US private real estate returns went negative in Q4 2022 as the impact of higher interest rates continued to ripple through to market pricing and appraised values. This trend is expected to continue through the first half of 2023 with stability projected to return later in the year.

Returns in the fourth quarter showed negative appreciation and income returns in line with previous quarters, resulting in negative total returns for both the NPI and ODCE. The slowdown in returns was most significant for industrial, with retail delivering the highest returns of the major sectors (this is a notable shift from trends of the last 5+ years). Looking ahead, the dominant theme in sector performance is expected to be the under-performance of offices.

This note provides details on the fourth quarter performance of the NPI and ODCE indices, summarizes the outlook for future returns, and provides some information regarding insights from the first release of data related to the new NCREIF subtypes.

Highlights from the Q4 data releases include:

- The quarterly total NPI return declined 410 bps from Q3 to -3.5%. The Q4 return comprised a 0.95% income return and -4.45% appreciation return.

- The trailing-year return declined more than 1,000 bps quarter-over-quarter to 5.53%.

- Returns for all property types were down from the previous quarter and in negative territory, with industrial seeing the greatest decline for the second consecutive quarter. Retail was the highest-returning property type for the first time since Q1 2016.

- The ODCE value-weighted quarterly gross total return of -4.97% was down 440 bps from the third quarter. Appreciation remained negative at an index level and the income return was flat at 0.80%, an all-time low. Mark to market on leverage was a positive as interest rates rose, but negative appreciation caused leverage to be an overall negative to returns.

Want to read more?

US private real estate returns weakened considerably in 3Q 2022 as higher interest rates continued to have a major impact on market pricing and appraised values. This trend is expected to continue in the remainder of 2022 and into the opening quarters of 2023. This is leading to a dramatic slowdown in returns from the record levels seen less than a year ago.

Returns in the third quarter showed negative appreciation, with total returns remaining positive for both the NPI and ODCE. The slowdown in returns was most significant for industrial, with apartments delivering the highest returns. Looking ahead, the dominant theme in sector performance is expected to be the under-performance of offices.

This note provides details on the third quarter performance of the NPI and ODCE indices, summarizes the outlook for future returns, and provides some information regarding insights from the first release of data related to the new NCREIF subtypes.

Highlights from the 3Q data releases include:

- The quarterly total NPI return declined 260 bps from 2Q to 0.6%. The 3Q return was a 0.93% income return (an all-time low), and the appreciation return went negative for the first time since 3Q 2020 at -0.37%.

- The trailing-year return declined more than 500 bps quarter-over-quarter to 16.08%, which is still high relative to history.

- Returns for all property types were down from the previous quarter, with industrial seeing the greatest decline. For the first time since 1Q 2016, industrial was not the highest-returning property type.

- The ODCE value-weighted quarterly gross total return of 0.52% was down 430 bps from the second quarter. Appreciation turned negative at an index level and the income return continued to fall to 0.81%, an all-time low. Mark to market on leverage was a positive as interest rates rose, but negative appreciation caused leverage to be an overall negative to returns.

Want to continue reading?

As macroeconomic and geopolitical trends generate concern, investors are weighing the impact of inflation, rising rates and an uncertain economic outlook. Clarity remains elusive in many areas of real estate, but LaSalle’s Insights, Strategy and Analysis (ISA) Outlook 2023 makes the case that looking through the acute phase of volatility can lead investors to find patterns and identify opportunities.

The full report can be viewed at: www.lasalle.com/isa

As the 2022 Investment Strategy Annual predicted, two areas of continued strength are the residential (encompassing both single-family rental and apartments) and industrial sectors, which continue to see healthy fundamentals. But, as the report notes, price discovery across the market remains difficult, and many sellers are anchoring to aspirational “peak” pricing, perpetuating a bid-ask gap and reducing transaction volume.

The report “looks through” this current period of volatility to a potentially more positive second half of 2023 and 2024 as economic growth recovers and new supply remains limited, potentially providing a rebound in rent growth for investors with holdings in sectors that are underpinned by solid fundamentals.

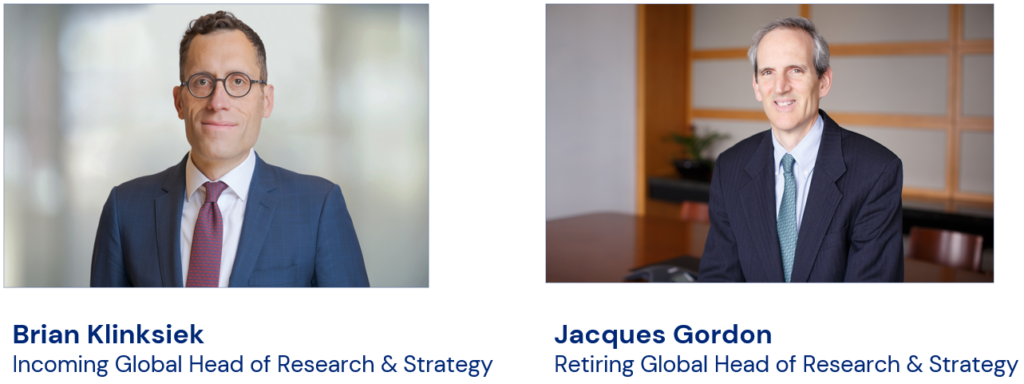

Brian Klinksiek, incoming Global Head of Research and Strategy at LaSalle, said: “Crises go through phases, but we humans are wired with recency bias that causes us to worry that short term pain could last forever. However, we’ve been through up and down cycles before, and we will eventually enter a more stable phase in the capital markets. Even now there remain opportunities within real estate for well-capitalized investors who understand the nuances of local markets and sectors.”

Select ISA Outlook 2023 findings for North America include:

- Inflation and higher rates continued to be key headlines in 2022. Many investors slowed transaction activity due to worries about the cost of capital. Many leveraged buyers were sidelined and may continue to be in early 2023. Expectations are interest rate pressures may start to ease, though this may come at the expense of a recession in Canada and the US early next year. The report lays out an expectation of returned economic growth in 2024 more in line with pre-pandemic norms.

