Breaking economic patterns: Europe’s real estate landscape

Today’s European market view is of a picture scarcely imaginable a few years ago.

2025 in Europe has a macroeconomic backdrop scarcely imaginable a few years ago: German stimulus spending, Greece in budget surplus and historically reliable real estate correlations – such as that between GDP and prime rents – behaving differently. And that’s on top of still to-be-determined new tariffs faced by Europe’s exporters. As we’ve shared in our recent ISA Briefings, it is helpful to “work backwards” to investment strategy based on what is actionable amidst all the noise.

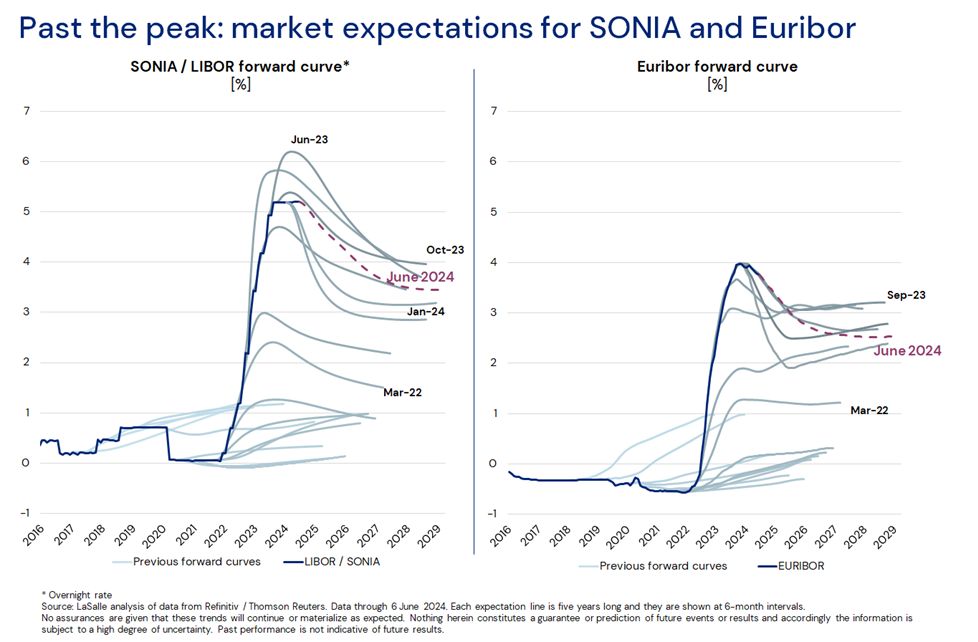

Initial bond and currency market reactions, several highlighted in our latest Europe Market View, imply a relative shift towards Europe as a safe haven. These changes are having ripple effects for European real estate. Easing eurozone borrowing costs have made debt more accretive to go-forward returns, supporting a cautious recovery in investment activity. A stabilization in real estate yields, and the return of yield compression in some segments, are signs of the beginning of a new real estate cycle. The MSCI Europe Property Index capital values have increased for two consecutive quarters following eight quarters of decline.

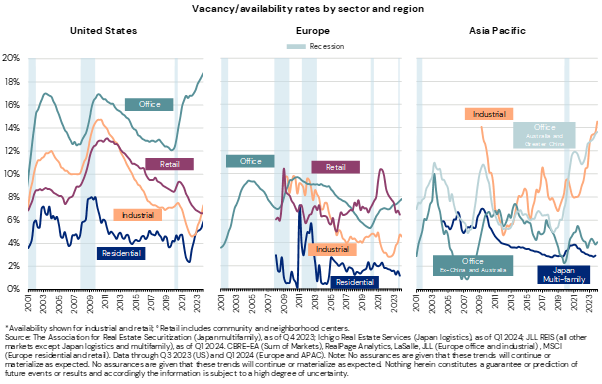

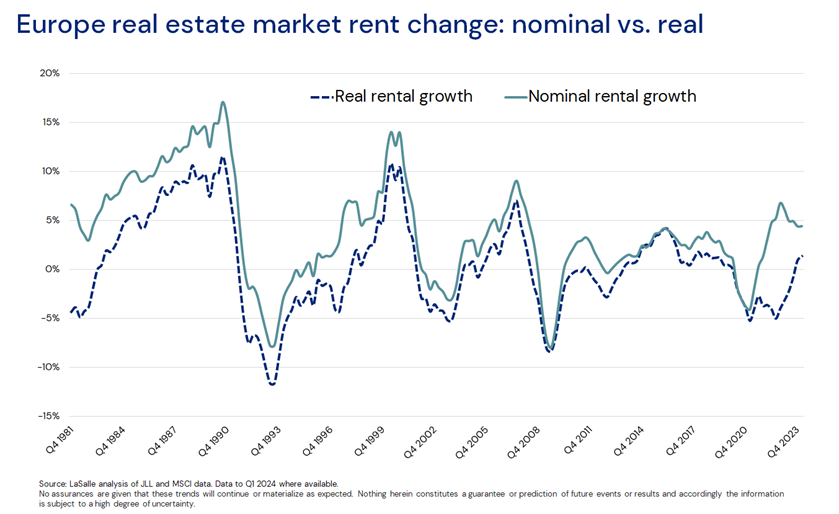

Europe all property inflation-adjusted rent growth has now been positive for six quarters. The wider office market is undergoing a rebalancing cycle with slowing building starts and rising conversions of obsolete offices to other uses helping to keep markets in balance. Conversions in Europe reached 1.4% of stock in 2024 compared to the long-term average of 0.9% p.a.

We graph these trends in our latest LaSalle Europe Market View chartbook. We also look ahead to sharing our ISA Outlook 2025 Mid-Year Update, as we move into the second half of an eventful year.

Want to read more?

Want to read more?

The what, why and how of Industrial Outdoor Storage (IOS)

Industrial outdoor storage (IOS) real estate is not new, but it has only recently been given a name and a place in institutional investment portfolios. Some in the market define IOS inexactly, or even as they “know it when they see it”. A more precise definition is that it encompasses open-air facilities used by industrial, manufacturing or logistics businesses to store or process equipment, vehicles, materials or products that do not require the protection of warehouse buildings.

IOS is an amalgam of facilities that serve auxiliary but essential functions to the logistics ecosystem. The prominent features of IOS are low site coverage (with FAR1 of less than 20-25% but often zero), zoning designations that allow for heavy industrial uses, and most importantly, value that is driven by underlying land rather than physical structures2. Attributes that are commonly considered in the evaluation of IOS sites include the quality of surfacing (full concrete surfacing to softer gravel surfacing), good vehicle access (light and heavy), and availability of utility and services (water, electricity, fencing/security).

IOS started gaining traction among institutional investors following the industrial sector’s boom in the post-pandemic era. As industrial pricing became more aggressive through the peak of the cycle, the IOS sector’s robust demand growth outlook provided an attractive alternative for investors seeking yield. Interest in IOS remained strong even when the broader capital market entered correction. This has continued in the context of the industrial sector broadly softening as it digests a (now resolving) wave of deliveries, while IOS has proven resilient given that its new supply tends to be much less elastic.

Despite its adjacency to the traditional industrial sector and its proven relevance to users, IOS as a property type has flown under the radar of institutional investors as it is usually transacted in small deals that are local or regional in nature, often involving owner occupiers. There are a few dedicated IOS players whose inceptions date back as early as 2013, but it is only in recent years that the sector came to be viewed as a critical component of the wider supply chain and distribution network.

The body of knowledge on the sector – operational, fundamentals, performance – is limited, but curiosity has been rising from new entrants in the past couple of years that include institutional capital. The IOS sector’s lack of transparency, common in emerging specialty sectors, demands rigorous scrutiny in underwriting. As IOS continues to mature, detailed research and underwriting as well as deep engagement with the local market can help navigate these challenges, enabling investors better assess and mitigate risks.

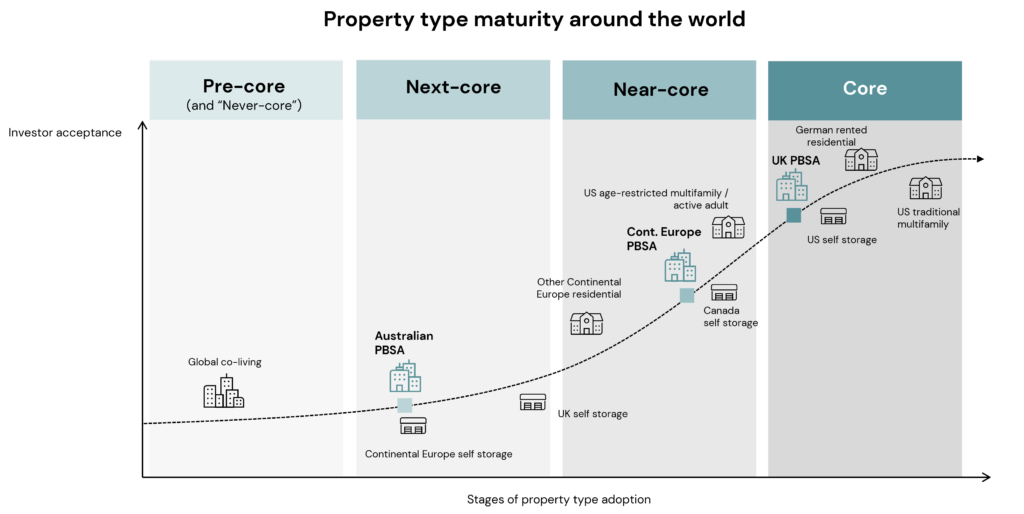

‘Next-core’3 in the US, emerging in the UK and continental Europe

In the US, the aggregate market value of IOS property is commonly estimated to be $200 billion in GAV, but the source of that stat as well as the inclusions and exclusions behind it are unclear.4 While institutional investment in IOS has accelerated in recent years, the sector’s overall ownership remains fragmented with a still-limited institutional footprint.

