Global Head of Research and Strategy

This article first appeared in the July 2025 edition of PERE

LaSalle’s Global CEO, Mark Gabbay, sat down with PERE for the magazine’s 20th anniversary special edition to discuss the real estate industry’s transformation over the past decade, LaSalle’s own evolution in that time, and the opportunities and risks ahead.

Real estate: The world’s simplest, most complicated asset class

Significant growth in real estate investment managers’ offerings has created unprecedented opportunities for investors to customize portfolios. But, as Mark explains, understanding relative value across sectors and geographies is crucial to long-term returns and outperformance.

While fundamentally real estate is composed of bricks and mortar that everyone understands, that hides its complexity. There is potential for real estate to shine as it acts as a diversifier in a volatile world, and faces potentially less demanding valuations than, say, large-cap equities. But it will be essential to be nimble and adapt to fast-changing relative value within the asset class.

Their discussion also covered the explosive growth in capital formation, the industry’s diversification of capital sources and LaSalle’s recalibration to mirror its global footprint.

Want to read more?

In a recent conversation,1 Dominic Silman and Brian Klinksiek revisited LaSalle’s ISA Outlook themes amid 2025’s rapidly developing and unpredictable geopolitical and macroeconomic climate.

Brian Klinksiek (BK):

The theme of our ISA Outlook 2025 was the ‘Dawn of a New Real Estate Cycle’. Looking back six months later, we’ve been through a rollercoaster of policy change with meaningful shifts in the economic narrative. We covered this in two recent Briefing notes. In the first, we recommended that investors “work backwards” from strategic actions that make sense regardless of macropolitical outcomes; in the second, we pointed to signals from key relativities among asset classes, geographies, and sectors. All those recommendations still stand, but we provide a further update on recent developments in our latest LaSalle Macro Quarterly deck (LMQ), which we released today. Thankfully, many of the most extreme US policies – such as the full “Liberation Day” tariffs – have been paused, at least for now. But as we have pointed out, uncertainty itself has a cost.

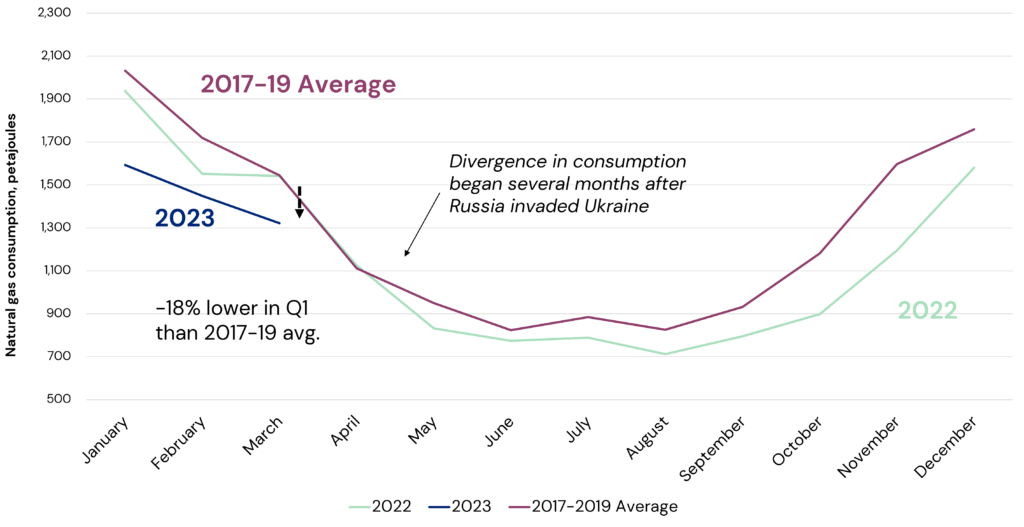

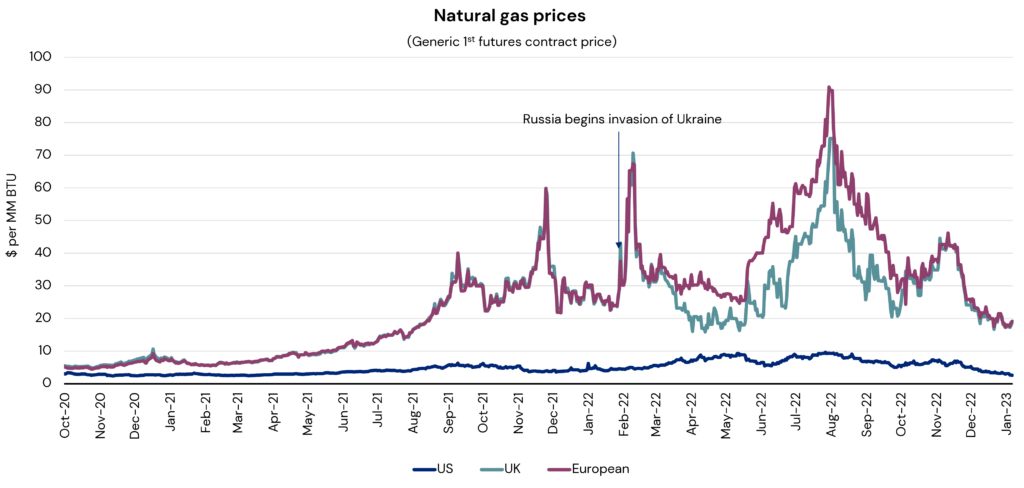

Beyond the trade war, in the past two weeks a real kinetic war unfolded between Israel and Iran, with the US stepping in as well. This is driving energy price volatility and, in the unlikely case of a severe escalation, could lead to the destruction of energy infrastructure in the region, or to the closure of the Strait of Hormuz, a major chokepoint on the global energy map.2 Both could potentially bring stagflation to the global economy.3 In the background, the global political calendar has also been very busy – we’ve seen election results in Canada, Australia, South Korea and Poland, as well as the new German coalition’s shift toward higher spending and investment. Given all this change, where do we stand today? Do we still think it’s the dawn of a new real estate cycle?

“It’s helpful to take a step back and ask: What is actually changing and what is likely to stay the same?”

Dominic Silman (DS):

As you say, it’s been quite a six months! It’s helpful to take a step back and ask: What is actually changing and what is likely to stay the same? For example, despite the movement and uncertainty, it bears mentioning how little has so far changed on the ground in property markets, which we will talk about later.

Among the many changes, we should also ask which are likely temporary and which are permanent. April’s extreme volatility has so far proven temporary; markets are a lot calmer today.4 It reminds me of that British Second World War poster: ‘Keep Calm and Carry On’. Are we carrying on? Certainly. Are markets actually keeping too calm recently, especially given still elevated uncertainty? I think there’s a risk of too much calmness, and too much of an instinct to assume that everything always works out absolutely fine and reverts to “normal”.

Want to read the rest of the conversation? Download the PDF

Footnotes

1 LaSalle has utilised JLL GPT to transform a transcript of a recorded verbal conversation that is documented in this publication. JLL GPT is a secure, in-house generative artificial intelligence (AI) interface that draws on the underlying models from OpenAI’s ChatGPT and other AI firms.

2 Source: Signum Global Advisors, Piper Sandler

3 Source: Oxford Economics

4 As indicated by a significant moderation in indicators of market volatility, such as the VIX for US equities and the MOVE index for US government bonds. Source: LaSalle analysis of Refinitiv data.

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. LaSalle takes reasonable steps to ensure the quality of AI-generated content, however LaSalle cannot guarantee the accuracy of AI-generated content. LaSalle does not accept liability for any errors or omissions in the content produced by AI technology and advise that recipients exercise caution when relying on such content. LaSalle is not responsible for consequences which may arise from recipients’ reliance on AI-generated content. Recipients should exercise discretion and seek expert advice when making decisions based on automated information. Additionally, LaSalle reserves the right to modify or remove AI-generated content at any time without prior notice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Breaking economic patterns: Europe’s real estate landscape

Today’s European market view is of a picture scarcely imaginable a few years ago.

2025 in Europe has a macroeconomic backdrop scarcely imaginable a few years ago: German stimulus spending, Greece in budget surplus and historically reliable real estate correlations – such as that between GDP and prime rents – behaving differently. And that’s on top of still to-be-determined new tariffs faced by Europe’s exporters. As we’ve shared in our recent ISA Briefings, it is helpful to “work backwards” to investment strategy based on what is actionable amidst all the noise.

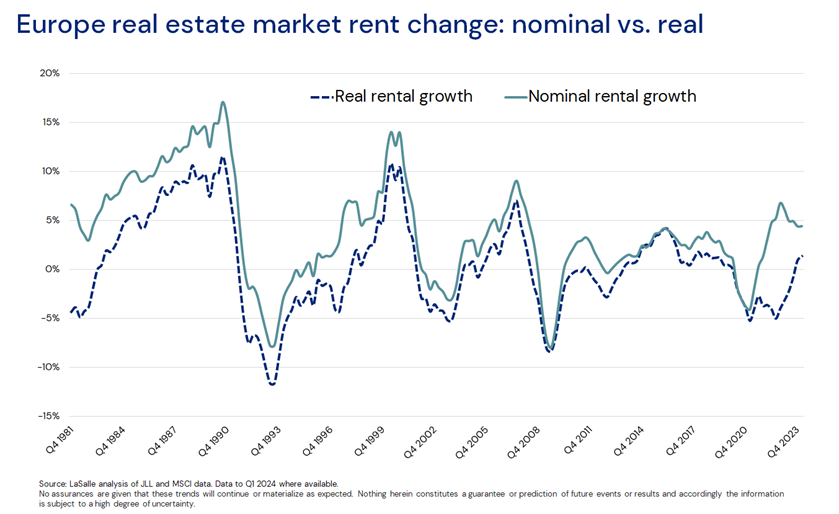

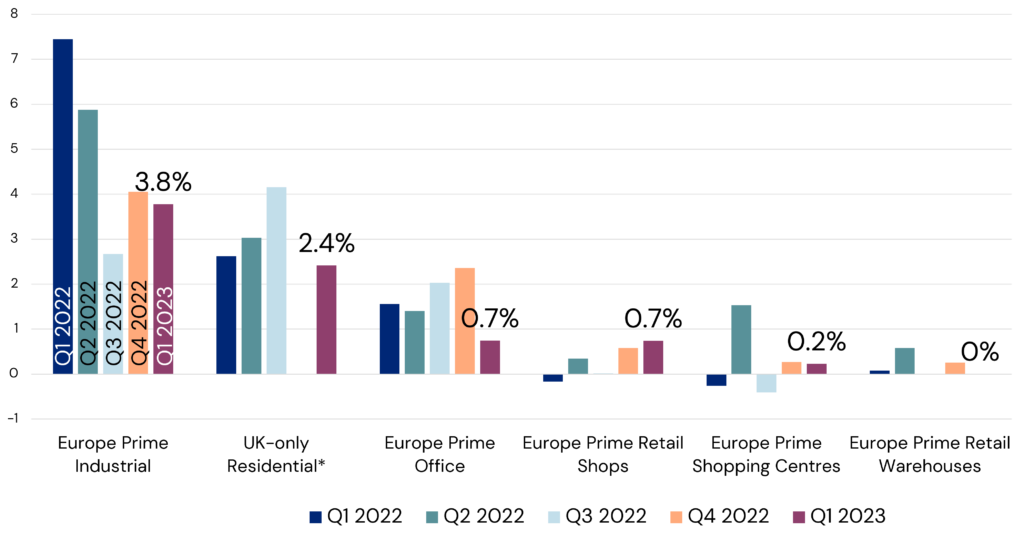

Initial bond and currency market reactions, several highlighted in our latest Europe Market View, imply a relative shift towards Europe as a safe haven. These changes are having ripple effects for European real estate. Easing eurozone borrowing costs have made debt more accretive to go-forward returns, supporting a cautious recovery in investment activity. A stabilization in real estate yields, and the return of yield compression in some segments, are signs of the beginning of a new real estate cycle. The MSCI Europe Property Index capital values have increased for two consecutive quarters following eight quarters of decline.

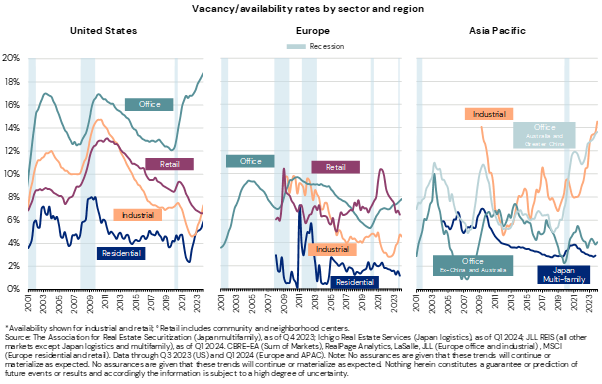

Europe all property inflation-adjusted rent growth has now been positive for six quarters. The wider office market is undergoing a rebalancing cycle with slowing building starts and rising conversions of obsolete offices to other uses helping to keep markets in balance. Conversions in Europe reached 1.4% of stock in 2024 compared to the long-term average of 0.9% p.a.

