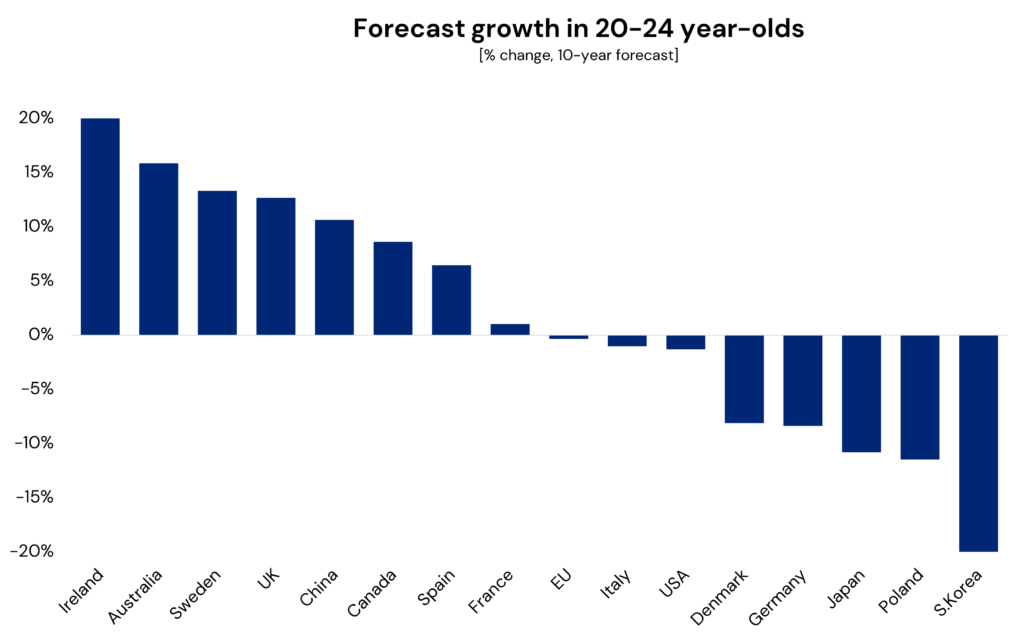

That said, there are demand-side risks to be mindful of. The demographic outlook for Europe is mixed; forecasts for some countries such as the UK, Spain and Sweden show a demographic ‘bump,’ with the number of university-aged people growing ahead of national population levels. However, in other nations, numbers are forecast to be broadly flat (France) or negative (Germany and the Netherlands). This suggests uneven growth in demand for higher education going forward.9

This mixed demographic outlook will mean greater reliance on international student demand, but there are tentative signs that may also be facing some headwinds. A recent policy change in the UK has removed the right to visas for international students’ family members.10 For now, this change represents tinkering around the edges and is unlikely to have a major impact on demand. It does, however, indicate a directional change in policy aimed at restricting overseas student numbers, presumably in a bid to bring down immigration figures. Such policy changes may incrementally dissuade would-be foreign students from studying in the UK, though demand may shift elsewhere, potentially to the benefit of other European countries. Despite such risk factors, the overriding view is one of positivity for higher education demand in Europe and therefore PBSA.

European student housing should be viewed within the wider context of the region’s housing market. Europe is currently facing a long-term, persistent housing shortage. Housing scarcity is not limited to major gateway cities, but is also the reality within mid-sized cities and even smaller university towns. Since 2010, Europe has built homes at a rate only 40% below pre-GFC levels,11 contributing to rising rents, increasing house-price-to-income ratios and worsening access to suitable housing. Demand for rental housing in cities remains robust, supported by long-term trends of immigration, urbanization and declining home ownership rates; as such, the imbalance between supply and demand is now fully entrenched.12

Students are, like all participants in the housing market, at the mercy of housing supply and demand. Shortages have fed through to the student market, with students finding accommodation increasingly unaffordable. Over the past two years, this has led to sharp growth in PBSA rents, with several UK cities reporting year-over-year growth in the high teens for 2023, and other markets experiencing growth well ahead of previous levels.13 The lack of supply is also leading to students being housed increasingly in unsuitable conditions; stories from the UK of students living in hotels or in completely different cities over an hour travel from campus are a clear symptom of insufficient student housing stock.

New investment in the sector should contribute to resolving the imbalance, but it will be a major challenge to fully close the wide gap between supply and demand. While there are nuances between markets, rising construction and development financing costs are making the delivery of new schemes less economical, evidenced by a sharp decline in the number of residential permits issued in several countries over the past year.14 Furthermore, restrictive planning laws and burdensome safety regulations are lengthening the time it takes for projects to be realized.

These factors inform our positive outlook on the rental housing market in Europe, which carries over into PBSA. The imbalance between supply and demand will likely persist and even worsen, driving very low vacancy and supporting strong rental growth for owners of residential and student housing real estate, or those who can deliver new schemes in those sectors.