Meanwhile, IOS is even more nascent among institutional investors in the UK and Europe, but interest is growing. An increasing number of institutional investors are now setting their sights on IOS opportunities across the region. This includes funds dedicated exclusively to IOS, as well as vehicles that incorporate the sector as part of a wider industrial strategy. We estimate that more than £1 billion has either been allocated for investment or has already been deployed into the UK’s IOS sector in recent years. Owing to structural factors, we see much more limited, but not zero, potential for IOS to emerge in the Asia-Pacific region (see below).

Types of/use cases for IOS

Service-oriented

• Equipment rental & maintenance

• Construction materials & staging

• Waste management & recycling

Transport-oriented

• Port logistics & intermodal transport

• Vehicle storage & parking

• Freight distribution & cross-docking

Storage-oriented

• Construction equipment & bulk material storage

• Vehicle or equipment fleets

Source: LaSalle analysis; images created with the assistance of AI

Truck terminals are the only type of IOS that is now explicitly defined in the NCREIF Property Index (NPI, previously “Expanded NPI”), with $5.3 billion in gross market value, or 1.8% of the US industrial index as of 1Q 2025.5 Tracking of other types of IOS is still a work in progress, although the NCREIF Research committee acknowledges the challenge, and has started the process of putting together guidance on how IOS should be classified and tracked to improve transparency. Investors’ desire to gauge the competitor landscape as well as returns supports this effort to define and track IOS as a distinct category in the NPI.

In Europe, there is still a lack of data availability for IOS, but some agents are extending coverage to the sector and starting to publish market data. For example, new data from late 2024 reported that 48% of enquiries for IOS space in the UK was driven by the need for fleet parking, approximately 60% of which was driven by Heavy Goods Vehicle (HGV) parking.6 This need can also be seen in data from a national survey of lorry parking, which reported a 5% increase in the number of on-site parking facilities between 2017 and 2022, even as the national average night on-site utilization at those facilities grew by nine percentage points over the same period to 83%, indicating strong growth in demand and a high occupancy rate for parking spaces.7

Is IOS “a thing” in Asia Pacific?

The Asia-Pacific IOS sector is evolving and yet to be institutionalized. High land values in many Asian markets make low- or no-coverage land sites uneconomic, at least beyond a temporary use. That said, the factors that drive IOS demand in the US are clearly present in the region, especially the need operational flexibility in handling trailers, containers and delivery vehicles, as well as flexibility to store overflow inventory. The confluence of Japan’s acute truck driver shortage and the implementation of stricter truck driver working hour regulations in 2024 is driving demand for specialized IOS-related assets in the long-term, particularly truck terminals. However, in most markets we view these factors as informing improvements to the design of existing multi-story logistics facilities, rather than driving the emergence of a new, investable specialty property type, at least in the near term.

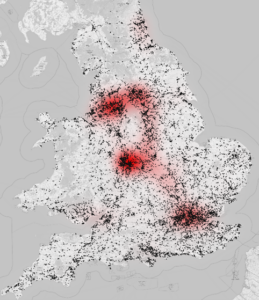

Using a non-traditional data source to identify IOS inventory in the UK

Geographical distribution of UK open storage land vs. warehouse space

Sites classified by VOA as land used for storage and lorry parking are indicated in black, with traditional industrial and warehouse space displayed as a heatmap in red

Data on IOS fundamentals are very limited in the UK and Europe. At least there is a way to estimate the size and shape of the IOS footprint in England and Wales, where the Valuation Office Agency undertakes detailed categorizations of use cases across property types to set business rates, including categories for open storage and lorry parking.i Proprietary analysis of these data by LaSalle identified some 29,000 locations, with a total area of 16,700 acres and an average size of 0.57 acre.ii The locational pattern (black on the map) is correlated with, but generally more broadly dispersed than, the distribution of traditional logistics space (red on the map). This analysis does not capture the entire UK IOS universe, but still highlights the significant size if the opportunity available within UK IOS, and can support investment decisions requiring a view on supply in markets and submarkets.

i Source: Valuation Office Agency

ii It must be noted that this approach likely misses a sizeable proportion of IOS that is currently classified within the warehouse category by the Valuation Office Agency, especially where the site itself is dominated by an open space but have a structure making up a smaller portion of overall area.

Joint ventures structured between institutional investors and specialized operators have been a common avenue for deploying capital into IOS. The challenges of limited transparency, as well as the transactional and operational inefficiencies of small deals, are factors that motivate partnerships with operators. However, the day-to-day operation of IOS is more like traditional industrial than a more operationally intense sector (such as self-storage). In addition, IOS portfolios of scale are currently rare compared to traditional industrial, but we expect greater consolidation of ownership as the sector matures. The assembly of institutional-scale portfolios, along with development of third-party leasing and management service providers, should support the sector becoming more “mainstream” over time.

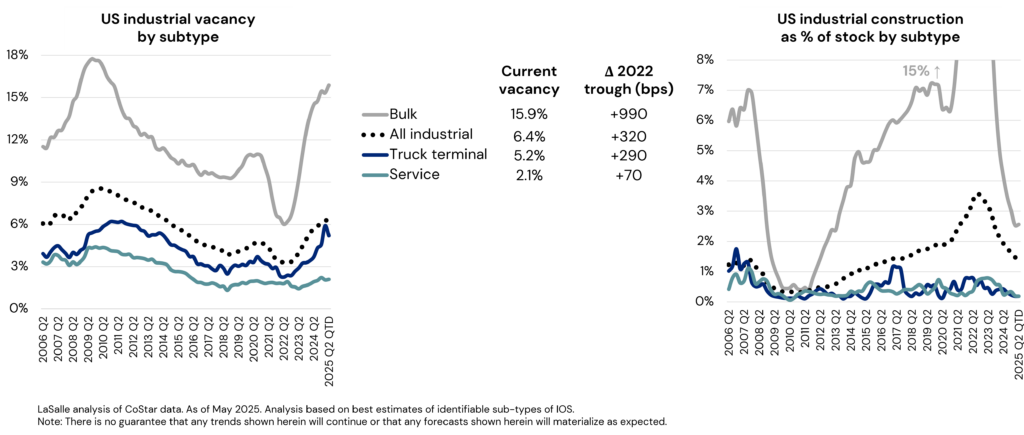

IOS fundamentals are tight and resilient

Data on historical industrial fundamentals illustrates consistently lower vacancy and reduced volatility for IOS assets like truck terminals and service facilities, compared to larger industrial buildings (see adjacent charts). The sector benefits from a weaker elasticity of supply, stemming from stringent zoning regulations and community resistance to new IOS facilities. Local municipalities are hesitant to approve them due to the perceived unappealing aesthetics of open-air industrial operations, and an assumption that they have limited potential for generating jobs and taxes. Data challenges remain in holistically assessing fundamentals of IOS sector that take multiple forms; however, the available data suggest a superior track record of fundamentals as well as outlook that is better protected from future development risks.

LOOKING AHEAD >

Several key attributes of IOS suggest it is well positioned to perform strongly:

• Tailwinds of the broader industrial sector: The growth of e-commerce and an emphasis on just-in-time delivery have boosted demand for strategically located industrial service facilities. Whether as a point of transfer, servicing freight vehicles or serving as supplementary outdoor warehousing, various stages of logistics operation require IOS sites. These should be in close proximity to the industrial clusters and population that they serve, and are often infill locations.

• Favorable supply dynamics: New development is limited due to the scarcity and high cost of suitable land — i.e., large sites with the appropriate zoning in proximity to population centers. Stringent zoning regulations and community resistance to new facilities — due to concerns such as noise pollution, increased traffic, and environmental impact —further create barrier to entry. This is a differentiator as compared to traditional industrial, which is currently experiencing softer fundamentals due to a recent supply wave.

• Operational resilience: IOS facilities typically present low operational risks for investors. The simplicity of these assets, usually combined with triple-net lease structures that place maintenance responsibilities on tenants, result in minimal capital expenditures and higher cash returns. The limited availability of alternative facilities contributes to high tenant retention rates, enhancing cash flow stability. The impact of tariff-driven uncertainties on IOS is expected to vary. While port and trade-linked IOS sites are more exposed, those serving local populations should demonstrate more resilience.

• Increasingly liquid and institutional: As recognition of the attractive value proposition of IOS grows, partnerships between institutional capital and professional operators to invest in it are being launched. This is not only likely to improve the management of assets, but should also provide a track record of sector performance. We anticipate a gradual compression of the yield spread between IOS and traditional industrial properties, supported by continued institutional capital flow to the sector and falling perceived risks.

1 FAR refers to floor-area ratio, which measures the relationship between land area and internal building area.

2 Source: JLL Research 2023.

3 Under the LaSalle Going Mainstream framework for maturation of niche sectors. “Next-core” is characterized by professionalization where specialists begin to track performance, transparency is rising, and the income quality is proven.

4 GAV refers to Gross Asset Value. The origin for this widely cited number appears to be the PwC Investor Survey.

5 Source: NCREIF 4Q 2024. NCREIF refers to the National Council of Real Estate Investment Fiduciaries and publishes indices tracking the performance of real estate in the US directly held by institutional investors and by institutional funds. Launched in 1Q 2024, the Expanded NCREIF Property Index (NPI) encompasses a wider array of property sectors and subtype designations than the Classic NPI, aimed at aligning performance measurement with the broader industry’s investable universe.

6 Source: Carter Jonas 2024

7 Source: UK Department for Transport

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. With reference to the graphs included in this publication, note that no assurances are given that trends shown therein will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

This article first appeared in the May 2025 edition of PERE

LaSalle’s Dave White sat down with peers from other leading alternative credit providers across Europe to discuss the state of real estate debt across the continent.

Facing up to competition and uncertainty

Geopolitical chaos overshadows the discussion around the outlook for private real estate debt markets in Europe, writes Stuart Watson

This year, the participants in PERE’s European debt roundtable met the same morning that was sure to become famous – or infamous – as US President Donald Trump’s tariff-trumpeting ‘Liberation Day.’

Their discussion covered a range of topics, from the fragmented market across Europe, to the scarcity of capital and deal pipelines, to the extraordinary levels of geopolitical turmoil.

Want to read more?

