BRISTOL (January 30, 2025) – LaSalle Investment Management (“LaSalle“), the global real estate investment manager together with its development partner Deeley Freed, has obtained outline planning permission for The Galleries Shopping Centre, Bristol.

The Galleries is situated in a prime location in Bristol’s city centre, adjacent to Castle Park, with excellent connectivity to public transport including Temple Meads station. The redevelopment will help unlock the Bristol City Council’s plans to regenerate the city centre. The surrounding infrastructure will undergo significant enhancements, becoming greener and more pedestrian-friendly. The redevelopment will support the Council’s sustainability goals, facilitating the delivery of a low-carbon District Heat Network and enhancing urban accessibility.

The proposed development includes plans for up to 450 new homes and 8,000 sq m of ground-floor space dedicated to retail, leisure, dining, health, and community facilities. In addition, the site will feature approximately 46,000 sq m of modern, sustainable employment space, the potential for a 240-room hotel or aparthotel, and up to 750 purpose-built student bedrooms. The development will also incorporate 1.5 acres of high-quality public realm which will look to bring Castle Park closer to the city centre.

A central feature of the project will be a new green transportation hub accessed via Fairfax Street, shifting the focus away from parking towards sustainable travel options. This regeneration project also aims to enliven Bristol’s nighttime economy, re-imagining the area as a vibrant city centre destination that will benefit residents and visitors. Additionally, the proposal reimagines public spaces – where the current Galleries site lack open areas, the new design will dedicate a third of the site to high-quality, welcoming public space. The redevelopment thoughtfully incorporates Bristol’s heritage by preserving the Merchant Almshouses and Greyhound Hotel, currently obscured by the Galleries structure, into the new design.

Tom Lewis, Fund Manager, UK Custom Accounts, LaSalle Investment Management said: “Following an extensive consultation process with local stakeholders, we’re delighted to have secured planning approval to transform Bristol city centre and provide the local community with new homes, commercial space, amenities, and green space. We’re committed to investing for the long term and this ambitious redevelopment scheme demonstrates our ability to create value and better meet the needs of future residents, occupiers and visitors.”

Max Freed, Director, from Bristol-based Deeley Freed, comments: “We’re delighted Bristol City Council has voted to support this redevelopment project. It is a once-in-a-generation chance to re-invent, revitalize and modernize such a large part of the city centre. Our vision involves completely transforming this 1980s shopping centre, making the site more diverse, safe and sustainable. The redevelopment of this site will bring more people to live and work in the city centre, accelerating the regeneration of the area.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

This article first appeared in the December 2024/January 2025 edition of PERE.

LaSalle’s Ryu Konishi and Julie Manning spoke to PERE about the growing importance of sustainability as part of investment decision-making and LaSalle’s approach to creating a global real estate net zero carbon pathway strategy.

A 360-degree approach to decarbonization

The importance of sustainability as part of investment decision-making in the real estate space has been on the rise for quite some time. In fact, the various physical risks associated with climate change, and the regulatory imperative of transitioning to net zero, are now so significant that these factors are gradually filtering through in the form of real-world valuation impacts.

For real estate investors, this raises both risks and opportunities. LaSalle Investment Management is one firm that was early to recognize this, having set up a global sustainability committee back in 2008. More recently, it has worked with the Urban Land Institute to develop a decision-making framework for assessing physical climate risk in relation to its real estate investments.

According to Julie Manning, global head of climate and carbon, and Ryu Konishi, fund manager of Lp3F (LaSalle’s global real estate net-zero strategy), this kind of approach to risk analysis – both broad and deep – is essential. So, where should investors start? And what might a determined decarbonization program in real estate look like?

Want to read more?

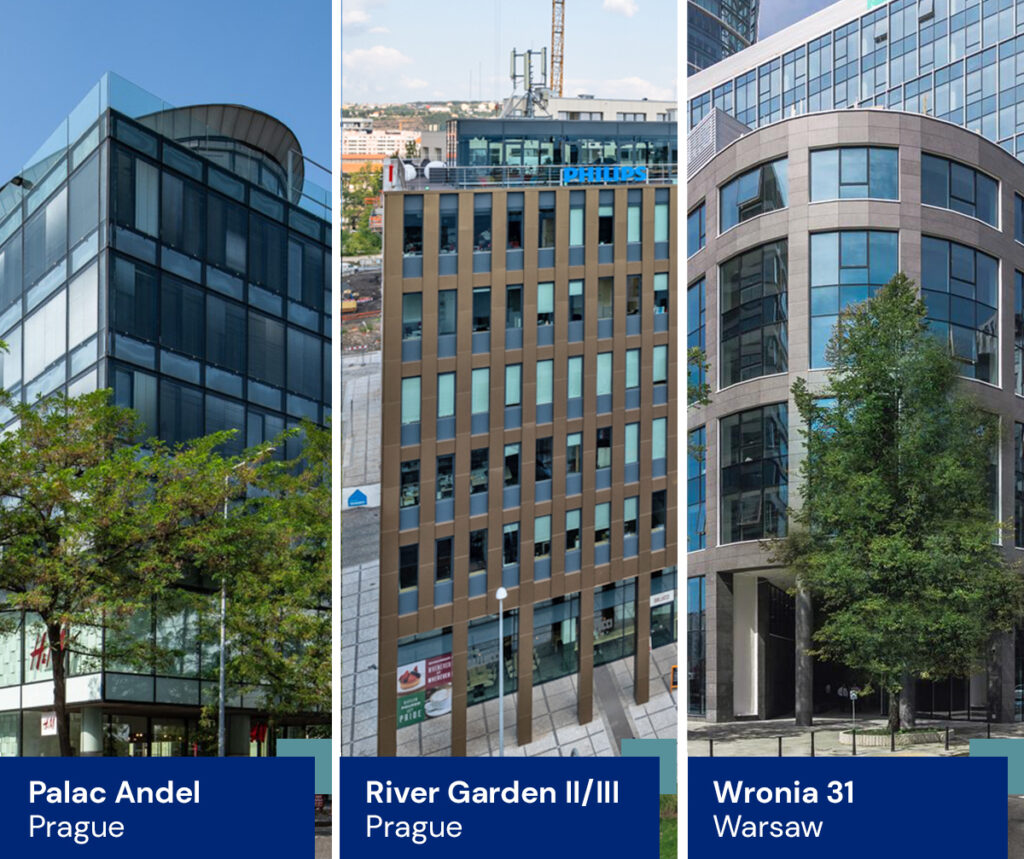

London (November 14, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has agreed a 10-year lease with Assmann Beraten + Planen, an international planning consultancy, for the remaining 3,200 sqm of the East Tower of the Columbia Twins office scheme in Hamburg. The scheme, which is owned by the open-ended, pan-European LaSalle E-REGI fund, is now fully occupied.