Regulations in Europe can act as a handbrake for residential rents, as we set out in our ISA Briefing, Controlling Interest: Keeping tabs on residential regulations. In nearly all continental European rental markets, rents cannot be increased annually at the landlord’s discretion, with rental levels for in-place tenants typically linked to a backward-looking index. During the recent ‘great reflation’ period, this has meant income from many rented residential properties did not keep pace with inflation. But student housing stands out from more traditional rental housing investments as having a cash flow profile far less impacted by the growth-muting tendencies of regulation.

In part, this is because PBSA often faces less regulation or stands outside of regulatory systems altogether. Students’ nature as transient, temporary residents means that their needs are rarely prioritized by local politicians, particularly compared to those of permanent residents. They typically only stay in a city for a few years, do not have dependents and their rental obligations often come with implicit or explicit parental guarantees. This means that PBSA is targeted for rent controls far less often than the wider rental market. Moreover, zoning and classifications for student accommodation are often distinct from standard rental housing, exempting it from regulations that limit absolute rent levels or restrict annual rental increases. Moreover, regulatory requirements on minimum unit sizes or lease lengths usually do not apply.

Even where regulated, PBSA benefits from its relatively short duration of tenancy. Given the vast majority of students study for 3-4 years, there is far greater annual turnover of tenants compared with the wider residential market. Faster turnover allows for landlords to more effectively mark rents to market levels. This means PBSA rents may better keep pace with inflation, even in jurisdictions where regulations do apply to the sector.

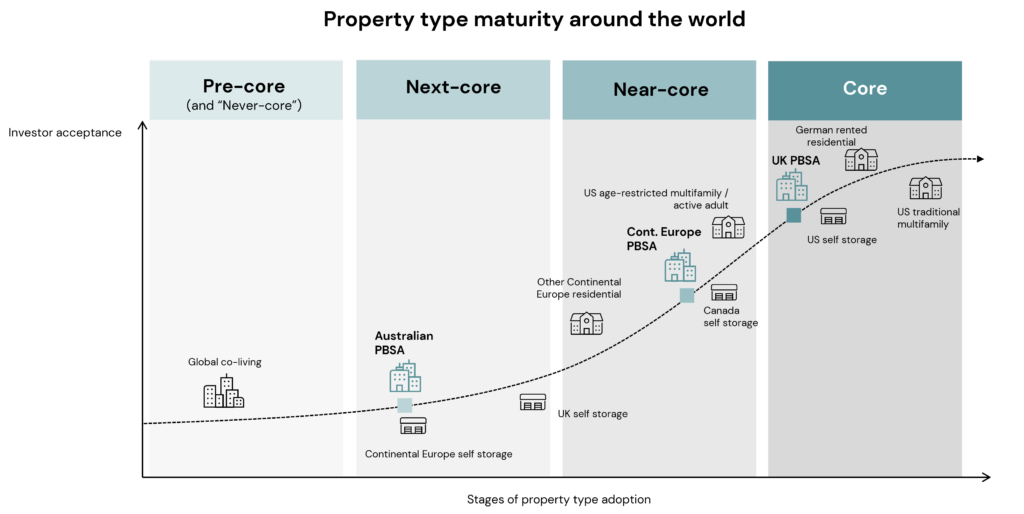

The increased maturity of student accommodation is another factor in its favor. The UK is clearly ahead of the rest of Europe in this regard, with a deep, liquid investment market, publicly traded REITs and a large number of established specialist operators. The sector’s wide acceptance from both tenants and investors means that we would consider it a ‘Core’ sector on our ‘going mainstream’ framework, as detailed in our ISA Portfolio View. Elsewhere in Europe the sector is considered more niche, but its growing acceptance means we would consider it ‘Near-Core’ on the same framework. Investment figures support the observation of a varying level of maturity for the sector—UK PBSA has made up 66% of investment volumes annual on average since 2014, despite the EU having 6.4 times the number of students.15

Over time, we expect this to change; the opportunity for investors to take advantage of the structural trends outlined above is likely to drive increased investment in the sector. Countries like as Spain or Italy have PBSA provision rates16 of below 10%, compared to more than 30% in some major UK markets,17 suggesting there is significant scope for delivery of new supply. Cities such as Milan, Madrid and Barcelona all have student populations of over 100,000 and multiple well-ranked institutions, giving them diverse demand bases and making them likely to be key growth markets for the sector in the coming years.

As niche sectors mature, greater liquidity and investor acceptance tends to lead to any yield premium they offer versus traditional sectors narrowing, as investors require less compensation for liquidity and transparency risks; such a pattern has already been observed in UK PBSA. This potential narrowing of yields in European markets is another factor behind our conviction that the sector is likely to offer attractive returns.

Student accommodation in much of Asia Pacific is still in a nascent stage, with relatively limited PBSA stock, few specialized operators and comparatively little institutional investment. The major exception in the region is Australia, which has characteristics similar to those of the sector in Europe and the UK, but is a number of years behind in its evolution. This suggests a similar path to maturity may lie ahead. Like Europe, Australia benefits from English-language courses at comparatively lower tuition costs than the US, while also offering post-study work visas. As a result, it has an even higher proportion of international students than most major European countries.18 Still, the Australian PBSA sector remains in its infancy as an investable property type. Stock numbers are low even compared to the most immature countries in Europe, with a student-to-bed ratios of 16-to-119 and significantly higher than the UK where it is around 3-to-1.