Craig Oram, Mark Milovic, Jen Wichmann and Alexandra Levy recently sat down in front of the camera to discuss how various teams at LaSalle – in particular Research and Strategy – work in tandem with the US debt investment team to identify prime sectors and locations for investment.

LaSalle’s Research and Strategy team plays a crucial role in our underwriting process. They provide insights on market dynamics, macroeconomic trends, and demographic shifts that can impact property operations and investment performance. By combining their top-down analysis with our decades of lending experience across the US, we can identify attractive opportunities that balance risk with reward. This comprehensive approach enables us to make more informed lending decisions, helping us to mitigate potential risks and work to enhance returns for our investors.

Learn more below.

Want to read more?

Craig Oram, Portfolio Manager and President of LaSalle Debt Investors and Alexandra Levy, Head of Debt Capital Markets, Americas, discuss the reasons why investors are increasing allocations to US real estate debt.

How should institutional investors seek out reliable income in 2025 when the majority of outlooks – including ours – are expecting the volatility of recent years to continue?

One answer for many investors has been increasing allocations to private credit. Elevated interest rates and repriced assets have led to better lending conditions for providers of alternative funding, with higher yields at lower loan-to-value ratios.

Learn more below.

Want to read more?

Singapore (December 12, 2024) – Asia Pacific macroeconomies and real estate markets are showing signs of potential structural changes and unique cyclical patterns, setting the region apart from global trends.

This is the thrust of the Asia Pacific chapter of ISA Outlook 2025 report just released by LaSalle Investment Management (“LaSalle”). Published every year since 1993, LaSalle’s ISA Outlook is designed to help the real estate industry navigate the year ahead.

This year’s key findings include:

- Investors in Asia Pacific real estate must navigate new investments and existing portfolios in a complex environment with signs of structural change and a distinctly different cycle compared to historical norms. These factors could have a combination of positive and negative implications for investors, some of which may only become apparent years later.

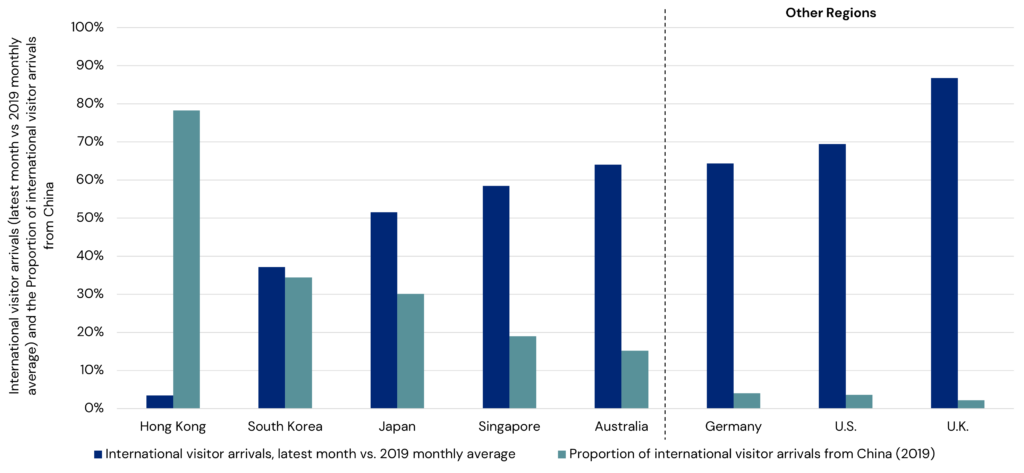

- Adding to the complex macro environment is the US election result, which could lead to heightened economic uncertainty and periodic capital market volatility. China is particularly vulnerable and, to a lesser extent, Hong Kong. Beyond China and Hong Kong, it is difficult to predict clear winners or losers from the U.S. election result for now. We believe that select real estate markets or sectors could benefit from some supply chain rebalancing. In addition, investors may consider focusing on Asia Pacific real estate markets/sectors that are anchored by domestic demand and domestic capital.

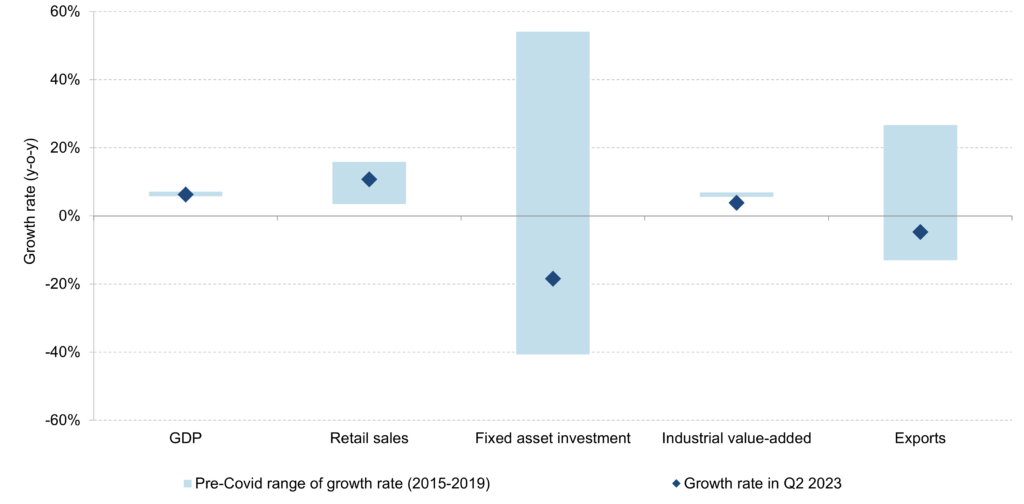

- In China, which faces the weakest economic growth and consumer confidence in decades, heightened geopolitical tensions between the US and China, as well as the absence of impactful structural reforms or larger-scale stimulus packages, suggest an extended period of economic weakness. This creates a challenging environment for China’s residential and commercial real estate markets over the next few years.

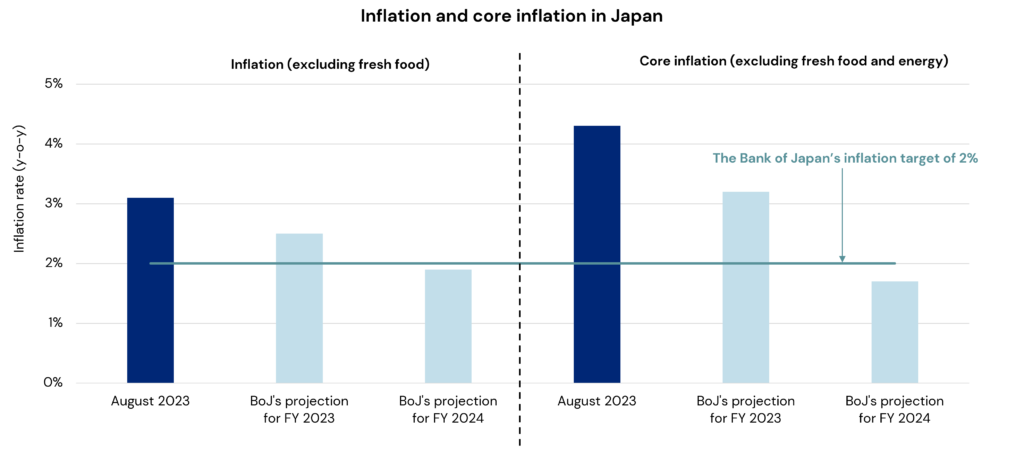

- Japan remains the most liquid market in the region, with inflationary growth prospects. Should the substantial domestic investor base in Japan continue to anchor the real estate capital market, the potential impact of further interest rate hikes can be limited. Nonetheless, it is essential to allow for flexibility and the potential for unexpected outcomes, when evaluating investment opportunities or setting up business plans for existing portfolios in Japan.

- In other developed economies of the region, the varying and sometimes contrasting cyclical patterns among major real estate sectors within each country set the region apart from global trends.

- Commercial real estate liquidity in Asia Pacific has demonstrated resilience compared to other global regions but is still constrained to varying degrees, except for Japan. The gap between buyer and seller expectations is weighing on liquidity and some investors are adopting a wait-and-see approach. Nonetheless, savvy investors understand that sometimes the best returns come from vintages in the wake of cycle turning points or when signs of structural change emerge.

Where favorable macroeconomic conditions present themselves and as global investment appetite returns, the diversity of Asia Pacific markets and sectors within the region will offer discerning investors a variety of opportunities with a wide range of risk-return profiles.

Five strategic themes are highlighted in the Asia Pacific ISA Outlook 2025:

- Multi-family: At a nascent stage, except Japan

The multi-family sector in Asia Pacific is undergoing structural changes, driven primarily by demographic shifts and government policies, with significant potential for institutionalization. This sector offers a range of investment opportunities in a basket of markets except China, although it would take time to fully unlock value in this nascent sector outside of Japan due to unproven liquidity.

- Office: Navigate cycle changes vs. potential for structural shifts

Office market performance across Asia Pacific varies significantly. It is increasingly important to consider the timing of entry and exit as well as risk mitigation plans. South Korean, Japanese and Singaporean offices offer strategically selected investment opportunities for investors with different risk and return appetites.

- Logistics: Not a clear outperforming sector

The logistics sector shows dispersion in performance across markets, submarkets and sub-sectors. With relatively balanced supply-demand dynamics, Australia, Singapore and select Japanese markets offer investment opportunities, despite reducing return expectations.

- Retail: Distinctive consumption patterns

We expect that well-managed retail assets that have adapted their tenant mixes and market positioning in response to changing consumption habits will outperform, adding to operational intensity. A granular, asset-level approach to investment is crucial, given the performance variations across markets and sub-sectors.

- Hotel: Momentum mostly priced in, except Japan

The Japanese hotel market is set to continue its growth trajectory, driven primarily by domestic demand and, to a lesser extent, inbound tourists. However, the performance is expected to vary across markets and segments, influenced by the operational capability to navigate challenges such as labor shortages and rising labor costs.

Looking ahead, investors in Asia Pacific real estate must navigate a complex environment marked by structural changes and atypical market cycles.

