Want to read more?

Two 90-day pauses, one on retaliatory tariffs with China and the other on the so-called “liberation day” tariffs, have not liberated markets from uncertainty. However, these course corrections have at least shown that the US administration has limits to its willingness to tolerate extreme market movements, particularly increases in Treasury yields, or severe outcomes for consumers such as product shortages1. They have also contributed to a more benign recent market environment than at the beginning of April.

That said, the future “steady state” of trade policy remains unknowable because it rests on a host of complex political, legal and diplomatic factors2. Even if it became clear where tariffs will settle, economic and real estate forecasting would still be challenging because the US administration has proposed a large and rapid change in the global trading system with little historical precedent3. Moreover, there is the additional variable of time — the longer uncertainty hangs over the economy, the greater the likely cost to investment and growth.4

What is a real estate investor to do? In our last ISA Briefing note, “Working backwards: Dealing with unprecedented policy uncertainty,” we cautioned against spending too much time or effort guessing exactly what comes next. Instead, we argued for pursuing strategies that are broadly prudent, aligned with long-term themes and likely to enhance the resilience of a portfolio, regardless of the state of the world. Our specific recommendations include seeking diversification and building a permanent allocation to real estate debt.

In this note, we take our analysis a step further to highlight three key relativities that we suspect are likely to hold, even as the absolute path of policy and the economy is unknown. These comparative assessments are rooted in our analysis of private real estate markets, confirmed by signals from public markets, and framed in the context of our Fair Value Analysis (FVA) approach. Even with all the uncertainty around absolutes, seeking conviction in key relativities can be helpful when making investment decisions.

1. Real estate relative to other asset classes

Real estate as an asset class does not exist in isolation. Although all assets face uncertainties due to trade turbulence, we believe real estate is relatively well positioned in today’s environment for three reasons. First, real estate has several attractive structural characteristics that should help it weather today’s stormy environment. Real estate values are underpinned by defensive, durable cash flows, backed in numerous sectors by long leases5, and supported in many cases by secular demographic drivers. In addition, the link between market rents and the cost of construction materials provides an indirect and imperfect, but meaningful, connection between inflation and property values6. Tariffs are likely to drive up the cost of construction in any country that raises tariffs on key construction inputs, and that pushes up the rents required to justify new development.

Second, these structural factors are reinforced by mostly healthy current real estate market conditions, as property markets today are not characterized by major imbalances. In our ISA Outlook 2025, we noted falling supply levels, a repricing process mostly in the rear-view mirror, and conservative overall leverage levels in most segments of the market. These factors continue to apply, despite new uncertainties around trade.

Third, real estate valuations appear less stretched than those of several other major asset classes, especially large-cap equities. As nominal rates rose and credit spreads fell over the past few years, real estate underperformed general equities, cumulatively underperforming by ~30% since the end of 2021 (see adjacent chart). As the environment has shifted, it is possible that real estate’s underperformance could reverse. From a relative valuation perspective, global REITs would need to outperform equities by around 15-20% as of April 30th to simply bring the historical earnings yield relationship back in line with its long-term average.7

2. Relative sector outlook

The trade war has the potential to impact virtually every assumption that goes into a Fair Value Analysis (see sidebar for more background on FVA). When the components of FVA are especially uncertain and volatile, as they are today, it helps to focus on the elements for which greater conviction is possible. Moreover, we recommend emphasizing relative assessments, which can be easier to build conviction around than absolute forecasts.

The channels by which tariffs impact real estate sectors can be classified as either direct and specific, or indirect and macro-related. In terms of trade-specific channels, we highlight that some sectors have unique dynamics that are directly shaped by barriers to the flow of goods. The poster child for this is industrial/logistics real estate. Given this property type literally houses the economy’s supply chains, it is clearly exposed to forces that are likely to disrupt and potentially reshape supply chains.

In the near term, decision-making by logistics occupiers is likely to slow.8 Markets and sub-markets exposed to trade, such as around major ports, may see reduced demand. It is worth noting that trade-related logistics demand generally tends to be greater nearer the points of import and consumption, rather than the points of manufacture and export. Thankfully, the long-term context of logistics real estate is one of positive structural growth, which means this impact takes the form of a downgrading, not a devastation, of the sector’s prospects. Moreover, in the long run, global economic fragmentation could lead to greater supply chain redundancy and therefore increased aggregate space demand.

What is Fair Value Analysis (FVA)?