The agreement follows SVA System Vertrieb Alexander, a German IT service provider, moving into the sixth and seventh floors of the East Tower on a 10-year lease in April 2024. The West Tower is leased to Columbia Shipmanagement, an international maritime service provider, which was also involved in the development of the asset.

In preparation of the recent lettings, the East Tower – formerly occupied by a single tenant – was renovated for multi-let purposes and to enhance its appeal to modern workforces. The project was led by Schmidhuber Future Work GmbH, a specialist in creating innovative work environments.

Built in 2009 and located in the Hamburg submarket of Harbour Fringe, Columbia Twins offers over 9,400 sqm of lettable space. It provides tenants with access to a roof terrace overlooking the river Elbe and famous Elbphilharmonie Concert Hall. Designed by renowned architect Carsten Roth, Columbia Twins holds DGNB gold certification and recognition from the BDA, the Hamburg architects’ association.

The long-term leases signed with multiple tenants underscore LaSalle’s ability to provide investors in LaSalle E-REGI with exposure to high-quality commercial real estate assets across Europe’s leading markets.

Sven Becker, Fund Manager, LaSalle E-REGI, said: “Both the signing of this new long-term lease and the existing high-quality tenants we have previously secured at Columbia Twins demonstrate the attractiveness of these buildings to various occupier needs. LaSalle E-REGI continues to deliver on its strategy to meet growing tenant demand for well-located, high-quality commercial space in key European city-centre markets and, as such providing long-term stable income for our investors.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (November 11, 2024) – LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate (“Trilogy”) have leased an additional 19,000 square feet at The Amp, a newly refurbished education and innovation campus at 41-71 Commercial Road in Aldgate in East London, to London College of Contemporary Arts (LCCA).

LCCA’s expansion at the campus brings their total footprint within the building to 57,000 square feet, and means that The Amp is now close to fully let – a milestone achieved in just over two years from the acquisition of the site from the Department of Education in the summer of 2022 and a year after completing the refurbishment project.

An expanded LCCA, which will now occupy more than three floors of the building, will sit alongside other education occupiers. This includes De Montfort University, which arrived in September 2024 after signing an agreement for 18,000 square feet aimed at offering programmes specialising in sustainable practice to post-graduate students, as well as Nottingham Trent’s Confetti Institute of Creative Technologies and Access Creative College, both of which signed pre-lets totalling 55,000 square feet. Specialist facilities, including recording studios, multi-performance space and a gaming and eSports arena, are also located on-site.

The construction project to transform the buildings at 41-71 Commercial Road was completed in under a year to meet the operational requirements of the education occupiers, who needed an opening date in September 2023. The Amp provides space for education and innovation in a well-connected location, with one foot in central London and the other in the dynamic creative scene in the East of the city.

The Amp is the latest demonstration of Trilogy’s successful ongoing partnership with LaSalle Investment Management, which previously helped transform Republic in East India Dock from a dated office and disaster recovery space to a thriving mixed-use education campus. As of today, Republic hosts more than 15,000 students across nine institutions.

Chris Lewis, Managing Director, LaSalle Value-Add Investments, said:

“The expansion of LCCA within our exciting mixture of universities at The Amp, taking the campus to nearly full occupation within just over two years, is a real signal of the strength of the local offer and the demand for education-led innovation campuses in leading European gateway cities – especially in city-fringe locations like Aldgate.

“Helping to bridge the gap between infrastructure and real estate, The Amp remains an important part of LaSalle’s broader European value-add strategy. Projects like the Amp, which focus on new economy sectors such as mixed education campuses, urban accommodation, student housing, private medical facilities, and distribution and data centres, are only growing in importance and we are very proud to have partnered on it with Trilogy.”

Robert Wolstenholme, Founder and CEO of Trilogy Real Estate, added:

“At Trilogy our mission is to deliver the next generation of leading innovation campuses – campuses that mix exceptional education assets with high-quality shared amenities for business and the community.

“The fact that we have been able to turn around the refurbishment works and secure a nearly fully let building within just over two years from site acquisition is a testament to the level of demand for this type of campus in what has otherwise been a challenging market. It also reflects the huge amount of work that has gone into delivering truly bespoke and end-user-oriented facilities for our occupiers, their students, and the local community.

We look forward to LCCA’s expanded presence, and what this means for welcoming even more students on site to join what is fast emerging as a leading hub for business, technology and creativity.”

Allsop and DLA advised Trilogy and LaSalle on LCCA’s expansion.

41-71 Commercial Road was originally built in 1971 as the London College of Furniture. The college operated until 1992, when it was taken over by London Metropolitan University. The building was vacated in 2016 when the university rationalised its estate.

Work on the seven-floor refurbishment began in October 2023, led by main contractor Oktra, Project Manager Quartz Project Services, Architect Hawkins\Brown and Civic Engineers.

The completed building provides flexible, open floorplate space tailored to the needs of universities and colleges, as well as business and industry partners that may look to co-locate with a university to access the talent of the future and provide facilities for research and industry innovation. The building’s energy performance has also been significantly enhanced through the refurbishment – an all-electric heating and cooling system ensures no fossil fuels are burned on site, while all-new glazing has helped the building to secure BREEAM Excellent, WiredScore Platinum and an EPC “B” rating.

The Aldgate and Whitechapel area is a well-established higher education community education, and one of Central London’s youngest and fastest growing neighbourhoods. The Amp’s local offer – plentiful PBSA, nightlife, leisure and food and drink options, excellent transport connectivity and proximity to London’s cultural attractions – makes it an attractive choice, including for mature students or students who wish to live in their family home during their studies.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Value-Add Investments

LaSalle Value-Add Investments is part of LaSalle’s growing US $10 billion Debt and Value-Add Strategies platform in Europe and targets higher-return real estate equity investments across Europe, with a focus on conviction investment themes and dislocation opportunities.

About Trilogy Real Estate

Trilogy Real Estate was founded in 2015 by former Resolution Property partner Robert Wolstenholme as an investment and development company specialising in transforming unloved assets to create inspiring and positively impactful mixed-use innovation campuses where the world of work meets education, skills and training.

Company news

No results found

Toronto (October 22, 2024) – LaSalle Canada Property Fund (“LCPF” or “the fund”), LaSalle Investment Management (“LaSalle”)’s core real estate fund in Canada, has achieved the highest rating of five stars from the 2024 Global Real Estate Sustainability Benchmark (“GRESB”), an industry-recognized global sustainability benchmark for asset managers. Additionally, LCPF has been named the Real Estate Sector Leader for all Americas Private Diversified Funds, ranking first out of 112 entities in this category.