Elysia Tse, Asia Pacific Head of Research and Strategy at LaSalle, commented: “There are many unknowns in the current complex economic climate, compounded by impending changes in Trump 2.0, which will likely lead to periodic episodes of capital market volatility. Investment strategies that favor domestic tenant demand and domestic capital, as well as those that focus on operational intensity, such as deal execution and in-house leasing, are important for value creation and preservation. In the event of significant dislocation or capital market volatility, investors could seek attractive entry points or creative, structured solutions to address capital stack issues for some troubled property owners or developers.”

Brian Klinksiek, Global Head of Research and Strategy at LaSalle, added: “As we enter 2025, we’re seeing the dawn of a new real estate cycle. While challenges remain, particularly in resolving legacy capital stack issues, we’re observing improving capital market conditions and emerging opportunities across a wide range of sectors and geographies. Investors who recognize these shifts early and act with flexibility are likely to benefit from attractive risk-adjusted returns. However, it’s crucial to remain vigilant about risks on the horizon and avoid the expectation of a rapid return to ultra-low interest rates.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Chicago (December 4, 2024) – US and Canadian real estate is on the verge of a new cycle in 2025, with interest rates down from peak levels and economic growth concerns fading, but also new risks on the horizon, according to the North America chapter of the ISA Outlook 2025 report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

The landscape for US and Canadian real estate has shifted since last year’s ISA Outlook 2024, which saw lower transaction volumes due to higher interest rates and challenging macroeconomic conditions. LaSalle sees considerable differences between this upcoming cycle and prior ones across both countries. Specifically, interest rates are expected to remain higher, which will lead to a more moderate pace of value recovery. And while the pace of capital flows to real estate is expected to pick-up in 2025, conditions across real estate sectors and markets will remain uneven.

These differences suggest that investing into the coming real estate cycle will not be a simple story of a “rising tide lifts all boats”; selectivity at the sector, market and sub-market level is likely to add value. LaSalle’s ISA Outlook 2025 follows several main themes that will influence real estate decision-making within the US and Canada, as well as sector by sector analysis of different property types:

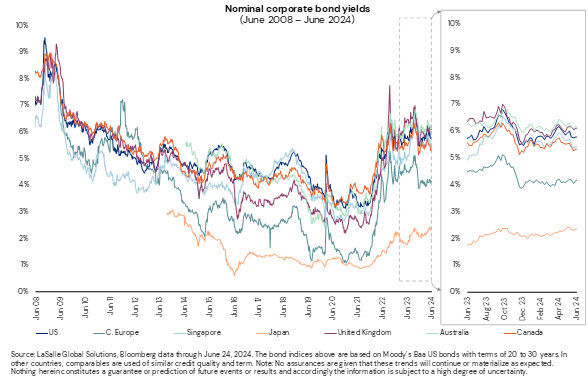

- Economic Outlook – Falling Rates but Risks on the Horizon: While the summer and fall of 2024 saw growing optimism among real estate investors, uncertainty around long-term interest rates rose in the fourth quarter of 2024. Long bond rates have moved higher, even as the Fed started cutting interest rates and Canada’s central bank has become more aggressive in lowering its policy rate. The recent volatility is a reminder that the goldilocks environment has not returned. Pandemic-era reverberations continue as we adjust to a new normal that includes at least the fear of higher inflation.

- Capital Markets – Best Market Entry Points Tend to be Early Cycle: Historically, the best entry points for investors tend to come early in the cycle, and the ISA Outlook predicts that 2025 will be the best year for entry into appraisal-based funds, and second best to 2024 for entry at market pricing. However, the research cautions that unless interest rates fall back to the low levels of the post-GFC period, pricing will not likely enable returns similar to those seen in the early years of previous cycles. Despite expectations for a strong vintage year, the ISA forecasts that transaction volume will grow slowly throughout 2025, as many sellers will delay sales expecting better values and fundamentals for 2026.

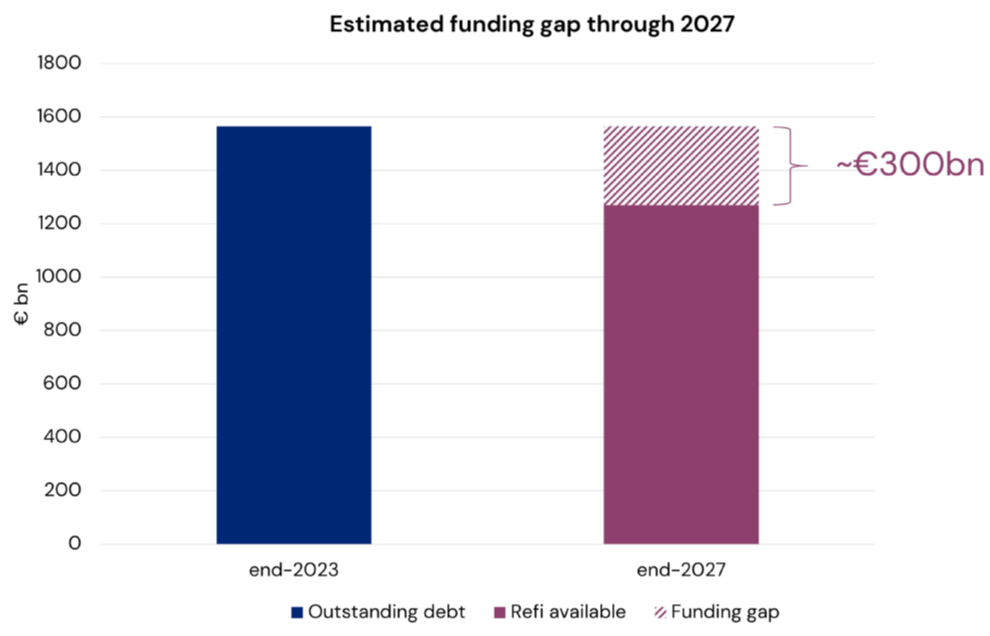

- Balancing a Portfolio – Real Estate Debt: LaSalle’s ISA Outlook 2025 notes that investors need to weigh the potential upside from allocating to equity vs. the downside protection in a debt position. While today this analysis tends to favor equity, there are still strong reasons for investors to allocate to debt. First, interest rates remain high relative to historic levels, which is a benefit to investors seeking high absolute current cash returns from debt investment. Second, there are structural tailwinds to private real estate debt investment as banks dial back direct mortgage activity in favor of providing cross-collateralized ‘back leverage’ to debt portfolios. Finally, debt is a good source of portfolio diversification as volatility remains elevated.

- Distress – The Capital Stack Hangover: LaSalle’s North America chapter of the ISA Outlook indicates that some market segments and assets will remain stressed under any realistic outlook for economic growth and interest rates. Challenged capital stacks will not be cured by lower rates, and the “pretend and extend” approach to distressed assets will eventually require resolution. Distress in the US office sector is rising fast, with US residential and retail seeing some limited distress. In Canada, the number of distressed commercial properties in 2024 is expected to double from 2023 levels, though on a dollar volume basis this is a small fraction of US levels.

Global and North American Property Sector Outlooks

The North America chapter of the ISA forms part of LaSalle’s Global ISA Outlook 2025, which analyzes real estate trends across geographies and sectors, and similarly finds the new cycle extends to global real estate markets.

- Apartments –In 2025, US apartments will still be dealing with the hangover from a supply boom that followed spiking rents, low cap rates and soaring values in 2021 and 2022. While there are significant market level differences, the ISA 2025’s national view is the hangover will not clear until 2026, while 2025 will be another year to muddle through. In Canada, apartment fundamentals remain strong due to migration-related demand drivers.

- Industrial – Industrial performance in 2025 is likely to be favorable in both countries, largely because the supply hangover is already ending, leaving fundamentals better positioned. Secular tailwinds are expected to continue, with e-commerce remaining a demand driver and policies boosting domestic manufacturing a growing benefit.

- Retail – Globally, the retail outlook continues to improve after an extended period as the least-favored sector. Across the US and Canada, retail construction is expected to remain very low, making existing supply more attractive, especially for the best centers in growing markets and sub-markets. Rent growth remains moderate as tenants’ ability to bear higher rents is constrained, but entry yields in some retail sub-segments are expected to provide an attractive investment opportunity.

- Office – Office continues to generate headlines and remains the most discussed sector. Remote working is expected to continue to negatively impact office demand in both countries, but economic growth will eventually outweigh that negative factor. Across North America, the investability of the office sector is increasing and the focus continues to be on quality.

Richard Kleinman, LaSalle’s Americas Head of Research and Strategy, said: “We are on the cusp of a new real estate cycle both globally and in the Americas specifically. That said, navigating the current environment will require selectivity at the sector, market, and submarket levels. The ISA Outlook 2025 research we’ve released today looks in depth at what is driving trends in North American real estate, and lays out our strategy for the year ahead.”

Chris Langstaff, Head of Research and Strategy for Canada at LaSalle, commented: “Our outlook for Canadian real estate next year resembles many of our global projections, with some important distinctions. Optimism is a bit more contained as economic performance has lagged and there’s been uncertainty around trade policies, but favourable demographics, healthy fundamentals in most sectors and forecasts for improved GDP and job growth in 2025 and 2026 will continue to drive opportunities across markets, including in specialty sectors.”

Brian Klinksiek, Global Head of Research and Strategy at LaSalle, added: “Global real estate sentiment is gradually improving following a long period of negativity and signs are pointing to the beginning of a new real estate cycle. History has shown that investing early in a cycle tends to lead to relatively strong performance. There are still risks on the horizon, however, and investors are advised to focus on diversified strategies that are flexible and broad enough to adapt to a complex and evolving relative value landscape. A comprehensive look at value across a wide range of sectors and markets will be required to build a well-positioned real estate portfolio.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.2 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

London (November 27, 2024) –Europe’s real estate cycle has reached a new dawn, following a deep capital market correction over recent years, according to the European chapter of the ISA Outlook 2025 report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

Last year’s ISA Outlook described the beginning of adjustment to the new reality of higher interest rates and challenging macroeconomic conditions. As we approach a new year, the latest ISA Outlook describes how market evidence is crossing thresholds that point to a new cycle. For example, data tracked by LaSalle’s asset managers show, from January 2024 to date, rents for new commercial leases across LaSalle’s European portfolio grew 2.7% relative to expiring passing rent, representing a return to an above-inflation pace.

