Insights

Research and commentary from across LaSalle designed to provide investors with a deeper understanding of topics and trends affecting real estate.

Physical Climate Risks and Underwriting Practices in Assets and Portfolios

LaSalle and the Urban Land Institute have released a step-by-step framework to evaluate physical and financial risk and compare cost and benefits of resilience.

Learn more >

ISA Briefing: Moving to the head of the class?

In Europe, purpose-built student accommodation (PBSA) ranks as one of our top-conviction sectors for the coming years. In this ISA Briefing, we discuss supply and demand factors, and why rising it’s on many investors’ “buy” lists.

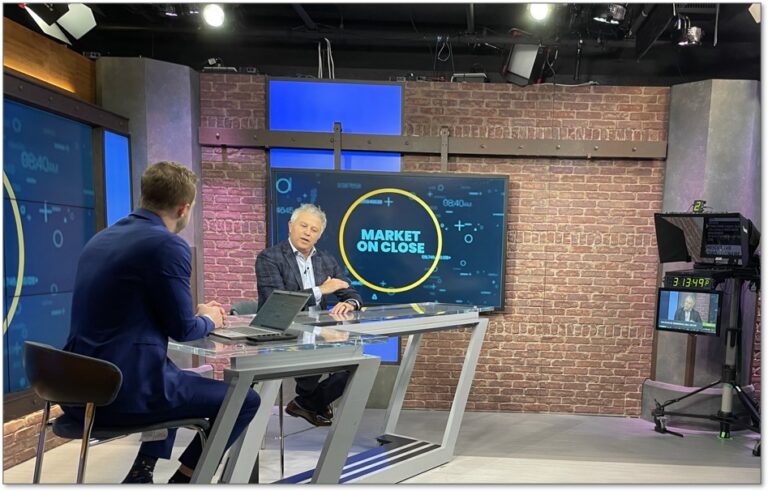

Read the briefing or watch the conversation >

ISA Briefing: US migration trends and (U)rbanization

Exploring how the aging of the Millennial generation, migration to the Sunbelt, and the Covid-19 pandemic have impacted urban and suburban markets and regional shifts in the world’s largest real estate market.

Read the briefing or watch the conversation >

Explore our Insights

No results found

Make sure you’ve spelled everything correctly, or try searching for something else. If you still can’t find what you’re looking for, you can always Contact us to talk to someone.

Research and Strategy team

Global Head of Research and Strategy

Americas Head of Research and Strategy

Europe Head of Research and Strategy

Asia Pacific Head of Research and Strategy

Canada Head of Research and Strategy

China Head of Research and Strategy

Head of Global Portfolio Research and Strategy

Europe Head of Core and Core-plus Research and Strategy

Europe Head of Debt and Value-add Capital Research and Strategy

Global Head of Climate and Carbon

No results found

Make sure you’ve spelled everything correctly, or try searching for something else. If you still can’t find what you’re looking for, you can always Contact us to talk to someone.