LaSalle Canada Property Fund scored 90/100 on the annual assessment, earning first place within its 17-member sector peer group. This achievement highlights the fund’s market-leading sustainability initiatives that continue to play a key role in the active asset management of the LCPF portfolio. In addition to the recognition for LCPF, seven other LaSalle funds and separate accounts domiciled across Europe, North America, and the Asia-Pacific regions were awarded a 5-star rating, with five additional LaSalle funds achieving a four-star rating.

Elena Alschuler, LaSalle Head of Sustainability, Americas, said: “This latest recognition as a GRESB sector leader reflects LaSalle’s ongoing dedication to meeting our clients’ sustainability goals, while enhancing the market value of our properties. Since its inception in 2017, LCPF has viewed sustainability as a key component of a high-quality property. This investment view informs decisions about both acquisitions and capital improvements, resulting in a portfolio that is in a leading position amongst peers.”

Sam Barbieri, LaSalle Managing Director of Development and Fund Management, added: “LCPF stands as a strong example of our commitment to both sustainability and investment excellence. This year’s GRESB score and our position as the Real Estate Sector Leader for all Americas Private Diversified Funds are a testament to the team’s hard work over the past year developing and embracing new strategies that align with the fund’s philosophy of ensuring sustainability goals are met, while simultaneously generating income for clients.”

The LCPF portfolio exemplifies sustainability across its diverse properties, with several standout examples highlighting this commitment. Montréal’s Maison Manuvie boasts net zero carbon performance, Ottawa’s 275 Slater is undergoing sustainability upgrades targeting LEED Certification, and the Tricont logistics properties in Whitby were designed to meet the prestigious LEED® Silver certifications through the Canada Green Building Council. These assets, among others in the portfolio, demonstrate LCPF’s broad commitment to environmental responsibility across various property types and locations.

LCPF’s portfolio totals nearly 9.4 million square feet across Vancouver, Calgary, Edmonton, Toronto, Ottawa and Montreal – the key markets in Canada’s investable real estate universe. The portfolio includes industrial, multifamily, office, retail and mixed-use properties, along with select development projects in these sectors.

ENDS

About LaSalle Canada Property Fund (LCPF)

LCPF is an open-ended fund targeting core properties in major markets across Canada. The fund is targeting commitments from Canadian and global institutional investors seeking access to the Canadian real estate market through a diversified, income-oriented vehicle. Launched in 2017, the fund aims to provide investors with immediate exposure to a diverse and mature portfolio comprised of office, industrial, mixed-use, retail and multifamily assets. Through its near-term pipeline of potential future investments, the fund will seek to take advantage of mispriced assets as it continues to grow.

About LaSalle Investment Management | Investing Today. For Tomorrow

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About GRESB

GRESB is an industry-driven organization transforming the way capital markets assess the sustainability performance of real asset investments. More than 900 property companies and funds, jointly representing more than USD 3.6 trillion in assets under management, participated in the 2018 GRESB Real Estate Assessment. The Infrastructure Assessment covered 75 funds and 280 assets, and 25 portfolios completed the Debt Assessment. GRESB data and analytical tools are used by more than 75 institutional and retail investors, including pension funds and insurance companies, collectively representing over USD 18 trillion in institutional capital, to engage with investment managers to enhance and protect shareholder value. Greater transparency on sustainability issues has become the norm, with GRESB widely recognized as the global sustainability benchmark for real assets. For more information about GRESB and its sustainability benchmarking and reporting for real estate, please visit https://gresb.com/gresb-real-estate-assessment/.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Paris (September 11, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has agreed a 10-year lease of its landmark office building at 69 Boulevard Haussmann in Paris with FLEX-O, a provider of premium coworking and office spaces. As part of the deal, the building, which is owned by LaSalle’s flagship pan-European core-plus fund Encore+, will undergo a new fit-out, including the replacement of windows, led by FLEX-O and its parent company Groupe Courtin.

The building offers a total lettable area of 6,700 square meters over seven floors and car parking for 95 cars. Situated in a prime location in the heart of the prestigious eighth arrondissement, 69 Boulevard Haussmann offers views of Rue des Mathurins and Rue des Arcades and exceptional transport connections. It is located just 150 metres from Saint Lazare train station and a few minutes’ walk from metro lines 3, 8, 9, 12, 13 and 14, as well as the RER regional express lines A and E. The iconic Haussmannian building is positioned in the capital’s Central Business District and on one of its main shopping streets, close to major department stores.

Scheduled for completion in March 2025, the fit-out of 69 Boulevard Hausmann will transform the building into a modern workspace, combining an outstanding city-centre location with a premium range of amenities, services and technologies. The long-term lease signed with a single tenant reaffirms LaSalle’s ability to provide investors in Encore+ with exposure to high-quality commercial real estate assets in Europe’s leading markets.

David Ironside, Fund Manager, LaSalle Encore+, said: “Hosting FLEX-O at 69 Boulevard Haussmann demonstrates the flexibility of this building to adapt to a variety of uses and layout configurations, as well as the growing tenant demand for centrally located, high-quality offices. FLEX-O’s offering, their eco-responsible approach and experience in creating modern, flexible workspace environments have convinced us to work together to revitalise the attractiveness of this landmark building.”

Christophe Courtin, Founder and CEO of FLEX-O, states: “With this new location on one of the most beautiful boulevards in Paris, within one of its most iconic buildings, we strengthen our presence in the capital and reach a decisive milestone in our development. FLEX-O Paris Haussmann stands out not only for its strategic location but also for its exceptional quality, which reflects our commitment to providing our clients with prestigious and accessible workspaces. We are delighted to be partnering with LaSalle to deliver on our vision of flex-office and coworking, which combines innovation, eco-responsibility and flexibility, meeting the diverse needs of all types of modern companies.”

BNP Paribas Real Estate represented both parties in this transaction.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (September 3, 2024) – LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate today announce the arrival of De Montfort University (DMU) to their education and innovation campus in East London: The Amp.

DMU will take 18,000 square feet, taking The Amp’s total building occupancy to 83% as it celebrates the first anniversary of its opening last September.

The move brings DMU students right into the heart of London, where it will offer postgraduate students programmes specialising in sustainable practice, aiming to equip professional managers and aspiring leaders with the skills to manage businesses ethically and lead with social responsibility underpinned by DMU’s commitment to the UN Principles for Responsible Management Education (PRME).

