-

A new real estate opportunity is gaining traction among institutional investors: Industrial Outdoor Storage (IOS). Want to read more?

The what, why and how of Industrial Outdoor Storage (IOS)

Industrial outdoor storage (IOS) real estate is not new, but it has only recently been given a name and a place in institutional investment portfolios. Some in the market define IOS inexactly, or even as they “know it when they see it”. A more precise definition is that it encompasses open-air facilities used by industrial, manufacturing or logistics businesses to store or process equipment, vehicles, materials or products that do not require the protection of warehouse buildings.

IOS is an amalgam of facilities that serve auxiliary but essential functions to the logistics ecosystem. The prominent features of IOS are low site coverage (with FAR1 of less than 20-25% but often zero), zoning designations that allow for heavy industrial uses, and most importantly, value that is driven by underlying land rather than physical structures2. Attributes that are commonly considered in the evaluation of IOS sites include the quality of surfacing (full concrete surfacing to softer gravel surfacing), good vehicle access (light and heavy), and availability of utility and services (water, electricity, fencing/security).

IOS started gaining traction among institutional investors following the industrial sector’s boom in the post-pandemic era. As industrial pricing became more aggressive through the peak of the cycle, the IOS sector’s robust demand growth outlook provided an attractive alternative for investors seeking yield. Interest in IOS remained strong even when the broader capital market entered correction. This has continued in the context of the industrial sector broadly softening as it digests a (now resolving) wave of deliveries, while IOS has proven resilient given that its new supply tends to be much less elastic.

Despite its adjacency to the traditional industrial sector and its proven relevance to users, IOS as a property type has flown under the radar of institutional investors as it is usually transacted in small deals that are local or regional in nature, often involving owner occupiers. There are a few dedicated IOS players whose inceptions date back as early as 2013, but it is only in recent years that the sector came to be viewed as a critical component of the wider supply chain and distribution network.

The body of knowledge on the sector – operational, fundamentals, performance – is limited, but curiosity has been rising from new entrants in the past couple of years that include institutional capital. The IOS sector’s lack of transparency, common in emerging specialty sectors, demands rigorous scrutiny in underwriting. As IOS continues to mature, detailed research and underwriting as well as deep engagement with the local market can help navigate these challenges, enabling investors better assess and mitigate risks.

‘Next-core’3 in the US, emerging in the UK and continental Europe

In the US, the aggregate market value of IOS property is commonly estimated to be $200 billion in GAV, but the source of that stat as well as the inclusions and exclusions behind it are unclear.4 While institutional investment in IOS has accelerated in recent years, the sector’s overall ownership remains fragmented with a still-limited institutional footprint.Meanwhile, IOS is even more nascent among institutional investors in the UK and Europe, but interest is growing. An increasing number of institutional investors are now setting their sights on IOS opportunities across the region. This includes funds dedicated exclusively to IOS, as well as vehicles that incorporate the sector as part of a wider industrial strategy. We estimate that more than £1 billion has either been allocated for investment or has already been deployed into the UK’s IOS sector in recent years. Owing to structural factors, we see much more limited, but not zero, potential for IOS to emerge in the Asia-Pacific region (see below).

Types of/use cases for IOS

Service-oriented

• Equipment rental & maintenance

• Construction materials & staging

• Waste management & recycling

Transport-oriented

• Port logistics & intermodal transport

• Vehicle storage & parking

• Freight distribution & cross-docking

Storage-oriented

• Construction equipment & bulk material storage

• Vehicle or equipment fleets

Source: LaSalle analysis; images created with the assistance of AI

Truck terminals are the only type of IOS that is now explicitly defined in the NCREIF Property Index (NPI, previously “Expanded NPI”), with $5.3 billion in gross market value, or 1.8% of the US industrial index as of 1Q 2025.5 Tracking of other types of IOS is still a work in progress, although the NCREIF Research committee acknowledges the challenge, and has started the process of putting together guidance on how IOS should be classified and tracked to improve transparency. Investors’ desire to gauge the competitor landscape as well as returns supports this effort to define and track IOS as a distinct category in the NPI.