We graph these trends in our latest LaSalle Europe Market View chartbook. We also look ahead to sharing our ISA Outlook 2025 Mid-Year Update, as we move into the second half of an eventful year.

Want to read more?

Industrial outdoor storage (IOS) real estate is not new, but it has only recently been given a name and a place in institutional investment portfolios. Some in the market define IOS inexactly, or even as they “know it when they see it”. A more precise definition is that it encompasses open-air facilities used by industrial, manufacturing or logistics businesses to store or process equipment, vehicles, materials or products that do not require the protection of warehouse buildings.

IOS is an amalgam of facilities that serve auxiliary but essential functions to the logistics ecosystem. The prominent features of IOS are low site coverage (with FAR1 of less than 20-25% but often zero), zoning designations that allow for heavy industrial uses, and most importantly, value that is driven by underlying land rather than physical structures2. Attributes that are commonly considered in the evaluation of IOS sites include the quality of surfacing (full concrete surfacing to softer gravel surfacing), good vehicle access (light and heavy), and availability of utility and services (water, electricity, fencing/security).

IOS started gaining traction among institutional investors following the industrial sector’s boom in the post-pandemic era. As industrial pricing became more aggressive through the peak of the cycle, the IOS sector’s robust demand growth outlook provided an attractive alternative for investors seeking yield. Interest in IOS remained strong even when the broader capital market entered correction. This has continued in the context of the industrial sector broadly softening as it digests a (now resolving) wave of deliveries, while IOS has proven resilient given that its new supply tends to be much less elastic.

Despite its adjacency to the traditional industrial sector and its proven relevance to users, IOS as a property type has flown under the radar of institutional investors as it is usually transacted in small deals that are local or regional in nature, often involving owner occupiers. There are a few dedicated IOS players whose inceptions date back as early as 2013, but it is only in recent years that the sector came to be viewed as a critical component of the wider supply chain and distribution network.

The body of knowledge on the sector – operational, fundamentals, performance – is limited, but curiosity has been rising from new entrants in the past couple of years that include institutional capital. The IOS sector’s lack of transparency, common in emerging specialty sectors, demands rigorous scrutiny in underwriting. As IOS continues to mature, detailed research and underwriting as well as deep engagement with the local market can help navigate these challenges, enabling investors better assess and mitigate risks.

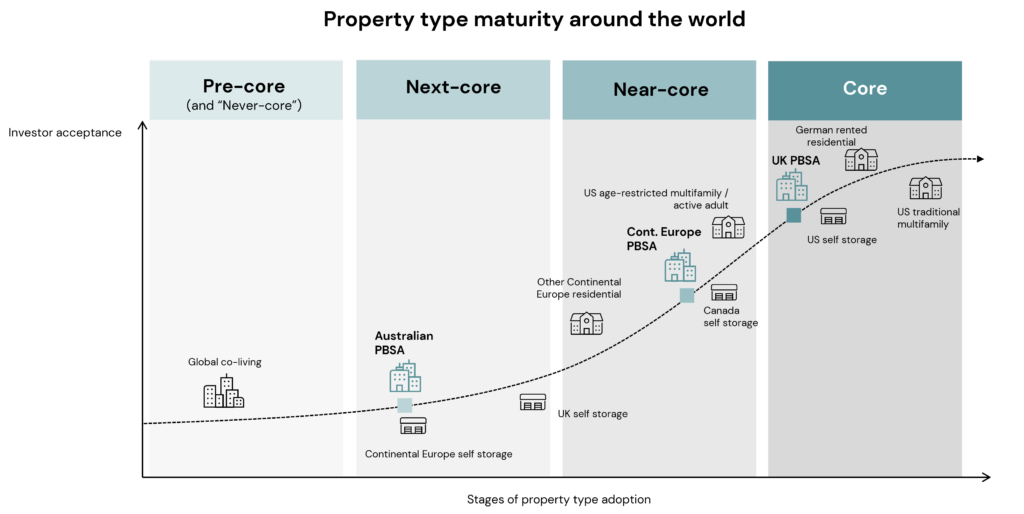

‘Next-core’3 in the US, emerging in the UK and continental Europe

In the US, the aggregate market value of IOS property is commonly estimated to be $200 billion in GAV, but the source of that stat as well as the inclusions and exclusions behind it are unclear.4 While institutional investment in IOS has accelerated in recent years, the sector’s overall ownership remains fragmented with a still-limited institutional footprint.

Meanwhile, IOS is even more nascent among institutional investors in the UK and Europe, but interest is growing. An increasing number of institutional investors are now setting their sights on IOS opportunities across the region. This includes funds dedicated exclusively to IOS, as well as vehicles that incorporate the sector as part of a wider industrial strategy. We estimate that more than £1 billion has either been allocated for investment or has already been deployed into the UK’s IOS sector in recent years. Owing to structural factors, we see much more limited, but not zero, potential for IOS to emerge in the Asia-Pacific region (see below).

Types of/use cases for IOS

Service-oriented

• Equipment rental & maintenance

• Construction materials & staging

• Waste management & recycling

Transport-oriented

• Port logistics & intermodal transport

• Vehicle storage & parking

• Freight distribution & cross-docking

Storage-oriented

• Construction equipment & bulk material storage

• Vehicle or equipment fleets

Source: LaSalle analysis; images created with the assistance of AI

Truck terminals are the only type of IOS that is now explicitly defined in the NCREIF Property Index (NPI, previously “Expanded NPI”), with $5.3 billion in gross market value, or 1.8% of the US industrial index as of 1Q 2025.5 Tracking of other types of IOS is still a work in progress, although the NCREIF Research committee acknowledges the challenge, and has started the process of putting together guidance on how IOS should be classified and tracked to improve transparency. Investors’ desire to gauge the competitor landscape as well as returns supports this effort to define and track IOS as a distinct category in the NPI.

In Europe, there is still a lack of data availability for IOS, but some agents are extending coverage to the sector and starting to publish market data. For example, new data from late 2024 reported that 48% of enquiries for IOS space in the UK was driven by the need for fleet parking, approximately 60% of which was driven by Heavy Goods Vehicle (HGV) parking.6 This need can also be seen in data from a national survey of lorry parking, which reported a 5% increase in the number of on-site parking facilities between 2017 and 2022, even as the national average night on-site utilization at those facilities grew by nine percentage points over the same period to 83%, indicating strong growth in demand and a high occupancy rate for parking spaces.7

Is IOS “a thing” in Asia Pacific?

The Asia-Pacific IOS sector is evolving and yet to be institutionalized. High land values in many Asian markets make low- or no-coverage land sites uneconomic, at least beyond a temporary use. That said, the factors that drive IOS demand in the US are clearly present in the region, especially the need operational flexibility in handling trailers, containers and delivery vehicles, as well as flexibility to store overflow inventory. The confluence of Japan’s acute truck driver shortage and the implementation of stricter truck driver working hour regulations in 2024 is driving demand for specialized IOS-related assets in the long-term, particularly truck terminals. However, in most markets we view these factors as informing improvements to the design of existing multi-story logistics facilities, rather than driving the emergence of a new, investable specialty property type, at least in the near term.

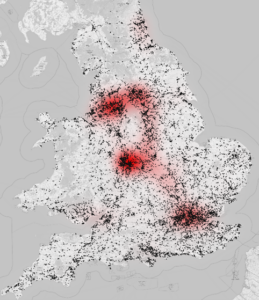

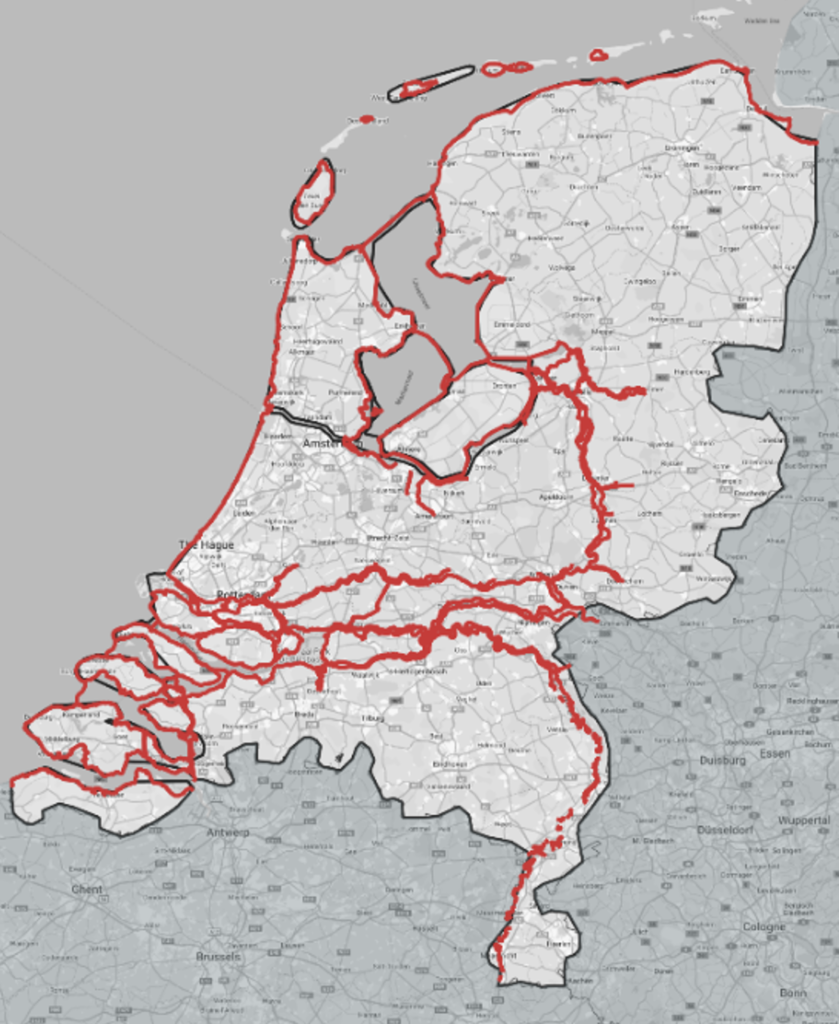

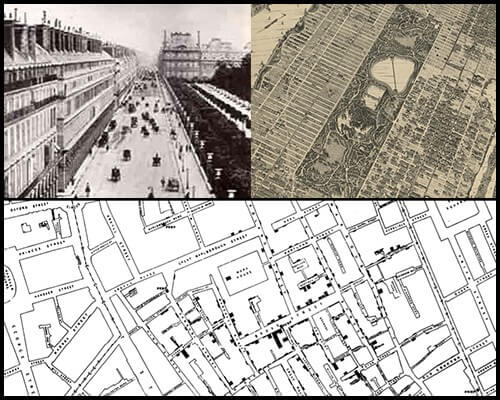

Using a non-traditional data source to identify IOS inventory in the UK

Geographical distribution of UK open storage land vs. warehouse space

Sites classified by VOA as land used for storage and lorry parking are indicated in black, with traditional industrial and warehouse space displayed as a heatmap in red

Data on IOS fundamentals are very limited in the UK and Europe. At least there is a way to estimate the size and shape of the IOS footprint in England and Wales, where the Valuation Office Agency undertakes detailed categorizations of use cases across property types to set business rates, including categories for open storage and lorry parking.i Proprietary analysis of these data by LaSalle identified some 29,000 locations, with a total area of 16,700 acres and an average size of 0.57 acre.ii The locational pattern (black on the map) is correlated with, but generally more broadly dispersed than, the distribution of traditional logistics space (red on the map). This analysis does not capture the entire UK IOS universe, but still highlights the significant size if the opportunity available within UK IOS, and can support investment decisions requiring a view on supply in markets and submarkets.

i Source: Valuation Office Agency

ii It must be noted that this approach likely misses a sizeable proportion of IOS that is currently classified within the warehouse category by the Valuation Office Agency, especially where the site itself is dominated by an open space but have a structure making up a smaller portion of overall area.

Joint ventures structured between institutional investors and specialized operators have been a common avenue for deploying capital into IOS. The challenges of limited transparency, as well as the transactional and operational inefficiencies of small deals, are factors that motivate partnerships with operators. However, the day-to-day operation of IOS is more like traditional industrial than a more operationally intense sector (such as self-storage). In addition, IOS portfolios of scale are currently rare compared to traditional industrial, but we expect greater consolidation of ownership as the sector matures. The assembly of institutional-scale portfolios, along with development of third-party leasing and management service providers, should support the sector becoming more “mainstream” over time.

