-

Through history, residential rent controls have tended to appear at times of external shock and dislocation.1 COVID-19 and the subsequent inflationary spike have proven to be such a catalyst. Changes to rent regulations can potentially reshape the risk-reward profile of residential investments, impacting values over both short and long timescales. As we set out in a previous piece, A New Wave of Residential Rent Control, the introduction of rent control measures can also have unintended consequences that distort the market. While often sold as a solution to spiralling housing costs, in practice they can have the opposite effect to their intent, deterring the construction of new rental housing, thus leading to further increases in rents.

Our findings in that report still hold true, but an update is needed because the “great reflation” period has seen a groundswell of support for further rent regulations, especially in Europe. The pandemic opened the door to unprecedented government intervention, and there has been a heightened willingness among politicians to introduce forms of rent control. But there continues to be vast differences across countries, regions and cities, reflecting varying political appetites for intervention. What is the impact of these recently enacted measures and which markets have been most impacted?

Rent regulation starting positions vary widely

Regulations take many different guises including broad brush limits on initial rent levels (e.g., in France, Ireland), market-wide caps to annual rental increases (Germany, Sweden) or caps limited to buildings of a certain age or in certain areas deemed to be stretched (Denmark, Catalonia, New York City, California). Beyond rent-setting, lease length, security of tenancy and eviction protections are additional factors to consider. Crucially, regulation should be viewed on a spectrum rather than as a binary determination.

In “unregulated” rental markets, such as England, most of the US and select European countries (e.g., Finland, Poland and Czechia), rents can typically be freely set at the outset of a tenancy, with the landlord permitted to increase them at the end of the agreement (typically 12 months) by any amount. This allows landlords in these markets to mark rents to market levels quickly. Even in markets that are usually considered to be unregulated, other legal limitations should also be considered; for example, the UK parliament is currently considering a law which would end no-fault evictions in England and Wales.

Elsewhere in Europe, in parts of Canada, and in several US states like California, Oregon and New York, the most typical form of rent control is limiting annual rent escalations for existing tenants. The devil is in the detail of these specific regulations. California, Oregon and New York City’s regulations, for example, apply to a subset of older assets; in Toronto (and all of Ontario) they apply to all but the newest. In the case of Oregon, a limit of 7% increase plus CPI is not much of a limitation on investment economics,2 while in New York City, rent increases are set by a regulatory body and can have a significant impact.

Europe’s generally more constraining rent increase caps mean that in-place rents are normally significantly below open-market rents for new leases. Limiting annual rent increases for in-place tenants prevents rents from being marked to market, usually resulting in tenants being “stickier”, staying in their homes in the knowledge that the rents they are paying are below what they would pay under a new lease. This has the effect of higher occupancy levels and lower expenses on unit turnover and voids. Catch-up between in-place and market rents occurs gradually, even during periods of weakness in market rents.

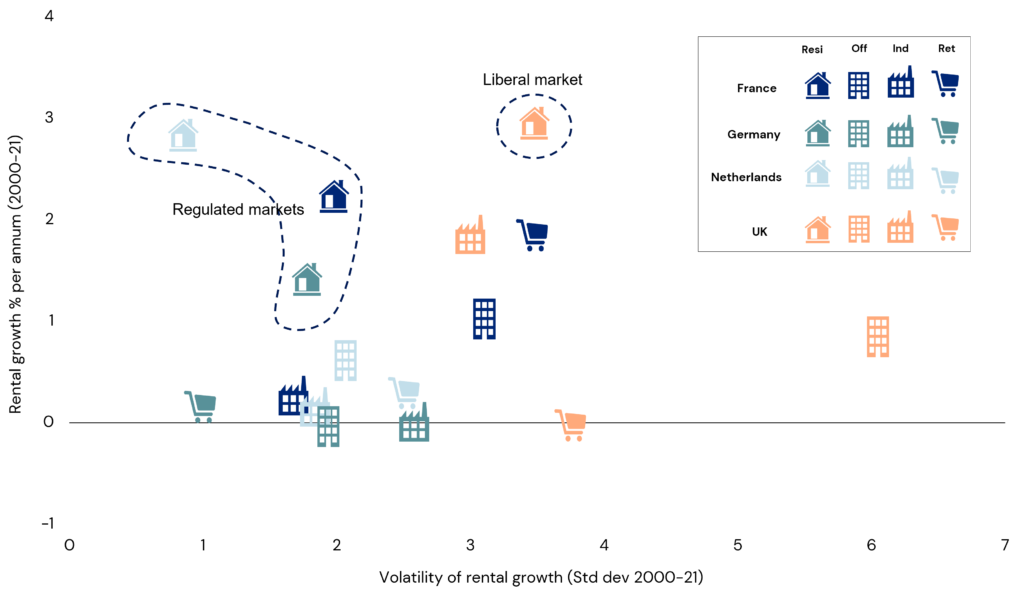

As a result of these factors, heavily regulated markets tend to experience stable in-place cash flow growth, without the cyclicality of less restrictive markets. This is highlighted on the below chart, which shows that residential rental growth in the UK has been far more volatile than regulated European markets. Given steady, non-cyclical growth, regulated residential in Europe has been able to deliver a higher level of long-run growth than most of the commercial sectors. These attributes of stability and low-but-dependable growth can be appealing to core investors, especially in lower inflation environments.