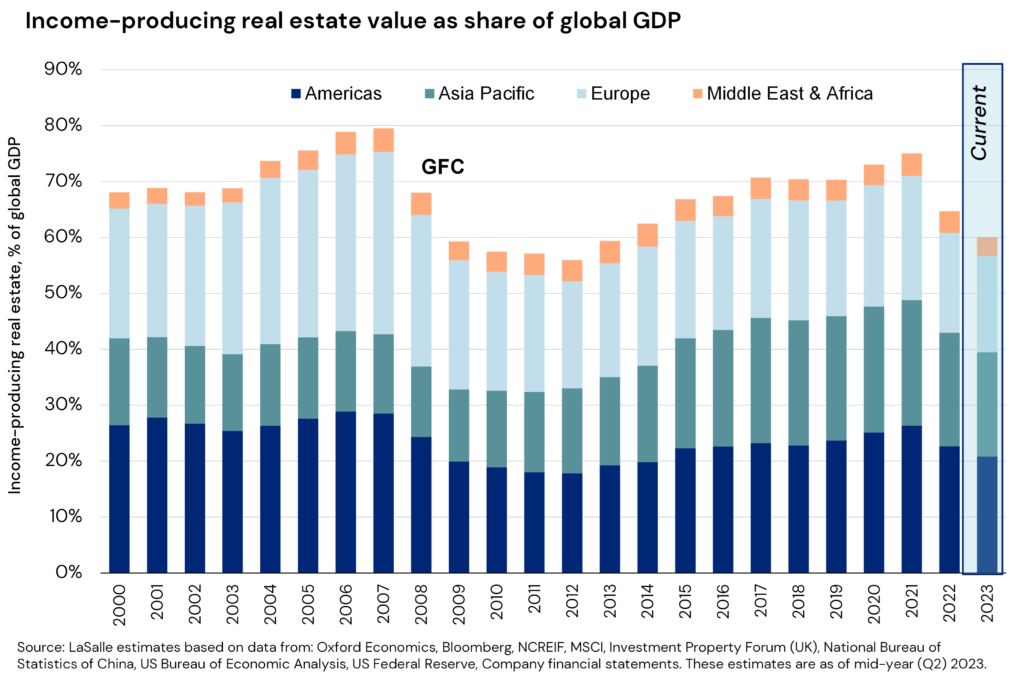

LaSalle estimates that expected go-forward returns for the overall European property market are at their highest level in a decade. As capital slowly returns to the market and yield spreads exceed long-term averages, the real estate outlook has diverged from the region’s weak pace of economic growth due to a combination of supply barriers and asset quality polarisation.

This year’s report identifies strategic themes for investment in European real estate, which earn the region’s real estate assets an important place in investors’ property portfolios.

Beyond beds and sheds

A laser focus on “beds and sheds” has become a market consensus portfolio theme for many real estate investors, yet it is now becoming too simplistic to capture the more complex dynamics of the market.

Today’s ISA Outlook 2025 report uses fair value analysis to zero in on the best opportunities across a range of real estate capital and debt strategies and asset classes. These span all property types – not for the sake of diversification – but because we believe there are specific compelling opportunities that span across property types.

The European chapter of ISA Outlook 2025’s five strategic themes:

- Don’t forget a (real estate debt) umbrella: Real estate debt strategies can guard against inclement market conditions. New performance data for European debt funds shows the benefits of preparedness. Debt investors are also taking advantage of the choice between fixed-rate and floating-rate lending positions, and the diversification benefits of investing in both.

- Follow the hexagons for logistics: In our Paths of Distribution Score, we have mapped Europe into 158,455 hexagons – scoring each on their centrality, from an occupier perspective, for distributing goods to the most consumers at the lowest cost – and we favour logistics strategies that focus on the top-scoring hexagons within the highest ranked markets in our fair value analysis (in France, the Netherland and Germany).

- Retail back on the menu: European retail has been through a deep reset, and select retail formats now look too attractive to ignore. Outlet centres in the UK and Northern Europe offer strong alignment between tenants and operators, while Spanish and French retail parks and convenience shopping centres in the Netherlands can also deliver high income returns.

- Master adapters – how Europe’s office markets are different: Europe is leading the office market’s adaptation to hybrid work, as their largely mixed-use, mid-rise character, creates distinctive opportunities. A rebalanced office sector is not a distant next buyer prospect for many of Europe’s markets – it’s happening now. This is evident in return-to-office figures as well as property fundamentals. London City office market vacancy has now declined for five consecutive quarters, driving prime rent growth.

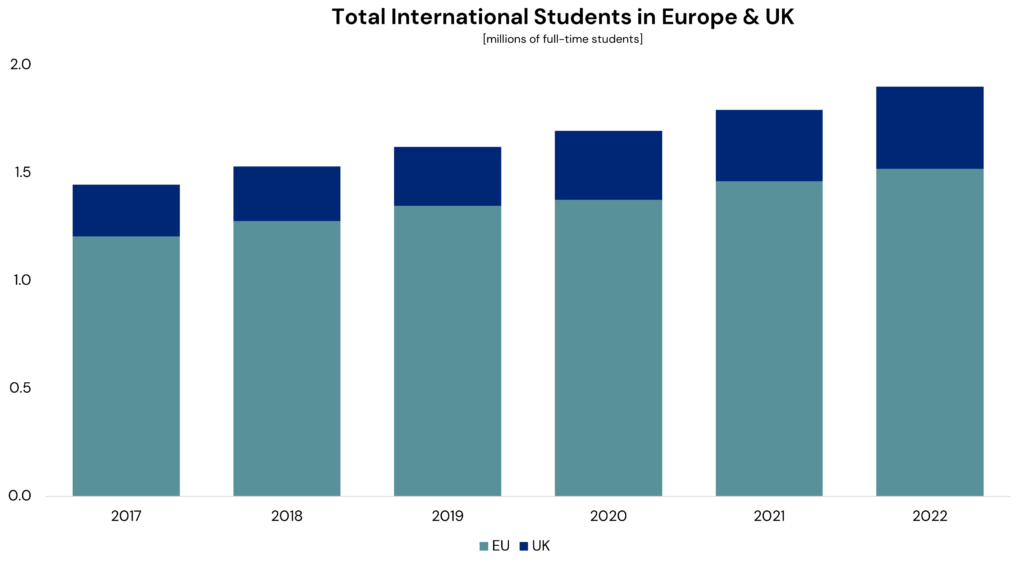

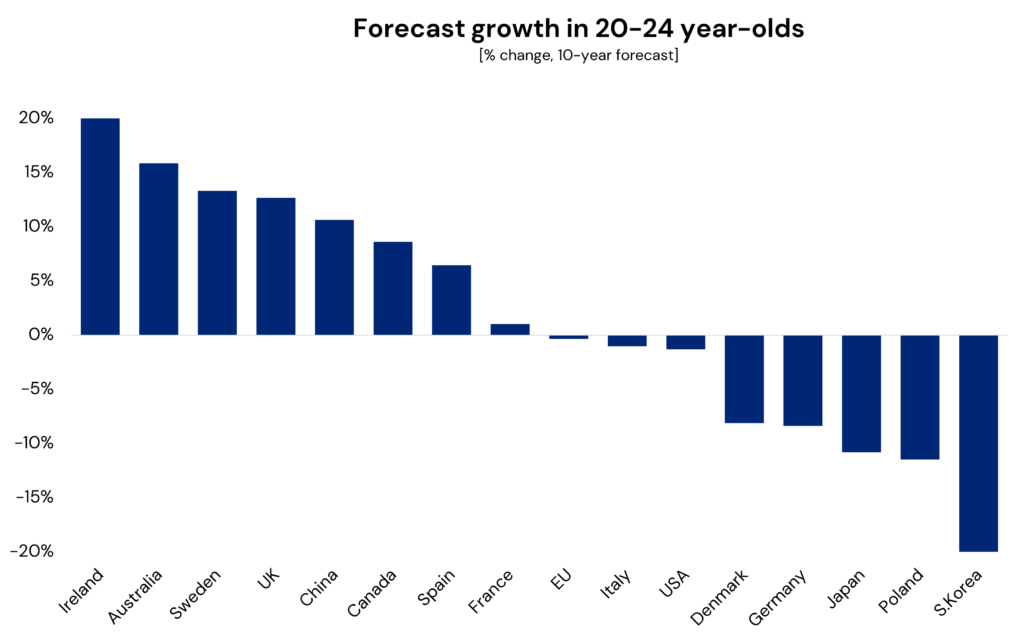

- A residential and living smörgåsbord: European residential (or living) is not really a single property type, it is a large collection of sub-sectors with widely varying cash flow profiles, pricing, regulation and target occupiers. There continue to be opportunities, but sector selection is paramount, with PBSA standing out in Spain and Germany.

Global uncertainty but clear opportunities

The European ISA Outlook forms part of LaSalle’s Global ISA Outlook, which finds that the new dawn extends across real estate around the world.

Greater clarity on the direction of interest rates around the world should help drive healing of the capital markets in 2025, with hesitant sellers gaining confidence as pricing starts to come in closer to their expectations.

There have, of course, been significant political developments in the US in recent weeks. The Global ISA Outlook reflects on how the “Red Sweep” may affect the real estate investment outlook and the shape of the dawning cycle, with signals pointing towards marginally higher growth, inflation and rates, but no great change in the overall outlook. LaSalle expects that the US economy remains on track for a soft landing. Equally, the European ISA Outlook considers the potential impact of the US Election in Europe, recognising that a stronger dollar could result in a possible boost in student demand for housing and tourist demand for hotel rooms.