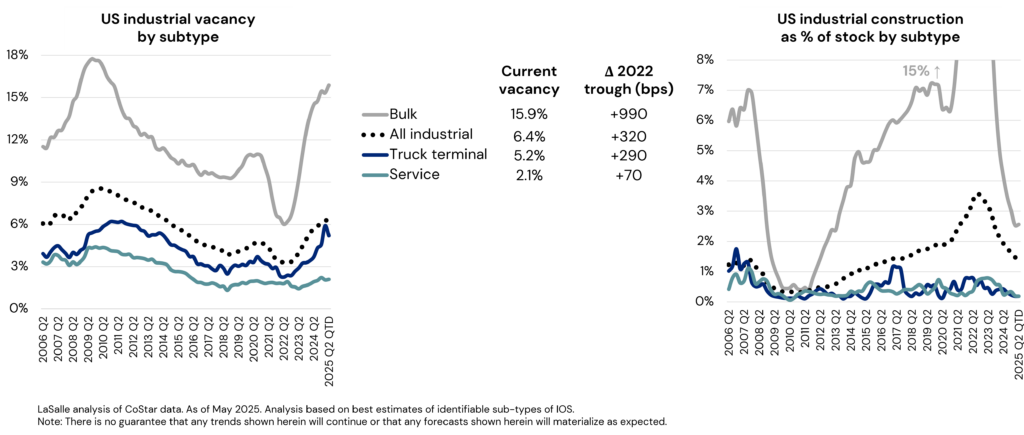

IOS fundamentals are tight and resilient

Data on historical industrial fundamentals illustrates consistently lower vacancy and reduced volatility for IOS assets like truck terminals and service facilities, compared to larger industrial buildings (see adjacent charts). The sector benefits from a weaker elasticity of supply, stemming from stringent zoning regulations and community resistance to new IOS facilities. Local municipalities are hesitant to approve them due to the perceived unappealing aesthetics of open-air industrial operations, and an assumption that they have limited potential for generating jobs and taxes. Data challenges remain in holistically assessing fundamentals of IOS sector that take multiple forms; however, the available data suggest a superior track record of fundamentals as well as outlook that is better protected from future development risks.

LOOKING AHEAD >

Several key attributes of IOS suggest it is well positioned to perform strongly:

• Tailwinds of the broader industrial sector: The growth of e-commerce and an emphasis on just-in-time delivery have boosted demand for strategically located industrial service facilities. Whether as a point of transfer, servicing freight vehicles or serving as supplementary outdoor warehousing, various stages of logistics operation require IOS sites. These should be in close proximity to the industrial clusters and population that they serve, and are often infill locations.

• Favorable supply dynamics: New development is limited due to the scarcity and high cost of suitable land — i.e., large sites with the appropriate zoning in proximity to population centers. Stringent zoning regulations and community resistance to new facilities — due to concerns such as noise pollution, increased traffic, and environmental impact —further create barrier to entry. This is a differentiator as compared to traditional industrial, which is currently experiencing softer fundamentals due to a recent supply wave.

• Operational resilience: IOS facilities typically present low operational risks for investors. The simplicity of these assets, usually combined with triple-net lease structures that place maintenance responsibilities on tenants, result in minimal capital expenditures and higher cash returns. The limited availability of alternative facilities contributes to high tenant retention rates, enhancing cash flow stability. The impact of tariff-driven uncertainties on IOS is expected to vary. While port and trade-linked IOS sites are more exposed, those serving local populations should demonstrate more resilience.

• Increasingly liquid and institutional: As recognition of the attractive value proposition of IOS grows, partnerships between institutional capital and professional operators to invest in it are being launched. This is not only likely to improve the management of assets, but should also provide a track record of sector performance. We anticipate a gradual compression of the yield spread between IOS and traditional industrial properties, supported by continued institutional capital flow to the sector and falling perceived risks.

1 FAR refers to floor-area ratio, which measures the relationship between land area and internal building area.

2 Source: JLL Research 2023.

3 Under the LaSalle Going Mainstream framework for maturation of niche sectors. “Next-core” is characterized by professionalization where specialists begin to track performance, transparency is rising, and the income quality is proven.

4 GAV refers to Gross Asset Value. The origin for this widely cited number appears to be the PwC Investor Survey.

5 Source: NCREIF 4Q 2024. NCREIF refers to the National Council of Real Estate Investment Fiduciaries and publishes indices tracking the performance of real estate in the US directly held by institutional investors and by institutional funds. Launched in 1Q 2024, the Expanded NCREIF Property Index (NPI) encompasses a wider array of property sectors and subtype designations than the Classic NPI, aimed at aligning performance measurement with the broader industry’s investable universe.

6 Source: Carter Jonas 2024

7 Source: UK Department for Transport

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. With reference to the graphs included in this publication, note that no assurances are given that trends shown therein will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Want to read more?

Two 90-day pauses, one on retaliatory tariffs with China and the other on the so-called “liberation day” tariffs, have not liberated markets from uncertainty. However, these course corrections have at least shown that the US administration has limits to its willingness to tolerate extreme market movements, particularly increases in Treasury yields, or severe outcomes for consumers such as product shortages1. They have also contributed to a more benign recent market environment than at the beginning of April.

That said, the future “steady state” of trade policy remains unknowable because it rests on a host of complex political, legal and diplomatic factors2. Even if it became clear where tariffs will settle, economic and real estate forecasting would still be challenging because the US administration has proposed a large and rapid change in the global trading system with little historical precedent3. Moreover, there is the additional variable of time — the longer uncertainty hangs over the economy, the greater the likely cost to investment and growth.4

What is a real estate investor to do? In our last ISA Briefing note, “Working backwards: Dealing with unprecedented policy uncertainty,” we cautioned against spending too much time or effort guessing exactly what comes next. Instead, we argued for pursuing strategies that are broadly prudent, aligned with long-term themes and likely to enhance the resilience of a portfolio, regardless of the state of the world. Our specific recommendations include seeking diversification and building a permanent allocation to real estate debt.

In this note, we take our analysis a step further to highlight three key relativities that we suspect are likely to hold, even as the absolute path of policy and the economy is unknown. These comparative assessments are rooted in our analysis of private real estate markets, confirmed by signals from public markets, and framed in the context of our Fair Value Analysis (FVA) approach. Even with all the uncertainty around absolutes, seeking conviction in key relativities can be helpful when making investment decisions.