Located at 41–71 Commercial Road in Aldgate, The Amp is a new campus for education and innovation in the East London district of the Tower Hamlets. Tenants alongside De Monfort University include Nottingham Trent’s Confetti Institute of Creative Technologies, Access Creative College and London College of Contemporary Arts.

The construction project to transform The AMP was completed in under a year to meet the operational requirements of the education occupiers, who needed an opening date in September 2023. The Amp provides space for education and innovation in a well-connected location, with one foot in central London and the other in the dynamic creative scene in the East of the city. Specialist on-site facilities include recording studios, multi-purpose performance space and an arena for gaming and esports.

The Amp reprises Trilogy’s successful partnership with LaSalle Investment Management, which has previously resulted in the transformation of Republic London from a dated office and disaster recovery space to a thriving education campus with over 15,000 students attending six universities and private education providers. The next phase of Republic London was granted planning consent last year and will also include 715 rooms of purpose-built student accommodation and a modern data centre, adding an infrastructure component to this mixed-use development and creating a new kind of urban campus centred on innovation, higher education and accommodation.

Chris Lewis, Managing Director, LaSalle Value-Add Investments, said: “The addition of De Montfort University to our exciting mixture of universities at The Amp, taking the campus to 83% let within a year of opening, shows the strength of the offer and the demand for education-led innovation campuses in leading European gateway cities.

“The Amp forms part of LaSalle’s broader European value-add strategy, bridging the gap between infrastructure and real estate, with a focus on new economy sectors such as mixed education campuses, urban accommodation, student housing, private medical facilities, distribution and data centres.”

May Molteno, Head of Campus Experience and Social Impact, Trilogy Real Estate, added: “At Trilogy we thrive on delivering exceptional education and innovation campuses which deliver high-quality facilities for colleges, universities and business. It is a testament to what the team has achieved here at The Amp that we are able to attract universities such as De Montfort. We look forward to welcoming students on site to join what is fast becoming a bustling community of learners and future innovators.”

DMU’s Vice-Chancellor, Professor Katie Normington, commented: “This expansion marks a pivotal moment for DMU as we reinforce our commitment to sustainability and educational innovation. For the first time, all staff at the new campus will undergo sustainability training, and Carbon Literacy will be integrated into the core curriculum for all students.

“Moving into The Amp allows us to do this in a unique way that give our students a campus experience while empowering them students not only through classroom-based sustainability-focused learning but also through direct engagement with the UN, industry partnerships, internships, networking opportunities, and practical experiences within London’s thriving business community.”

41-71 Commercial Road was originally built in 1971 as the London College of Furniture. The college operated until 1992, when it was taken over by London Metropolitan University, and the building was vacated in 2016 when the university rationalised its estate.

Work on the seven-floor refurbishment began in October 2023, led by main contractor Oktra, Project Manager Quartz Project Services, Architect Hawkins\Brown and Civic Engineers.

The completed building provides flexible, open floorplate space tailored to the needs of universities and colleges, as well as business and industry partners that may look to co-locate with a university to access the talent of the future and provide facilities for research and industry innovation. The Aldgate and Whitechapel area is already well established as a community for higher education, as well as being one of Central London’s youngest and fastest growing neighbourhoods, with a major life sciences cluster planned for the site of the former Royal London Hospital Buildings to the north of The Amp.

Allsop and DLA acted on the deal for Trilogy and LaSalle. DMU has been advised by Metric RE and Mills and Reeve.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Value-Add Investments

LaSalle Value-Add Investments is part of LaSalle’s growing US $10 billion Debt and Value-Add Strategies platform in Europe and targets higher-return real estate equity investments across Europe, with a focus on conviction investment themes and dislocation opportunities.

About Trilogy Real Estate

Trilogy Real Estate was founded in 2015 by former Resolution Property partner Robert Wolstenholme as an investment and development company specialising in transforming unloved assets to create inspiring and positively impactful mixed-use innovation campuses where the world of work meets education, skills and training.

Company news

No results found

Seoul (August 19, 2024) — LaSalle Investment Management Co., Ltd. (“LaSalle Korea”), on behalf of its Korea logistics investment joint venture with a Middle Eastern sovereign wealth fund (“the Joint Venture”) as well as LaSalle Asia Opportunity Fund VI (“the Fund”), has acquired two dry-only logistics facilities in Anseong within Greater Seoul with a combined gross floor area (GFA) of 385,946 square meters, at a purchase price of approximately US$450 million (or KRW5.3 million per pyung).

The two facilities are located next to each other and are built with modern warehouse specifications including spacious yards for its tenants and direct ramp access to each floor with leasable area efficiency of approximately 99%. The latter is a distinct feature for the facilities, compared to other similar sized warehouses designed with circular ramps which significantly reduces net leasable area.

- Center-A, with GFA of 187,226 square meters was completed in June 2023 with 100% occupancy and Weighted Average Lease Expiry (WALE) of 4.35 years.

- Center-B, with GFA of 198,718 square meters was recently completed in July 2024 and also has 100% occupancy with WALE of 4.55 years.

- Across Center-A and Center-B, which will be renamed Logiport Anseong Center-I and Logiport Anseong Center-II respectively, there are four institutional tenants representing established companies in their respective industries, including semiconductor, pharmaceutical, beauty and consumer goods.

This transaction follows the acquisition of two logistics facilities in Icheon made by LaSalle Korea last year, also on behalf of the Joint Venture and the Fund. LaSalle Korea also divested a separate cold storage warehouse project this year for KRW10.4 million per pyung after completing ground-up development and stabilizing leasing on the asset.

Steve Hyung Kim, Senior Managing Director and Head of Korea, commented: “The logistics sector continues to be one of the most dislocated property types requiring a high level of deal selectivity. LaSalle Korea’s recent acquisitions represent unique opportunities to invest in newly-built modern warehouses with full occupancy by institutional tenants, purchased at well below replacement costs. LaSalle Korea also plans to upgrade and implement new sustainability initiatives across these two investments which total over 4.15 million square feet in GFA.”

End

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages over US $87 billion of assets in private and public real estate equity and debt investments as of Q1 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Seoul (July 30, 2024) — LaSalle Investment Management Co., Ltd. (“LaSalle Korea”), on behalf of LaSalle Asia Opportunity Fund VI (“the Fund”) and a local co-investor, was awarded an office site in Seoul after submitting the winning bid in the 5th round of a non-performing loan (NPL) collateral auction. The winning bid price of approximately US$115 million represented a 33% discount to its appraised value. The land site is walking distance from Gangnam Station within the Gangnam Business District, with existing zoning to allow development of a new office with planned GFA of over 29,000 square meters. The project cost upon completion is estimated to be approximately US$245 million.