The Global ISA Outlook also identifies areas of concern, with China a significant ‘soft spot’ due to a combination of generationally low growth and liquidity alongside weak property fundamentals. The Chinese government has made significant interventions to shore up the economy, and in recent weeks further stimulus has been implemented to guard against the potential onset of US tariffs on Chinese goods. These factors mean that China is something of a unique case in the ISA Outlook, with less applicability of global trends. Similarly, the Japanese market is experiencing a different cycle to the rest of the world. Japan is in the process of exiting a long period of deflationary risk and rock-bottom rates, so unlike other countries, monetary policy in Japan has a modest tightening bias.

Dan Mahoney, Head of European Research and Strategy at LaSalle, said: “We are seeing a new cycle dawning for Europe’s real estate markets. Today’s Europe ISA Outlook delves into why we believe we are entering a new cycle, evidence of data thresholds crossed, and our strategy for the years ahead. These go beyond simple ‘beds and sheds’ – which is too simplistic to capture the complexity of European real estate today.”

Brian Klinksiek, Global Head of Research and Strategy at LaSalle, added: “Global real estate sentiment is gradually improving following a long period of negativity and signs are pointing to the beginning of a new real estate cycle. History has shown that investing early in a cycle tends to lead to relatively strong performance. There are, however, still risks on the horizon, and investors are advised to focus on diversified strategies that are flexible and broad enough to adapt to a complex and evolving relative value landscape. A comprehensive look at value across a wide range of sectors and markets will be required to build a well-positioned real estate portfolio.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.2 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Almost three years after interest rates began to spike leading into the Great Tightening Cycle, the first light of a new real estate cycle is clearly visible on the horizon. As with the start of every new day, however, opportunities and challenges lie ahead. LaSalle’s Research and Strategy team will examine both throughout the course of November and December, as we publish four separate chapters, one covering our global outlook, and three deep-dives covering the outlook for Europe, North America and Asia Pacific. Each chapter can be found alongside an accompanying video conversations with lead authors on the links below.

Chapters

In the Global chapter of ISA Outlook 2025, we look at how to make the most of this new dawn and the opportunities it may present, but with a watchful eye on ways the new day could go off track. We examine these through four broad themes in this year’s report: the morning sky, the capital stack hangover, the breakfast menu, and the early bird.

We examine each of these concepts in turn, and ask what each means for real estate and they intersect with one another and other key trends.

Authors

Global Head of Research and Strategy

Managing Director, Global Research and Strategy

No results found

While dawn is universal, across Europe it can appear different from each location and every angle. European real estate is transiting inflection points following a deep capital market correction. The INREV ODCE index shifted in the latest quarter from declines to positive after seven down quarters.

Against this backdrop, we share our Impressions of a Rising Cycle in Europe, with a focus on what makes the region different from others across the globe. We also share our five key strategy themes for investors in European real estate for the year ahead.

Authors

Europe Head of Research and Strategy

Europe Head of Core and Core-plus Research and Strategy

Chief Economist

No results found

The summer and autumn of 2024 saw growing optimism among real estate investors. The belief that the dawn of 2025 would open with sunny skies for the real estate market was driven by falls in interest rates from peak levels, fading economic growth concerns and real estate valuations now more aligned with market transactions.

But with more uncertainty creeping into the picture in late 2024, especially around longer-term interest rates, what we see could be described as a “partly cloudy sunrise.”

Authors

Americas Head of Research and Strategy

Canada Head of Research and Strategy

No results found

The current real estate cycle in Asia Pacific is not a simple repetition of a typical cycle. While Asia Pacific economies have not been immune to supply chain disruptions and elevated inflation, interest rates and construction costs, real estate capital market liquidity in the region (with the exception of China and Hong Kong) has fared much better than in other parts of the world.

In our view, the varying and sometimes contrasting cyclical patterns among major real estate sectors within each country set the region apart from global trends.

Authors

Vice President, Strategist

China Head of Research and Strategy

No results found

Published every year since 1993, LaSalle’s annual ISA Outlook is designed to help our clients and partners navigate the year ahead. It brings together smart perspectives and investment ideas from our teams around the world, based on what we see across our more than 1,200 assets that span geographies, property types and risk profiles.

As always, we welcome your feedback. If you have any questions, comments or would like to learn more,

please get in touch by using our Contact Us page.

On November 19, 2024, LaSalle hosted a client webinar to discuss the outlook for listed real estate. LaSalle Global Solutions Chief Investment Officer Matt Sgrizzi offered a recap of our recent ISA Briefing: A new “golden era” for REITs and real estate? and took questions from clients in attendance.

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Want to read more?

We regularly receive questions about past property market dislocations and what they might tell us about today, such as: Is office the new retail?, Will the 7+ years it took retail to rebalance be a template for office? and Should we be worried about the wave of supply in US apartments?

In our latest ISA Focus report, Rebalancing past and present, we engage in patten recognition across a range of historical episodes of occupier market challenges. We present a framework for how these imbalances tend to be resolved, and discuss the range of structural and cyclical factors that drive rebalancing. We also present a selection of historical case studies from around the world, highlighting the complex nature of the rebalancing process and how it can occur not only at different speeds, but also with “bumps in the road” for investors.

We conclude the report with a refresh of our ISA Focus: Revisiting the future of office, noting in particular that there will be specific investment opportunities that arise as the current rebalancing cycle plays out.

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Dave White, Head of Real Estate Debt Strategies, and Dominic Silman, Europe Head of Debt and Value-add Capital Research and Strategy, discuss how we find opportunities and the evolution of the investment landscape over the last 15 years.

Dave White and Dominic Silman discuss our investment selection process, which combines bottom-up, on-the-ground market knowledge with top-down, macroeconomic and geopolitical analysis to identify attractive investments that meet our investment criteria.

In addition to how we identify opportunities, they cover where we are likely to invest, and how the opportunities before us have evolved over the last decade and a half.

Want to read more?

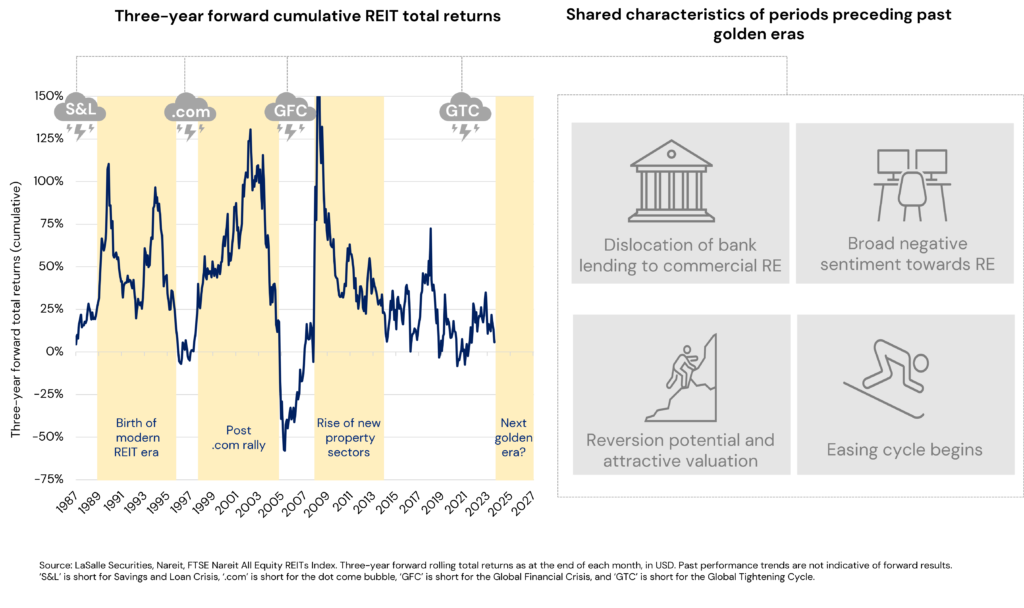

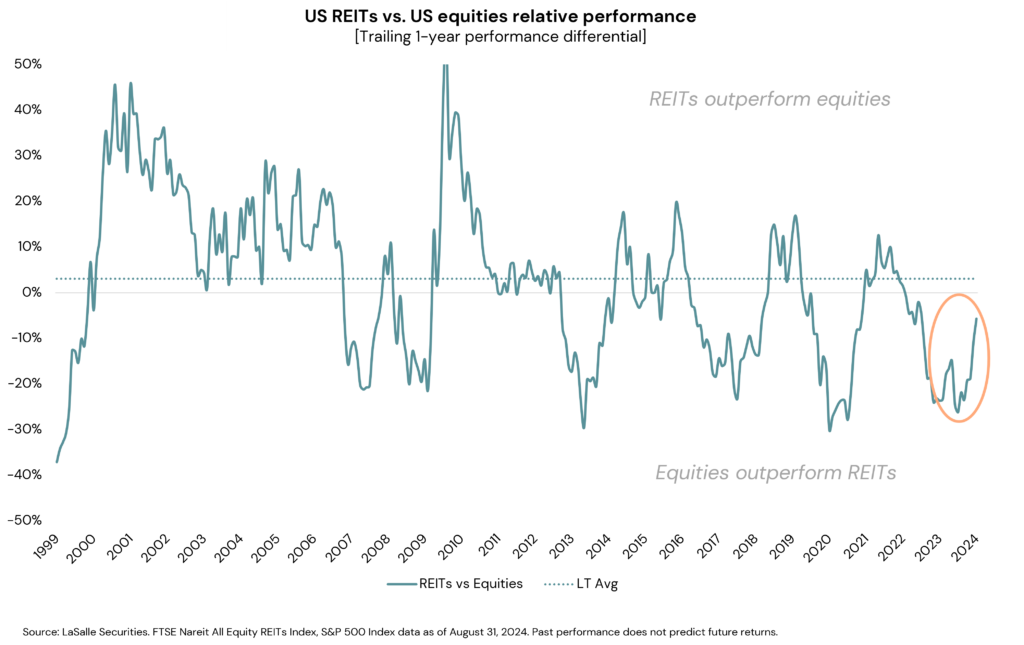

Listed real estate investment trusts (REITs) have faced a tough two and a half years, driven by the rapid tightening of financial conditions (see LaSalle Macro Quarterly, or LMQ, pg. 13). Sentiment towards REITs has been weighed down not only by the higher interest rate environment, but also by constrained bank lending, a barrage of negative headlines about commercial real estate and REIT underperformance relative to the broader equity market. But, as the saying goes, it’s often darkest before the dawn.

