London (June 18, 2025) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has acquired the Ruby Stella hotel in Clerkenwell, London, on behalf of a UK Custom Account client for £48 million.

The newly developed, purpose-built 153-key hotel, featuring a ground-floor bar and restaurant, opened in late 2024 and is operated by Ruby Hotels on a 30-year index-linked lease. The asset was constructed to outstanding sustainability specifications, achieving a BREEAM ‘Excellent’ rating and an EPC rating of ‘A’.

Located just off Clerkenwell Road in central London, the Ruby Stella is situated in one of the capital’s most vibrant, creative and well-connected districts. The property is only an eight-minute walk from Farringdon Station, providing access to the newly built Elizabeth Line and multiple other Underground lines.

Sophie Simmonds, Managing Director, UK Custom Accounts at LaSalle, commented: “Ruby Stella represented a compelling opportunity to secure another long-income, index-linked asset built to impeccable sustainability standards in a prime central London location. This latest hotel acquisition in the UK’s capital city further strengthens our exposure to the resilient and evolving lifestyle hotel sector whilst being underpinned by a strong residual value.”

Chris House, Senior Transactions Manager at LaSalle, commented: “With London attracting 20 million visitors in 2024, the Ruby Stella is perfectly situated in a vibrant and accessible location, well-positioned to capture both business and leisure demand. As well as allowing us to tap into this dynamic market, the acquisition of the Ruby Stella supports our broader strategy of enhancing portfolio quality through investments in modern, well-located assets with strong fundamentals.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages $US 82.3 billion of assets in private and public real estate equity and debt investments as of Q4 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

JLL (NYSE: JLL) has been recognized by Ethisphere, a global leader in defining and advancing the standards of ethical business practices, as one of the 2025 World’s Most Ethical Companies. For the 18th consecutive year, JLL has been honored for demonstrating exceptional leadership and a commitment to business integrity through best-in-class ethics, compliance and governance practices.

In 2025, 136 honorees were recognized spanning 19 countries and 44 industries.

LaSalle is a wholly owned subsidiary of JLL and is proud to share in this achievement.

Company news

No results found

BRISTOL (January 30, 2025) – LaSalle Investment Management (“LaSalle“), the global real estate investment manager together with its development partner Deeley Freed, has obtained outline planning permission for The Galleries Shopping Centre, Bristol.

The Galleries is situated in a prime location in Bristol’s city centre, adjacent to Castle Park, with excellent connectivity to public transport including Temple Meads station. The redevelopment will help unlock the Bristol City Council’s plans to regenerate the city centre. The surrounding infrastructure will undergo significant enhancements, becoming greener and more pedestrian-friendly. The redevelopment will support the Council’s sustainability goals, facilitating the delivery of a low-carbon District Heat Network and enhancing urban accessibility.

The proposed development includes plans for up to 450 new homes and 8,000 square meters of ground-floor space dedicated to retail, leisure, dining, health, and community facilities. In addition, the site will feature approximately 46,000 square meters of modern, sustainable employment space, the potential for a 240-room hotel or aparthotel, and up to 750 purpose-built student bedrooms. The development will also incorporate 1.5 acres of high-quality public realm which will look to bring Castle Park closer to the city centre.

A central feature of the project will be a new green transportation hub accessed via Fairfax Street, shifting the focus away from parking towards sustainable travel options. This regeneration project also aims to enliven Bristol’s nighttime economy, re-imagining the area as a vibrant city centre destination that will benefit residents and visitors. Additionally, the proposal reimagines public spaces – where the current Galleries site lack open areas, the new design will dedicate a third of the site to high-quality, welcoming public space. The redevelopment thoughtfully incorporates Bristol’s heritage by preserving the Merchant Almshouses and Greyhound Hotel, currently obscured by the Galleries structure, into the new design.

Tom Lewis, Fund Manager, UK Custom Accounts, LaSalle Investment Management said: “Following an extensive consultation process with local stakeholders, we’re delighted to have secured planning approval to transform Bristol city centre and provide the local community with new homes, commercial space, amenities, and green space. We’re committed to investing for the long term and this ambitious redevelopment scheme demonstrates our ability to create value and better meet the needs of future residents, occupiers and visitors.”

Max Freed, Director, from Bristol-based Deeley Freed, comments: “We’re delighted Bristol City Council has voted to support this redevelopment project. It is a once-in-a-generation chance to re-invent, revitalize and modernize such a large part of the city centre. Our vision involves completely transforming this 1980s shopping centre, making the site more diverse, safe and sustainable. The redevelopment of this site will bring more people to live and work in the city centre, accelerating the regeneration of the area.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

London (January 20, 2025) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, announces that it has provided a £100 million loan facility through its flagship LaSalle Real Estate Debt Strategies IV (LREDS IV) Fund to refinance the acquisition of Pavilion Court, a fully-leased 699-bed Purpose-Built Student Accommodation (PBSA) asset in Wembley, London, owned by Apollo-managed funds.

Located in the Wembley Park Masterplan residential development, Pavilion Court is a 10-minute walk from Wembley Park underground station with quick access into central London. Benefitting from one of Europe’s largest regeneration schemes, Wembley is home to the London Designer Outlet and the world-famous stadium. The area is an established residential neighbourhood which benefits from a wide range of food and beverage establishments. Its close proximity to several academic institutions such as the University of Westminster, UCL and Middlesex University, among others – positions the area favourably as a hub for student accommodation.

Completed in 2021, the 699-bed building sits across four blocks centred around a courtyard. It includes 89 studios and 610 en-suite rooms, alongside a gym, a games room, multiple study spaces, dining room and multimedia room, catering for both domestic and international students. Alongside this, Pavilion Court performs strongly against industry real estate sustainability standards and is accredited with a BREEAM ‘Very Good’ certification.

David White, Head of LaSalle Real Estate Debt Strategies, said: “This large-scale refinancing demonstrates the strength of our Debt Investments platform and maintains our strong pace of deployment, positioning our business as one of the most active real estate debt providers in Europe. We are delighted to be able to offer Apollo Global Management a bespoke and creative capital solution to support this acquisition. The building is in prime position to attract domestic and international students looking for high-quality, amenity-rich and centrally located accommodation that provide quick access to universities. We look forward to expanding our footprint in this segment of the market.”

Apollo Partner Samuele Cappelletti, added: “We are pleased to have worked with an institutional party like LaSalle in the financing of this landmark asset for which we continue to see multiple value creation levers to be implemented over the life of our business plan.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

London (January 9, 2025) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, announces that it has provided a £68.7 million green loan to Vita Group to finance the delivery of a new 540-bed purpose-built student accommodation (PBSA) scheme in central Birmingham.