- A “post-pandemic steady state” has emerged, with lockdowns in the region now in the rearview mirror and data showing people exhibiting pre-pandemic levels of activity – at least when it comes to leisure. Hospitality has benefitted from this rebound, and well-located convenience retail is getting an uplift. Office, however, remains negatively affected. The report discusses the weak return to office in the US and Canada, and the dim outlook for office performance in the next several years.

- Industrial, single-family rental and apartments have much stronger fundamentals than office, though they are still impacted by rising interest rates. The expectation is these sectors will produce positive rent growth in 2023, albeit below the 2021 and 2022 inflation-fueled spike. Meanwhile, medical office is a haven for investors given its resilience to economic cycles.

- Market selection must now include assessment of climate risk exposure. Hurricane Ian, potentially the costliest hurricane in US history in terms of damages, was a reminder that climate risk will impact asset performance in a variety of ways.

Rich Kleinman, Co-CIO and Head of Research & Strategy for the Americas at LaSalle, said, “While private real estate is often slower to re-price than public real estate, it is impacted by the same capital markets pressures driven by inflation and rising interest rates. In the short term, we expect price discovery to be slow in the US as both buyers and sellers have shifting price expectations. However, we believe this uncertainty can produce opportunity if you have the right insights on markets and sectors. This will be challenging and will require investors to weigh short-term value with long-term portfolio objectives.”

Chris Langstaff, Head of Research & Strategy for Canada at LaSalle, said, “We anticipate some short-term softening in the Canadian economy, especially given that household wealth is closely tied to home prices. However, Canada’s high levels of immigration will help the country with a more rapid recovery and the demand generated will allow real estate markets to quickly recover.”

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $79 billion of assets in private and public real estate property and debt investments as of Q3 2022. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit http://www.lasalle.com, and LinkedIn.

Forward looking statement

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (LaSalle) is pleased to announce it has been named a Best Place to Work in Money Management for 2022 by Pensions & Investments (P&I). This marks the seventh consecutive year LaSalle has received this prestigious recognition.

Presented by Pensions & Investments, the global news source of money management, the 11th annual survey and recognition program is dedicated to identifying and recognizing the best employers in the money management industry.

Kristy Heuberger, LaSalle Americas Co-Head, said: “We are proud to once again be recognized as one of the best places to work in our industry. We pride ourselves on creating a Culture of Care, which incorporates a holistic approach to promoting employee wellbeing, community connection and diversity, equity and inclusion. This honor is a reflection of the contributions of each employee at LaSalle and their critical role in sustaining our culture.”

Brad Gries, LaSalle Americas Co-Head, added: “Receiving this recognition seven years in a row speaks to a core tenant of our business: our people are our greatest asset. LaSalle is a tremendous place to grow together and not only provide superior client service, but foster a culture of inclusion and growth opportunities for our people. Thank you to all of our employees for making LaSalle a Best Place to Work in Money Management.”

P&I Executive Editor Julie Tatge said: “As their employees attest, the companies named to this year’s Best Places to Work list demonstrate a commitment to building and maintaining a strong workplace culture. Even as firms grappled with volatile markets and stresses from the pandemic, their employees said they feel strong support from their managers, enabling them to do their best work.”

Pensions & Investments partnered with Best Companies Group, a research firm specializing in identifying great places to work, to conduct a two-part survey process of employers and their employees. The first part consisted of evaluating each nominated company’s workplace policies, practices, philosophy, systems and demographics. This part of the process was worth approximately 25% of the total evaluation. The second part consisted of an employee survey to measure the employee experience. This part of the process was worth approximately 75% of the total evaluation. The combined scores determined the top companies.

For a complete list of the 2022 Pensions & Investments Best Places to Work in Money Management winners and write-ups, go to www.pionline.com/BPTW2022.

About Pensions & Investments

Pensions & Investments, owned by Crain Communications Inc., is the 50-year-old global news source of money management. P&I is written for executives at defined benefit and defined contribution retirement plans, endowments, foundations, and sovereign wealth funds, as well as those at investment management and other investment-related firms. Pensions & Investments provides timely and incisive coverage of events affecting the money management and retirement businesses. Visit us at www.pionline.com.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $79 billion of assets in private and public real estate property and debt investments as of Q3 2022. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit http://www.lasalle.com, and LinkedIn.

Forward looking statement

The information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

The global economy in general – and real estate markets in particular – are currently in the throes of an acute episode with pressure coming from every direction.

Eventually, we expect post-COVID-19 pressures such as inflation, supply chain issues and large fiscal stimulus to settle and a new normal to emerge. It’s just a question of “when?”

In this year’s edition, we seek to look through the current acute period of volatility and uncertainty, to discuss our view of likely outcomes and scenarios to consider, key themes for investing and real estate strategy recommendations that we expect to be resilient across the range of conceivable macro environments.

Want to continue reading?

In Conversation

Brian Klinksiek, Global Head of Research and Strategy talks with his predecessor, Jacques Gordon, about where we are – and where we have been – in real estate.

In this keynote interview with PERE on net zero’s responsibility and consequences, Darline Scelzo says employees want greater connectivity and a stronger sense of belonging.

When the pandemic hit, LaSalle was already formulating a new strategy for diversity, equity, inclusion (DE&I) and employee wellbeing, which evolved into a comprehensive initiative it calls the Culture of Care.

Want to continue reading?

In this keynote interview with PERE on net zero’s responsibility and consequences, David DeVos considers how to manage the risk of sustainability obsolescence

As the real estate industry moves toward` net zero, how to do so cost-effectively is a consideration for investors, developers, vendors, suppliers and tenants. David DeVos, trained and licensed as an architect and now Global Head of Sustainability at LaSalle, reflects on the direction of travel and how the industry’s many constituents must balance competing priorities.

Want to continue reading?

In 2016 LaSalle added “E” or Environmental factors to the demographics, technology and urbanization (DTU) set of secular forces real estate investors need to focus on for delivering positive long-term performance. As with other secular forces the “E-factors” are long-term in nature and live beyond the cyclical market shifts that drive near-term performance.