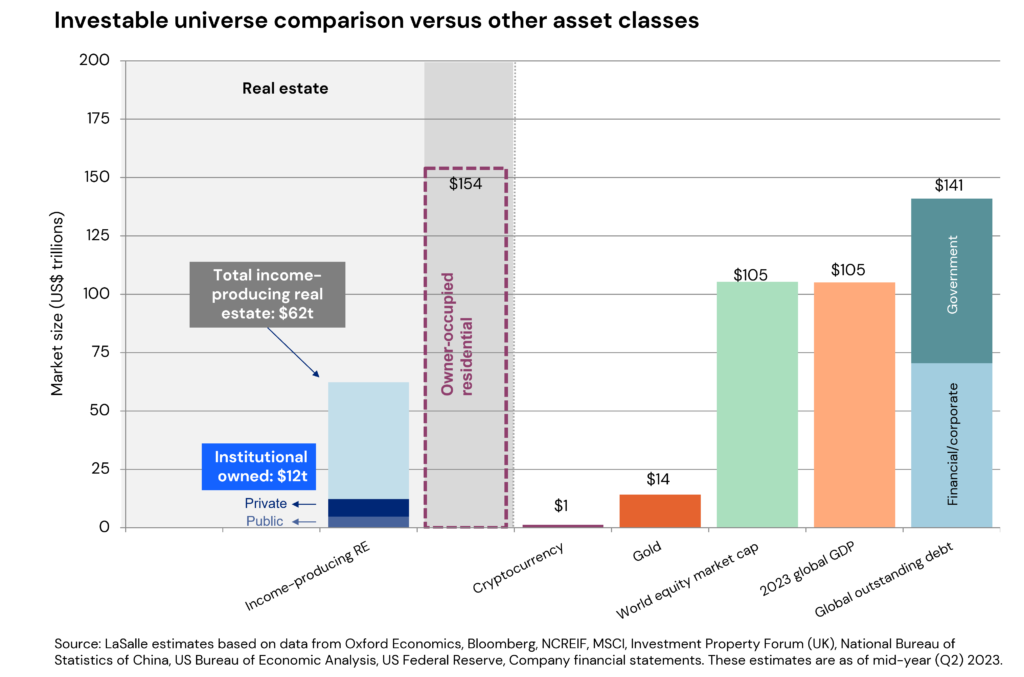

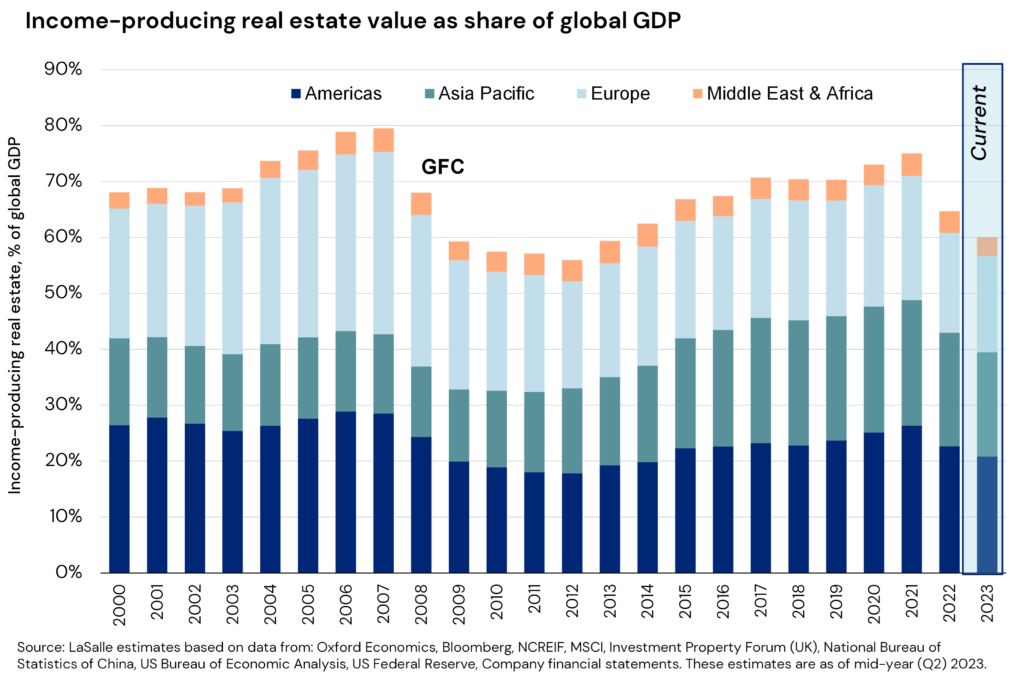

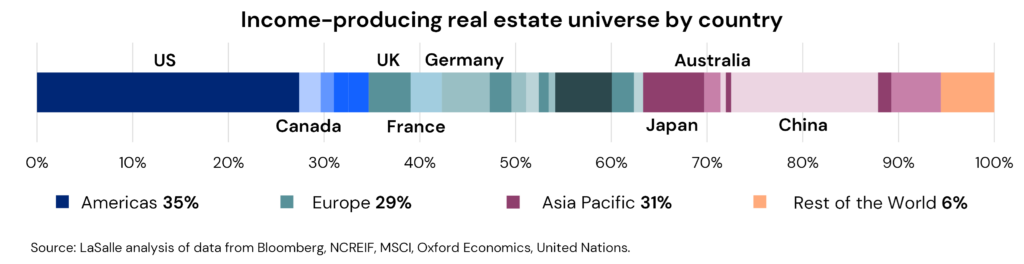

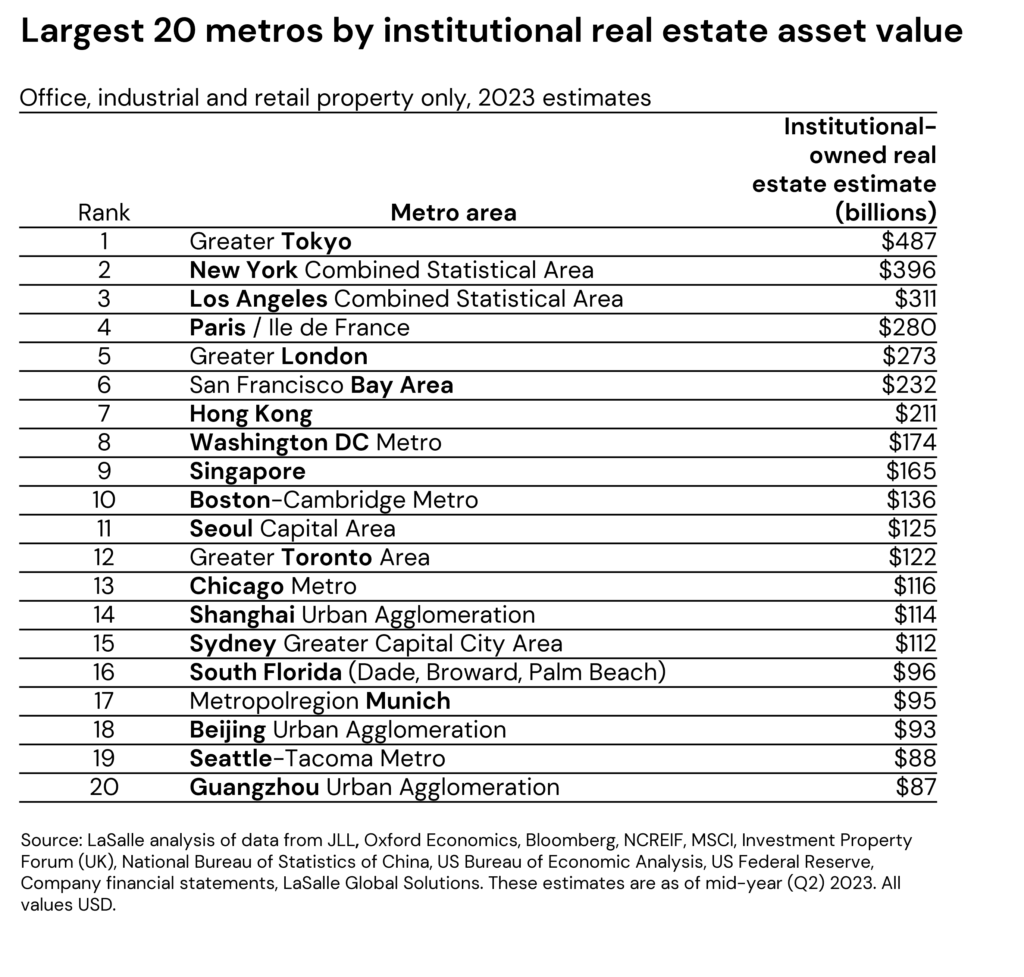

1. Real estate relative to other asset classes

Real estate as an asset class does not exist in isolation. Although all assets face uncertainties due to trade turbulence, we believe real estate is relatively well positioned in today’s environment for three reasons. First, real estate has several attractive structural characteristics that should help it weather today’s stormy environment. Real estate values are underpinned by defensive, durable cash flows, backed in numerous sectors by long leases5, and supported in many cases by secular demographic drivers. In addition, the link between market rents and the cost of construction materials provides an indirect and imperfect, but meaningful, connection between inflation and property values6. Tariffs are likely to drive up the cost of construction in any country that raises tariffs on key construction inputs, and that pushes up the rents required to justify new development.

Second, these structural factors are reinforced by mostly healthy current real estate market conditions, as property markets today are not characterized by major imbalances. In our ISA Outlook 2025, we noted falling supply levels, a repricing process mostly in the rear-view mirror, and conservative overall leverage levels in most segments of the market. These factors continue to apply, despite new uncertainties around trade.

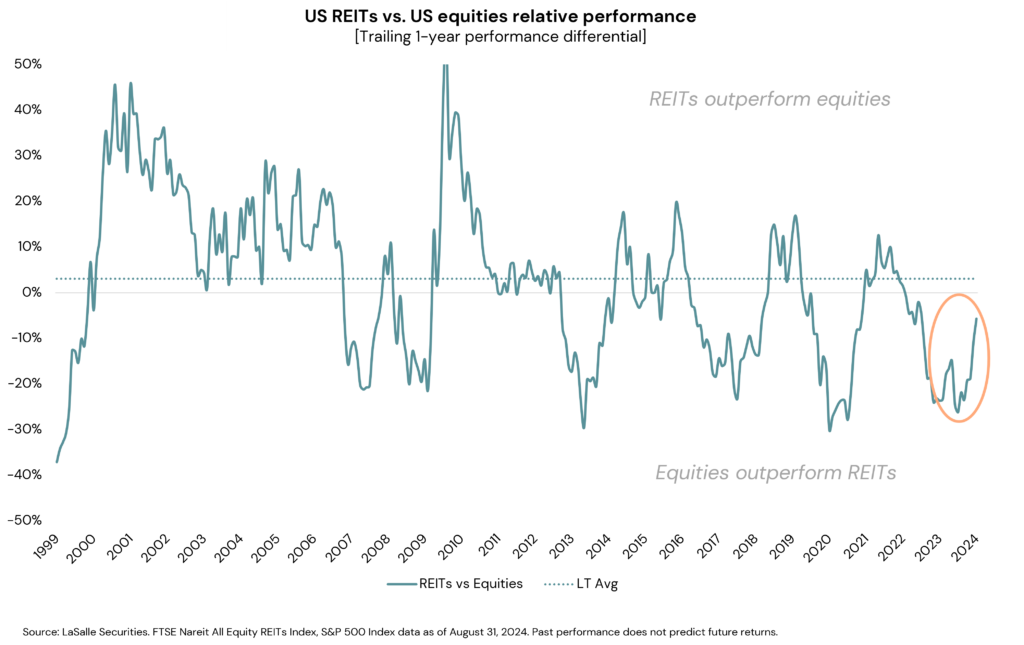

Third, real estate valuations appear less stretched than those of several other major asset classes, especially large-cap equities. As nominal rates rose and credit spreads fell over the past few years, real estate underperformed general equities, cumulatively underperforming by ~30% since the end of 2021 (see adjacent chart). As the environment has shifted, it is possible that real estate’s underperformance could reverse. From a relative valuation perspective, global REITs would need to outperform equities by around 15-20% as of April 30th to simply bring the historical earnings yield relationship back in line with its long-term average.7

2. Relative sector outlook

The trade war has the potential to impact virtually every assumption that goes into a Fair Value Analysis (see sidebar for more background on FVA). When the components of FVA are especially uncertain and volatile, as they are today, it helps to focus on the elements for which greater conviction is possible. Moreover, we recommend emphasizing relative assessments, which can be easier to build conviction around than absolute forecasts.

The channels by which tariffs impact real estate sectors can be classified as either direct and specific, or indirect and macro-related. In terms of trade-specific channels, we highlight that some sectors have unique dynamics that are directly shaped by barriers to the flow of goods. The poster child for this is industrial/logistics real estate. Given this property type literally houses the economy’s supply chains, it is clearly exposed to forces that are likely to disrupt and potentially reshape supply chains.

In the near term, decision-making by logistics occupiers is likely to slow.8 Markets and sub-markets exposed to trade, such as around major ports, may see reduced demand. It is worth noting that trade-related logistics demand generally tends to be greater nearer the points of import and consumption, rather than the points of manufacture and export. Thankfully, the long-term context of logistics real estate is one of positive structural growth, which means this impact takes the form of a downgrading, not a devastation, of the sector’s prospects. Moreover, in the long run, global economic fragmentation could lead to greater supply chain redundancy and therefore increased aggregate space demand.

What is Fair Value Analysis (FVA)?

Fair Value Analysis, or FVA, is central to LaSalle’s investment strategy process. We conduct FVA across a range of “slices” of the property market—that is, various combinations of sectors, sub-sectors, cities, sub-markets, quality grades and the like. The FVA methodology compares our assessment of expected and required returns:

• Expected Returns (ERs) represent the return expected for a given real estate slice, which is build-up of current real estate entry pricing, plus short and long-term income growth, minus an estimate of the capital expenditure needed to keep the property competitive.

• Required Returns (RRs) represent an appropriate risk-adjusted cost of capital for a given slice, starting with bond yields and applying sector- and market-appropriate risk premia.

It is possible to extract both absolute and relative pricing indications from FVA. By comparing ERs and RRs, we can assess which slices appear attractively priced (ER>RR), fairly priced (ER≈RR) or overpriced (ER<RR). But implicit in this absolute analysis is a presumption that current bond yields are “correct;” its conclusions tend to be volatile in periods when bond markets are volatile. That is why is also helpful to simply rank order the ratio of ERs to RRs, which produces a relative sorting of attractiveness by slice. Relative assessments help steer investment toward the real estate most likely to outperform the broader property market.

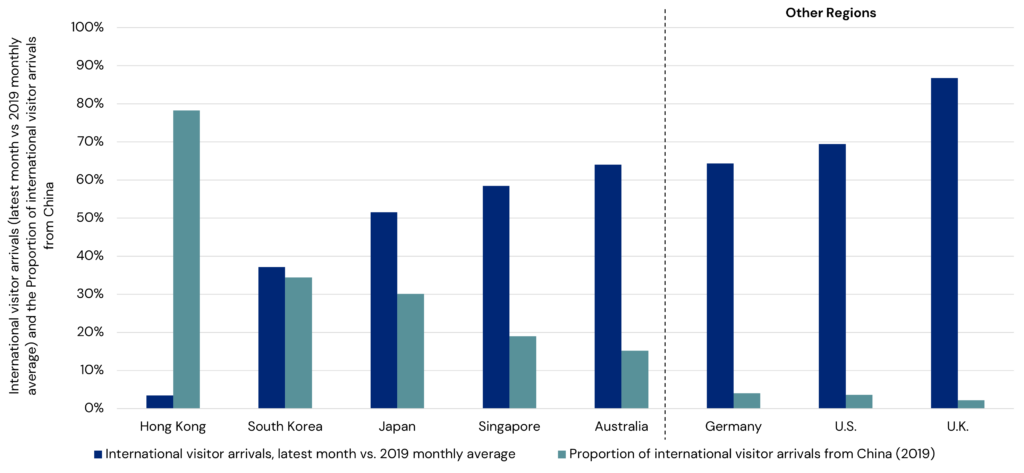

Other examples of real estate sectors facing impacts directly tied to tariffs include US power centers exposed to discretionary expenditure on (largely) imported goods. There are also potential direct impacts on real estate from other Trump policies beyond tariffs, for example around reputational issues that seem to be suppressing inbound and outbound tourism, as well as changes to scientific research funding.9

To understand the broader macro channels of impact, it is useful to assesses real estate sectors and markets by their relative sensitivities to economic growth and to interest rates.10 Sectors with a high degree of economic sensitivity, such as hotels, are likely to see an outsized negative hit to their cash flows in the event of an economic downturn. Meanwhile, economic impacts should be muted on sectors with low fundamental sensitivity to GDP growth, such as medical office.

Relative impacts are potentially the reverse for sectors with a high degree of interest rate sensitivity. An economic downturn usually leads to lower interest rates – although recent market movements suggest that is not necessarily a given.11 The impact of lower rates on the more interest-rate sensitive parts of the real estate market could enable them to absorb some or even all the effect of softer demand. These property types are generally those with longer leases, such as the mainstream commercial sectors.