Located on Gough Street in Birmingham city centre, the asset will benefit from excellent rail, bus and tram links. The scheme will help address the undersupply of specialist accommodation in the UK’s second largest student market, with five universities and c.80,000 students based in the Birmingham Metropolitan Area. Planning permission was secured and construction work, led by MRP, commenced in 2023, with completion set for August 2026.

The 105,000-sq-ft scheme will comprise two tower blocks, of 10 and 29 stories respectively, with amenities including private dining rooms, a vibrant hub space for socialising and studying, a state-of-the-art gym, an outdoor basketball court, outdoor terraces and shared cycle storage. The building is designed to be highly sustainable, targeting BREAAM ‘Excellent’ certification, with LaSalle’s green loan structured under the Loan Market Association’s green loan framework.

David White, Head of LaSalle Real Estate Debt Strategies, said: “This latest development loan completed by our Debt Investments platform maintains our strong pace of deployment, positioning our business as one of the most active real estate debt providers in Europe. In Vita Group and MRP, we are working with two firms with best-in-class reputations for providing high-calibre, well-amenitized student accommodation and for successfully delivering large-scale PBSA schemes. Our investment in the Gough Street development provides our investors with exposure to a high-quality asset, supported by the strong fundamentals of Birmingham’s structurally undersupplied student market.”

Max Bielby, Chief Operating Officer for Vita Group, added: “We’re delighted to be working with trusted partner LaSalle to deliver this best-in-class student accommodation to the heart of Birmingham. The delivery of this building is well underway and will raise the standards of what students should and can expect from their accommodation experience in the city centre. We look forward to welcoming students from September 2026.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

London (November 27, 2024) –Europe’s real estate cycle has reached a new dawn, following a deep capital market correction over recent years, according to the European chapter of the ISA Outlook 2025 report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

Last year’s ISA Outlook described the beginning of adjustment to the new reality of higher interest rates and challenging macroeconomic conditions. As we approach a new year, the latest ISA Outlook describes how market evidence is crossing thresholds that point to a new cycle. For example, data tracked by LaSalle’s asset managers show, from January 2024 to date, rents for new commercial leases across LaSalle’s European portfolio grew 2.7% relative to expiring passing rent, representing a return to an above-inflation pace.

LaSalle estimates that expected go-forward returns for the overall European property market are at their highest level in a decade. As capital slowly returns to the market and yield spreads exceed long-term averages, the real estate outlook has diverged from the region’s weak pace of economic growth due to a combination of supply barriers and asset quality polarisation.

This year’s report identifies strategic themes for investment in European real estate, which earn the region’s real estate assets an important place in investors’ property portfolios.

Beyond beds and sheds

A laser focus on “beds and sheds” has become a market consensus portfolio theme for many real estate investors, yet it is now becoming too simplistic to capture the more complex dynamics of the market.

Today’s ISA Outlook 2025 report uses fair value analysis to zero in on the best opportunities across a range of real estate capital and debt strategies and asset classes. These span all property types – not for the sake of diversification – but because we believe there are specific compelling opportunities that span across property types.

The European chapter of ISA Outlook 2025’s five strategic themes:

- Don’t forget a (real estate debt) umbrella: Real estate debt strategies can guard against inclement market conditions. New performance data for European debt funds shows the benefits of preparedness. Debt investors are also taking advantage of the choice between fixed-rate and floating-rate lending positions, and the diversification benefits of investing in both.

- Follow the hexagons for logistics: In our Paths of Distribution Score, we have mapped Europe into 158,455 hexagons – scoring each on their centrality, from an occupier perspective, for distributing goods to the most consumers at the lowest cost – and we favour logistics strategies that focus on the top-scoring hexagons within the highest ranked markets in our fair value analysis (in France, the Netherland and Germany).

- Retail back on the menu: European retail has been through a deep reset, and select retail formats now look too attractive to ignore. Outlet centres in the UK and Northern Europe offer strong alignment between tenants and operators, while Spanish and French retail parks and convenience shopping centres in the Netherlands can also deliver high income returns.

- Master adapters – how Europe’s office markets are different: Europe is leading the office market’s adaptation to hybrid work, as their largely mixed-use, mid-rise character, creates distinctive opportunities. A rebalanced office sector is not a distant next buyer prospect for many of Europe’s markets – it’s happening now. This is evident in return-to-office figures as well as property fundamentals. London City office market vacancy has now declined for five consecutive quarters, driving prime rent growth.

- A residential and living smörgåsbord: European residential (or living) is not really a single property type, it is a large collection of sub-sectors with widely varying cash flow profiles, pricing, regulation and target occupiers. There continue to be opportunities, but sector selection is paramount, with PBSA standing out in Spain and Germany.

Global uncertainty but clear opportunities

The European ISA Outlook forms part of LaSalle’s Global ISA Outlook, which finds that the new dawn extends across real estate around the world.

Greater clarity on the direction of interest rates around the world should help drive healing of the capital markets in 2025, with hesitant sellers gaining confidence as pricing starts to come in closer to their expectations.

There have, of course, been significant political developments in the US in recent weeks. The Global ISA Outlook reflects on how the “Red Sweep” may affect the real estate investment outlook and the shape of the dawning cycle, with signals pointing towards marginally higher growth, inflation and rates, but no great change in the overall outlook. LaSalle expects that the US economy remains on track for a soft landing. Equally, the European ISA Outlook considers the potential impact of the US Election in Europe, recognising that a stronger dollar could result in a possible boost in student demand for housing and tourist demand for hotel rooms.

The Global ISA Outlook also identifies areas of concern, with China a significant ‘soft spot’ due to a combination of generationally low growth and liquidity alongside weak property fundamentals. The Chinese government has made significant interventions to shore up the economy, and in recent weeks further stimulus has been implemented to guard against the potential onset of US tariffs on Chinese goods. These factors mean that China is something of a unique case in the ISA Outlook, with less applicability of global trends. Similarly, the Japanese market is experiencing a different cycle to the rest of the world. Japan is in the process of exiting a long period of deflationary risk and rock-bottom rates, so unlike other countries, monetary policy in Japan has a modest tightening bias.

Dan Mahoney, Head of European Research and Strategy at LaSalle, said: “We are seeing a new cycle dawning for Europe’s real estate markets. Today’s Europe ISA Outlook delves into why we believe we are entering a new cycle, evidence of data thresholds crossed, and our strategy for the years ahead. These go beyond simple ‘beds and sheds’ – which is too simplistic to capture the complexity of European real estate today.”