The early nature of the decarbonization process—both pledges and regulation—creates risks and opportunities. Catching a secular trend too early or too late in its trajectory are both risky. Our view is to move carefully and deliberately to mitigate portfolio risk and maximize returns. The net zero carbon (NZC) movement will impact different markets and segments at different points in time. The most important lesson is to pay close attention to how the trend affects specific projects and investment decisions.

Want to continue reading?

LaSalle Investment Management (“LaSalle”) has continued to deliver upon its sustainability goals, recording improved performance in two industry-recognized global sustainability benchmarks for asset managers.

Within the 2022 Global Real Estate Sustainability Benchmark (GRESB), 18 of the firm’s funds and separate accounts, domiciled across Europe, North America, and the Asia-Pacific region, have been recognized again for their sustainability standards, further improving upon the results reported in 2021. Across 18 submissions, the firm achieved four 5-Star, eight 4-Star and six 3-Star GRESB Ratings.

LaSalle commingled products recognized within the 2022 GRESB include:

- LaSalle Asia Opportunity Fund V

- LaSalle Asia Venture Trust

- LaSalle Canada Property Fund

- LaSalle China Logistics Venture

- LaSalle Encore+

- LaSalle E-REGI

- LaSalle Japan Property Fund

- LaSalle Japan Retail Portfolio

- LaSalle LOGIPORT REIT

- LaSalle Property Fund

- JLL Income Property Trust

In addition, LaSalle has also received updated scores for the 2021 ‘Principles for Responsible Investment’ (PRI) Assessment Report, most notably securing a 5-star rating in the Investment & Stewardship Policy score, the only rating that applies across the whole of the firm. 5-star scores are reserved for asset managers that can, “demonstrate leading practices within the responsible investment industry.”

These results come following changes to the PRI’s reporting structure and scoring methodology, which included moving to a star classification system from letter classification.

LaSalle PRI Assessment Report results include:

- Investment & Stewardship Policy: 5 Stars

- Direct – Real estate: 4 Stars

- Indirect – Real estate: 4 Stars

- Direct – Listed equity – Active fundamental – incorporation: 4 Stars

- Direct – Listed equity – Active fundamental – voting: 2 Stars

David DeVos, Global Head of Sustainability at LaSalle said: “These impressive results evidenced in leading industry benchmarks demonstrate LaSalle’s commitment and expertise in delivering upon our sustainability goals. While pleasing to have secured these metrics, reinforcing LaSalle’s status as a leader in responsible real estate investment, we continue to seek opportunities to accelerate our efforts in achieving our long-term targets and achieving superior performance for our clients.”

About GRESB

GRESB is an industry-driven organization transforming the way capital markets assess the sustainability performance of real asset investments. More than 900 property companies and funds, jointly representing more than USD 3.6 trillion in assets under management, participated in the 2018 GRESB Real Estate Assessment. The Infrastructure Assessment covered 75 funds and 280 assets, and 25 portfolios completed the Debt Assessment. GRESB data and analytical tools are used by more than 75 institutional and retail investors, including pension funds and insurance companies, collectively representing over USD 18 trillion in institutional capital, to engage with investment managers to enhance and protect shareholder value. Greater transparency on sustainability issues has become the norm, with GRESB widely recognized as the global sustainability benchmark for real assets. For more information about GRESB and its sustainability benchmarking and reporting for real estate, please visit https://gresb.com/gresb-real-estate-assessment/.

About the PRI

The PRI is the world’s leading proponent of responsible investment. It works to understand the investment implications of sustainability factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions. The PRI acts in the long-term interests of its signatories, of the financial markets and economies in which they operate and ultimately of the environment and society as a whole. The PRI encourages investors to use responsible investment to enhance returns and better manage risks, but does not operate for its own profit; it engages with global policymakers but is not associated with any government; it is supported by, but not part of, the United Nations. For more information about UN PRI and its sustainability benchmarking and reporting for real estate, please visit https://www.unpri.org/

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Inflation, energy and real estate

Inflation has moved rapidly from overlooked to top-of-mind this year. For the past eight months, many different types of price movements have received significant attention among economists, central bankers and real estate owners and occupiers. Global supply chain bottlenecks and pandemic-related fiscal and monetary stimulus have all contributed to price instability. More recently, Russia’s invasion of Ukraine has been a particularly troubling cause of energy price volatility, especially in Europe.

Many countries are transitioning their energy grids to more renewable sources, but a full transition could take several decades. Fossil fuels supply about 77% of the world’s energy, according to the Environmental and Energy Study Institute (see p. 7). The chaotic collision of inflation and energy shortages – particularly in Europe – has decision-makers scrambling as winter approaches.

The disruption of Russian natural gas flows to Europe prompted delegates of the European Union to discuss solutions and to wean itself from Russian gas. Some are promoting a common price cap on all gas imports, while others believe this will limit supply, further stressing consumers and businesses. As winter approaches, strategic reserves in Europe are at full storage capacity (see p. 45 Gas Storage), so an immediate crisis has likely been averted. However, it remains unclear how these reserves will be replenished once they are depleted. Our analysis of this rapidly-changing situation in Europe can be found on p. 9 of this month’s deck.

Energy inflation is also impacting lease agreements between real estate owners and occupiers. Green Street Advisors recently noted that on average, energy costs to either the owner or tenant equals roughly 6% of total rent or USD ~$2.00 psf in both the US and EU. But with energy costs having risen sharply, the question becomes: who bears the cost?

In North America, most commercial leases are triple net, with tenants responsible for utilities, taxes, maintenance, and insurance. Triple net leases are also prevalent among retail properties in the US and Canada, but Canada also has gross, semi-gross or base-year leases which are indexed to CPI inflation. While tenants pay directly for their energy usage, owners are not fully off the hook as they bear responsibility for vacant spaces. Owners can also mitigate cost risk through guaranteed maximum price contracts for certain utilities.

Leases in the UK are also generally on a net basis. However, to counter rising prices, tenants have been renegotiating rents based on total occupancy cost, thus the property owner becomes responsible for any costs that exceed a threshold. In this regard, UK tenants have been increasingly seeking different lease structures that are effectively gross in nature, with shorter lease terms (see p. 10).