This acquisition marks the Fund’s second foray into the office market in Korea following a high-yield loan deal last year to bridge finance a 10-storey office project in Seoul’s Seongsu district. This collateralized loan was priced during a period of credit spread dislocation and was successfully repaid on its maturity date in December 2023, allowing the Fund to exit its first opportunistic debt investment in Asia Pacific.

Amongst key gateway city office markets globally, Seoul’s Gangnam office district continues to display post-pandemic resilience supported by both occupier demand and capital markets liquidity. According to JLL REIS and JLL Korea Research, as of Q1 2024, the office vacancy rate in Gangnam was 0.3%, the lowest compared to the two other business districts in Seoul with net effective rents also registering the highest year on year increase compared to the other business districts.

Steve Hyung Kim, Senior Managing Director and Head of Korea, commented: “Opportunistic investing in a higher cost of capital environment has forced us to be patient and also creative in how we source attractive entry points to our acquisitions. On behalf of our investors, we recently closed on recapitalizations, private off-market sales, and collateral acquisitions from NPL auctions like this recent transaction which capitalizes on both Gangnam’s strong office fundamentals, as well as a lowered project cost basis due to a legacy borrower and junior lender getting foreclosed. Larger sized office sites in Gangnam have retained scarcity value and this latest project from LaSalle Korea will introduce modern designs and sustainability initiatives to which we are very excited about.”

End

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages over US $87 billion of assets in private and public real estate equity and debt investments as of Q1 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

TE Capital Partners (“TE Capital”) and LaSalle Investment Management (“LaSalle”) jointly announced the sales launch of Visioncrest Orchard, a freehold Grade A commercial strata development located in the heart of Singapore’s prime Orchard Road precinct, with a combined office and retail area of 154,711 sqft (14,373 sqm). TE Capital is the operator for Visioncrest Orchard and the partners are accompanied in the joint venture by Metro Holdings as a capital partner of the TE Capital-managed vehicle.

As part of the launch, a 14,725 sqft office space on Level 6 and a 14,844 sqft office space on Level 9 have been released for sale at S$3,980 psf and S$4,130 psf respectively. Following VIP previews in June, a 14,725 sqft office space and several retail units spanning 1,388 sqft are currently under due diligence.

TE Capital and LaSalle attribute the strong demand for the LEED Gold certified, 11-storey freehold office to the allure of the Orchard submarket as well as the asset’s outstanding core qualities which have been boosted by substantial enhancements.

Located along Penang Road, Visioncrest Orchard offers easy walking access to Dhoby Ghaut and Somerset Mass Rapid Transit (MRT) stations, with direct access to three train lines (North-South, North-East and Circle lines). The Central Expressway (CTE) and Pan Island Expressway (PIE) expressways can be reached within a few minutes’ drive.

Situated just over 400 meters (437 yards) from Plaza Singapura and 550 meters (601 yards) from 313@Somerset, Visioncrest Orchard occupies a strategic position close to Orchard’s vibrant retail scene while being just a stone’s throw away from Singapore’s central business district. It is also nestled within the exclusive Oxley enclave and Istana, the official residence and office of the president of Singapore, providing a coveted address which combines prestige with cultural and historical significance.

Offices at Visioncrest Orchard boast greenery views through expansive full-glass, solar-protected windows with floor to floor heights reaching 4.3 meters. Large floorplates of approximately 14,500 sqft offer numerous possibilities for customization, while a generous provision of 135 onsite parking lots offer convenience for occupiers. Smart fittings that offer user-friendly building access via self-registration e-kiosks, as well as enhanced security through biometric features such as facial recognition are among the upgrades that occupiers can expect, while amenities such as a swimming pool, a well-equipped gym, a tennis court and other recreational facilities promote the integration of wellness with work.

In the years to come, Visioncrest Orchard is expected to benefit from commitments by the Singapore government to revitalize the Orchard district. Initiatives such as the Strategic Development Incentive (SDI) scheme will see the introduction of broadened urban planning parameters such as increased building heights, expanded gross floor area and more flexible land use permissions on older assets. Plans to pedestrianize parts of Orchard and redesign traffic flows will also contribute to the transformation of the area. As the availability of high-quality, high-specification freehold offices in the Orchard district will continue to be limited, the partners expect interest in Visioncrest Orchard to remain robust.

CBRE, ERA, JLL, Knight Frank, PropNex and Savills have been appointed as agents for Visioncrest Orchard.

About TE Capital Partners

TE Capital Partners is a uniquely positioned real estate investment and fund management firm, equipped with development management capabilities that focuses on APAC real estate markets. Established in 2019, TE Capital Partners is backed by the family office of Mr Teo Tong Lim, Group Managing Director of Tong Eng Group, a real estate company with a history of more than 80 years, having owned and developed close to 200 acres of land, comprising mixed-use, office, retail, landed housing and apartments.

As of Q4 2023, TE Capital Partners and its subsidiaries, has an AUM of more than S$3 billion across Singapore, Australia, Japan and the United States, and the Principals have developed more than S$3 billion of commercial office, residential and mixed development projects in Singapore in recent years, such as Solitaire on Cecil. Some commercial projects under management include 350 Queen Steet and 312 St Kilda Road in Melbourne, Australia. For more information, please visit www.tecapitalasia.com and LinkedIn.

NOTE: This press release may contain forward-looking statements by TE Capital Partners and should not be relied upon by readers and/or investors for any purposes. This is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. No representation or warranty express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this press release. Actual performance, outcomes and results may differ from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately US$87 billion of assets in private equity, debt and public real estate investments as of Q1 2024. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Chicago (July 9, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announced that it has promoted Kyle Dupree to Head of Asset Management and Pat Pelling to Head of Transactions. Both are long-time LaSalle veterans who will report to Brad Gries, Head of Americas, in their new roles.

As Head of Asset Management, Kyle brings a wealth of experience executing asset-level strategies, honed through his years of experience on the asset management team. Having joined the firm in 2010, Kyle has demonstrated exceptional growth and leadership, and will be responsible for leading asset management initiatives and processes across various property sectors. He also provides strategic leadership for digital enterprise applications and spearheads the valuation process for U.S. private equity. Kyle is based in LaSalle’s San Diego office.

Pat works out of LaSalle’s New York office, and succeeds Brad as Head of Transactions. Pat has an impressive track record of success at the firm, with over 15 years of experience in both asset management and transactions positions. Most recently, Pat has been a key leader with the transactions group – sourcing, underwriting, and executing new investments. He has also served as a thought leader, driving new, strategic investment initiatives, programmatic partnerships and cultivating key relationships.