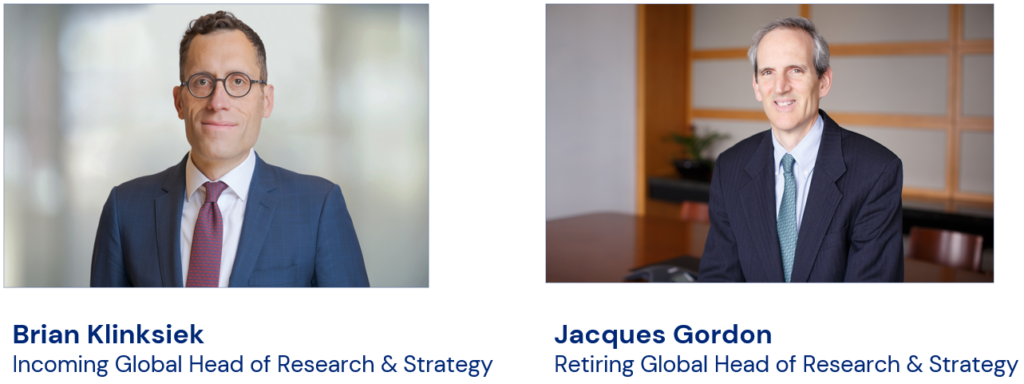

Brian Klinksiek, Global Head of Research and Strategy at LaSalle, added: “Global real estate sentiment is gradually improving following a long period of negativity and signs are pointing to the beginning of a new real estate cycle. History has shown that investing early in a cycle tends to lead to relatively strong performance. There are, however, still risks on the horizon, and investors are advised to focus on diversified strategies that are flexible and broad enough to adapt to a complex and evolving relative value landscape. A comprehensive look at value across a wide range of sectors and markets will be required to build a well-positioned real estate portfolio.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.2 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

London (November 14, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has agreed a 10-year lease with Assmann Beraten + Planen, an international planning consultancy, for the remaining 3,200 sqm of the East Tower of the Columbia Twins office scheme in Hamburg. The scheme, which is owned by the open-ended, pan-European LaSalle E-REGI fund, is now fully occupied.

The agreement follows SVA System Vertrieb Alexander, a German IT service provider, moving into the sixth and seventh floors of the East Tower on a 10-year lease in April 2024. The West Tower is leased to Columbia Shipmanagement, an international maritime service provider, which was also involved in the development of the asset.

In preparation of the recent lettings, the East Tower – formerly occupied by a single tenant – was renovated for multi-let purposes and to enhance its appeal to modern workforces. The project was led by Schmidhuber Future Work GmbH, a specialist in creating innovative work environments.

Built in 2009 and located in the Hamburg submarket of Harbour Fringe, Columbia Twins offers over 9,400 sqm of lettable space. It provides tenants with access to a roof terrace overlooking the river Elbe and famous Elbphilharmonie Concert Hall. Designed by renowned architect Carsten Roth, Columbia Twins holds DGNB gold certification and recognition from the BDA, the Hamburg architects’ association.

The long-term leases signed with multiple tenants underscore LaSalle’s ability to provide investors in LaSalle E-REGI with exposure to high-quality commercial real estate assets across Europe’s leading markets.

Sven Becker, Fund Manager, LaSalle E-REGI, said: “Both the signing of this new long-term lease and the existing high-quality tenants we have previously secured at Columbia Twins demonstrate the attractiveness of these buildings to various occupier needs. LaSalle E-REGI continues to deliver on its strategy to meet growing tenant demand for well-located, high-quality commercial space in key European city-centre markets and, as such providing long-term stable income for our investors.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (November 11, 2024) – LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate (“Trilogy”) have leased an additional 19,000 square feet at The Amp, a newly refurbished education and innovation campus at 41-71 Commercial Road in Aldgate in East London, to London College of Contemporary Arts (LCCA).

LCCA’s expansion at the campus brings their total footprint within the building to 57,000 square feet, and means that The Amp is now close to fully let – a milestone achieved in just over two years from the acquisition of the site from the Department of Education in the summer of 2022 and a year after completing the refurbishment project.

An expanded LCCA, which will now occupy more than three floors of the building, will sit alongside other education occupiers. This includes De Montfort University, which arrived in September 2024 after signing an agreement for 18,000 square feet aimed at offering programmes specialising in sustainable practice to post-graduate students, as well as Nottingham Trent’s Confetti Institute of Creative Technologies and Access Creative College, both of which signed pre-lets totalling 55,000 square feet. Specialist facilities, including recording studios, multi-performance space and a gaming and eSports arena, are also located on-site.

The construction project to transform the buildings at 41-71 Commercial Road was completed in under a year to meet the operational requirements of the education occupiers, who needed an opening date in September 2023. The Amp provides space for education and innovation in a well-connected location, with one foot in central London and the other in the dynamic creative scene in the East of the city.

The Amp is the latest demonstration of Trilogy’s successful ongoing partnership with LaSalle Investment Management, which previously helped transform Republic in East India Dock from a dated office and disaster recovery space to a thriving mixed-use education campus. As of today, Republic hosts more than 15,000 students across nine institutions.

Chris Lewis, Managing Director, LaSalle Value-Add Investments, said:

“The expansion of LCCA within our exciting mixture of universities at The Amp, taking the campus to nearly full occupation within just over two years, is a real signal of the strength of the local offer and the demand for education-led innovation campuses in leading European gateway cities – especially in city-fringe locations like Aldgate.

“Helping to bridge the gap between infrastructure and real estate, The Amp remains an important part of LaSalle’s broader European value-add strategy. Projects like the Amp, which focus on new economy sectors such as mixed education campuses, urban accommodation, student housing, private medical facilities, and distribution and data centres, are only growing in importance and we are very proud to have partnered on it with Trilogy.”

Robert Wolstenholme, Founder and CEO of Trilogy Real Estate, added:

“At Trilogy our mission is to deliver the next generation of leading innovation campuses – campuses that mix exceptional education assets with high-quality shared amenities for business and the community.

“The fact that we have been able to turn around the refurbishment works and secure a nearly fully let building within just over two years from site acquisition is a testament to the level of demand for this type of campus in what has otherwise been a challenging market. It also reflects the huge amount of work that has gone into delivering truly bespoke and end-user-oriented facilities for our occupiers, their students, and the local community.

We look forward to LCCA’s expanded presence, and what this means for welcoming even more students on site to join what is fast emerging as a leading hub for business, technology and creativity.”

Allsop and DLA advised Trilogy and LaSalle on LCCA’s expansion.

41-71 Commercial Road was originally built in 1971 as the London College of Furniture. The college operated until 1992, when it was taken over by London Metropolitan University. The building was vacated in 2016 when the university rationalised its estate.

Work on the seven-floor refurbishment began in October 2023, led by main contractor Oktra, Project Manager Quartz Project Services, Architect Hawkins\Brown and Civic Engineers.