Fair Value Analysis, or FVA, is central to LaSalle’s investment strategy process. We conduct FVA across a range of “slices” of the property market—that is, various combinations of sectors, sub-sectors, cities, sub-markets, quality grades and the like. The FVA methodology compares our assessment of expected and required returns:

• Expected Returns (ERs) represent the return expected for a given real estate slice, which is build-up of current real estate entry pricing, plus short and long-term income growth, minus an estimate of the capital expenditure needed to keep the property competitive.

• Required Returns (RRs) represent an appropriate risk-adjusted cost of capital for a given slice, starting with bond yields and applying sector- and market-appropriate risk premia.

It is possible to extract both absolute and relative pricing indications from FVA. By comparing ERs and RRs, we can assess which slices appear attractively priced (ER>RR), fairly priced (ER≈RR) or overpriced (ER<RR). But implicit in this absolute analysis is a presumption that current bond yields are “correct;” its conclusions tend to be volatile in periods when bond markets are volatile. That is why is also helpful to simply rank order the ratio of ERs to RRs, which produces a relative sorting of attractiveness by slice. Relative assessments help steer investment toward the real estate most likely to outperform the broader property market.

Other examples of real estate sectors facing impacts directly tied to tariffs include US power centers exposed to discretionary expenditure on (largely) imported goods. There are also potential direct impacts on real estate from other Trump policies beyond tariffs, for example around reputational issues that seem to be suppressing inbound and outbound tourism, as well as changes to scientific research funding.9

To understand the broader macro channels of impact, it is useful to assesses real estate sectors and markets by their relative sensitivities to economic growth and to interest rates.10 Sectors with a high degree of economic sensitivity, such as hotels, are likely to see an outsized negative hit to their cash flows in the event of an economic downturn. Meanwhile, economic impacts should be muted on sectors with low fundamental sensitivity to GDP growth, such as medical office.

Relative impacts are potentially the reverse for sectors with a high degree of interest rate sensitivity. An economic downturn usually leads to lower interest rates – although recent market movements suggest that is not necessarily a given.11 The impact of lower rates on the more interest-rate sensitive parts of the real estate market could enable them to absorb some or even all the effect of softer demand. These property types are generally those with longer leases, such as the mainstream commercial sectors.

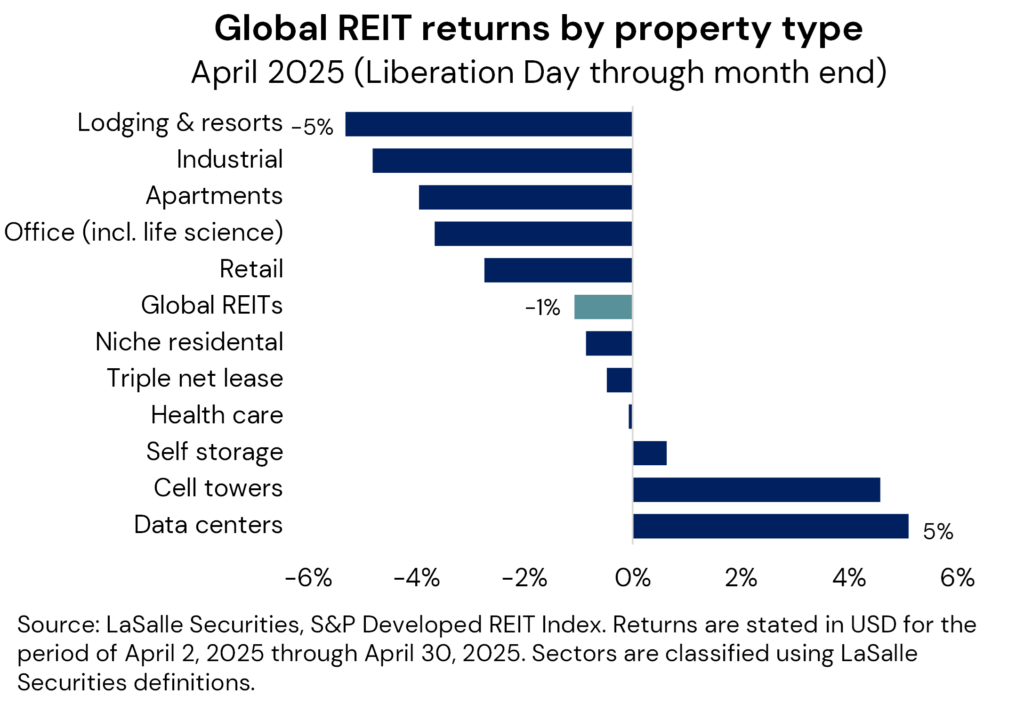

Relative listed real estate performance following “liberation day”, confirms these intuitive sector relativities. Despite an initial drawdown of nearly 10%, the overall listed REIT market was down only marginally for the rest of April, though the dispersion of property sector performance has been wide (see adjacent chart). Initial investor reactions have been most focused in property types which are most directly exposed to a potential trade war (e.g., industrial/ logistics) or those which are more economically sensitive in nature (lodging).