Brad Gries, Head of Americas at LaSalle Investment Management, commented: “These promotions highlight LaSalle’s continued focus on strategic leadership succession and our desire to foster the growth of talented people within our firm. Both Kyle and Pat are exceptionally good at what they do, and we are proud to welcome them into these leadership roles.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LLaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $87 billion of assets in private and public real estate equity and debt investments as of Q1 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Recognition has grown substantially in recent years that climate risk can shape real estate investment outcomes. This owes to an increasing frequency and severity of loss events,1 surging insurance premiums,2 improving data availability and a mounting reporting burden driven by regulations.3 Investors have had to move quickly from acquiring basic climate risk literacy, to sourcing good quality climate risk data, to most recently, leveraging that data into improved investment decisions. There is a clear and rising likelihood that investors on the lagging edge of this process may underperform.

At LaSalle, we have sought to share insights from our own climate risk journey, combining that with broader analysis of our industry’s climate risk challenges and opportunities. In 2022, we partnered with the Urban Land Institute (ULI) on a report, How to choose, use, and better understand climate-risk analytics, which addressed the difficulties in selecting and evaluating climate data from an ever-changing and increasingly crowded—and sometimes contradictory—data provider landscape. In April, we released a new report with ULI, Physical Climate Risks and Underwriting Practices in Assets in Portfolios, which looks at how investors are taking these data and seeking to make better-informed buying, selling and portfolio construction decisions based on them.

While the joint ULI report takes an industry-wide view, this ISA Briefing looks at the topic through the lens of LaSalle’s own investment process. We present three case studies of our evaluation of climate risk on a regional, market and asset-level scale. These examples – one each from each of our global investment regions – illuminate how we are taking account of climate risk and lay out our views on issues investors should be thinking about.

A broader regional view: wide-scale impacts

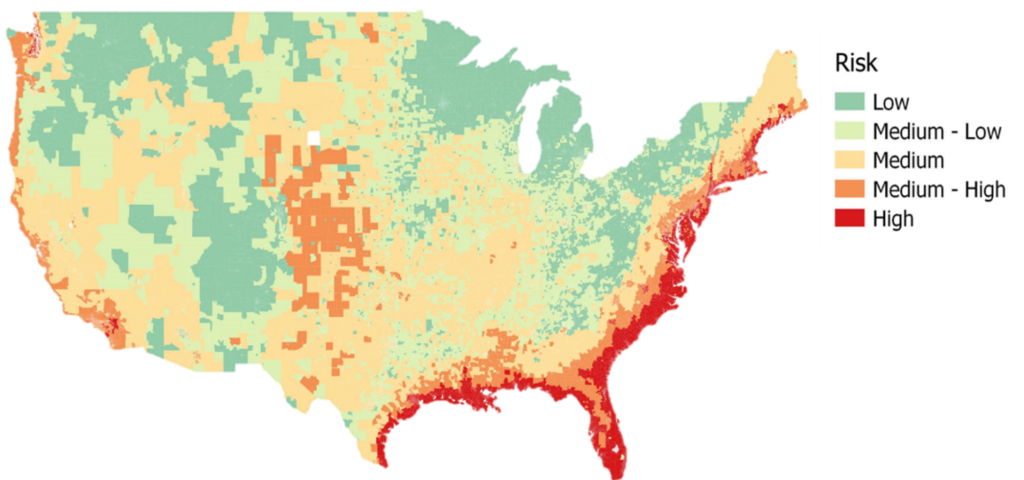

In 2023, the US recorded 28 weather/climate disaster events for which losses exceeded $1 billion, the highest recorded number of distinct events exceeding that threshold.4 But of course, these events were not uniformly distributed across the country. To better understand the geographic predisposition of parts of the country to these hazards, LaSalle’s US Research and Strategy team developed two separate climate risk indexes, evaluating current and future climate risk. The indexes encompass a range of climate hazards, such as heatwaves, floods and wildfires, with earthquakes added as a non-climate threat. The current climate risk index harnesses machine learning to scrutinize hyper-local data from the Federal Emergency Management Agency (FEMA). Meanwhile, the future climate risk projections rely on data from the Rhodium Group data set, as analyzed by ProPublica and assuming an RCP 8.5 scenario.5

Looking at climate risk at a regional scale has been useful in several ways. First, it can accelerate analysis of new opportunities by acting as a “yellow flag,” directing resources early in the underwriting process toward deeper analysis into asset-specific climate risk issues that may turn out to be red flags. Second, regional climate risk can be integrated into market-targeting tools, weighing it alongside other factors that influence real estate performance (for example, demographic variables such as population growth and real estate variables like the prospects for rental growth). To this end, LaSalle has embedded these climate risks scores into our proprietary Target Market Analyses (TMAs). Thirdly, it can help frame inquiry into how metro-level performance factors, such as migration patterns, can interact with climate risk over time.

On that last point, the map appears to beg a question about recent migration trends that have favored the Sunbelt.6 Are people disproportionally moving to at-risk places, and if so, why? An important follow-on question that is germane for investment strategy is whether climate change may eventually cause a reversal of recently observed migration patterns. Indeed, we do observe a discernible, moderately positive correlation7 (+29%) between climate risk exposure and increased migration over the past five years. This pattern holds, and even intensifies, when considering population growth projections for the next five years (+47% correlation).8

The implication is that regions facing severe climate challenges continue to draw new residents. This suggests that environmental risks may not yet be so widely recognized as to shape behavior. That said, a mere 8% of market value within the NCREIF Property Index’s (NPI) apartment asset base is situated in markets we classify as high-risk.9 This suggests the impact in the near-term on institutional real estate investors will be limited, at least until climate change is severe enough to routinely impact markets in the next less risky band, which encompasses 16% of total NPI apartment value.10 Either way, investors looking to the long-term would be wise to consider how people will respond to growing climate hazards in high-risk markets. If a major reaction is that Sunbelt denizens relocate back to the Rustbelt, that could have significant implications for regional economic growth and real estate market prospects.

A market-level view: Evaluating mitigating infrastructure

Below the regional level, it is at the scale of an individual metro area where different degrees of exposure to climate risk can be evaluated with more granularity. It is often at this level where both in-place and planned efforts to mitigate the potential impacts of climate hazards can be identified. As we discussed in our 2022 ULI report, such measures can confound traditional climate risk data if they ignore its impact.