The completed building provides flexible, open floorplate space tailored to the needs of universities and colleges, as well as business and industry partners that may look to co-locate with a university to access the talent of the future and provide facilities for research and industry innovation. The building’s energy performance has also been significantly enhanced through the refurbishment – an all-electric heating and cooling system ensures no fossil fuels are burned on site, while all-new glazing has helped the building to secure BREEAM Excellent, WiredScore Platinum and an EPC “B” rating.

The Aldgate and Whitechapel area is a well-established higher education community education, and one of Central London’s youngest and fastest growing neighbourhoods. The Amp’s local offer – plentiful PBSA, nightlife, leisure and food and drink options, excellent transport connectivity and proximity to London’s cultural attractions – makes it an attractive choice, including for mature students or students who wish to live in their family home during their studies.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Value-Add Investments

LaSalle Value-Add Investments is part of LaSalle’s growing US $10 billion Debt and Value-Add Strategies platform in Europe and targets higher-return real estate equity investments across Europe, with a focus on conviction investment themes and dislocation opportunities.

About Trilogy Real Estate

Trilogy Real Estate was founded in 2015 by former Resolution Property partner Robert Wolstenholme as an investment and development company specialising in transforming unloved assets to create inspiring and positively impactful mixed-use innovation campuses where the world of work meets education, skills and training.

Company news

No results found

London (November 5, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, announces that it has provided a loan facility of £123 million through its flagship real estate debt fund, LREDS IV, to finance the acquisition of two UK holiday parks on behalf of One Investment Management (“OneIM”), a global alternative investment manager, and Foundation Partners, an independent private equity firm.

Located across the UK in Somerset (Unity Farm) and Yorkshire (Skirlington), the holiday parks benefit from proximity to the coast, lakes and local amenities, and collectively comprise around 4,300 pitches with about half of those currently operational.

The sites represent some of the largest UK holiday park assets that are not currently held in institutional portfolios. OneIM and Foundation Partners’ investment will help the two sites expand their number of pitches, develop new holiday homes for prospective visitors, grow the onsite offering and professionalise local operations. Underpinned by strong fundamentals and significant growth potential, the two large-scale parks represent the first seed assets as part of a targeted £500 million platform called Unity Holidays, which OneIM and Foundation Partners intend to grow.

Nathan Jackson, Director, LaSalle Debt Investments, said: “We are pleased to have supported best-in-class sponsors in OneIM and Foundation Partners to secure these high-quality assets in the UK leisure market. The breadth and depth of expertise in the LaSalle Debt Investments platform has ensured that we’re able to deliver a bespoke financing solution to clients and capitalise on attractive opportunities for our investors. We very much look forward to continuing to support OneIM and the future growth of their platform.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$ 10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

About OneIM

OneIM is a global alternative investment manager that invests across the capital structure, in a range of asset classes, industries and geographies. The firm applies a flexible investment approach driven by fundamental analysis, focusing on credit special situations and capital dislocations. OneIM seeks to provide tailored capital solutions built on proprietary sourcing and underwriting complexity. OneIM is sector agnostic and targets complex situations that do not fit into a single asset class, where truly bespoke structured investments can offer superior risk-reward dynamics and asymmetrical outcomes. The firm was founded in 2022 and currently manages approximately $7 billion in assets. The team operates from offices in Abu Dhabi, London, Tokyo and New York.

Company news

No results found

Paris / Île-de-France is home to Europe’s top micro-locations for efficient logistics distribution, according to the inaugural release of the Paths of Distribution score, published today by LaSalle Investment Management (“LaSalle”). The innovative, granular new research gives the ability to compare logistics locations at a micro, market, country and pan-European level, with extensive flexibility for understanding, benchmarking and ranking locations at both micro and macro scale.

The Netherlands, thanks to its immediate access to Europe’s major consumption centres and having one of the crossroads of trade within and into Europe, was identified as the strongest-performing country. The port city of Rotterdam, the key gateway of global trade, ranked second and is joined in the top 20 regional markets by local rivals Amsterdam and the North Brabant region of Breda and Tilburg. Germany, the second-best performing country, provided another five of Europe’s top 20 markets, all in the west of the country, establishing this corner of north-western Europe as a hotspot for manufacturing and transportation. The UK, although separated from continental European logistics markets, placed third in the country standings, with Greater London its highest-ranked logistics market, although the West and East Midlands, the North-West of England (surrounding Manchester) and Kent all placed in the top 20 thanks to their strong infrastructure.

Belgium was fourth best performing, with the Antwerp and Brussels markets ranking seventh and seventeenth respectively. The wider Milan region also scored highly in the rankings, despite comparatively low investment volumes historically, while the Veneto-Verona corridor was another Italian market which scored well, with domestic consumption being the primary driver. Likewise, in Poland, the biggest winners were the Katowice-Krakow corridor and Lodz – ranking above the capital Warsaw – both growing notably in recent years and benefitting from investment in infrastructure and labour availability. LaSalle’s analysis shows there is a positive correlation between Paths of Distribution and logistics take-up, making a connection between current demand and these locations’ potential.

Micro-location and methodology

The research is the first of its kind, and takes an innovative, granular approach to its methodology, breaking the continent down into 158,445 10-kilometre hexagons. Each micro-location is scored across four key pillars of manufacturing output, consumer spend, infrastructure quality and the proximity to skilled labour. The model not only factors in demand, but also considers the cost from an operator’s perspective of meeting that demand, using an extensive set of region-to-region road freight transport cost metrics, along with a random forest machine learning model evaluating how extensive and accessible the road network is at the most granular level.

The top scoring micro-location hexagons are in the Eastern Crescent that semi-circles Paris, stretching from the area surrounding the Charles de Gaulle airport in the north, moving south-east through Noisy-le-Grand, then continuing south covering Créteil. This sub-market of Paris benefits from excellent connectivity into Paris, as well as to the wider French market, and further north and east.

Logistics distribution scoring is unlike other city rankings because it is about far more than central cities – entire regions and all the micro-locations within them are potentially efficient places for distribution. So the LaSalle team took a new approach filling in all the gaps in the regions of Europe between cities. The vibrant maps showing location scores across all of Europe highlight the corridors, conurbations, clusters, and crescents which define the optimal locations for modern logistics.

Petra Blazkova, Head of Research & Strategy, Core & Core-Plus Capital, Europe at LaSalle, said: “With continued uncertainty around energy prices and supply chains being disrupted, cost uncertainty is high across the continent for logistics providers. Location is a key variable which distributors can still control, and so it is more important than ever: optimising your choice of location can help minimise exposure to these other risks and protect your supply chain. Today’s rankings demonstrate which areas are best for distributors to try to insulate themselves from those pressures. As investors in the sector, this new insight into the most resilient logistics markets in Europe informs our portfolio composition and asset management.”