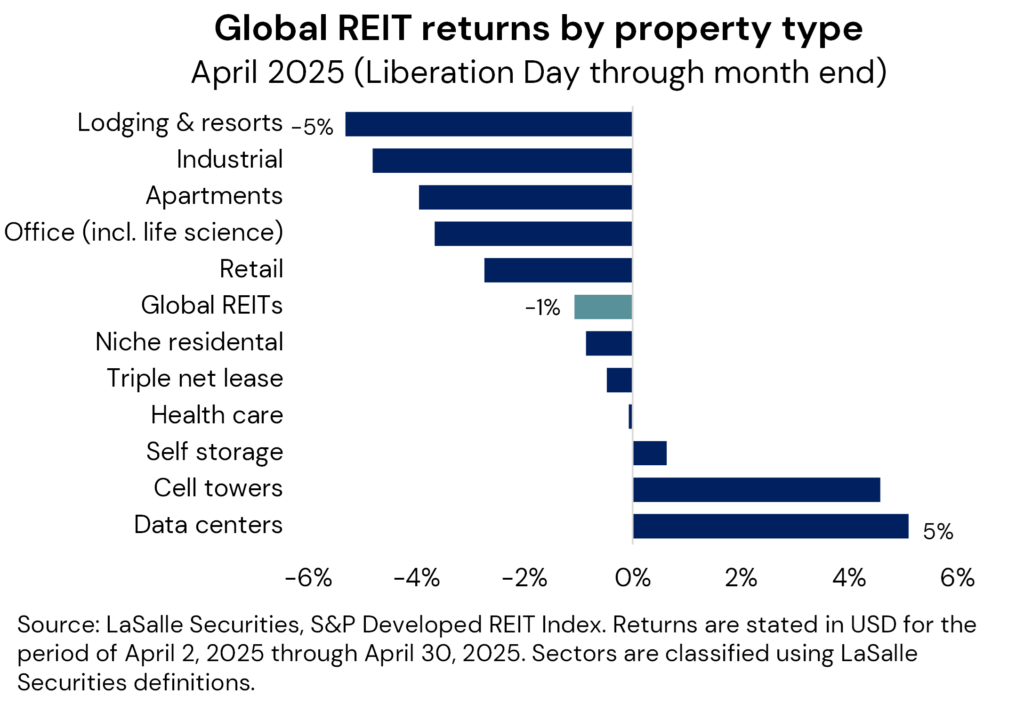

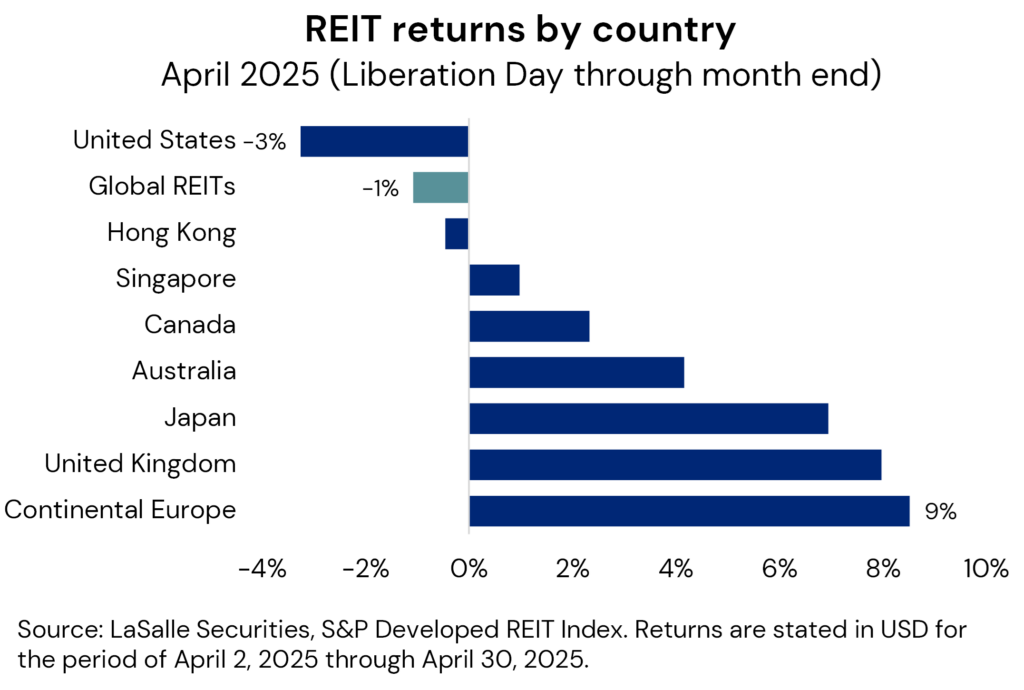

Relative listed real estate performance following “liberation day”, confirms these intuitive sector relativities. Despite an initial drawdown of nearly 10%, the overall listed REIT market was down only marginally for the rest of April, though the dispersion of property sector performance has been wide (see adjacent chart). Initial investor reactions have been most focused in property types which are most directly exposed to a potential trade war (e.g., industrial/ logistics) or those which are more economically sensitive in nature (lodging).

3. Relative global impacts

The same relative-value thinking can be applied to the relative prospects of countries and regions, which have been dynamic this year, to say the least. The economic narrative has quickly shifted from the post-election consensus of dominance by the US economy, to post-inauguration worries about fallout from US trade policy alongside a growth-positive break in European fiscal policy.12

Indeed, it seems likely that tariff-related worries may hit US real estate more than in many other countries, for two reasons. First, the strongest headwinds in many exporting nations will be largely contained to specific industries, compared to potentially generalized challenges in the US.13 A second is that the US Fed will have to balance risks of higher unemployment against those of higher prices, while in other countries, the short-term impact of tariffs could drive local goods prices lower. This may give ex-US central banks wiggle room to offset a weaker economy with policy easing.

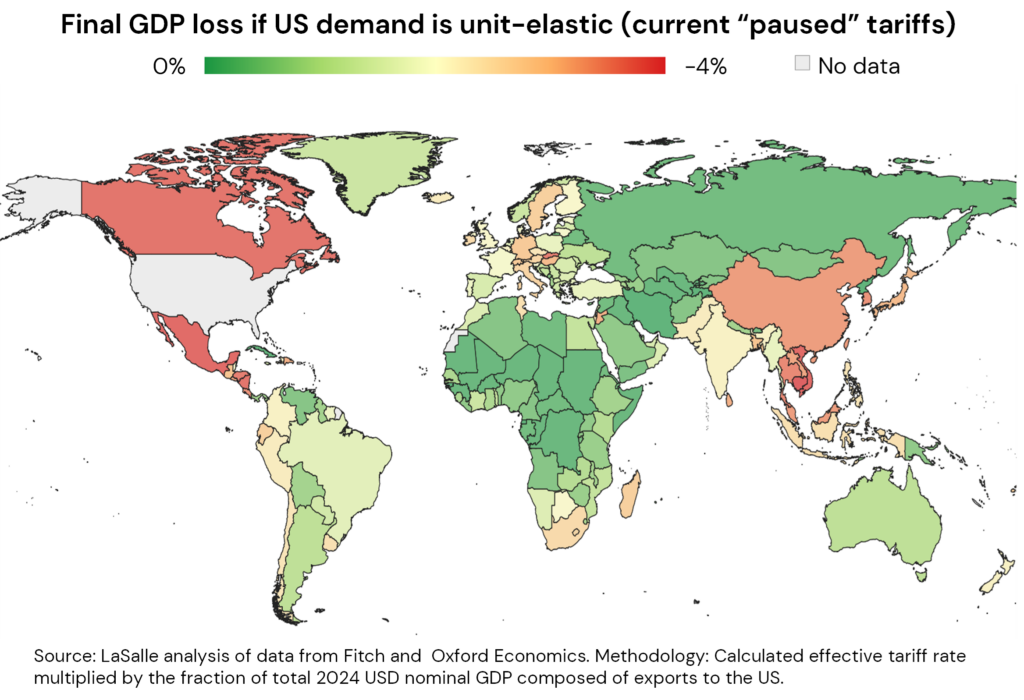

To separate relatively harder-hit from less-hit ex-US markets, we track the level of applied tariffs and a country’s exports to the US as a share of the exporting country’s GDP. On this basis, the map shows that China, Southeast Asia, Canada and Mexico may be more impacted, while Australia and Europe potentially could be less so. The nature of the exports themselves also matters. It may be difficult to find viable substitute suppliers for many complex, high-value goods (e.g., cutting-edge semiconductors), or for raw materials (rare earths). Countries whose exports have fewer substitutes may be more insulated from the trade war.

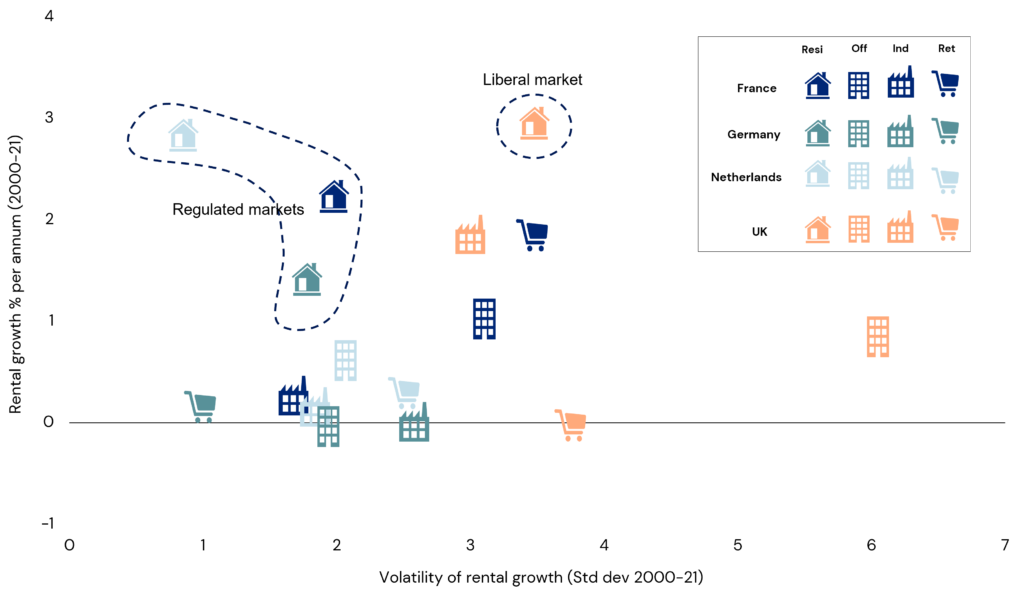

A final factor to consider is that the economic sensitivity of property varies by sector and country, but real estate’s return beta is especially low in some market segments, such as the European living sectors.14 The degree to which a sector’s drivers are inward- or outward-facing can also matter. For example, we observe that real estate in Japan, with its large domestic market, tends to see robust investor and tenant demand that may be less susceptible to external forces.15

These relativities have been evident in the performance of US and ex-US listed real estate markets. The shift in US trade policy has led to the largest REIT share price declines being registered in the US (see adjacent chart). European REIT markets, including the UK, have been relative winners given the potential pro-growth developments in fiscal policy and a more limited direct impact from US trade policy. Asia Pacific REIT market performance has been more mixed in this period, with Japan and Australia notable outperformers.

LOOKING AHEAD >

1 The April 9th reciprocal tariffs pause may have been in response to a meaningful increase in Treasury yields, to which the administration seems more reactive than equity markets. The April 12th China pause appears timed to preempt the expiration of “on water” exemptions for goods already en route. Sources: Piper Sandler and Signum Global Advisors.

2 Contributors to uncertainty include: legal challenges to presidential trade authority; negotiations between the US and other nations; potential Congressional action, especially after the mid-term elections; and of course, unilateral adjustments by the administration. Sources: Piper Sandler and Signum Global Advisors.

3 According to Goldman Sachs, the US average tariff rate has increased from ~3% to ~20% in the past few months, even before the paused tariffs. For comparison, the 1930 Smoot-Hawley tariffs represented a rate increase of only a few percentage points, off of already high levels. Moreover, trade is today roughly three times as large a share of the US economy as it was then. As such, there is no clear precedent for a tariff increase of this magnitude.

4 According to analysis by Piper Sandler and Baker, Bloom and Davis, 2016.

5 Leases are, in some sense, only as defensive as the revenues of the tenant. But crucially, they are mediated by the option to relet a building to another tenant. In essence, real estate is a layer of abstraction removed from the tenants’ businesses, just as the tenant is in turn a layer of abstraction higher than any specific product (because they may have multiple products). Just as products have widely varying success/failure profiles, companies are a kernel on products, so their success/failure rate is in turn smoothed, and real estate is a further kernel on businesses.

6 The cash flow characteristics of real estate, including its inflation pass-through potential, are discussed in greater depth in our ISA Portfolio View report.

7 LaSalle has tracked and compared the relationship of REIT AFFO yields to Equity earnings yields for the period of April 2006 through April 2025. Using this data series, we estimate that the relative performance of REITs that would be needed as of the latest data point to revert the relationship to the historical average, assuming all else equal.