On the European continent, most commercial leases are fully indexed to inflation annually. Larger retail tenancies such as grocers often have bargaining power and can negotiate an index cap or lower indexation levels. But even with indexation, tenants are becoming more sensitive to utility costs and are negotiating for increases to be capped. In Japan and China, fixed-term leases typically put the burden of paying higher utility costs on the tenant, but landlords must be careful to keep total occupancy costs under control or a downward reset to the base rent could be the only way to get a tenant to renew.

Despite progress in transitioning energy grids to renewables in many countries, the world remains largely dependent on fossil fuels to provide the power to heat and cool buildings. Rising energy prices are testing the tenant-landlord relationship and the balance of power is rapidly shifting in favor of tenants, especially in weaker sectors like mall retail and offices.

LaSalle Investment Management (“LaSalle”) is pleased to announce Matthew Jianguo Yao, a seasoned investment manager in the Greater China market, has been appointed its Head of RMB Strategy. Matthew joins LaSalle from PGIM and brings with him 10 years of experience from CBRE Global Investors, where he worked on capital raising and built operational capabilities including development and asset management.

This appointment follows LaSalle’s successful registration as a private equity fund manager (“PFM”) with the Asset Management Association of China, which enables LaSalle to carry out RMB-denominated capital raising, as well as provide fund management services for RMB funds in China. LaSalle is one of a few wholly foreign-owned firms to have obtained the status of a PFM in China.

In this newly formed role Matthew will partner with LaSalle’s team across Shanghai and Hong Kong to further develop its RMB strategy and execution. He will also leverage his market expertise and deeply-rooted network to forge more capital partnerships with China’s domestic institutional investors and capture new opportunities in the market.

Matthew reports to Claire Tang, Head of Greater China and Co-Chief Investment Officer, Asia Pacific.

Claire Tang commented: “China is a strategically important market for LaSalle and one to which we have a long-term commitment, having operated in the country since 2005. We’re pleased to welcome Matthew to our team as we broaden our fundraising to tap on the deep pool of domestic investable capital in China. As we scale our platform in China and across Asia Pacific, we are looking to continue to deliver strong returns to our investors over time.”

Matthew Yao added: “I’m looking forward to working with the LaSalle team to diversify our investor base and to extend the firm’s track record of investment excellence.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) has partnered with Volta Trucks, the leading and disruptive full-electric commercial vehicle manufacturer and services provider, to launch the first Volta Trucks Hub in the UK. The Hub will serve the battery electric Volta Zero vehicles that are set to operate on the streets of London from early 2023. The Hub is the second service and maintenance facility announced by Volta Trucks, after Bonneuil-sur-Marne in Paris, with further centres in other European cities to be announced in due course.

Volta Trucks will soon begin fitting out the facility in London, which is on White Hart Lane in Tottenham, near many of Volta Trucks initial UK-based customers, and within easy reach of all of east and west London’s significant logistics centres. The facility covers 30,000 sq feet, operating eight workshop bays. It will also accommodate a showroom, admin offices, a Volta Trucks Academy training centre and Call Centre that will provide the interface between customers and the company’s team of technical and commercial experts.

With sustainability at the heart of the Volta Trucks brand, the new Volta Trucks Hub in London is at the cutting edge of building design. LaSalle has managed the refurbishment of the facility to create a net zero carbon property in operation, with a photovoltaic panel system on its roof, converting sunlight into energy for the site, and a passive solar wall, optimising the heating and ventilation of the building. It is also designed with a charging infrastructure to support 50kW fast charging of Volta Zero vehicles while they are being maintained. Overall, the facility has an A+ EPC rating and has been designed to achieve the BREAAM ‘Excellent’ rating.

The Volta Trucks Hub in London is part of a wider representation strategy that will see a vehicle service offering across all launch locations of Paris, London, Madrid, Milan, the Rhine-Ruhr region of Germany, and the Randstad region of the Netherlands. The network of Hubs will be a critical enabler of the company’s innovative Truck as a Service offer, that sets out to revolutionise the finance and servicing of commercial vehicle fleets.

Truck as a Service will accelerate the adoption of electric commercial vehicles by delivering a frictionless and hassle-free way to electrify fleets, while de-risking the migration for Fleet Operators. Truck as a Service supports every step of the electrification migration by offering a single, affordable, monthly fee that funds the use of a full-electric Volta Zero vehicle, and all of its servicing, maintenance, insurance and training requirements, maximising the uptime and operational efficiency of the vehicle.

Confirming the Volta Trucks Hub in London, Casper Norden, Chief Fleet Solutions Officer of Volta Trucks, said: “London and Paris are Volta Trucks’ initial launch markets, and the availability of service and maintenance facilities is key for customer’s trust and confidence in our ability to deliver on our promises, and maintain the uptime of their vehicles. The search for the right location with the right environmental credentials has been extensive, but our new Volta Trucks Hub in Tottenham gives us, and our customers, everything needed to introduce our innovative truck into the important UK market and be fully operational from day one.”

Edd Fitch, Director of Asset Management, LaSalle Investment Management, added: “We are thrilled to partner with Volta Trucks to launch its first Volta Trucks Hub in the UK. This Hub will bring Volta Trucks’ innovative, full-electric commercial vehicles to the UK’s logistics sector, supporting our collective ambition for cleaner and more sustainable city centre environments.

“LaSalle has managed an extensive refurbishment of the facility at White Hart Lane to create a market-leading Net Zero Carbon logistics property in operation, and we continue to invest in our property portfolio across Europe to meet the ever-evolving demands of future tenants around sustainability, wellbeing, quality, amenities and infrastructure. We look forward to seeing the first Volta Zero vehicles on London’s streets early next year.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) announced its fifth Canadian value-add real estate fund in Canada, LaSalle BVK Canada Advantage (“BVK Advantage” or “the fund”), expanded its portfolio through the acquisitions of a mid-bay industrial portfolio and multifamily property. Both the industrial portfolio and the multifamily property are located in Toronto.