The full top 20 logistics markets were as follows:

1 Paris / Île-de-France, France

2 Rotterdam, The Netherlands

3 Frankfurt-Mainz, Germany

4 Milan, Italy

5 Greater London, United Kingdom

6 Rhine-Ruhr, Germany

7 Antwerp, Belgium

8 West Midlands, United Kingdom

9 Madrid, Spain

10 Dortmund, Germany

11 Amsterdam, The Netherlands

12 East Midlands, United Kingdom

13 Stuttgart, Germany

14 North West England (Manchester), United Kingdom

15 North Brabant (Breda-Tilburg), The Netherlands

16 Karlsruhe-Mannheim corridor, Germany

17 Brussels, Belgium

18 Veneto-Verona corridor, Italy

19 Kent, United Kingdom

20 Barcelona, Spain

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (September 3, 2024) – LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate today announce the arrival of De Montfort University (DMU) to their education and innovation campus in East London: The Amp.

DMU will take 18,000 square feet, taking The Amp’s total building occupancy to 83% as it celebrates the first anniversary of its opening last September.

The move brings DMU students right into the heart of London, where it will offer postgraduate students programmes specialising in sustainable practice, aiming to equip professional managers and aspiring leaders with the skills to manage businesses ethically and lead with social responsibility underpinned by DMU’s commitment to the UN Principles for Responsible Management Education (PRME).

Located at 41–71 Commercial Road in Aldgate, The Amp is a new campus for education and innovation in the East London district of the Tower Hamlets. Tenants alongside De Monfort University include Nottingham Trent’s Confetti Institute of Creative Technologies, Access Creative College and London College of Contemporary Arts.

The construction project to transform The AMP was completed in under a year to meet the operational requirements of the education occupiers, who needed an opening date in September 2023. The Amp provides space for education and innovation in a well-connected location, with one foot in central London and the other in the dynamic creative scene in the East of the city. Specialist on-site facilities include recording studios, multi-purpose performance space and an arena for gaming and esports.

The Amp reprises Trilogy’s successful partnership with LaSalle Investment Management, which has previously resulted in the transformation of Republic London from a dated office and disaster recovery space to a thriving education campus with over 15,000 students attending six universities and private education providers. The next phase of Republic London was granted planning consent last year and will also include 715 rooms of purpose-built student accommodation and a modern data centre, adding an infrastructure component to this mixed-use development and creating a new kind of urban campus centred on innovation, higher education and accommodation.

Chris Lewis, Managing Director, LaSalle Value-Add Investments, said: “The addition of De Montfort University to our exciting mixture of universities at The Amp, taking the campus to 83% let within a year of opening, shows the strength of the offer and the demand for education-led innovation campuses in leading European gateway cities.

“The Amp forms part of LaSalle’s broader European value-add strategy, bridging the gap between infrastructure and real estate, with a focus on new economy sectors such as mixed education campuses, urban accommodation, student housing, private medical facilities, distribution and data centres.”

May Molteno, Head of Campus Experience and Social Impact, Trilogy Real Estate, added: “At Trilogy we thrive on delivering exceptional education and innovation campuses which deliver high-quality facilities for colleges, universities and business. It is a testament to what the team has achieved here at The Amp that we are able to attract universities such as De Montfort. We look forward to welcoming students on site to join what is fast becoming a bustling community of learners and future innovators.”

DMU’s Vice-Chancellor, Professor Katie Normington, commented: “This expansion marks a pivotal moment for DMU as we reinforce our commitment to sustainability and educational innovation. For the first time, all staff at the new campus will undergo sustainability training, and Carbon Literacy will be integrated into the core curriculum for all students.

“Moving into The Amp allows us to do this in a unique way that give our students a campus experience while empowering them students not only through classroom-based sustainability-focused learning but also through direct engagement with the UN, industry partnerships, internships, networking opportunities, and practical experiences within London’s thriving business community.”

41-71 Commercial Road was originally built in 1971 as the London College of Furniture. The college operated until 1992, when it was taken over by London Metropolitan University, and the building was vacated in 2016 when the university rationalised its estate.

Work on the seven-floor refurbishment began in October 2023, led by main contractor Oktra, Project Manager Quartz Project Services, Architect Hawkins\Brown and Civic Engineers.

The completed building provides flexible, open floorplate space tailored to the needs of universities and colleges, as well as business and industry partners that may look to co-locate with a university to access the talent of the future and provide facilities for research and industry innovation. The Aldgate and Whitechapel area is already well established as a community for higher education, as well as being one of Central London’s youngest and fastest growing neighbourhoods, with a major life sciences cluster planned for the site of the former Royal London Hospital Buildings to the north of The Amp.

Allsop and DLA acted on the deal for Trilogy and LaSalle. DMU has been advised by Metric RE and Mills and Reeve.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Value-Add Investments

LaSalle Value-Add Investments is part of LaSalle’s growing US $10 billion Debt and Value-Add Strategies platform in Europe and targets higher-return real estate equity investments across Europe, with a focus on conviction investment themes and dislocation opportunities.

About Trilogy Real Estate

Trilogy Real Estate was founded in 2015 by former Resolution Property partner Robert Wolstenholme as an investment and development company specialising in transforming unloved assets to create inspiring and positively impactful mixed-use innovation campuses where the world of work meets education, skills and training.

Company news

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has acquired a central London hotel from abrdn for £56 million on behalf of a UK Custom Account client.

The modern, 291-bedroom hotel is situated on the Minories, at Tower Hill in the City of London. The hotel is let to Motel One – the European hotel operator – on a long-term inflation-linked lease. The building achieved a BREEAM ‘Excellent’ rating on its construction in 2014 and has an EPC rating of ‘A’.

Sophie Simmonds, Managing Director, UK Custom Accounts at LaSalle, said: “We are delighted to add this acquisition to our client’s growing portfolio. The hotel meets our objectives, being a high-quality asset with strong sustainability credentials, in a fantastic city-centre location, with a long-term inflation-linked income stream, and leased to a leading European hotel operator.”