In Europe, there is still a lack of data availability for IOS, but some agents are extending coverage to the sector and starting to publish market data. For example, new data from late 2024 reported that 48% of enquiries for IOS space in the UK was driven by the need for fleet parking, approximately 60% of which was driven by Heavy Goods Vehicle (HGV) parking.6 This need can also be seen in data from a national survey of lorry parking, which reported a 5% increase in the number of on-site parking facilities between 2017 and 2022, even as the national average night on-site utilization at those facilities grew by nine percentage points over the same period to 83%, indicating strong growth in demand and a high occupancy rate for parking spaces.7

Is IOS “a thing” in Asia Pacific?

The Asia-Pacific IOS sector is evolving and yet to be institutionalized. High land values in many Asian markets make low- or no-coverage land sites uneconomic, at least beyond a temporary use. That said, the factors that drive IOS demand in the US are clearly present in the region, especially the need operational flexibility in handling trailers, containers and delivery vehicles, as well as flexibility to store overflow inventory. The confluence of Japan’s acute truck driver shortage and the implementation of stricter truck driver working hour regulations in 2024 is driving demand for specialized IOS-related assets in the long-term, particularly truck terminals. However, in most markets we view these factors as informing improvements to the design of existing multi-story logistics facilities, rather than driving the emergence of a new, investable specialty property type, at least in the near term.Using a non-traditional data source to identify IOS inventory in the UK

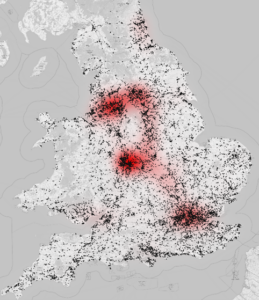

Geographical distribution of UK open storage land vs. warehouse space

Sites classified by VOA as land used for storage and lorry parking are indicated in black, with traditional industrial and warehouse space displayed as a heatmap in red

Data on IOS fundamentals are very limited in the UK and Europe. At least there is a way to estimate the size and shape of the IOS footprint in England and Wales, where the Valuation Office Agency undertakes detailed categorizations of use cases across property types to set business rates, including categories for open storage and lorry parking.i Proprietary analysis of these data by LaSalle identified some 29,000 locations, with a total area of 16,700 acres and an average size of 0.57 acre.ii The locational pattern (black on the map) is correlated with, but generally more broadly dispersed than, the distribution of traditional logistics space (red on the map). This analysis does not capture the entire UK IOS universe, but still highlights the significant size if the opportunity available within UK IOS, and can support investment decisions requiring a view on supply in markets and submarkets.

i Source: Valuation Office Agency

ii It must be noted that this approach likely misses a sizeable proportion of IOS that is currently classified within the warehouse category by the Valuation Office Agency, especially where the site itself is dominated by an open space but have a structure making up a smaller portion of overall area.

Joint ventures structured between institutional investors and specialized operators have been a common avenue for deploying capital into IOS. The challenges of limited transparency, as well as the transactional and operational inefficiencies of small deals, are factors that motivate partnerships with operators. However, the day-to-day operation of IOS is more like traditional industrial than a more operationally intense sector (such as self-storage). In addition, IOS portfolios of scale are currently rare compared to traditional industrial, but we expect greater consolidation of ownership as the sector matures. The assembly of institutional-scale portfolios, along with development of third-party leasing and management service providers, should support the sector becoming more “mainstream” over time.