8 The commentary in this paragraph is based on LaSalle analysis and that of Green Street Advisors and CBRE-EA.

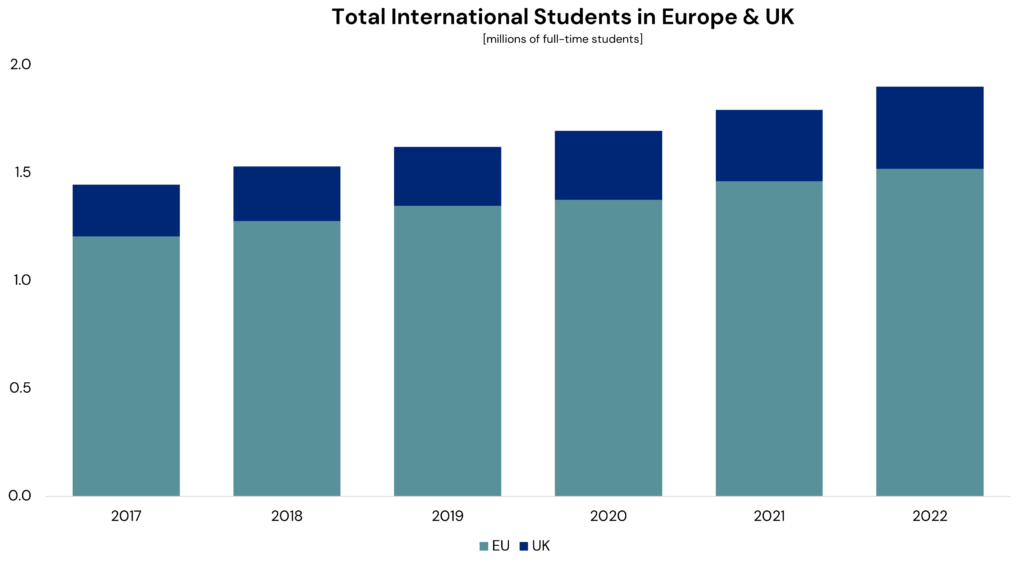

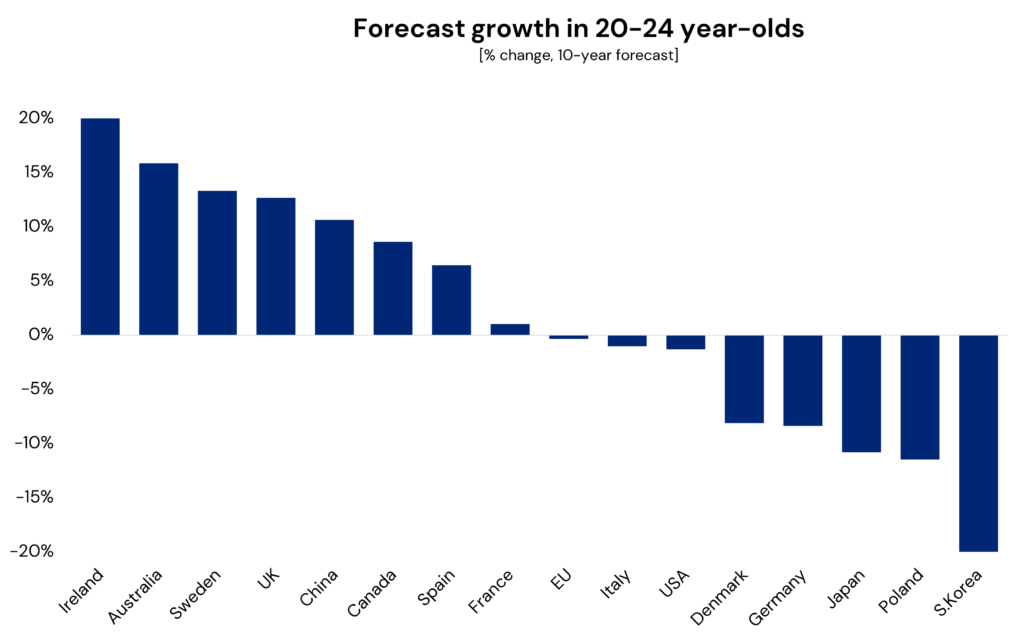

9 We are monitoring hotel markets with a high share of international visitors; US student housing assets that are heavily exposed to international students (with European student housing potentially benefiting); and life sciences real estate.

10 LaSalle’s Portfolio Balance framework describes real estate market segments according to their sensitivities to economic growth and interest rates. It classifies markets and sectors into four categories: growth-led, rate-led, stable, and reactive. For a fuller discussion, see the ISA Outlook 2025.

11 Bond yields typically fall as economies go into recession because the market prices in central bank easing (rate cuts) and lower inflation. However, this is not always the case. Recent upward volatility in US 10-Year Treasury yields has been attributed to movement in the risk premium required for investing in dollar assets, given concerns that recent rapid changes in economic policy herald longer-term US policymaking instability. Sources: Piper Sandler and Oxford Economics.

12 For more discussion of this narrative shift, and the German debt Zeitenwende, see the ISA Briefing “Working backwards: Dealing with unprecedented policy uncertainty” and the accompanying LaSalle Macro Quarterly.

13 For example, LaSalle estimates the impact of US tariffs on the German automotive industry to represent just 0.04% of European GDP, using data from Oxford Economics. We derive this by dividing the $25.5bn German auto exports to the US by the eurozone’s $15.9tn GDP, multiplied by 25% tariffs (assuming unit elasticity and no export redirection).

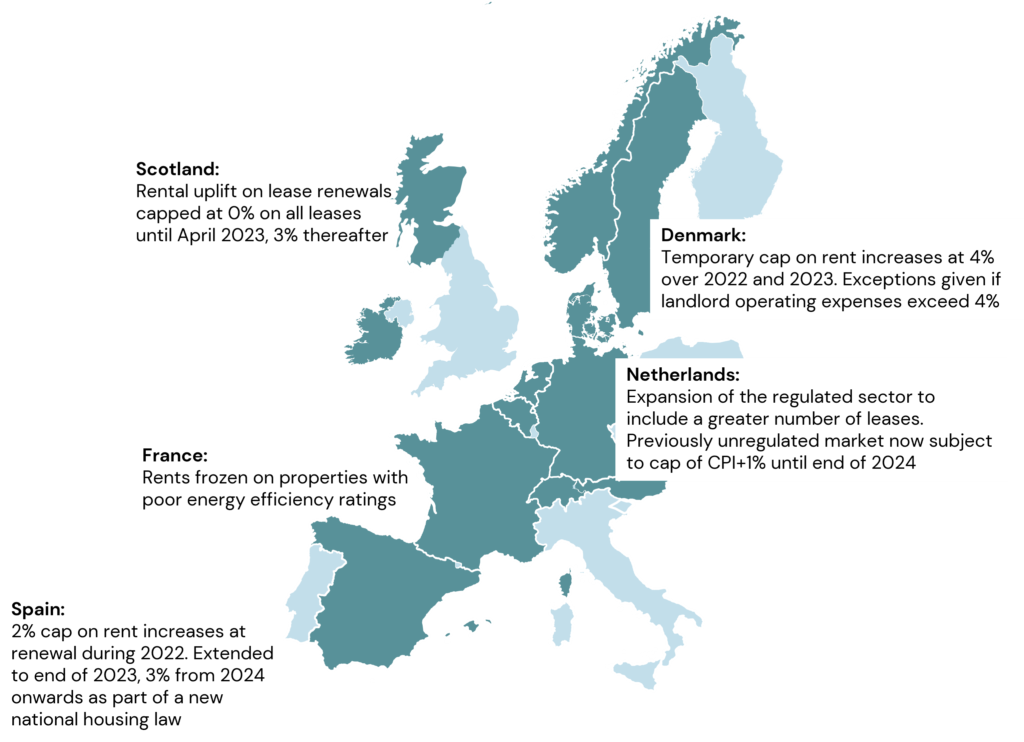

14 European residential markets have seen strong rental growth in recent years, even as GDP growth was weak, owing to long-term structural supply shortages. Source: LaSalle analysis of data from PMA and Green Street.

15 According to analysis by LaSalle of data from JLL REIS and MSCI Real Capital Analytics.

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. With reference to the graphs included in this publication, note that no assurances are given that trends shown therein will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

This article first appeared in the May 2025 edition of PERE

LaSalle’s Dave White sat down with peers from other leading alternative credit providers across Europe to discuss the state of real estate debt across the continent.

Facing up to competition and uncertainty

Geopolitical chaos overshadows the discussion around the outlook for private real estate debt markets in Europe, writes Stuart Watson

This year, the participants in PERE’s European debt roundtable met the same morning that was sure to become famous – or infamous – as US President Donald Trump’s tariff-trumpeting ‘Liberation Day.’

Their discussion covered a range of topics, from the fragmented market across Europe, to the scarcity of capital and deal pipelines, to the extraordinary levels of geopolitical turmoil.

Want to read more?

Craig Oram, Mark Milovic, Jen Wichmann and Alexandra Levy recently sat down in front of the camera to discuss how various teams at LaSalle – in particular Research and Strategy – work in tandem with the US debt investment team to identify prime sectors and locations for investment.

LaSalle’s Research and Strategy team plays a crucial role in our underwriting process. They provide insights on market dynamics, macroeconomic trends, and demographic shifts that can impact property operations and investment performance. By combining their top-down analysis with our decades of lending experience across the US, we can identify attractive opportunities that balance risk with reward. This comprehensive approach enables us to make more informed lending decisions, helping us to mitigate potential risks and work to enhance returns for our investors.

Learn more below.

Want to read more?

Real estate debt has always been a valuable component of any portfolio; however, it is emerging as a viable solution to a wide array of investor concerns today. It’s a strategy that offers a range of benefits with attractive risk-adjusted returns across market cycles.

Read our six reasons why investors should consider adding it to their portfolios, and learn more about our capabilities in Europe and the United States below.

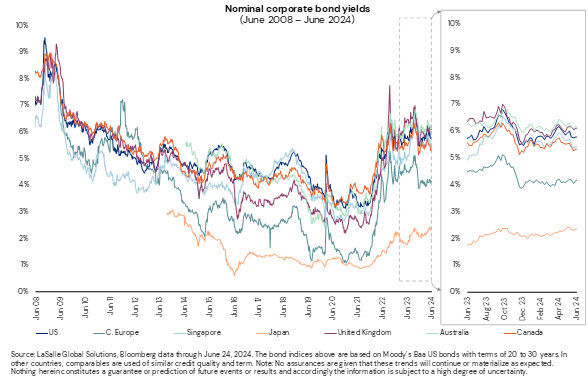

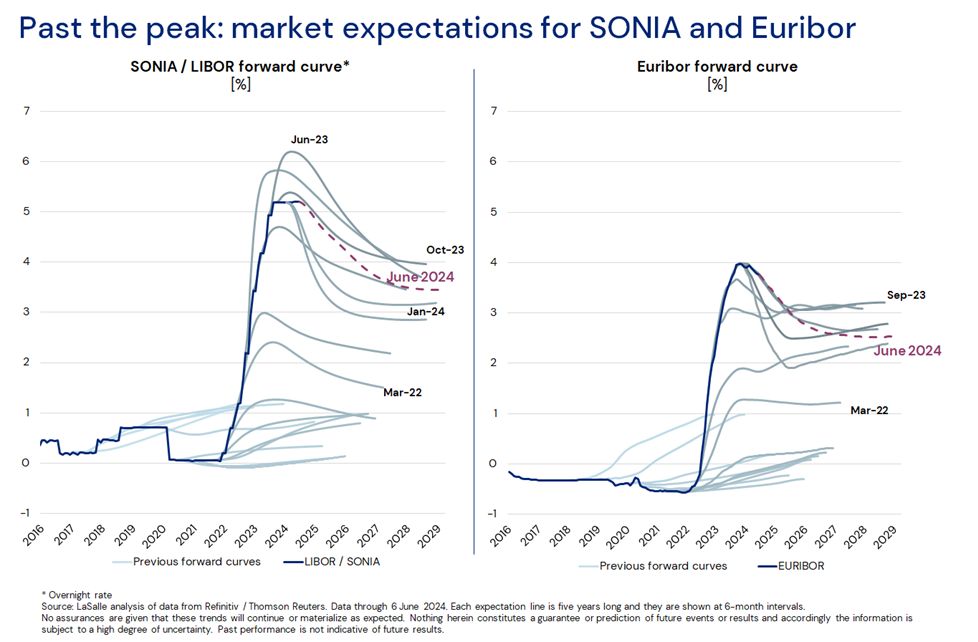

1. Attractive risk-adjusted returns: In today’s environment, the combination of elevated interest rates and attractive credit spreads mean that real estate debt offers compelling returns relative to other fixed income alternatives. The potential for achieving these higher yields, while maintaining a relatively conservative risk profile, is appealing to institutional investors looking to mitigate risk.

Real estate debt can offer different opportunities through the market cycle, with the ability to adjust advance rates during market downturns to minimize risk, while benefiting from cyclical recoveries.

2. Stable and predictable income: An allocation to real estate debt may allow investors to enhance their portfolio income returns. The coupon-like nature of interest payments from borrowers can provide consistent and stable cash flows for investors, with a significant portion of the total return being achieved through income returns.

3. Downside protection and capital preservation: Real estate debt offers the ability for investors to gain exposure to the same underlying real estate, but via a protected position in the capital structure, offering an often-significant equity cushion to buffer against potential value fluctuations.

Careful structuring can further enhance downside protections; these investments are typically collateralized by the physical underlying property, providing security that differs to some other forms of fixed income investments. In a default event, active asset management is critical, and managers who have the expertise to step in and manage the underlying asset can further protect against potential losses and in some instances create upside value.

Senior or unlevered whole loan lenders sit in the last-loss position, allowing investors to consider more actively managed business plans than they might be comfortable investing in via an equity commitment.

4. Diversification benefits: Real estate debt provides exposure to one of the largest segments of the real estate market, typically with lower volatility than real estate equity. And adding real estate debt to an institutional portfolio can enhance diversification, as it often has low correlation with traditional asset classes like stocks and bonds, which can help to improve overall risk-adjusted returns.

5. Regulatory efficiency and opportunity: For insurance companies, real estate debt is treated favorably under Solvency II and other similar regimes, making it a capital-efficient way to deploy assets and capture attractive relative returns. Additionally, enhanced regulation has led to retrenchment by traditional bank lenders, creating opportunities for investors working with non-bank alternative lenders, such as institutionally managed debt funds.