LaSalle was advised on the transaction by Kimmre. abrdn was advised by JLL.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

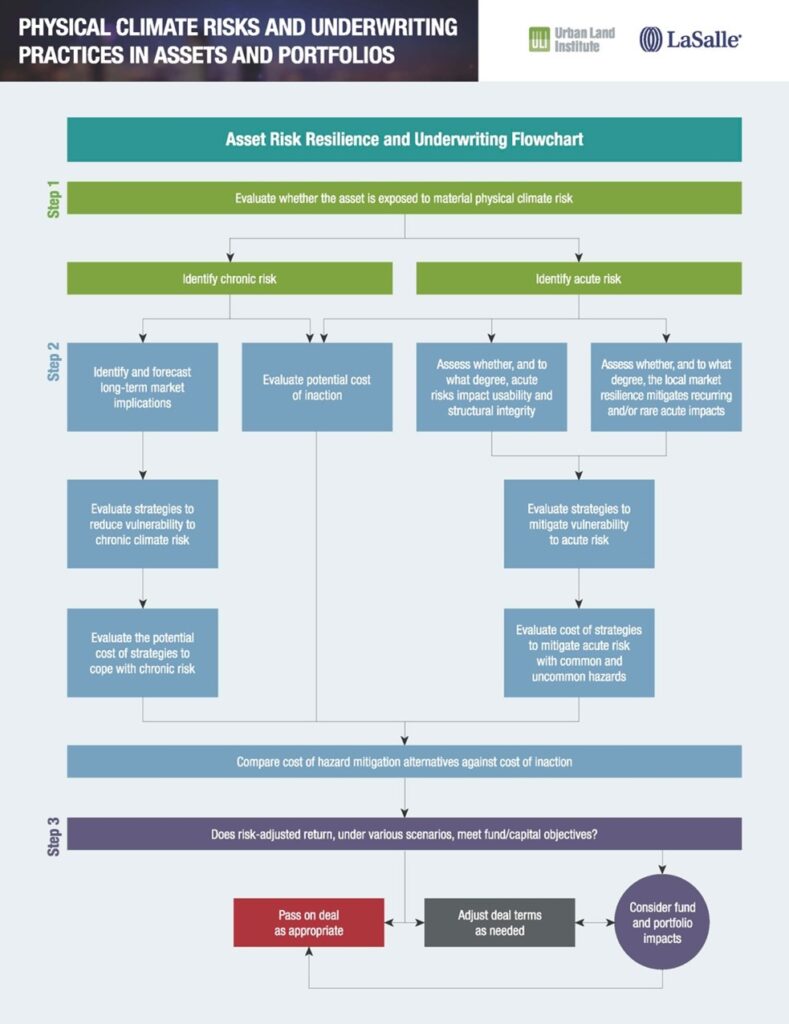

- Step-by-step framework to evaluate physical and financial risk and compare cost and benefits of resilience

- As of Q4 2023, of the US $850 billion of commercial real estate tracked by NPI, $285 billion, or 34% is situated in high and medium-high climate risk zones in the US, according to LaSalle’s Research and Strategy team analysis

Washington / New York (April 11, 2024) – A new global report from the Urban Land Institute (ULI) and LaSalle Investment Management (LaSalle), a leading real estate investment management firm, offers a new framework to help the real estate industry act on climate risk disclosure data. Across the real estate industry, practitioners understand physical climate risk to assets and portfolios poses a financial risk, but there are still many challenges to enacting on the data being collected and disclosed.

This new framework is the latest tool for real estate investors and other practitioners to evaluate the costs of action and inaction when it comes to investing in resilience. The report, Physical Climate Risks and Underwriting Practices in Assets and Portfolios, is the second in a series by ULI and LaSalle. Building on the first report that outlined how to source and interpret reliable climate risk data, the second provides a market overview, adaptable framework, and recommendations based on emerging best practices for incorporating physical climate risk in the underwriting process.

“Physical climate risk data collection and disclosure is the first step the real estate industry can take to further invest in and build resilient infrastructure,” said Lindsay Brugger, head of Urban Resilience at ULI. “Data drives action and doing nothing incurs deeper costs — from higher insurance premiums to asset repair or replacement. Focusing on the underwriting process, the framework offers investment managers a methodology for developing risk-adjusted returns so deals can be adapted in alignment with a firm’s fund or portfolio objectives.”

“Of the $850 billion of commercial real estate tracked by NPI, LaSalle estimates $285 billion, or 34% is situated in high and medium-high climate risk zones in the US,” said Julie Manning, Global Head of Climate and Carbon at LaSalle Investment Management. “This report helps provide guidance that investment managers can follow to factor the climate risk data they have available to them and improve outcomes at the asset and portfolio level. We want to lead the conversation across the industry and collaborating with ULI is a great conduit to amplify the discussion that will ultimately benefit investors of all kinds with more resilient real estate portfolios.”

The framework is broken down into three steps for decision making based on individual asset risks, local market risks, and ongoing risk mitigation efforts:

1. Evaluate the level of exposure to physical climate risk and financial implications;

2. Identify hazard mitigation strategies and estimate associated costs; and

3. Determine risk-adjusted return and whether or not that return meets firm objectives

The redevelopment will also look to meet future tenant requirements and evolving work trends with high-quality amenities to promote in-person interaction and facilitate a hybrid working, including an auditorium, business centre, bars and restaurants, event spaces and a media broadcast studio.

As climate impacts continue to influence real estate markets around the world, improving understanding of physical climate risk and adjusting pricing to reflect risk are growing imperatives. Firms can better navigate the complexities of physical climate risk and capitalize on emerging opportunities by leveraging this new report’s insights and guidance. Prioritizing knowledge diffusion and empowering informed decision-making processes is key to effectively managing and mitigating incoming climate risks in the evolving real estate industry, whether at a community or individual building scale.

The full report and downloadable framework can be found on ULI’s Knowledge Finder.

REPORTERS AND EDITORS: For more information, please contact:

ULI

LaSalle

Drew McNeill

About the Urban Land Institute

The Urban Land Institute is a non-profit education and research institute supported by its members. Its mission is to shape the future of the built environment for transformative impact in communities worldwide. Established in 1936, the institute has more than 48,000 members worldwide representing all aspects of land use and development disciplines. For more information on ULI, please visit uli.org, or follow us on Twitter, Facebook, LinkedIn, and Instagram.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages over US $89 billion of assets in private and public real estate equity and debt investments as of Q4 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (February 26, 2024) – LaSalle has been recognised as Real Estate Firm of the Year (ESG) at the New Private Markets Awards 2023 in recognition of the steps taken last year to embed sustainability across its operations in Europe.

LaSalle completed net zero carbon audits for 177 properties in the UK and continental Europe, created a dedicated NZC implementation team, and introduced sustainability-related performance targets for all investment-related employees, with 119 having already undertaken bespoke training.

Alex Edds, Head of Sustainability, Europe at LaSalle commented:

“This award recognises the significant progress we’ve made in delivering on our sustainability strategy in Europe, and in particular our net zero carbon programme. We remain committed to improving and delivering upon ours and our clients’ sustainability goals in ways that also drive investment performance.”