3. Relative global impacts

The same relative-value thinking can be applied to the relative prospects of countries and regions, which have been dynamic this year, to say the least. The economic narrative has quickly shifted from the post-election consensus of dominance by the US economy, to post-inauguration worries about fallout from US trade policy alongside a growth-positive break in European fiscal policy.12

Indeed, it seems likely that tariff-related worries may hit US real estate more than in many other countries, for two reasons. First, the strongest headwinds in many exporting nations will be largely contained to specific industries, compared to potentially generalized challenges in the US.13 A second is that the US Fed will have to balance risks of higher unemployment against those of higher prices, while in other countries, the short-term impact of tariffs could drive local goods prices lower. This may give ex-US central banks wiggle room to offset a weaker economy with policy easing.

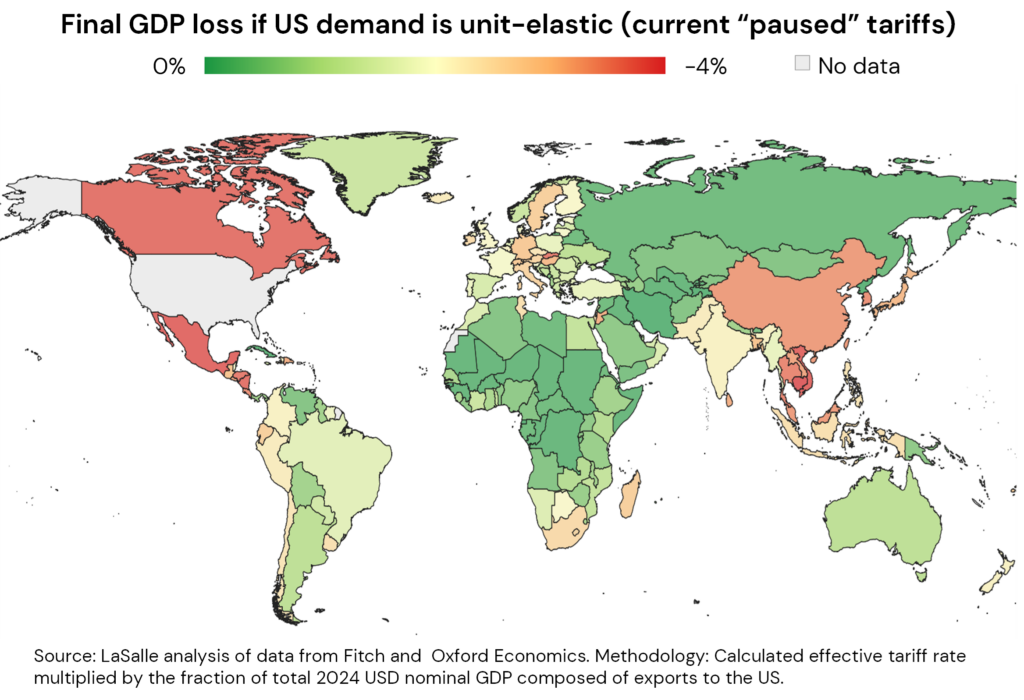

To separate relatively harder-hit from less-hit ex-US markets, we track the level of applied tariffs and a country’s exports to the US as a share of the exporting country’s GDP. On this basis, the map shows that China, Southeast Asia, Canada and Mexico may be more impacted, while Australia and Europe potentially could be less so. The nature of the exports themselves also matters. It may be difficult to find viable substitute suppliers for many complex, high-value goods (e.g., cutting-edge semiconductors), or for raw materials (rare earths). Countries whose exports have fewer substitutes may be more insulated from the trade war.