For example, when overlaying LaSalle’s global portfolio with raw data from our climate risk providers, Amsterdam and its broader ‘Randstad’ region stand out as especially exposed to sea-level rise. Not considering any protective infrastructure, we estimate that 52% of Amsterdam and 38% of Rotterdam commercial property would have a significant exposure to severe flood.11

Thankfully, the Dutch have been building dams and levees to protect their low landmass from flooding for centuries.12 Modern infrastructure investment accelerated in the wake of the 1953 North Sea flood – a combination of a severe European windstorm and high spring tide that caused the sea to flood land up to 5.6 meters above mean sea level.13 The ‘Deltawerken’ (Delta Works), now complete, consists of a set of storm surge barriers, locks and dams mainly located in the south of the country. But the Dutch flood defense program extends beyond the Delta Works,14 encompassing almost 1,500 constructed barriers, including more than 20,000 kilometers of dikes, enough to encircle the country over 15 times. In fact, the Delta Works program has evolved into the Delta Programme, a continuous project that take future effects of climate change into account, with a target of 100% of the Dutch population protected by floods not exceeding a 1 in 100,000-year event by 2050.15

The presence of these flood defense programs is of imperative importance when considering the Dutch markets for investments. We find that many climate risk data providers do not adjust for the Netherlands’ formidable stock of anti-flood infrastructure investment which mitigates much of the risk. Investors who act as uncritical “takers” of unadjusted climate risk stats may thus excessively underweight the Dutch market.

An asset-level view

Below the regional and market level, the asset level is where the outcomes of climate hazards have the most direct impact on a building’s structural integrity or the ability to access and operate a property. An asset manager’s actions can directly influence a building’s capacity to withstand climate-related hazards. This tends to be the most impactful when such interventions are made during the design phase of the development.

For example, take the case of a LaSalle logistics development in Osaka, Japan, a city that has historically been vulnerable to flooding due to its geographical location, with much of the urban area made up of flat lowlands that make natural drainage a challenge in the event of tsunamis and heavy rainfall.16 The local city planning assesses the maximum level water could rise above sea level by submarket in the event of a flood. The flood height varies by location while considering additional factors such as the city’s infrastructure (i.e., floodgates and seawalls) and the overall elevation of the submarket. In the case of one of LaSalle’s Osaka Bay logistics developments, the subject warehouse is at a site where water levels could rise to three meters above sea level in the case of a flood.17

Seawalls, ranging in height from 5.7-7.2 meters protect the asset from extreme floods coming from the sea. To further mitigate the flood risk in the case of extreme rainfall or failure of the sea walls, the warehouse is designed with an elevated floor plate that puts the ground level 1.4 meters above mean sea level, and places key building equipment on the second floor, minimizing potential damage to the asset in the event of flood. This effort resulted in a 4.4 meter clearance above sea level (i.e., sea level + 1.4 meter buffer + 3 meters = 4.4 meters), which is above the required 3.5 meters above sea level (i.e., sea level + 1.4 meter buffer + 2.05 meters = 3.45 meters) for the location. In addition, the property management team has been trained and equipped to minimize flood damage on the first floor by closing the doors and shutters and placing sandbags in any gaps. By incorporating considerations to mitigate flood risk when designing the warehouse, the asset is well positioned to support tenants’ business continuity plans in the event of a flood.

Looking ahead

- The impacts of an evolving climate need to be considered through multiple lenses, from country or continent spanning impacts, down to the level of individual assets. At all levels it is necessary to understand the interplay between the impact of climate on people, how governing bodies are responding to it, and how asset and investment managers have opportunities to better safeguard their portfolios against climate-related risks.

- Investors should use climate risk data, but apply an overlay of judgement, particularly concerning factors that climate risk data providers generally do not incorporate well. A key example of this is the impact of protective infrastructure. Investors should ask: What mitigating infrastructure is currently in place? Over what time horizon is this accounted for in the present time? Are the plans to strength, expand or enhance local infrastructure in the future? Are these initiatives being appropriately funded, to ensure that plans become a reality?

- While our collaboration with ULI on two reports is rooted in a desire to help the industry adopt best practices, standardization need note – and indeed should not – be the central goal. In the future, we expect an increasing share of real estate transactions to be at least partly motivated for buyers’ and sellers’ disagreement on the climate risks faced by a property.18 With increasing severity and intensity of climate-related loss events and surging insurance costs, it is our view that players that get climate risk right are likely to outperform those who do not. Having a differentiated climate risk process could lead to differentiated investment outcomes.

Footnotes

1 Source: National Centres for Environmental Information of the National Oceanic and Atmospheric Administration (NOAA). See Billion Dollar Weather and Climate Disasters

2 Source: The Climbing Costs to Insure US Commercial Real Estate, MSCI, November, 29 2023

3 The TCFD framework which has now been absorbed by IFRS’ ISSB, serves as the framework with which other international reporting standards setters seek to align such as the US SEC who voted in favour of The enhancement and standardization of climate-related disclosure, or the UK Government and the Sustainability Standards Board of Japan who will align its disclosure standards with ISSB.

4 According to the National Centers for Environment Information (NCEI). $1 billion threshold adjusted for inflation in historical periods. See https://www.ncei.noaa.gov/access/billions/.

5 RCP refers to Representative Concentration Pathway, a standard for modeling future climate scenarios of greenhouse gas concentration in the atmosphere. RCP 8.5 represents an extreme case scenario. See this Intergovernmental Panel on Climate Change (IPCC) glossary for more detail.

6 For more discussion on this trend, see our recent ISA Briefing, US migration trends and (U)rbanization.

7 Cross-sectional correlation between the LaSalle current climate risk index and the population change in the top 45 US metro areas between December 2018 and December 2023.

8 Cross-sectional correlation between the LaSalle future climate risk index and population change in the top 45 US metro areas between December 2023 and December 2028 based on Moody’s forecast as of February 2024.

9 Source: LaSalle analysis of data from NCREIF, FEMA.

10 Source: LaSalle analysis of data from NCREIF, FEMA.

11 Source: LaSalle analysis of MSCI data.

12 Source: The Dutch experience in flood management: A history of institutional learning

13 Source: The devastating storm of 1953, The History Press

14 Source: Dutch primary flood defenses, Nationaal Georegister

15 See Delta Programme 2024

16 See Osaka city – Flood disaster prevention map outline from the Osaka City Office of Emergency Management.

17 Estimates of maximum flood depth are based on historical records of natural disasters such as earthquakes, river floods and tsunamis that have occurred as reported by Japan’s Ministry of Land, Infrastructure and Tourism.

18 A superficial view of markets is that transactions are based on agreement on value. More accurately, buyers and sellers agree on a price, but their willingness to transact is based on disagreement on value. A seller, for example, may have a less bullish view on NOI growth prospects than a buyer. We expect the same disagreement on climate-related risk/reward trade-offs to be increasingly important.