Read more about this year’s New Private Market Awards on the NPM website (subscription required): New Private Markets Awards 2023: ESG in fund management winners.

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (January 29, 2024) LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces that Alexandre Arhuis-Grumbach has been appointed to the newly created role of Head of Transactions Europe, Core and Core+ Strategies.

Previously Head of Encore+ Transactions, Alexandre will now oversee all transactions, across LaSalle’s core and core+ commingled funds (including the firm’s flagship Encore+ fund) and custom accounts in Europe.

In his new role, the core and core-plus transactions teams across the UK and continental Europe will report into Alexandre, who will in turn report into LaSalle’s Head of Europe, Philip La Pierre.

Alexandre has worked at LaSalle for more than 13 years, having joined in 2010 as a financial analyst on a pan-European Value-Add fund before becoming an acquisitions manager in France. He earned an MSc in Civil Engineering from the French school ESTP and an MSc in Real Estate Management from Glasgow Caledonian University. He is also a Member of the Royal Institution of Chartered Surveyors (MRICS).

Philip La Pierre, Head of Europe at LaSalle, said: “Alexandre’s newly created role will help drive core and core-plus transactions as the market continues its recovery from the macroeconomic headwinds it has faced. Having worked with LaSalle for well over a decade, Alexandre has been instrumental in the success of our flagship Encore+ fund and we are delighted that a wider range of our clients will now benefit from his transaction expertise.”

Alexandre Arhuis-Grumbach, Head of Transactions Europe, Core and Core+ Strategies at LaSalle, commented: “This is an exciting opportunity to lead LaSalle’s core and core-plus transactions at a critical time, working with a best-in-class team to source and execute transactions in line with our clients’ investment objectives. I am delighted to take on this new role and help ensure that LaSalle continues to expand across the UK and continental Europe, while maintaining its position as one of the world’s leading real estate investment managers.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (January 25, 2024) LaSalle Investment Management, the global real estate investment manager acting on behalf of Malaysian investor Permodalan Nasional Berhad (PNB), has selected Multiplex Construction Europe Limited (Multiplex) as the main contractor for the construction of One Exchange Square, a state-of-the-art 447,000 square foot office development at Broadgate Campus in the City of London. M3 Consulting are acting as the Development Manager for the project.

Designed by Fletcher Priest Architects, the 13-story scheme to be delivered by Multiplex will comprise 430,000 square feet of premium workspace and 17,000 square feet of retail, fronting both Bishopsgate and the newly re-landscaped park at Exchange Square. With 13 upper floors and floorplates averaging 40,000 square feet, the building features landscaped terraces on every floor, totalling 33,000 square feet across the building. In addition to boasting a striking feature reception and 8,000 square feet amenity lounge, One Exchange Square benefits from outstanding transport connections and a diverse array of amenities, conveniently situated just a one-minute walk from Liverpool Street Station and surrounded by vibrant locations such as Broadgate Campus, Spitalfields, Shoreditch and the City of London.

Scheduled for completion in Q1 2026. One Exchange Square is envisioned as an office of the future, designed to meet tenants’ high sustainability and wellness demands. It is targeting exemplary environmental credentials, including a BREEAM Outstanding rating, NABERS 5* and Well Platinum. By retaining 90% of the existing structure, the asset will have 50% lower embodied carbon than a typical new build office of comparable size, saving approximately 7,600 tonnes of CO2e compared to the GLA 2030 target. The project is 100% electric, using intelligent façade design and mechanical services twinned with building management systems to manage operational energy use.

Gary Moore, Head of International Accounts, Europe, LaSalle Investment Management commented: “Once completed, One Exchange Square will be a truly landmark office development in London. It will boast top-notch environmental performance ratings in a conveniently central location, and is poised to be highly sought after for years to come. We are excited to work with Multiplex on its development and construction, integrating state-of-the-art design and sustainability features to cater to the needs of its future tenants.”

Callum Tuckett, Managing Director at Multiplex, said: “We are incredibly proud to have been selected by LaSalle and PNB to transform this key building in the Broadgate campus and the City of London. We look forward to working with our development partners and all the professional teams to deliver a contemporary and highly sustainable building that will have a positive impact not just on its occupiers but on the surrounding areas of Bishopsgate and Exchange Square.”

Trowers & Hamlins LLP advised on property, planning, procurement and construction legals. The construction team was led by partner James Huckstep and assisted by Nicola Conway and Natasha Kaulsay.

JLL and Cushman and Wakefield are advising on the repositioning and leasing of the project.

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (January 16, 2024) LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate have completed the 135,000 square feet refurbishment of The Amp, a new campus for education and innovation in the Aldgate district of the London borough of Tower Hamlets. 40% of the building will be immediately occupied by two pre-let tenants: Nottingham Trent University’s Confetti Institute of Creative Technologies and Access Creative College.

A further two floors of the building have been let to the London College of Creative Arts (LCCA), bringing the building up to 66% occupation ahead of completion. Allsop advised Trilogy during the leasing to LCCA, and Mark Kleinman at James Andrew International acted for LCCA.

The construction project to transform the buildings at 41-71 Commercial Road was completed in under a year to meet the operational requirements of the education occupiers, who needed an opening date in September 2023. The Amp provides space for education and innovation in a well-connected location, with one foot in central London and the other in the dynamic creative scene in the East of the city. Specialist on-site facilities include recording studios, performance space and an arena for gaming and esports.

The Amp reprises Trilogy’s successful partnership with LaSalle Investment Management, which has previously resulted in the transformation of Republic London from a dated office and disaster recovery space to a thriving education campus with over 15,000 students attending six universities and private education providers. The next phase of Republic London was granted planning consent in October 2023 and will also include 715 rooms of purpose-built student accommodation and a state-of-the-art data centre, adding an infrastructure component to this mixed-use development and creating a new kind of urban campus centred on innovation, higher education and accommodation.

Chris Lewis, Managing Director, LaSalle Value-Add Investments, said:

“The Amp is a great example of our venture with Trilogy, which is creating exciting new urban higher education assets to meet the increased demand from universities in gateway cities. 66% of the space has already been leased prior to completion, reinforcing The Amp’s offering as a thriving education and innovation campus.”

“It is part of LaSalle’s broader European value-add strategy, bridging the gap between infrastructure and real estate, with a focus on new economy sectors including urban accommodation, student housing, private medical facilities, distribution and data centres.”

Robert Wolstenholme, Founder and CEO of Trilogy Real Estate, said:

“The Amp is the latest example of our strategy to develop the best innovation campuses in the country. Focused on breathing new life into unloved buildings in our city centres and high streets, our goal is well-connected hubs for universities and colleges that offer easier access and more choice for students. Our buildings create opportunities to collaborate and even co-locate with industry, business, the local community and the third sector.