6. Inflation hedge: As inflation rises, so too do the interest rates central banks often use to combat it. Real estate debt investments, particularly those with floating-rate loans linked to central bank rates, can therefore offer some protection against inflation.

Want to read more?

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

A reader waking up from a quarter-long slumber on April 1, 2025 would be forgiven for confusing the headlines for an April Fools’ Day prank. They would scan the news and see stories about:

• large tariffs alternately announced, rescinded, delayed and reintroduced at a breakneck pace (see LaSalle Macro Quarterly, or LMQ, p. 4);

• US equities in correction territory as ex-US markets, including even China’s, outperform (LMQ p. 25);

• increasing calls that the risk of a US recession is rising (LMQ p. 20); and

• substantial upward revisions in forecasts of long-term European GDP growth (LMQ p. 21).

Each of these is at least partly (and in some cases completely) contrary to expectations from the beginning of this year. But the quick reversal in the economic narrative is no April 1st joke. The post-election consensus of a supercharged US economy pulling ahead of the rest of the world has clearly been challenged, if not upended.

In this period of elevated policy uncertainty, real estate investors should focus on what they can and should do amidst all the noise. At the risk of stating the obvious, we think it helps to take a step back and break down the analysis into three basic steps of incorporating news flow into investment strategy — the what, the so what, and action steps. But as we will discuss, the first two are characterized by so much uncertainty that it is also helpful to start from the end and work backwards, asking: What can investors do to improve their chances of successfully navigating this environment regardless of what happens?

Normally, the “what” of political developments and other events is the easy part. But since the US presidential inauguration, the Trump administration has made policy announcements — especially regarding trade and federal employment — at a rapid pace. Some of these seem to have taken even insiders by surprise. Widespread post-election expectations that actual policy would be more measured than campaign-trail rhetoric have proven incorrect.1 Reversals and postponements have also been a regular occurrence.

Adding to the news flow are announcements by other countries. These include the tit-for-tat of retaliatory tariff measures. But there have also been substantial structural shifts, most notably the German coalition agreement to spend more on infrastructure and defense. This news is arguably linked to a realization by European leaders that, given less collaboration with the US, Europe will have to forge its own path to generate economic growth and provide for its security.2 Aside from the break that this represents from the post-World War II order, this change is significant because it is a key driver of higher economic growth expectations for Europe.

The result of all this is a “layering” of announcements that is difficult to digest at once (see our attempt at a timeline at LMQ p. 4). It is even more of a challenge to roll-forward the news into reasonable predictions for subsequent weeks, let alone months. As a result, measures of economic policy uncertainty have risen to levels close to historic highs (LMQ p. 5). Indeed, the implications of the many recent developments on the growth and inflation outlook include first-order effects such as the direct impacts of lower government spending on GDP and higher prices on tariffed goods (LMQ p. 7), but also the second-order effects of broadly elevated uncertainty.

Uncertainty is the enemy of investment decision-making. This applies both to financial investment as well as spending by businesses in plant, property, equipment and digital tools. Empirical research has shown a clear negative relationship between uncertainty and investment.3 If businesses are unsure (as they are today) about the rules of the road — for example, around the basic terms of trade governing imports and exports — they may be hesitant to commit capital to long-horizon projects. At the same time, expectations of lower taxes and less regulation may push them back toward optimism.

Our analysis of recent events comes with a dose of humility. While LaSalle dedicates significant resources to tracking and analyzing the constant flow of indicators and news — as highlighted by the LaSalle Macro Quarterly (LMQ) — we do not purport to have a unique competitive advantage doing so. We would expect that our readers follow a range of news outlets, forecasters and other observers in staying abreast of the news flow and making sense of it.

We do feel, by contrast, that our experience managing property and data from our portfolio puts us in a strong position to assess the likely impacts of policy developments on real estate. Even in the context of elevated overall uncertainty, we can make several observations with relative confidence.

First, we suspect that a key real estate impact of recent policy trends could be higher replacement costs. Tariffs on construction materials, such as steel, are likely to drive up their price. In addition, a lower level of migration into the US may reduce the supply of construction labor there. Increased European spending on infrastructure and defense could also contribute to higher global and regional materials costs. Higher replacement costs would mean that rents would have to rise more to justify new development, ultimately leading to higher net operating income (NOI) growth. This could counterbalance the impact of macro factors such as a potentially slower economy, as well as property type-specific impacts such as softer demand for housing in the context of muted household formation by immigrants. A simpler way to state this is that real estate can act as an inflation hedge.4

Second, we see value in undertaking granular research to identify potential winners and losers from the current policy environment. This approach can help investors identify real estate that is likely less exposed (or may even benefit from) current trends, while flagging potentially more-impacted market segments. Although the exact mix of government policies remains uncertain, the direction of travel is clear enough in some areas to make a few relative calls. For example, a move away from global free trade could weaken real estate demand related to import-export activities, for example in proximity to ports, while bolstering it in emerging near-shoring hubs.

These sorts of analyses can operate both at the national level, for example by identifying more and less trade-exposed countries (e.g., LMQ p. 9), and at the metro-area level, by examining city-level economic exposures (LMQ p. 10 and 11). One specific economic concentration worth mentioning is that of government employment in Washington, DC. Clearly, job cuts by the newly formed Department of Government Efficiency (DOGE)5 are a risk, but there are mitigating factors such as mandated in-person work; we predict a net negative effect for DC real estate demand, but we have not yet seen much impact on the ground or in the data.

Finally, we note that economic softness comes with mixed effects for real estate. As a long-duration, interest rate-sensitive asset class, it is quite possible that a mild or moderate economic slowdown that leads to lower long interest rates could, in fact, be a positive for real estate values in the aggregate. That said, there are likely to be winners and losers, depending on the relative sensitivity of an asset’s performance to interest rates versus sensitivity to economic growth.6

A bigger risk than a slowdown alone is that of stagflation: weak growth at the same time that sticky inflation keeps rates high. However, most economic research suggests that tariffs represent a one-time upward adjustment to the price level, rather than a driver of a sustained, self-reinforcing cycle of higher inflation;7 as such, central bankers may be more willing to ”look through” the impact of tariffs. So far, a recent softening in 10-year Treasury yields suggests that bond markets agree with that assessment (LMQ p. 26).

All this points to avoiding excessive pessimism on the direction of values, while remaining cautious and selective. But being discriminating is not the only thing investors can do. We also advocate for turning the process of incorporating news flow into strategy on its head. Because we know so little about where the dust will settle on many of the policy shifts, let alone the impacts of those shifts, it is also prudent to ”work backwards” from the implementation step. Some of the most prudent actions an investor can take do not depend on the specific geopolitical or policy debate of the week.

A key recommendation in this regard is to build a globally diversified portfolio. That the market narrative has shifted quickly from one of US dominance of global growth, to a more balanced view with Europe gathering pace, reinforces that countries’ trajectories may exhibit lower correlations in a more fractured global economy. Rapid reversals of market narratives can generate significant market volatility, particularly when they are “priced to perfection” as the post-election optimism now appears to have been. Diversification should help to absorb that volatility, while avoiding being “left out” of unexpected positive shifts. A microcosm of this occurred recently in the public REIT market, where post-election euphoria led to what appeared to us a significant underpricing of European listed real estate.

Investors are also likely to benefit from diversification across the capital stack, which is why we recommend a permanent allocation to real estate debt. As we discussed in our ISA Focus report, “Investing in real estate debt,” debt investment provides low-correlation returns that are by definition not sensitive to volatility contained entirely within the first-loss equity position. While the risk of a recession in the next year is debatable but possibly rising, the risk of an eventual recession is always 100% in the long run. A debt allocation can help add stability and predictability to a portfolio’s return regardless of the exact path the economy takes.

• Investors should not get lost in the noise. Our view, expressed in the ISA Outlook 2025, is that we are at the ”dawn of a new real estate cycle.” This call is not dependent on a highly certain or favorable macro context, but rests on observations specific to real estate. These include pricing that has caught up with bond yields, valuations that have caught up with pricing, solid property fundamentals and substantially approved debt availability, among other factors. Neither a booming economy nor falling rates are necessary conditions for a revival in investment activity or the existence of attractive investment opportunities.

• There will likely be both winners and losers among specific real estate strategies. Granular analysis of risks and mitigants should inform revised assessments of relative value. To get these shifts right, investors must continue to ask: What is priced in? Overreactions are possible, which can create opportunities for investors to take advantage of volatility.

• Near-term uncertainty can distract from a longer-term picture that is arguably clearer. Over a horizon of years and decades, trends toward higher trade barriers and a more fragmented world seem likely to continue. Moving from a global economy where countries with a comparative advantage in producing a particular good do so and sell it to other countries, to one in which trade barriers create more siloed supply chains, would likely have complex effects. Classic economic theory suggests that transition could hinder productivity. But it could also spur real estate demand as productive capacity and inventories are un-pooled and duplicated. Correlations between real estate markets could also decrease. Investors should be ready to build portfolios with these dynamics in mind.

Footnotes

1 We made this mistake as well, saying that “legislative obstacles exist to enacting full campaign-trail rhetoric” in our November 11, 2024 ISA Briefing, “The ‘Red Sweep’ and real estate: has the outlook changed?”.

2 Source: Signum Global Advisors, Piper Sandler, Oxford Economics

3 According to analysis by Piper Sandler, there is an inverse correlation of -42% between a sustained upward shift in policy uncertainty (as measured by the US Economic Policy Uncertainty Index) and GDP growth; a doubling of uncertainty over a quarter is consistent with -1.5% real GDP growth over the following year. For academic work on this relationship, see Baker, Bloom and Davis, 2016

4 For more discussion of real estate’s role as an inflation hedge, see LaSalle’s ISA Portfolio View.

5 DOGE is seeking to quickly remodel the US government to be more effective at a lower cost. If successful, the project could contribute to the US economy’s productive capacity by reducing the crowding-out effect of government spending on private sector activity. Inconveniently, the prospects for reducing government spending face many constraints, not least the fact that a very large proportion of US government spending is committed to entitlement programs like Social Security, Medicare and Medicaid, which most politicians have pledged not to touch. Moreover, in the short term, reduced government employment and lower outlays would directly reduce GDP. Sources: Piper Sandler, Signum Global Advisors

6 In LaSalle’s ISA Outlook 2025, we highlighted our Portfolio Balance framework, which describes real estate market segments according to their historical sensitivities to economic growth and interest rates. The framework segments markets and sectors into four categories: growth-led, rate-led, stable, and reactive. We found that while short-leased, economically sensitive sectors like hotels may see values soften in a recession, other sectors may actually see values benefit if interest rates soften enough.

7 Source: Economic Policy Institute, Federal Reserve Bank of Boston, Piper Sandler

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Craig Oram, Portfolio Manager and President of LaSalle Debt Investors and Alexandra Levy, Head of Debt Capital Markets, Americas, discuss the reasons why investors are increasing allocations to US real estate debt.

How should institutional investors seek out reliable income in 2025 when the majority of outlooks – including ours – are expecting the volatility of recent years to continue?

One answer for many investors has been increasing allocations to private credit. Elevated interest rates and repriced assets have led to better lending conditions for providers of alternative funding, with higher yields at lower loan-to-value ratios.

Learn more below.

Want to read more?

This article first appeared in the December 2024/January 2025 edition of PERE.

LaSalle’s Ryu Konishi and Julie Manning spoke to PERE about the growing importance of sustainability as part of investment decision-making and LaSalle’s approach to creating a global real estate net zero carbon pathway strategy.

A 360-degree approach to decarbonization

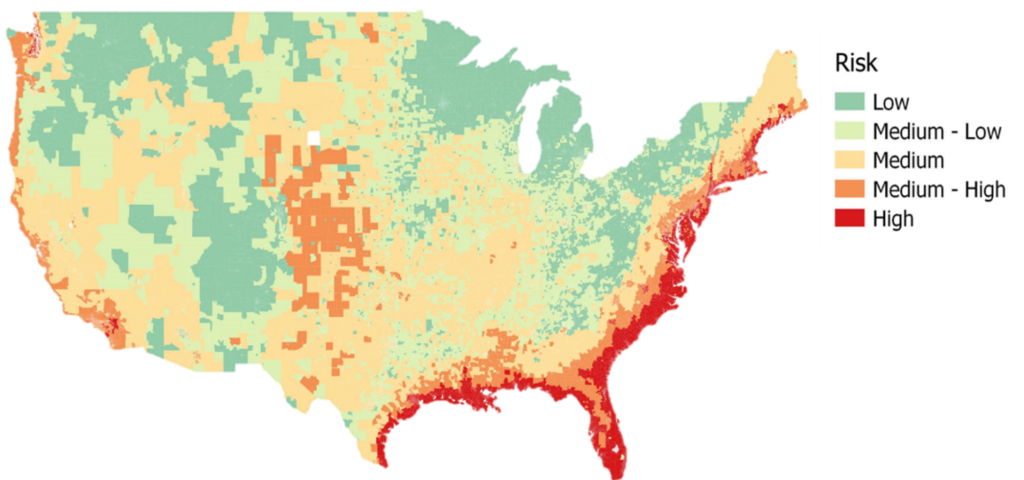

The importance of sustainability as part of investment decision-making in the real estate space has been on the rise for quite some time. In fact, the various physical risks associated with climate change, and the regulatory imperative of transitioning to net zero, are now so significant that these factors are gradually filtering through in the form of real-world valuation impacts.