The multifamily property and industrial portfolio acquisitions are the first capital deployments for BVK Advantage, respectively, after the fund closed in December of 2021 with a total capital raise of C$306 million. Both acquisitions speak to the compelling fundamentals of the Toronto market and the market’s attractive value-add opportunities.

John McKinlay, CEO of LaSalle Canada, said: “We view Toronto as a premier real estate market not just in North America, but globally. Its continued demographic tailwinds, economic strength and land-constrained nature offer opportunities across the risk spectrum that domestic and foreign capital can capitalize on. Even amid an increasing rate environment, there remains an opportunity to find yield in a well-executed value-add acquisition as long as your team has the vision and knowledge to execute at a high level, which I believe our team possesses.”

Added Chris Lawrence, Sr. Managing Director and Head, Value-Add Strategies at LaSalle Canada: “These acquisitions provide a strong foundation for BVK Advantage’s portfolio and highlight our conviction in the multifamily and industrial sectors. We’ve found success in previous funds by identifying well-located properties that can respond to our active management approach, and believe we have done so again here. I’m proud of our team for their creative approach to sourcing and executing both transactions.”

The Toronto Airport Mid-Bay Industrial Portfolio consists of eight properties totaling nearly 400,000 square feet, and is located in Mississauga and Brampton, prime Greater Toronto Area (“GTA”) industrial submarkets. The portfolio is fully leased, with a short weighted average lease term of just over 2 and a half years, and significant upside due to below market in-place rents. The GTA is one of North America’s largest industrial markets at 800 million square feet, and has seen rents grow at a three-year compound annual growth rate of 20% amid a surge in industrial demand driven by e-commerce.

Mike Cornelissen, LaSalle Managing Director of Acquisitions, added: “e-Commerce demand and the potential runway for further expansion in Canada has put a premium on industrial properties. We feel that the land constraints of Toronto, specifically the surrounding Greenbelt, combined with the larger product coming online, positions infill mid-bay product to be a destination for tenants looking for prime distribution facilities. All of this comes at a fraction of replacement cost.”

The multifamily property, 75 Eastdale, includes a 15-story, 253-unit high rise apartment building along with 16 two-story townhomes in the desirable Danforth Village in Toronto’s East End. The property’s unit mix includes studios and 1-4 bedroom apartments and townhouses, and is 96 percent leased. The Toronto market benefits from exceptional population growth, and is projected to be the fastest growing market in Canada totaling 10 million people by 2046, according to LaSalle Research & Strategy. Toronto has averaged under 1.5% apartment vacancy for the last 10 years as demand has outpaced supply. In 75 Eastdale’s immediate area, there is limited apartment supply, and excellent proximity to public transit and employment, which should continue to drive strong leasing trends.

Stephen Robertson, Head of Acquisitions for LaSalle Canada, said: “75 Eastdale is an excellent way for BVK Advantage to enter the market as it is well-located with a strong history of tenant demand. We feel there is excellent upside to this property through select unit and common area renovations that will continue to make this an attractive rental option for those looking for a vibrant neighborhood with easy access to surrounding employment and downtown Toronto.”

About LaSalle in Canada

On an aggregate basis, LaSalle has executed more than C$7 billion in Canadian real estate since 2000, providing it with an in-depth understanding of the market. The formation of LCPF expanded LaSalle’s existing Canadian real estate product suite and investment vehicles, which include a series of closed-end commingled funds as well as separate accounts.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) today announced Samer Honein will succeed Alok Gaur as its Global Head of Investor Relations, effective November 30. Samer will join LaSalle’s Global Management Committee upon commencement of his new role, and continue to be based in Paris.

LaSalle Global CEO Mark Gabbay said, “We are grateful to have a leader of Samer’s caliber step up to this critical leadership role, and thankful for the many contributions Alok has made during his time at LaSalle. Our IR team is well-positioned to continue driving growth for LaSalle, as we seek to scale our flagship vehicles and deliver new offerings in the market.”

Samer has been with LaSalle and JLL for more than 21 years, and has over 25 years of industry experience. He was appointed the LaSalle’s Head of EMEA Investor Relations in April 2021 and in that role has served as a leader both within the IR group and for the firm. During his time at LaSalle, Samer has driven large capital raises and maintained relationships with key clients in the EMEA region with a focus on the Middle East. Samer previously worked with LaSalle’s Acquisitions team, sourcing investments opportunities and executing acquisitions in France on behalf of LaSalle’s Strategic Partnerships.

Samer Honein, Head of EMEA Investor Relations said, “It is an honor to be named the next leader of LaSalle’s global Investor Relations group. I thank Alok for his partnership, insight and leadership, and look forward to building on the momentum our team has created in recent years, having raised more than $35 billion of capital since 2017. We have strong and respected IR leaders in each region that will continue to deliver world-class service to our investor clients, while helping LaSalle achieve its strategic objectives.”

Alok joined LaSalle in 2016 to co-lead the global capital raising team and then assumed the Global Head role in January 2021. During his tenure he helped accelerate several programmatic IR processes enhanced transparency and cross-functional collaboration across the firm.

Alok Gaur, Global Head of Investor Relations said, “I am thankful for the colleagues I’ve worked alongside during my time at LaSalle. The firm has an enviable track record and platform to help drive its future successes and Samer is an ideal leader to advance the next phase of growth. I thank Mark and our Global Management Committee for their partnership and confidence in me to lead this team, and look forward to seeing the firm prosper in the years ahead.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

London ranks as Europe’s leading city for projected real-estate occupier demand for the sixth year running in the latest annual edition of the European Cities Growth Index (“ECGI”, formerly the European Regional Growth Index, or “E-REGI”). Following closely behind, Paris retains its position as one the “Big Two” European cities owing to its position as one of Europe’s key innovation and technology hubs.

While London retains its top position, its ECGI score worsened compared to last year, due to pressures on GDP growth. In 2022, the ECGI score worsened for 57 cities across Europe, the highest number since the Great Financial Crisis.

Polarization between London and UK regional cities also continued to widen in this year’s index.