“The Amp has been an ambitious project to take on – we were blessed with a building with good bones, but which needed total modernisation with a 12-month turnaround. It’s testament to the skill of the team and our contractors and designers that the result belies the huge effort that has gone into getting it into tip-top condition in time and on budget. Huge amounts of work have gone into delivering a stunning, bespoke space for our occupiers and, in turn, the students that will be beginning their professional careers in this inspiring and uplifting place.”

Craig Chettle, CEO of Confetti Institute of Creative Technologies, said:

“The decision to take a pre-let at The Amp, with such a tight programme to delivery in September 2023, did present a significant challenge for us, but this was more than offset by the potential reward on offer. What has been delivered is a fully bespoke environment for our university courses in a fantastic location for our staff and students, supported by Trilogy’s focus on creating a campus for education that is more than the sum of its parts.

“We’re delighted to be here in the heart of one of East London’s great creative communities. At Confetti, we train our students for a career in the creative and entertainment industries, and being in Aldgate means there’s no shortage of opportunities for students to gain hands-on ‘Do It For Real’ experience. This, combined with the very best technology, studios, equipment and industry-connected tutors, means that students have access to the highest standard of specialist creative higher education.

The Amp was acquired by LaSalle and Trilogy from the Department for Education in a sale facilitated by the government-owned property company, LocatED, in the summer of 2022.

The partnership was advised on the acquisition by strategic real estate consultancy Kauffmans, which also acted to structure the pre-leasing agreement for Access Creative College and Confetti Institute of Creative Technologies during the negotiations to acquire the building.

41-71 Commercial Road was originally built in 1971 as the London College of Furniture. The college operated until 1992, when it was taken over by London Metropolitan University, and the building was vacated in 2016 when the university rationalised its estate.

Work on the seven-floor refurbishment began in October 2023, led by main contractor Oktra, Project Manager Quartz Project Services, Architect Hawkins\Brown and Civic Engineers.

The completed building provides flexible, open floorplate space tailored to the needs of universities and colleges, as well as business and industry partners that may look to co-locate with a university to access the talent of the future and provide facilities for research and industry innovation. The Aldgate and Whitechapel area is already well established as a community for higher education, as well as being one of Central London’s youngest and fastest growing neighbourhoods, with a major life sciences cluster planned for the site of the former Royal London Hospital Buildings to the north of The Amp.

Student lifestyles are supported by a strong local offer that includes plentiful PBSA, nightlife, leisure and food & drink options, excellent transport connectivity and proximity to London’s cultural attractions. The Amp’s location on a well-connected city-centre high street also makes it an attractive choice for mature students or students who wish to live in their family home during their studies.

Both Access Creative College and Confetti Institute of Creative Technologies have a large welcome space on the ground floor of the building, with full height glazing and their own entrances onto Commercial Road that create a highly visible public “shopfront” that encourages public interaction. Bespoke fitouts for each occupier have been completed as part of the refurbishment works, with specialist facilities including recording studios prepared for the start of the academic year.

To the rear of The Amp, the former Met Works building, a warehouse extension built in the 2000s, has been converted into an auditorium space for Confetti Institute of Creative Technologies. This auditorium will allow the Institute to host live music, comedy, spoken word, esports, screenings and more. Access Creative College will operate a music venue within their space, providing opportunities for students within the college to use their skills within a live environment.

The sustainability and energy performance of the building has been substantially upgraded, with an all-electric heating and cooling system that ensures no fossil fuels are burned on site. All new glazing and upgraded energy performance means that the refurbished building is fully compliant with the requirements of Part L and is rated BREEAM Excellent with WiredScore Platinum and an EPC “B” rating.

Ends

About LaSalle Investment Management | Investing today. For tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately US $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit lasalle.com and LinkedIn.

About LaSalle Value-Add Investments

LaSalle Value-Add Investments is part of LaSalle’s growing US $10 billion Debt and Value-Add Strategies platform in Europe and targets higher-return real estate equity investments across Europe, with a focus on conviction investment themes and dislocation opportunities. The business line was reconstituted in 2021, building on LaSalle’s long-term track record of European special situations and value-add equity investing and complementing the established opportunistic/value-add fund series in Asia and North America.

About Trilogy Real Estate

Trilogy Real Estate is a London-based real estate investment and development business specialising in unlocking the hidden potential of buildings through rigorously considered yet highly creative asset management strategies to inspire the talent of the future and regenerate urban environments. trilogyproperty.com/

About Confetti Institute of Creative Technologies

Confetti Institute of Creative Technologies is a dynamic and progressive learning institute offering specialist vocational education and training – from college-level courses to postgraduate degrees. Subject areas include audio and music technology and performance, games design and production, esports production, film and television, animation and VFX, and live events production. Home to over 2,500 students across its Nottingham and London

Company news

No results found

LONDON (29 November 2023) – Despite a challenging macroeconomic picture, European real estate has begun to acclimatise to higher interest rates and will offer some of the world’s most attractive supply-demand dynamics next year, according to the Insights, Strategy and Analysis (ISA) Outlook 2024 report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

Last year’s report predicted European macro headwinds and a stall in capital markets activity, but also strong real estate market fundamentals. Looking ahead, the 2024 ISA Outlook for Europe describes how investors that are ready to move out of waiting mode, with realistic expectations for operating income growth, can find compelling new investment opportunities.

This year’s report identifies five trends that differentiate Europe and earn the region’s real estate assets an important place in investors’ property portfolios:

- Europe’s city centre vibrancy and occupier demand have strongly rebounded

- The region’s firms and individuals are taking the lead in decarbonization

- Skilled migration is supporting growth

- Expansion of the EU’s single market is regaining traction

- The high prevalence of inflation-index commercial leases in the EU has helped the region’s property cash flows to better keep pace with inflation

These trends are driving demand in particular for logistics and rental housing, as well as superior performance by offices in the ‘super-prime’ segment.

Macro challenges but appealing supply-demand dynamics

Having defied expectations of a recession in 2023, Europe still faces elevated recession risk. Inflation has begun to abate but proven comparatively stubborn, particularly in the UK, inducing higher policy rates from the ECB and Bank of England. As the delayed impact of rising rates begins to bite, European property markets enter 2024 searching for a clear peak in interest rates – as well as an end to the war in Ukraine.

Europe’s occupational fundamentals are coming off the boil of recent years, with rental growth set to cool to its lowest level since 2020 next year. However, we expect that average rent growth should remain positive, especially for logistics and rental housing – even in an economic downturn – helped by low vacancy rates relative to history.