A final factor to consider is that the economic sensitivity of property varies by sector and country, but real estate’s return beta is especially low in some market segments, such as the European living sectors.14 The degree to which a sector’s drivers are inward- or outward-facing can also matter. For example, we observe that real estate in Japan, with its large domestic market, tends to see robust investor and tenant demand that may be less susceptible to external forces.15

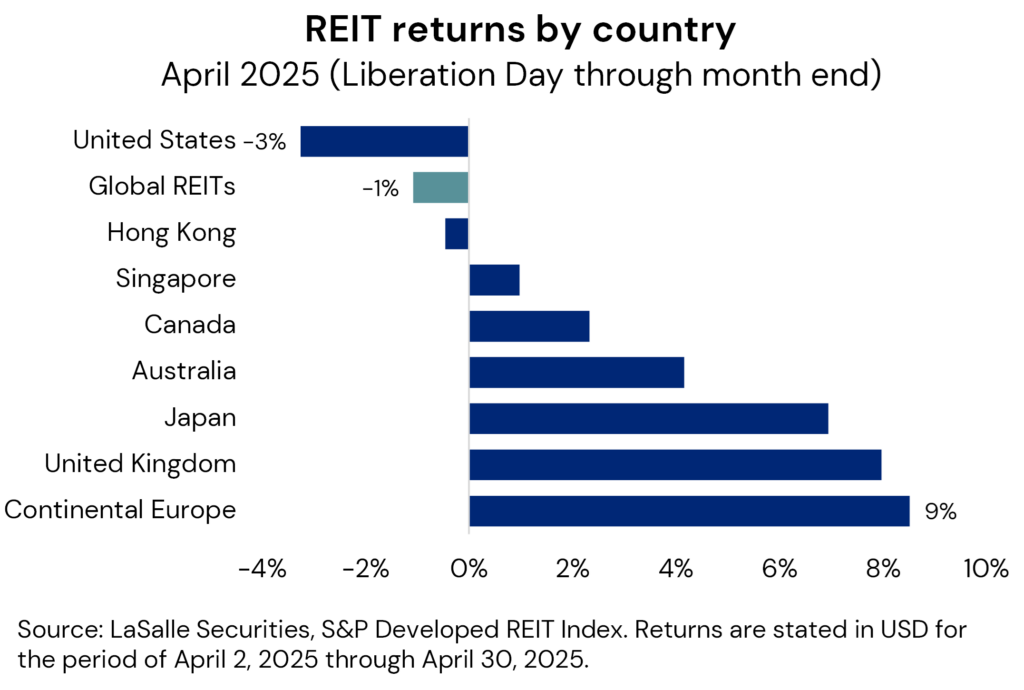

These relativities have been evident in the performance of US and ex-US listed real estate markets. The shift in US trade policy has led to the largest REIT share price declines being registered in the US (see adjacent chart). European REIT markets, including the UK, have been relative winners given the potential pro-growth developments in fiscal policy and a more limited direct impact from US trade policy. Asia Pacific REIT market performance has been more mixed in this period, with Japan and Australia notable outperformers.

LOOKING AHEAD >

- • In normal times, recession probabilities reference probabilistic models that draw on indicators of economic activity, relating current levels to the historical incidence of recessions. In today’s environment, recession probabilities are better thought of as the weighted odds of various trade policies being implemented. In the context of such uncertainty, we recommend focusing less on absolute forecasts, and more on relativities that we expect to hold no matter the ultimate outcome.

- • Fair value analysis (FVA) is our preferred tool for comparing, framing and debating investment strategy. It can also be a helpful framework for scenario modeling in uncertain times such as today. But quickly rebalancing real time private, direct real estate portfolios to take advantage of rapid changes in relative value is difficult if not impossible. We use FVA to inform portfolio additions and exits, as we incrementally migrate overall portfolio allocations toward the sectors and markets that are most attractively priced. We believe doing so can contribute to outperformance versus the overall market.

- • More immediate execution is available in listed real estate markets, allowing investors to capitalize on shorter-term mispricing and relative value shifts. Periods such as this trade war episode are great examples of times when having a public real estate allocation can provide maximum opportunity to benefit from volatility.

1 The April 9th reciprocal tariffs pause may have been in response to a meaningful increase in Treasury yields, to which the administration seems more reactive than equity markets. The April 12th China pause appears timed to preempt the expiration of “on water” exemptions for goods already en route. Sources: Piper Sandler and Signum Global Advisors.

2 Contributors to uncertainty include: legal challenges to presidential trade authority; negotiations between the US and other nations; potential Congressional action, especially after the mid-term elections; and of course, unilateral adjustments by the administration. Sources: Piper Sandler and Signum Global Advisors.