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

London (March 11, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has appointed Bouygues Rénovation Privée (“Bouygues”) as the main contractor for the redevelopment of Bergère, a landmark office-led, highly-amenitized workspace project in Paris.

Situated in the 9th Arrondissement, Bergère is in a prime location in the heart of Paris, surrounded by a thriving cluster of companies from across technology, fashion, and financial and professional services. It forms part of a vibrant urban environment with a high concentration of restaurants, bars, shops, department stores, and cultural and leisure facilities. Positioned just 150 metres from the Grands Boulevards metro station, Bergère also benefits from convenient transport links and access to three of Paris’s largest transportation hubs: Gare du Nord, Saint Lazare and Chatelet – Les Halles. The renovated building will have a floor area of approximately 26,850 square meters and was redesigned by the leading French architectural firm PCA-Stream.

Scheduled for completion in Q1 2026, the redevelopment of Bergère will incorporate industry-leading sustainability practices. This will involve a sensitive restoration of the building’s architectural heritage while upgrading the technical equipment to meet operational Net Zero Carbon goals. The project will prioritise the reuse of materials to minimise the projected embodied carbon associated, and the building is targeting a BREEAM Excellent certification, with a 50% reduction in operational CO2e and a 20% reduction in embodied CO2e compared with the benchmark for Parisian office renovations.

The redevelopment will also look to meet future tenant requirements and evolving work trends with high-quality amenities to promote in-person interaction and facilitate a hybrid working, including an auditorium, business centre, bars and restaurants, event spaces and a media broadcast studio.

Marc Fauchille, Head of Development and Repurposing, Europe, LaSalle Investment Management, commented: “We are excited to work together with the experience and expertise at Bouygues Bâtiment Ile-de-France on Bergère, to create an innovative and truly revolutionary workspace in the heart of Paris. Bergère is set to be a prime office-led development in Paris, situated in a highly sought-after location in one of the strongest European markets. The project is already attracting a high level of tenant interest given its quality, location and sustainability credentials.”

Thomas Rousseau, Managing Director of Bouygues Bâtiment Ile-de-France Rénovation Privée, adds: “We are very proud to have been selected by LaSalle Investment Management for this Parisian prime office restructuring operation, which is also listed as a Historic Monument. The teams were particularly driven by the ambition of the project, the technical complexity as well as the challenges in terms of uses and the environment. This success is the result of collective work. Our teams are already mobilized to highlight their expertise and know-how in heritage restoration, our core business. This building is a real showcase for our company in terms of decarbonization, exemplarity and innovation. A big thank you to LaSalle Investment Management and its partners for trusting us with the realization of this exceptional project.

LaSalle acquired Bergère, on behalf of Encore+, its flagship open-ended pan-European fund, in May 2020 from BNP Paribas in a sale-and-leaseback transaction.

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $90 billion of assets in private and public real estate equity and debt investments as of Q4 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

Marketing Disclaimer: This information is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for information purposes only and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results. Please refer to the offering documents Encore+ for detailed information on the risks, reward and performance information of the Fund.

Company news

No results found

London (January 25, 2024) LaSalle Investment Management, the global real estate investment manager acting on behalf of Malaysian investor Permodalan Nasional Berhad (PNB), has selected Multiplex Construction Europe Limited (Multiplex) as the main contractor for the construction of One Exchange Square, a state-of-the-art 447,000 square foot office development at Broadgate Campus in the City of London. M3 Consulting are acting as the Development Manager for the project.

Designed by Fletcher Priest Architects, the 13-story scheme to be delivered by Multiplex will comprise 430,000 square feet of premium workspace and 17,000 square feet of retail, fronting both Bishopsgate and the newly re-landscaped park at Exchange Square. With 13 upper floors and floorplates averaging 40,000 square feet, the building features landscaped terraces on every floor, totalling 33,000 square feet across the building. In addition to boasting a striking feature reception and 8,000 square feet amenity lounge, One Exchange Square benefits from outstanding transport connections and a diverse array of amenities, conveniently situated just a one-minute walk from Liverpool Street Station and surrounded by vibrant locations such as Broadgate Campus, Spitalfields, Shoreditch and the City of London.

Scheduled for completion in Q1 2026. One Exchange Square is envisioned as an office of the future, designed to meet tenants’ high sustainability and wellness demands. It is targeting exemplary environmental credentials, including a BREEAM Outstanding rating, NABERS 5* and Well Platinum. By retaining 90% of the existing structure, the asset will have 50% lower embodied carbon than a typical new build office of comparable size, saving approximately 7,600 tonnes of CO2e compared to the GLA 2030 target. The project is 100% electric, using intelligent façade design and mechanical services twinned with building management systems to manage operational energy use.

Gary Moore, Head of International Accounts, Europe, LaSalle Investment Management commented: “Once completed, One Exchange Square will be a truly landmark office development in London. It will boast top-notch environmental performance ratings in a conveniently central location, and is poised to be highly sought after for years to come. We are excited to work with Multiplex on its development and construction, integrating state-of-the-art design and sustainability features to cater to the needs of its future tenants.”

Callum Tuckett, Managing Director at Multiplex, said: “We are incredibly proud to have been selected by LaSalle and PNB to transform this key building in the Broadgate campus and the City of London. We look forward to working with our development partners and all the professional teams to deliver a contemporary and highly sustainable building that will have a positive impact not just on its occupiers but on the surrounding areas of Bishopsgate and Exchange Square.”

Trowers & Hamlins LLP advised on property, planning, procurement and construction legals. The construction team was led by partner James Huckstep and assisted by Nicola Conway and Natasha Kaulsay.

JLL and Cushman and Wakefield are advising on the repositioning and leasing of the project.

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (January 16, 2024) LaSalle Investment Management (“LaSalle”) and Trilogy Real Estate have completed the 135,000 square feet refurbishment of The Amp, a new campus for education and innovation in the Aldgate district of the London borough of Tower Hamlets. 40% of the building will be immediately occupied by two pre-let tenants: Nottingham Trent University’s Confetti Institute of Creative Technologies and Access Creative College.

A further two floors of the building have been let to the London College of Creative Arts (LCCA), bringing the building up to 66% occupation ahead of completion. Allsop advised Trilogy during the leasing to LCCA, and Mark Kleinman at James Andrew International acted for LCCA.

The construction project to transform the buildings at 41-71 Commercial Road was completed in under a year to meet the operational requirements of the education occupiers, who needed an opening date in September 2023. The Amp provides space for education and innovation in a well-connected location, with one foot in central London and the other in the dynamic creative scene in the East of the city. Specialist on-site facilities include recording studios, performance space and an arena for gaming and esports.