Conversely, German cities proved to be less volatile in economic crisis and complementary of each other, with four German cities making it into the index’s top 20.

More broadly, since the ECGI’s inception in 2000, only London, Paris and Munich have consistently ranked in the top 10. Moreover, Amsterdam’s inclusion in the list this year comes due to the city’s human capital and employment growth prospects which remain exceptionally strong.

Want to continue reading?

London ranks as Europe’s leading city for projected real-estate occupier demand for the sixth year running in the latest annual edition of the European Cities Growth Index (“ECGI”), published by LaSalle Investment Management (“LaSalle”), the global real estate investment manager. Following closely behind, Paris retains its position as one the “Big Two” European cities owing to its position as one of Europe’s key innovation and technology hubs.

While London retains its top position, its ECGI score worsened compared to last year, due to pressures on GDP growth. In 2022, the ECGI score worsened for 57 cities across Europe, the highest number since the Great Financial Crisis.

Polarization between London and UK regional cities also continued to widen in this year’s index.

Conversely, German cities proved to be less volatile in economic crisis and complementary of each other, with four German cities making it into the index’s top 20.

More broadly, since the ECGI’s inception in 2000, only London, Paris and Munich have consistently ranked in the top 10. Moreover, Amsterdam’s inclusion in the list this year comes due to the city’s human capital and employment growth prospects which remain exceptionally strong.

Petra Blazkova, Head of Research & Strategy, Core & Core-Plus Capital, Europe at LaSalle said: “This year’s findings come amidst significant turbulent macroeconomic headwinds for European markets. Despite their rankings and strong fundamentals, several top European cities will continue to face challenges in the coming months.

“That is why this year’s findings and the metrics tracked in the ECGI provide a valuable tool in assessing occupier demand and prospects for real-estate markets as investors look to the property sector for stability amidst a worsening global financial landscape.”

Uwe Rempis, Managing Director and Fund Manager of LaSalle E-REGI, added: “Amidst a challenging market backdrop, real estate remains a critical asset class for investors. Our research shows that whilst many cities across Europe were recovering from the pandemic last year, markets now face twin economic and geopolitical challenges, making it imperative for investors to build a diversified portfolio of assets underpinned by long-term resilience.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) is pleased to confirm it has been selected for a global real estate investment mandate by the Government Pension Investment Fund (GPIF), Japan. With Mizuho Trust & Banking Co., Ltd. acting as gatekeeper, the mandate will pursue co-investments, joint ventures and club deals.

Mark Gabbay, Global CEO of LaSalle, said: “It is an honor to be selected by GPIF for this investment mandate. Our global scale, wide ranging real estate investment capabilities and long track record will help shape our strategy and we look forward to delivering strong performance on behalf of GPIF for years to come.”

Jon Zehner, Head of LaSalle Global Partner Solutions at LaSalle, added: “We are pleased to have earned the trust of GPIF to manage real estate investments on their behalf. Our team is focused on sourcing and delivering compelling opportunities, and we look forward to strengthening our relationship of trust as we build a global portfolio.”

About GPIF

Government Pension Investment Fund (GPIF) is an incorporated administrative agency, established by the Japanese government. Total assets as of the end of June in 2022 count for JPY193,012.6 billion. For more information, visit: https://www.gpif.go.jp/en/about/.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Climate risks: Too big to ignore

The last day of summer in the Northern Hemisphere was September 22nd, and cooler temperatures will surely be welcomed by many. Europe and China recorded their hottest-ever summers since recordkeeping began in 1880, according to NOAA’s National Centers for Environmental Information. Meanwhile, the US recorded its third-hottest summer by the same metric.

The summer has also been a reminder to consider both the physical and transition risks associated with climate change. Reducing carbon emissions, which is key to preventing further long-term escalation in events such as these, has come under renewed urgency given recent geopolitical tensions.

Economic impacts extended across the world. Transport throughout the UK ground to a halt for part of July as temperatures reached levels never imagined by the Victorian engineers who designed its railway network. A lack of rainfall left crops parched and caused key rivers such as the Rhine to reach levels so shallow that they were not navigable by the barges that have become a key part of Central Europe’s supply chains. In some areas of the US, the key problem was too much precipitation, with extreme rain causing severe disruption in Kentucky and Saint Louis; flooding contributed to a drinking water crisis in Jackson, Mississippi. In China, precipitation in Jiangxi and Anhui provinces in July and August was 60% less than a year ago. Record heat and drought across China, including parts of the Yangtze River, caused a shortage of hydro-power and halted shipping. Relief from this year’s extreme temperatures is coming at the same time as what looks to be another severe season for hurricanes and wildfires takes shape. Hurricane Fiona left all of Puerto Rico without power before making a rare assault on Canada’s maritime provinces, and Hurricane Ian is likely to be the worst hurricane to hit the west coast of Florida since 1921.

The summer has also been a reminder to consider both the physical and transition risks associated with climate change. Reducing carbon emissions, which is key to preventing further long-term escalation in events such as these, has come under renewed urgency given recent geopolitical tensions. Most European countries face a severe energy crisis triggered by Russia’s war in Ukraine and the cessation of natural gas flows through key pipelines. Renewables like solar power have the dual benefit of aiding decarbonization and reducing dependence on Russian fossil fuels.

As real estate investors, we are concerned about the impacts that climate change will have on our investments. On the physical risk side, it is critical that we become aware of the extent to which climate risk hazards may directly impact our portfolios and prepare our buildings to be resilient to climate change. The first step is to identify the physical climate hazards that will impact specific buildings, measure the exposure to those hazards in aggregate within the portfolio, and then get to work managing, mitigating, and strategizing around these risks.

To get the data, we have a plethora of climate data providers and forecasters to choose from, but it can be overwhelming to narrow the field down. When we reviewed multiple data providers, we found considerable inconsistency in how metrics are defined, and wide variation in risk scores for the same hazard at the same property.