For real estate investors, this raises both risks and opportunities. LaSalle Investment Management is one firm that was early to recognize this, having set up a global sustainability committee back in 2008. More recently, it has worked with the Urban Land Institute to develop a decision-making framework for assessing physical climate risk in relation to its real estate investments.

According to Julie Manning, global head of climate and carbon, and Ryu Konishi, fund manager of Lp3F (LaSalle’s global real estate net-zero strategy), this kind of approach to risk analysis – both broad and deep – is essential. So, where should investors start? And what might a determined decarbonization program in real estate look like?

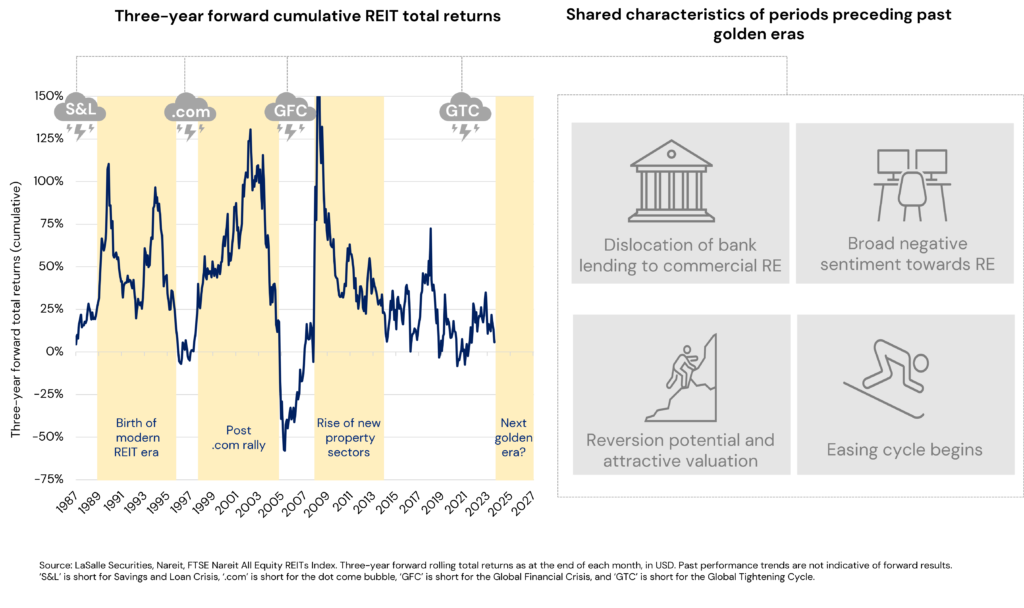

Almost three years after interest rates began to spike leading into the Great Tightening Cycle, the first light of a new real estate cycle is clearly visible on the horizon. As with the start of every new day, however, opportunities and challenges lie ahead. LaSalle’s Research and Strategy team will examine both throughout the course of November and December, as we publish four separate chapters, one covering our global outlook, and three deep-dives covering the outlook for Europe, North America and Asia Pacific. Each chapter can be found alongside an accompanying video conversations with lead authors on the links below.

In the Global chapter of ISA Outlook 2025, we look at how to make the most of this new dawn and the opportunities it may present, but with a watchful eye on ways the new day could go off track. We examine these through four broad themes in this year’s report: the morning sky, the capital stack hangover, the breakfast menu, and the early bird.

We examine each of these concepts in turn, and ask what each means for real estate and they intersect with one another and other key trends.

Global Head of Research and Strategy

Managing Director, Global Research and Strategy

While dawn is universal, across Europe it can appear different from each location and every angle. European real estate is transiting inflection points following a deep capital market correction. The INREV ODCE index shifted in the latest quarter from declines to positive after seven down quarters.

Against this backdrop, we share our Impressions of a Rising Cycle in Europe, with a focus on what makes the region different from others across the globe. We also share our five key strategy themes for investors in European real estate for the year ahead.

Europe Head of Research and Strategy

Europe Head of Core and Core-plus Research and Strategy

Chief Economist

The summer and autumn of 2024 saw growing optimism among real estate investors. The belief that the dawn of 2025 would open with sunny skies for the real estate market was driven by falls in interest rates from peak levels, fading economic growth concerns and real estate valuations now more aligned with market transactions.

But with more uncertainty creeping into the picture in late 2024, especially around longer-term interest rates, what we see could be described as a “partly cloudy sunrise.”

Americas Head of Research and Strategy

Canada Head of Research and Strategy

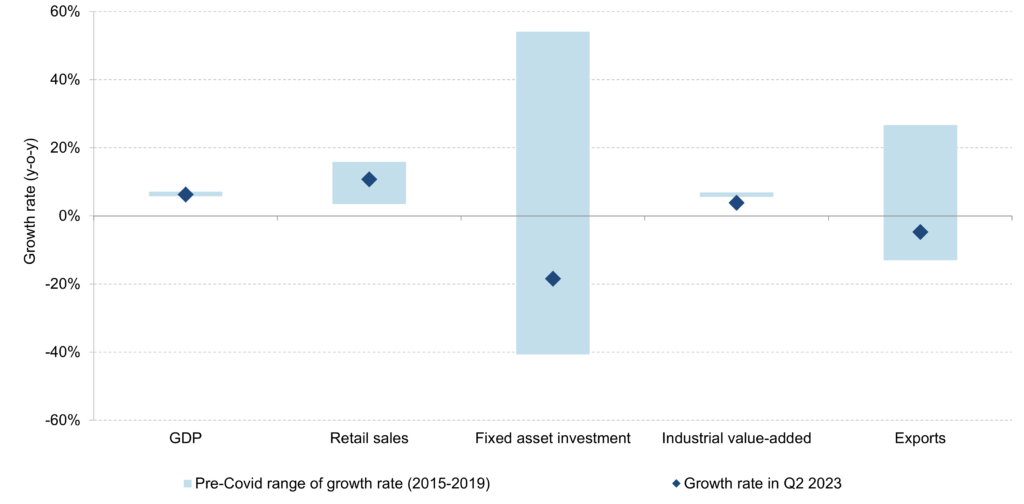

The current real estate cycle in Asia Pacific is not a simple repetition of a typical cycle. While Asia Pacific economies have not been immune to supply chain disruptions and elevated inflation, interest rates and construction costs, real estate capital market liquidity in the region (with the exception of China and Hong Kong) has fared much better than in other parts of the world.

In our view, the varying and sometimes contrasting cyclical patterns among major real estate sectors within each country set the region apart from global trends.

Vice President, Strategist

China Head of Research and Strategy

Published every year since 1993, LaSalle’s annual ISA Outlook is designed to help our clients and partners navigate the year ahead. It brings together smart perspectives and investment ideas from our teams around the world, based on what we see across our more than 1,200 assets that span geographies, property types and risk profiles.

As always, we welcome your feedback. If you have any questions, comments or would like to learn more,

please get in touch by using our Contact Us page.

This article first appeared in the Fall 2024 edition of PREA Quarterly

Chris Battista, Senior Product Manager at LaSalle Global Solutions, and Brian Klinksiek, Global Head of Research and Strategy, discuss the value of publicly traded real estate investments.

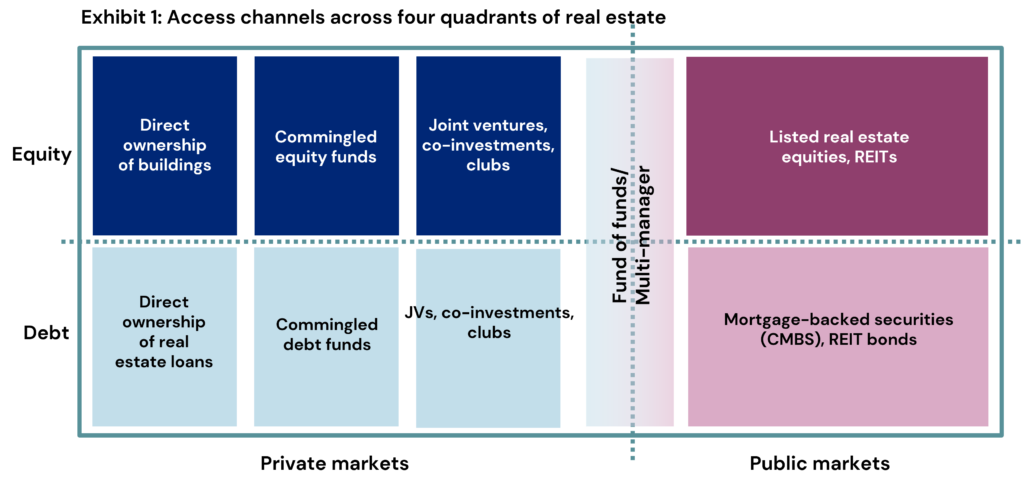

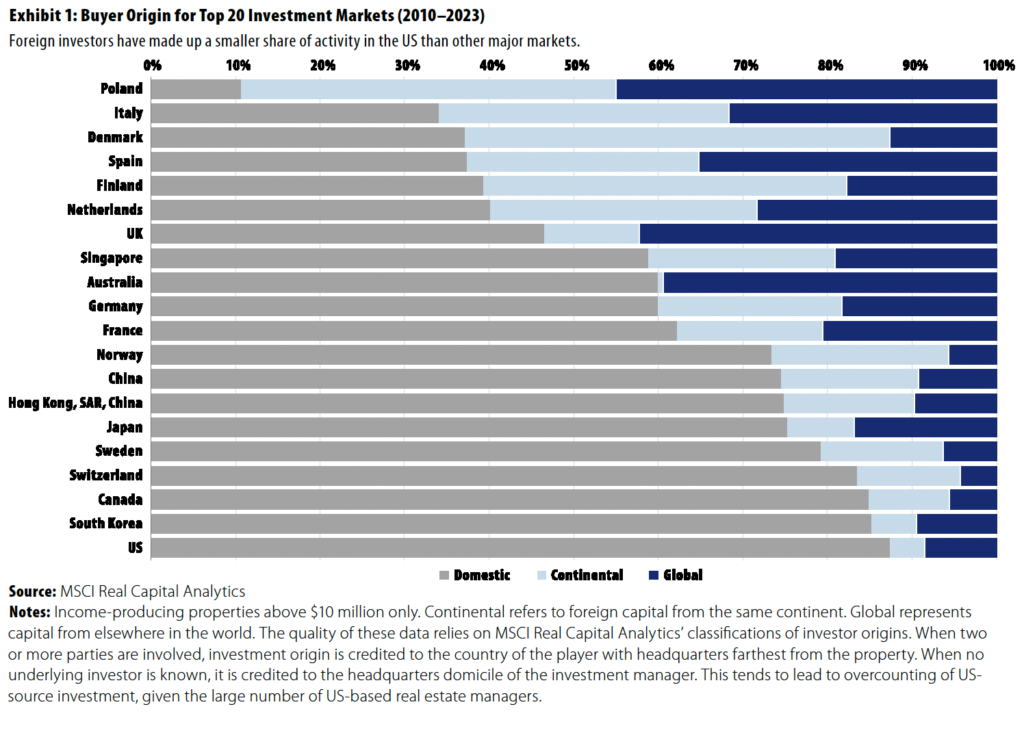

Investors should consider a holistic approach to the real estate asset class across the “four quadrants.” This means considering opportunities spanning both equity and debt positions on one dimension and both private and public market executions on the other (Exhibit 1). Doing so captures the full gross capitalization of real estate, enhances diversification, and opens opportunities to capture the best relative value. We call this being “quadrant smart” in LaSalle’s recently released ISA Portfolio View 2024, an annual report on portfolio construction.

Allocating between real estate debt and equity investing should be driven by risk appetite, views of relative pricing, and an investor’s broader portfolio considerations. Although debt investing has been quite topical over the past two years and covered by multiple investment managers, including LaSalle (see ISA Focus: Investing in Real Estate Debt), this article discusses the relationship between the public and private avenues to real estate equity investment.

Institutional investors tend to be well versed in private equity real estate investing but less consistent in their approach to the publicly traded side of real estate—even though the public side offers similar characteristics, a broad opportunity set, and often leading signals on the broader market’s direction. This article focuses on how to think about using both sides of the equity real estate investing coin, public and private, to maximize access and potentially improve the overall risk-adjusted return profile.

Want to read more?

Want to read more?