Traditionally, international students in Australia tap into private rental housing for accommodation. Both the private rental market and the PBSA sector in Australia have experienced tight occupier market fundamentals and experienced double-digit rental growth over the past two years.20 The solid performance has been primarily driven by strong migrant inflows, including international students, as well as high interest rates that encourage Australians to rent rather than buy, and relatively limited existing stock and new supply of all types of housing.

The United States, by contrast, has a more established student housing sector, but our view of the property type there is less favorable as compared to other regions. For a start, the demographics are less favorable given the population of 18-to-24 year-olds in the US is forecast to decline through 203321 and enrollment rates at 4-year institutions have remained roughly flat since 2010.22

An additional point of difference between US and European universities is their locations. Many top-tier US universities are in small cities in which a single school dominates the population and economy. Student housing properties in these markets are dependent on a single source of demand that controls enrollment growth and housing policy. Additionally, barriers to new supply are generally lower compared to major European cities, which allows for more new development to come in and disrupt the market. Taken together, these factors mean rent trends in these markets can be volatile. While there are similar university-centric towns in Europe, our investment focus is on the larger markets, where housing markets are tightest and there is a diverse demand base from multiple universities.

Footnotes

1 Source: Eurostat

2 Source: Higher Education Statistics Agency (UK)

3 Source: Eurostat, Higher Education Statistics Agency (UK)

4 Source: Savills

5 The number of European universities in the top 2000 spots Center for World University Rankings (CWUR) league tables per capita is the highest of any world region, according to data from CWUR, Oxford Economics, and analysis by LaSalle.

6 Source: Educationdata.org

7 Source: Eurostat

8 Source: HESA

9 Assuming no change in the propensity of people in that age cohort to attend university.

10 UK Government introduced policy on January 1st 2024

11 Source: European Central Bank

12 For deeper analysis of European housing markets and the underlying supply imbalance see LaSalle’s ISA Outlook 2024.

13 Source: JLL

14 LaSalle analysis of data taken from the national statistics agencies of major European countries (Germany, UK, France, Spain, Sweden, Denmark, Finland, Italy, Portugal, Netherlands, Ireland)

15 Source: MSCI Real Capital Analytics

16 Metric defined as number of purpose-built student beds as a share of total enrolled population of students in higher education.

17 Source: JLL

18 Source: UNESCO

19 Source: CBRE

20 Source: SQM Research (for private rental market), as of November 2023; CBRE (for PBSA), as of August 2023

21 Source: Oxford Economics

22 Source: National Center for Education Statistics (US)

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

FOR INTENDED INSTITUTIONAL INVESTORS ONLY – NOT FOR GENERAL PUBLIC DISTRIBUTION

LaSalle manages both closed-end funds and separate accounts that seek to provide attractive risk-adjusted returns in Canadian real estate.

0

closed-end vehicles

0+

years of experience

0+

transactions

$ 0b

transaction volume

Assets in Canadian dollars; data as of December 31, 2024; returns may increase or decrease as a result of exchange rate fluctuation.

The value-add strategy is focused on investing in assets that have significant potential for value creation, has a moderate exposure to ground-up development and a flexible approach to reposition-to-sell and build-to-core strategies. The team has successfully closed six previous vehicles and has 20+ years of experience across property sectors in major Canadian markets.

Canada is of the few AAA sovereign markets with a sizable and transparent real estate market. G7 leading population growth, a highly educated workforce and a service-oriented economy all point to continued demand.

The value-add team in Canada focuses on building diversified portfolios of assets where user demand is strongest but supply is insufficient. The team is also able to pivot with changing market conditions.

LaSalle’s Canadian asset management team drives returns in our portfolio of assets. By identifying opportunities for value creation and execution, the team seeks to manage downside risk and aims to realize income and value for investors.

The ability to harness and synthesize information is key to the success of the Canadian value-add team. They regularly draw on the expertise of LaSalle’s data-driven, in-house Research and Strategy team, who are actively involved in advising on strategy and investment decisions.

For a full description of the risks associated with investing in any opportunity, please refer to the “Summary of Risks” in the relevant offering memorandum.

LaSalle recognizes that sustainability factors, when properly applied, can positively influence investment performance. We tailor our approach to each fund and each asset, working to protect and enhance financial returns today and in the future. We are proud to have achieved a score of A+ from the UN PRI for both strategy and governance and property. We have also committed to being a net zero carbon firm by 2050.

By working to improve energy efficiency, lower emissions and capture resources such as sunlight and rainwater, we’re improving performance today and building a better tomorrow.

Office

Office

2 & 30 International Boulevard

Modern flex-office near Canada’s largest international airport

Residential

Residential

East York Apartments

Toronto multifamily complex

Retail

Retail

Mission Junction Shopping Centre

A dominant grocery-anchored shopping center in Mission, British Columbia

Industrial

Industrial

Southern Ontario Industrial Portfolio

Six industrial assets across southern Ontario

Industrial

Industrial

Toronto Airport Mid-Bay Industrial Portfolio

An eight-building portfolio near Pearson International Airport

Important information