Our recent report, “How to Choose, Use and Better Understand Climate Risk Analytics”, researched and written in partnership with the Urban Land Institute (ULI), is an excellent overview of the challenges faced by first-time consumers of climate data. The paper outlines physical climate risk basics, identifies differences between data providers to be aware of, and raises a call to action to standardize the outputs in ways that are most meaningful and useful for real estate, with transparency that enables apples‑to‑apples comparisons across models.

Once the data is in hand, the next step is to manage the risks at two levels: at the property level, through evaluating both existing and potential new hardening strategies to be more resilient against particular hazards; and at the portfolio level, through assessment of exposure concentrations and consideration of how climate risk informs overall portfolio construction strategies. And lastly, we must continue to monitor these risks on a regular basis, because one thing we know for sure is that our climate will continue to change, and more disruptive and damaging seasons like the hot summer of 2022 are likely to recur.

LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate has announced the acquisition of the former London Metropolitan University buildings, 41-71 Commercial Road and the Met Works Building, in the Aldgate district of the London Borough of Tower Hamlets.

The estate includes 133,163 sq ft (NIA) of innovation and education space set inside two buildings on a one-acre site. The campus had previously been in use as workshops and teaching space for London Metropolitan University. LaSalle and Trilogy acquired the site from the Department for Education in a sale facilitated by the government-owned property company LocatED.

The building was acquired subject to over 40% of the space pre-leased to two providers of further and higher education: Nottingham Trent University’s Confetti Institute of Creative Technologies, and Access Creative College.

LaSalle and Trilogy were advised in the acquisition by strategic real estate consultancy Kauffmans, which also acted to structure the pre-leasing agreement for both occupiers. The refurbishment programme will create a pathway toward a major creative education centre in a growing area of Central London and has been de-risked through a contract with design build company Oktra.

The Commercial Road campus will be substantially refurbished and expanded to circa 150,000 sq ft, leaving 80,000 sq ft of education and creative learning accommodation available for interested occupants.

Chris Lewis, Managing Director, LaSalle Value-Add Investments, said:

“This investment is a great example of LaSalle’s growing Value-Add Investments strategy focusing on creating urban higher education and science accommodation in major gateway markets. Working with Trilogy to secure pre-lets on over 40% of the space provides strong downside protection in this economic environment, and we are looking forward to working closely with Trilogy to replicate the success of our prior investment in East India Dock.”

Robert Wolstenholme, Founder and CEO of Trilogy Real Estate, said:

“Trilogy is delighted to be extending our partnership with LaSalle to bring a second major education campus to Tower Hamlets. We previously developed Republic, a 600,000 sq ft campus where education meets business, which demonstrated that London’s youngest and fastest growing borough is a great place to be training the talent of the future.

“Aldgate is a place where the next generation of innovators and pioneers live, work, and are educated, in close proximity to the financial centres of the City of London and Canary Wharf, and surrounded by significant innovation ecosystems, particularly in the creative, technology and biomedical sectors. Our project will bring the campus back into use as a centre for higher education, upgrading it to create world-class space fit for the 21st century economy.”

Craig Chettle MBE, Chief Executive, Confetti Institute of Creative Technologies, said:

“We’re excited to be working with LaSalle and Trilogy on creating a campus that will support our ambitious vision to shape the future creative and entertainment industries. Working closely with our partner, Nottingham Trent University, we look forward to working with businesses and the wider community in East London in preparing for our new students in 2023.”

Jason Beaumont, CEO of Access Creative College, said:

“Access Creative College has been educating young creatives in London for over 20-years and it’s an absolute pleasure to be able to announce our vision for the future.”

“We are thrilled by the opportunity to design and build world-class facilities, alongside a pioneering curriculum in the heart of East London, where our collaboration with employers and higher education will be at the centre of a coherent and connected journey for all our students.”

“We look forward to working with all parties involved, to truly create an unrivalled experience and generate future opportunities for the young people of London.”

The campus sits within London’s strategically significant “Tech Belt” and is surrounded by a substantial cluster of student accommodation, biomedical, and life sciences buildings that extends into the area south of the Royal London Hospital in Whitechapel. The area is renowned for the quality of its amenity offer and the campus benefits from proximity to the leisure opportunities offered by Whitechapel, Spitalfields and the wider East End. The campus is an eight-minute walk from Elizabeth Line services at Whitechapel and a five-minute walk from the London Underground station at Aldgate East.

Previously, Trilogy and LaSalle developed Republic, a unique mixed-use innovation campus where education meets business in East India Dock, providing courses for more than 3,350 students from four major UK universities. Republic provides a high-quality learning environment and leisure offer alongside office space, with initiatives to bring education and business closer together.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) announced that its flagship core institutional real estate fund, LaSalle Property Fund (“LPF” or “the fund”), bolstered its life sciences portfolio with a majority interest acquisition in 3215 Merryfield Row, a Class A+ life sciences building located in the heart of the high-barrier-to-entry market of Torrey Pines in San Diego, California. LPF acquired its stake in 3215 Merryfield Row through a joint venture with a publicly traded REIT.

The investment aligns with the fund’s strategy of investing in best-in-class life sciences properties in high-conviction markets as part of its national, diversified portfolio. With the addition of a stake in 3215 Merryfield Row, life sciences and medical office properties now comprise 13 percent of LPF’s portfolio. LPF’s life science investment includes Illumina’s world headquarters, located in the UTC submarket of San Diego, in which it acquired a partial interest in 2019.

Jim Garvey, President of LaSalle Property Fund, said: “We have high conviction in the life sciences sector given the strong tenant demand, which is a function of the continuing advancement in pharmaceuticals, medical devices and therapeutics. 3215 Merryfield Row is an exceptional property, both in its location, and best-in-class construction, and comes with the added bonus of a leading partner who we know and trust. We’re very pleased to add 3215 Merryfield Row to LPF’s portfolio.”

Erick Paulson, LaSalle Acquisitions Officer, added: “This is a special property with a premier location, a strong credit tenant, and an outstanding operating partner for LPF. Life sciences properties continue to be in high demand due to their challenging and often expensive construction and should provide excellent cash flow and appreciation for well capitalized buyers looking to achieve long-term gains.”