IOS fundamentals are tight and resilient

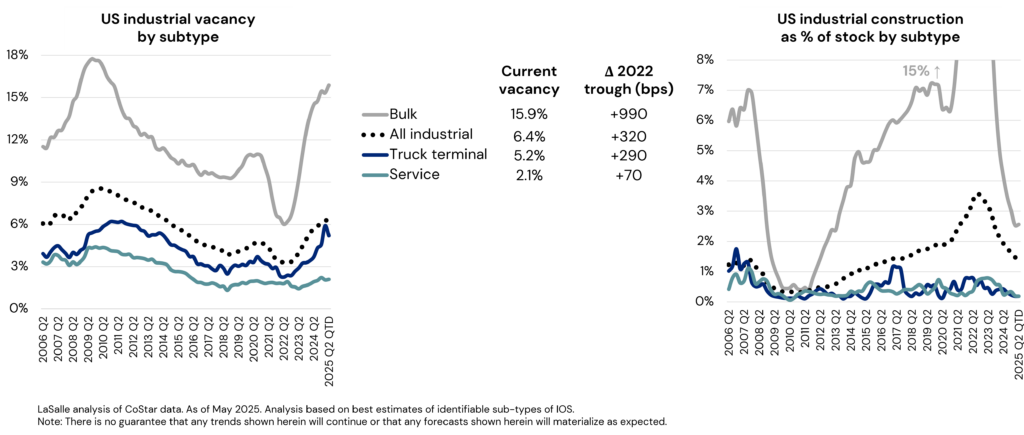

Data on historical industrial fundamentals illustrates consistently lower vacancy and reduced volatility for IOS assets like truck terminals and service facilities, compared to larger industrial buildings (see adjacent charts). The sector benefits from a weaker elasticity of supply, stemming from stringent zoning regulations and community resistance to new IOS facilities. Local municipalities are hesitant to approve them due to the perceived unappealing aesthetics of open-air industrial operations, and an assumption that they have limited potential for generating jobs and taxes. Data challenges remain in holistically assessing fundamentals of IOS sector that take multiple forms; however, the available data suggest a superior track record of fundamentals as well as outlook that is better protected from future development risks.LOOKING AHEAD >

Several key attributes of IOS suggest it is well positioned to perform strongly:

• Tailwinds of the broader industrial sector: The growth of e-commerce and an emphasis on just-in-time delivery have boosted demand for strategically located industrial service facilities. Whether as a point of transfer, servicing freight vehicles or serving as supplementary outdoor warehousing, various stages of logistics operation require IOS sites. These should be in close proximity to the industrial clusters and population that they serve, and are often infill locations.

• Favorable supply dynamics: New development is limited due to the scarcity and high cost of suitable land — i.e., large sites with the appropriate zoning in proximity to population centers. Stringent zoning regulations and community resistance to new facilities — due to concerns such as noise pollution, increased traffic, and environmental impact —further create barrier to entry. This is a differentiator as compared to traditional industrial, which is currently experiencing softer fundamentals due to a recent supply wave.

• Operational resilience: IOS facilities typically present low operational risks for investors. The simplicity of these assets, usually combined with triple-net lease structures that place maintenance responsibilities on tenants, result in minimal capital expenditures and higher cash returns. The limited availability of alternative facilities contributes to high tenant retention rates, enhancing cash flow stability. The impact of tariff-driven uncertainties on IOS is expected to vary. While port and trade-linked IOS sites are more exposed, those serving local populations should demonstrate more resilience.

• Increasingly liquid and institutional: As recognition of the attractive value proposition of IOS grows, partnerships between institutional capital and professional operators to invest in it are being launched. This is not only likely to improve the management of assets, but should also provide a track record of sector performance. We anticipate a gradual compression of the yield spread between IOS and traditional industrial properties, supported by continued institutional capital flow to the sector and falling perceived risks.

1 FAR refers to floor-area ratio, which measures the relationship between land area and internal building area.

2 Source: JLL Research 2023.

3 Under the LaSalle Going Mainstream framework for maturation of niche sectors. “Next-core” is characterized by professionalization where specialists begin to track performance, transparency is rising, and the income quality is proven.

4 GAV refers to Gross Asset Value. The origin for this widely cited number appears to be the PwC Investor Survey.

5 Source: NCREIF 4Q 2024. NCREIF refers to the National Council of Real Estate Investment Fiduciaries and publishes indices tracking the performance of real estate in the US directly held by institutional investors and by institutional funds. Launched in 1Q 2024, the Expanded NCREIF Property Index (NPI) encompasses a wider array of property sectors and subtype designations than the Classic NPI, aimed at aligning performance measurement with the broader industry’s investable universe.

6 Source: Carter Jonas 2024

7 Source: UK Department for Transport

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. With reference to the graphs included in this publication, note that no assurances are given that trends shown therein will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

May 15, 2025

ISA Briefing: The trade war, relatively speaking: Tariffs and real estate fair value

The future “steady state” of trade policy remains unknowable because it rests on a host of complex factors.