The modern REIT period has seen three “golden eras” of REIT investing (see chart below).1 These have been characterized by either a dramatic growth in the REIT market or outsized investment returns versus other asset classes, or both. The Savings and Loan (S&L) crisis spurred what is often considered the birth of the modern REIT era in the mid-1990s. During this period, the number of REITs increased by nearly 50%, while the market cap of that group grew nearly seven-fold. Following the Dot-com bubble, a period where REITs had been significantly out of favor, the REIT market endured a multi-year run of strong absolute performance in which it cumulatively outperformed broader equity markets by more than 300%. The period following the Global Financial Crisis (GFC) saw the rise of dynamic new property sectors in the public market, and another period of outperformance in which REITs led broader equities by 50%.

While each golden era was unique, our analysis finds that each period was preceded by challenging circumstances with four common elements (see LMQ pg. 14). These are:

- dislocation of bank lending to real estate;

- broad-based negative sentiment around real estate;

- underperformance versus broader equities which leads to attractive relative valuation and the potential for renewed outperformance; and

- an easing or reset of financial conditions, potentially aided by a central bank easing cycle.

Recent history, marked by a post-pandemic recovery followed swiftly by the Great Tightening Cycle (GTC), presents important similarities to these historical periods of severe market challenges. For instance, real estate bank lending is dislocated. An AI-driven tech frenzy and fears of a generalized “commercial” real estate malaise mean REITs have underperformed compared to equities (see LMQ pg. 22). Meanwhile, signs of an easing or stabilization in financial conditions and a potential global monetary easing cycle are becoming more apparent (see LMQ pgs. 9, 10 and 30).

While history does not repeat itself, it does often rhyme. The presence of those elements in today’s market environment, and the potential for those concerns to flip to opportunities, may foretell the next REIT golden era. We discuss each of these factors in turn.

Challenged real estate lending represents an opportunity for REITs. The past two to three years have been characterized by a significant retrenchment in bank lending to real estate. According to the US Senior Loan Officer Survey (see LMQ pg. 16), the net balance between demand for loans and banks’ willingness to lend points to the widest undersupply of credit in the past ten years, except for during the depths of COVID-19. The shortage is evident in all styles of borrowing, from riskier construction loans to mortgages backed by traditional, defensive apartment assets.

This circumstance presents an opportunity for REITs given their strong financial positions and access to the capital markets. Having learned a painful lesson from the GFC, global REITs went into the GTC with their lowest leverage levels on record (see LMQ pg. 16), and nearly 90% of their debt on fixed rates and an average remaining term of seven years.2 Looking specifically at the US market, the overwhelming majority of REIT borrowing – nearly 80% – is from the unsecured market, at rates that are today almost 100 bps lower than a traditional mortgage. This relative advantage in both access and cost of capital positions REITs to potentially play the role of aggregator and to take market share.

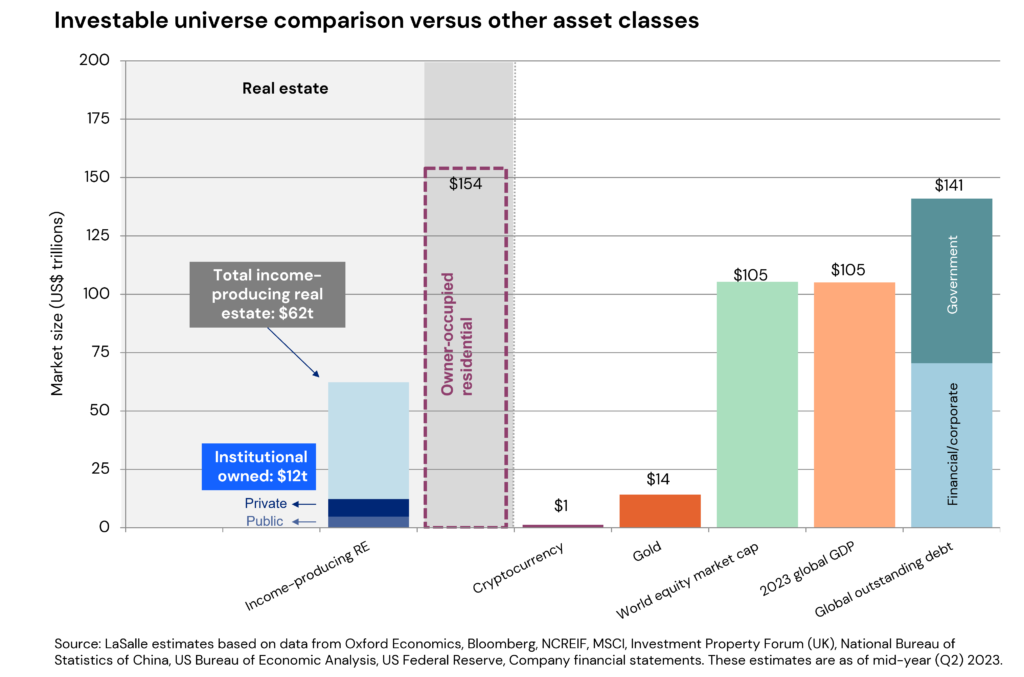

“Commercial” real estate negativity is office-focused, but all real estate is not office. Headlines proclaiming the demise of commercial real estate usually involve a misleading generalization. Professionally managed, income-producing real estate generally should not be conflated with office specifically. It is well known that hybrid work and other factors have harmed office values. Office fundamentals are expected to remain relatively weak,3 with the sector’s growth outlook trailing nearly all other REITs globally. Office landlords will likely need to invest capital aggressively to maintain competitiveness.

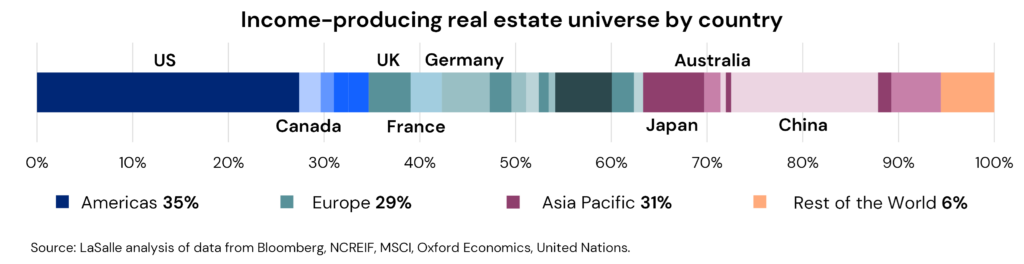

These challenging office sector dynamics have unfairly cast a shadow over the broader real estate and REIT universe. In reality, office has over time become a smaller portion of the real estate landscape, especially in the public market; as of the date of this paper, only about 6% of global REITs by market capitalization are office focused (see LMQ pg. 20).4 The public market now offers a diverse sector menu comprising a wide range of dynamic sectors. These include industrial and logistics; forms of rental residential including multi- and single-family rental, manufactured housing and student housing; various formats of healthcare property; and exposure to tech-related real estate in the form of data centers and cell towers. Sectors other than office comprise the overwhelming majority of the public REIT market,5 and many of those sectors have growth outlooks that are forecast to produce earnings growth that is in line with or better than broader equities.6 That growth outlook is underpinned by a combination of secular demand drivers and declining supply levels, the other side of the higher interest rate coin.7

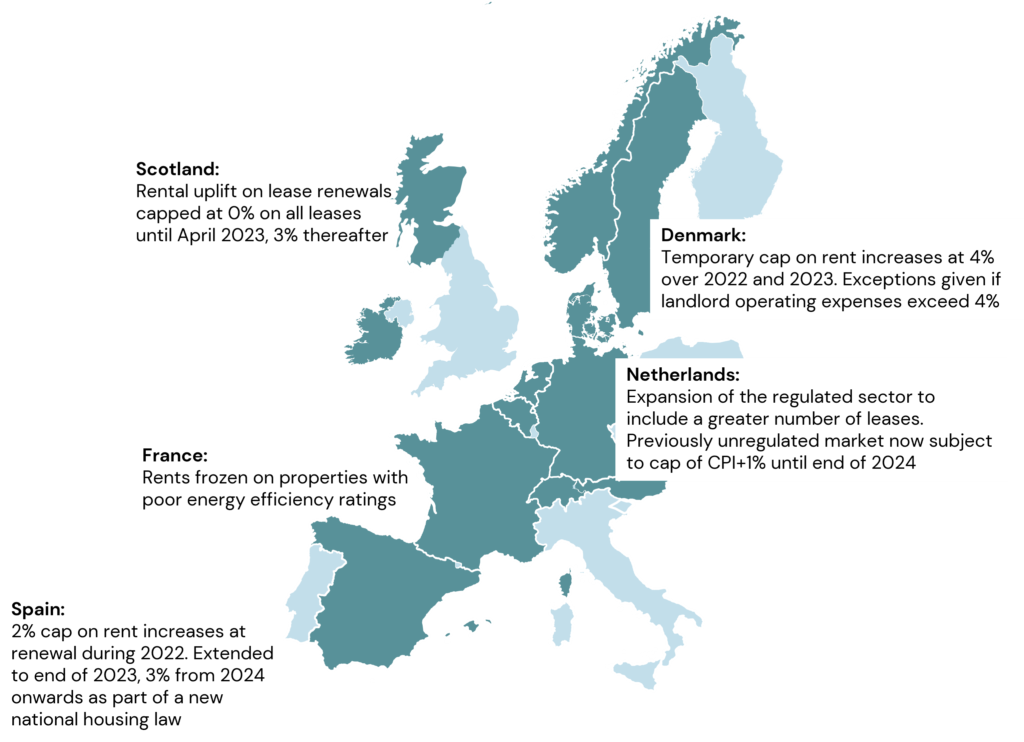

Media coverage naturally tends to focus on the national and trans-national arenas, but local political developments can be especially impactful for real estate investments. Such issues can fly under the radar, especially given many of the most relevant ones are only of interest to a specialist audience. For example, changes in policy around topics like the planning process, property taxes and transfer taxes (a.k.a. stamp duty) can have direct, measurable and immediate impacts on property cash flows and thus values. The distraction of the bright shiny lights of global geopolitics should not be allowed to excessively overshadow the critical local issues that impact real estate.