Rental growth and volatility

[Average per annum since 2000* and standard deviation]

Source: LaSalle (May 2023), MSCI (December 2021)

Variety of cash flows can be a positive – but beware regulatory surprises

If regulations are known and stable, they can be priced in, limiting the risks to informed investors. A bigger concern comes from new, unforeseen regulations during the ownership of an asset. So-called “stroke-of-the-pen” risks may cause underwritten rent levels and growth to suddenly change. This remains a persistent threat as long as some policymakers are willing to support new rent controls. The factors which have made residential such a compelling sector in recent years, namely the undersupply of housing and tailwinds supporting demand, have exacerbated the threat, as rents in many major markets have increased as a share of average household income. The bout of high inflation seen in 2022-23 has put even more pressure on household finances and motivated politicians to act. The result has been new regulations brought in across Europe and North America, although some are some supposedly temporary.

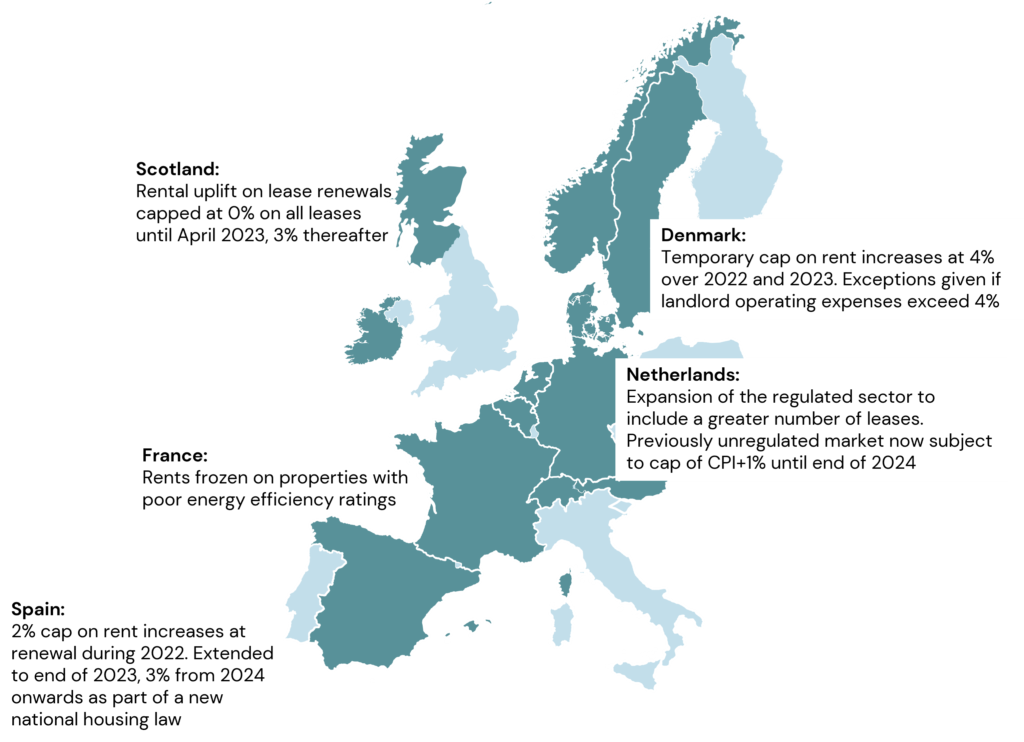

Another wave of new regulation—Europe

Since beginning of 2022, several European markets have introduced new rental regulations, including in Scotland, France, Spain, Denmark and the Netherlands (see map). In other markets, such as Germany, new regulations are now being discussed.

The impact of these is just beginning to play out, but they are having meaningful effects already, with significant variation by market and asset profile. During this period of high inflation, these caps have created a double hit for some residential owners, limiting rental growth at the same time as operating expenses rose quickly.