Constructed in 2018 with state-of-the-art life science specs, the property is fully leased to Vertex, a global biotech company focused on small molecule therapeutics and cystic fibrosis, and serves as one of the company’s three global research hubs. Largely considered one of the most architecturally significant life science properties on the West Coast, 3215 Merryfield Row is LEED Gold Certified and includes glass interior walls, a 1,500-square-foot Learning Lab for STEM education programs, an interactive art display in the lobby, and an air circulation system that is designed to bring in 100 percent outside air.

The property also benefits from its coveted location in the sought-after Torrey Pines submarket, which has a life sciences vacancy rate of just 0.3 percent. More broadly, LaSalle Research & Strategy pegs San Diego as the nation’s third-best life sciences market. San Diego is home to more than 1,300 life science companies and is comprised of 19.8 million square feet of life science space supported by strong fundamentals, including a record low direct vacancy rate of 2.3 percent and an average triple-net asking rate that has risen 166 percent since 2015.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) today announced that Tom Rose, LaSalle’s current Head of UK Relative Returns, will succeed Julian Agnew as Head of Custom Accounts, Europe, effective from 1 December 2022.

After a long and successful career at LaSalle, Julian has confirmed he will be leaving the business at the end of December 2022.

Tom has been a key member of Julian’s team for more than 20 years, with responsibility for client portfolios with relative return investment strategies within the UK. In his new role, Tom will report into Philip La Pierre, Head of Europe at LaSalle, and will continue to shape and position client portfolios, ensuring competitive investment performance in the context of individual client risk-return requirements. Tom will also become a member of LaSalle’s European Management Board, where he will lead Custom Accounts’ contribution to LaSalle’s growing and integrated investor product mix across Europe.

Tom Rose, incoming Head of Custom Accounts, Europe at LaSalle Investment Management, commented: “It is an honour to be appointed Julian’s successor and lead our Custom Accounts business in Europe. We are committed and driven to deliver the best possible performance for our clients’ long-term success. I look forward to working with our Custom Accounts clients in this new role, supported by our integrated pan-European operating platform and market-leading research, to achieve the investment objectives of their real estate investment programmes.”

Julian Agnew, outgoing Head of Custom Accounts, Europe at LaSalle Investment Management, said: “I have had a long career across LaSalle Investment Management, and I am very fortunate to have worked with some incredible people both internally and externally. LaSalle is well-positioned to continue to deliver exceptional value for clients, and Tom is the right leader to drive the next phase of growth for the Custom Accounts business.

“I look forward to the next challenge in an industry that I still find as rewarding and exciting as when I first started.”

Philip La Pierre, Head of Europe at LaSalle Investment Management, added: “We thank Julian for his distinguished service and leadership. Julian has played a seminal role in the success of the business, and we look forward to celebrating his contribution and many achievements at LaSalle before he leaves at the end of this year. We wish him every success in the next challenge that he takes up in the industry.

“Tom’s unique skillset and professional experience positions him well to take on this role, having been a member of Julian’s team for over 20 years. I look forward to working with Tom as a member of our European Management Board to build upon Custom Accounts’ contribution to our pan-regional, best-in-class client offering.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

A new report from the Urban Land Institute (ULI) and LaSalle Investment Management (LaSalle), a leading real estate investment management firm, outlines steps that real estate practitioners can take to better manage climate risk in their portfolios and suggests ways in which climate risk providers can better serve the real estate industry.

Based on the insights of real estate managers and climate data providers across the globe, How to Choose, Use, and Better Understand Climate-Risk Analytics comes as real estate investors are recognizing the need to incorporate the physical risks associated with climate change – including wildfires, hurricanes, and excessive heat – into their business models. Accordingly, having reliable data and analytics tools to assist in this process is becoming an increasingly important consideration.

“Over the past few years, climate analytics tools have transformed how investors can assess, price, and mitigate climate risk,” said Billy Grayson, Executive Vice President for Centers and Initiatives at ULI. “As with all new tools, it will take some time for real estate developers and investors to identify the best ways to apply these tools to real estate decision-making. Learning from the successes and challenges of early adopters will help the real estate community as a whole, and we hope this report can serve as a roadmap for those looking to better leverage these tools to manage climate risk in their assets and portfolios.”

“Dealing with climate risk is a collective effort – we all benefit from consistency and transparency,” said LaSalle’s Americas Head of Sustainability Elena Alschuler. “Alignment on key terms and methodologies is critical to the industry’s effort to assess and address climate risk, which should ultimately benefit investors through improved returns.”

How to Choose, Use, and Better Understand Climate-Risk Analytics provides a climate assessment roadmap for practitioners seeking to optimize their risk-mitigation practices. The roadmap will help the real estate industry:

- Assess key areas of variation among climate risk providers in terms of the strength of their approach and ability to meet strategic objectives, such as business needs and regulatory compliance.

- Interpret physical climate risk results including value-at-risk, or the potential financial impact of a property experiencing climate-related damage.

- Integrate risk-assessment strategy with acquisition, development, financial reporting, and asset and portfolio management teams.

Additionally, the report provides four key takeaways on the state of climate risk assessment in real estate:

- Current risk metrics are inconsistent. Often, different climate risk analytics produce widely disparate risk scores for the same property, sometimes by orders of magnitude.

- Bridging the science-business gap. Translating the complexity of climate science into applied real estate industry practices is still in its early stages, with firms trying different approaches to integrating climate risk across investment, asset management, and disposition strategies.

- Rapid acceleration of market value impacts. While the impact of climate risk on current asset prices is not yet apparent in the market, institutional real estate managers are starting to incorporate it, therefore many believe the impacts will become increasingly visible.

- Transparency is key. Improved understanding and increased public discourse on physical risk in pricing will push the industry closer to uniform practice and standards.

“Investors today face numerous challenges factoring climate risk into their portfolios,” said Lindsay Brugger, Vice President of Resilience at ULI. “The industry lacks clear guidance around how climate risk data providers should be selected and how to integrate that information into business strategy. This report provides a series of guidelines so real estate practitioners can simultaneously mitigate the effects of climate change while remaining competitive in a rapidly evolving marketplace.”