Underperformance may set the stage for a return to outperformance. The negativity around lending or financing concerns and the “death of office” have weighed on both the absolute and relative performance of REITs. The chart below shows the rolling one-year relative performance differential between REITs and equities; it indicates that REIT underperformance has reached its typical peak historical level before starting to reverse. Periods of underperformance have historically tended to reverse, and this instance is likely no different; indeed, the performance gap is already narrowing.

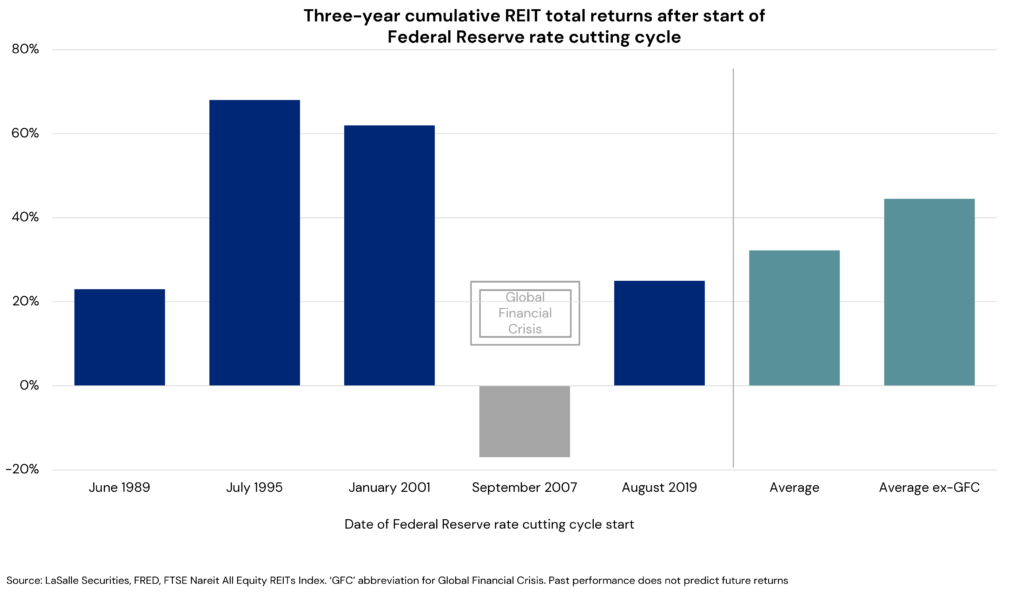

The start of a global monetary easing cycle. Real estate is a capital-intensive business that exhibits significant sensitivity to changes in financial conditions, an observation that holds for both directions of interest rate change. The downside of this dynamic was evident for much of 2022 and 2023, but the upside is likely coming into play. A global monetary easing cycle is now decidedly underway, heralded by the Fed’s 50 bps rate cut on September 18 (see LMQ pg. 31). REITs have generally performed well in periods leading up to and following a central bank easing cycle, as the chart below shows.

Over the past 25 years, REITs have produced total returns of 8% per annum, with 4-5 percentage points of that return coming from income. LaSalle’s base case underwriting for the next three years is for the REIT market to produce total returns of 9%, slightly above historical averages, with roughly four percentage points of that coming from income. That base case forecast incorporates today’s fundamental outlook and interest rate levels. Should any further easing in financial conditions occur, even only in the amount of 50 bps or 100 bps, those return expectations increase to 13% and 18% per annum, respectively, in line with previous “golden eras.”

LOOKING AHEAD >

- Pattern recognition is a useful approach that can help in predicting regime shifts in market conditions. Our study of historical periods of listed REIT under- and outperformance identifies a clear pattern. Namely, there are four common factors that have driven REIT strength after a period of challenges: dislocated bank finance, weak sentiment, underperformance versus broader equities, and the start of an easing in financial conditions.

- We also identify three historical “golden eras” for REITs — all of which were preceded by periods characterized by those four factors. These periods are those immediately in the wake of the S&L crisis, the Dot-com bust and the GFC.

- The current environment resembles the set up for these historical golden eras, suggesting that the REIT market may be on the cusp of its next golden era of investment, according to our analysis.

- Many of the factors supporting the REIT market’s upbeat prospects are also positives for real estate as a whole. For example, an easing in financial conditions has historically been a driver of strong forward REIT returns, as well as those for private equity real estate.

- That said, some of the dynamics are more specific to listed real estate markets. For example, REITs’ strong balance sheets and the cost of capital advantage of their unsecured borrowing options versus conventional mortgages positions listed players to seize opportunities.

Footnotes

1 This analysis based on LaSalle Securities analysis of historical macroeconomic, capital market and listed market trends. Source for the REIT performance data cited below are the FTSE Nareit indices.

2 Source for debt pricing comments in this paragraph: S&P Global Market Intelligence, Green Street Advisors, company financial releases, company research and market analysis conducted by LaSalle Securities.

3 There is considerable global variation in office performance, and there are certainly exceptions to this generalization, especially in select Asia-Pacific markets and the higher end of the European office quality spectrum. For more discussion of global office trends, see our ISA Outlook 2024 Mid-Year Update.

4 Source: LaSalle Securities. Percent of companies classified as office focused within the global listed universe defined as the constituents of the S&P Developed REIT, FTSE EPRA Nareit Developed and Nareit All Equity Indices. Sector classifications determined by LaSalle Securities.

5 As measured by market capitalization. Source: LaSalle Securities. Global listed universe defined by the constituents of the S&P Developed REIT, FTSE EPRA Nareit Developed and Nareit All Equity Indices. Sector classifications determined by LaSalle Securities.

6 As based on LaSalle Securities proprietary modelling and consensus earnings forecasts for the Bloomberg World Index, a proxy for broader equity markets.

7 Higher interest rates mean development proformas use higher exit yield assumptions and more expensive development finance. When interest rates are high, all else being equal, the rents required to justify development are higher.

8 Based on proprietary internal LaSalle Investment Management modeling of securities returns. There is no guarantee that such forecasted returns, or any other returns referred afterwards, will materialize.

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Dave White, Head of Real Estate Debt Strategies, and Brett Ormrod, Net Zero Carbon Lead for Europe, discuss the current and future state of green lending across Europe.

While lending volumes across the market remain volatile, data shows one continuously increasing metric: the demand for green loans, which is being driven by the ever-growing sustainability requirements from both investors and sponsors.

Dave White and Brett Ormrod discuss the challenges that borrowers and investors are facing, and how we at LaSalle are navigating these dynamics. They discuss how green loans are impacting the European real estate market, what they can mean for investors’ bottom lines, and the overall opportunity not just for green loans, but for greener assets in investors’ portfolios.

Want to read more?

This article first appeared in PropertyEU’s State of Logistics report

LaSalle’s Petra Blazkova recently joined Property EU’s State of Logistics 2024 conference in Amsterdam to present the firm’s inaugural Paths of Distribution Score research, which gives the ability to compare logistics locations at a micro, market, country and pan-European level.

LaSalle identifies top logistics locations in Europe

Paris and the surrounding Île-de-France region are the top micro-locations for efficient logistics distribution in Europe, according to a new study by LaSalle Investment Management.

The Paths of Distribution study considered over 150,000 micro-locations across the UK and EU, scoring them based on factors like manufacturing output, consumer spending, infrastructure, and labour costs. It also took into account the location of Amazon warehouses and analyzed data from REITs and other real estate databases.

Presenting the results at the Amsterdam logistics event, Petra Blazkova, Europe head of Core and Core-plus Research and Strategy, LaSalle Investment Management, pointed out that the data provides valuable insights for investors seeking the most efficient and attractive logistics locations with the greatest potential for long-term rental growth.

Want to read more?

Paris / Île-de-France is home to Europe’s top micro-locations for efficient logistics distribution, according to the inaugural release of the Paths of Distribution score, published today by LaSalle Investment Management (“LaSalle”). The innovative, granular new research gives the ability to compare logistics locations at a micro, market, country and pan-European level, with extensive flexibility for understanding, benchmarking and ranking locations at both micro and macro scale.

The Netherlands, thanks to its immediate access to Europe’s major consumption centres and having one of the crossroads of trade within and into Europe, was identified as the strongest-performing country. The port city of Rotterdam, the key gateway of global trade, ranked second and is joined in the top 20 regional markets by local rivals Amsterdam and the North Brabant region of Breda and Tilburg. Germany, the second-best performing country, provided another five of Europe’s top 20 markets, all in the west of the country, establishing this corner of north-western Europe as a hotspot for manufacturing and transportation. The UK, although separated from continental European logistics markets, placed third in the country standings, with Greater London its highest-ranked logistics market, although the West and East Midlands, the North-West of England (surrounding Manchester) and Kent all placed in the top 20 thanks to their strong infrastructure.

Belgium was fourth best performing, with the Antwerp and Brussels markets ranking seventh and seventeenth respectively. The wider Milan region also scored highly in the rankings, despite comparatively low investment volumes historically, while the Veneto-Verona corridor was another Italian market which scored well, with domestic consumption being the primary driver. Likewise, in Poland, the biggest winners were the Katowice-Krakow corridor and Lodz – ranking above the capital Warsaw – both growing notably in recent years and benefitting from investment in infrastructure and labour availability. LaSalle’s analysis shows there is a positive correlation between Paths of Distribution and logistics take-up, making a connection between current demand and these locations’ potential.

Micro-location and methodology

The research is the first of its kind, and takes an innovative, granular approach to its methodology, breaking the continent down into 158,445 10-kilometre hexagons. Each micro-location is scored across four key pillars of manufacturing output, consumer spend, infrastructure quality and the proximity to skilled labour. The model not only factors in demand, but also considers the cost from an operator’s perspective of meeting that demand, using an extensive set of region-to-region road freight transport cost metrics, along with a random forest machine learning model evaluating how extensive and accessible the road network is at the most granular level.