Rental regulations introduced over 2022-2023

[Lighter colored markets considered unregulated]

Source: LaSalle (May 2023)

In some markets, recent regulatory changes are less disruptive. For example, the cap to indexation at 4% in Denmark may result in below-inflation rental growth for one or two years. Should inflation revert to historic levels as anticipated, this is unlikely to meaningfully damage performance on assets held over the long term, but potentially mean negative real cashflow growth for landlords in the near term. This is because inflation exceeded the cap in 2022 and will expect it will likely do so again in 2023. Residential assets in regulated markets have only been able to deliver inflationary in-place rent growth when inflation is at “normal” levels. This is because regulators in Denmark and elsewhere have tended to prevent double-digit nominal increases even when justified by inflation.

The Scottish government’s decision to ban rent increases completely in September 2022 was potentially more disruptive. Some developers and investors indicated that construction of badly needed new for-rent supply was not viable in such an environment. Being unable to underwrite rental growth would likely discourage private investment in Scotland’s housing market, exacerbating the housing shortages which necessitated the rent controls in the first place. The Scottish government backtracked in April 2023, replacing the freeze with a still tight 3% cap.

Once regulations are introduced they are often very difficult to unwind, as few politicians will publicly campaign to reverse policies which will result in their voters paying more in rent. Evidence of this can already be seen in Spain, which introduced supposedly temporary caps to rent increases that have been extended beyond their original end dates and has further tightened regulations with the introduction of a wide-ranging national housing law.

Less constraining changes in the US

In parts of the US, rent control gained traction in the late 2010s, reversing a two-decade trend toward less regulation. But most cases, new measures have been relatively mild. In 2019, Oregon and California enacted statewide caps on annual rent increases for existing tenants, but limited the restrictions to older properties and set the level of the caps high.3 A notable example of a more severe new rent ordinance comes from St. Paul, Minnesota. Voters there approved an ordinance in 2021 that limited rental increases to 3% across all buildings and for renewals and new leases alike. Developers responded by halting construction projects in the city, with residential permits falling by 30%. Less than a year later, the St. Paul city council revised the ordinance to more closely resemble the legislation in California and Oregon.4

Despite the advances of rent control legislation in a small number of states and cities in recent years, many more jurisdictions have rejected it. In 2022 alone, new rent regulations were introduced by state legislators in 19 states and did not receive enough support to pass. Most recently, in April 2023, Florida passed an outright ban on rent control in that state while at the same time allocating new funding for the development of affordable housing.

Living with increased regulation

Despite the risks of regulatory change, regulated residential assets can potentially offer investors a favourable return given low risks, particularly when compared to the more challenged office sector. That said, the devil is in the details, given widely varying regulatory frameworks across cities, states and countries. With changes to policies underway, managing the risks of greater regulation is now more important than ever for investors. To do so, we recommend an approach that encompasses vigilance, diversification and identification of less-regulated proxies for residential—we detail each of these strategies below.

Looking ahead

- Be vigilant of shifting regulations impacting both current and potential investments. Assessing the likelihood and timing of new legislation is an extremely difficult task but is a prerequisite when screening any potential acquisition in the sector.

- Diversify exposures across markets with differing regulatory regimes, limiting the impact of a single change in legislation to a portfolio.

- Require higher returns to compensate for future regulatory risk. The lack of certainty on regulations necessitates that investors to add an extra level of uncertainty to their future cashflows, potentially requiring additional risk premia at both acquisition and exit.

- Consider whether other Living sub-sectors may be less likely to be brought under the scope of rent controls. For example, in European purpose-built student accommodation (PBSA) operates with very limited restrictions on rents, even in the most tightly controlled markets. Because European universities tend to be clustered in major cities, PBSA offers investors some of the same compelling attributes as traditional residential—a chronic supply-demand imbalance, short leases allowing for rapid capturing of rental growth and further maturity as an asset class to come—but with lower regulatory risk. Similarly, shorter-stay co-living and serviced apartment stock may fall outside the regulation of traditional apartments.

- The earliest record of rent control dates to the Roman Empire. Notable shocks that were a catalyst for new rent regulation included the Chinese Song dynasty’s relocation to its new capital city in 1127 and the period immediately following the Great Lisbon Earthquake of 1755. See Kholodilin’s fascinating review of historic rent control at this link.

- On the other hand, changes in eviction protections in Oregon have been significant; this is a reminder to consider non-rent aspects of regulation.

- California’s law caps annual rent increases at the lower of CPI+5% or 10% while Oregon allows for 7% plus the rate of inflation.

- The revised St. Paul ordinance exempts buildings less than 20 years old and allowing for increases of CPI plus 8% for new leases.

Want to read more?

Jul 01, 2025

Keep calm and carry on? The ISA Outlook 2025, six months in

Dominic Silman and Brian Klinksiek revisit LaSalle’s ISA Outlook themes amid 2025’s rapidly developing and unpredictable geopolitical and macroeconomic climate.