3 According to Goldman Sachs, the US average tariff rate has increased from ~3% to ~20% in the past few months, even before the paused tariffs. For comparison, the 1930 Smoot-Hawley tariffs represented a rate increase of only a few percentage points, off of already high levels. Moreover, trade is today roughly three times as large a share of the US economy as it was then. As such, there is no clear precedent for a tariff increase of this magnitude.

4 According to analysis by Piper Sandler and Baker, Bloom and Davis, 2016.

5 Leases are, in some sense, only as defensive as the revenues of the tenant. But crucially, they are mediated by the option to relet a building to another tenant. In essence, real estate is a layer of abstraction removed from the tenants’ businesses, just as the tenant is in turn a layer of abstraction higher than any specific product (because they may have multiple products). Just as products have widely varying success/failure profiles, companies are a kernel on products, so their success/failure rate is in turn smoothed, and real estate is a further kernel on businesses.

6 The cash flow characteristics of real estate, including its inflation pass-through potential, are discussed in greater depth in our ISA Portfolio View report.

7 LaSalle has tracked and compared the relationship of REIT AFFO yields to Equity earnings yields for the period of April 2006 through April 2025. Using this data series, we estimate that the relative performance of REITs that would be needed as of the latest data point to revert the relationship to the historical average, assuming all else equal.

8 The commentary in this paragraph is based on LaSalle analysis and that of Green Street Advisors and CBRE-EA.

9 We are monitoring hotel markets with a high share of international visitors; US student housing assets that are heavily exposed to international students (with European student housing potentially benefiting); and life sciences real estate.

10 LaSalle’s Portfolio Balance framework describes real estate market segments according to their sensitivities to economic growth and interest rates. It classifies markets and sectors into four categories: growth-led, rate-led, stable, and reactive. For a fuller discussion, see the ISA Outlook 2025.

11 Bond yields typically fall as economies go into recession because the market prices in central bank easing (rate cuts) and lower inflation. However, this is not always the case. Recent upward volatility in US 10-Year Treasury yields has been attributed to movement in the risk premium required for investing in dollar assets, given concerns that recent rapid changes in economic policy herald longer-term US policymaking instability. Sources: Piper Sandler and Oxford Economics.

12 For more discussion of this narrative shift, and the German debt Zeitenwende, see the ISA Briefing “Working backwards: Dealing with unprecedented policy uncertainty” and the accompanying LaSalle Macro Quarterly.

13 For example, LaSalle estimates the impact of US tariffs on the German automotive industry to represent just 0.04% of European GDP, using data from Oxford Economics. We derive this by dividing the $25.5bn German auto exports to the US by the eurozone’s $15.9tn GDP, multiplied by 25% tariffs (assuming unit elasticity and no export redirection).

14 European residential markets have seen strong rental growth in recent years, even as GDP growth was weak, owing to long-term structural supply shortages. Source: LaSalle analysis of data from PMA and Green Street.

15 According to analysis by LaSalle of data from JLL REIS and MSCI Real Capital Analytics.

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. With reference to the graphs included in this publication, note that no assurances are given that trends shown therein will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

This article first appeared in the May 2025 edition of PERE

LaSalle’s Dave White sat down with peers from other leading alternative credit providers across Europe to discuss the state of real estate debt across the continent.

Facing up to competition and uncertainty

Geopolitical chaos overshadows the discussion around the outlook for private real estate debt markets in Europe, writes Stuart Watson

This year, the participants in PERE’s European debt roundtable met the same morning that was sure to become famous – or infamous – as US President Donald Trump’s tariff-trumpeting ‘Liberation Day.’

Their discussion covered a range of topics, from the fragmented market across Europe, to the scarcity of capital and deal pipelines, to the extraordinary levels of geopolitical turmoil.

Want to read more?

Craig Oram, Mark Milovic, Jen Wichmann and Alexandra Levy recently sat down in front of the camera to discuss how various teams at LaSalle – in particular Research and Strategy – work in tandem with the US debt investment team to identify prime sectors and locations for investment.

LaSalle’s Research and Strategy team plays a crucial role in our underwriting process. They provide insights on market dynamics, macroeconomic trends, and demographic shifts that can impact property operations and investment performance. By combining their top-down analysis with our decades of lending experience across the US, we can identify attractive opportunities that balance risk with reward. This comprehensive approach enables us to make more informed lending decisions, helping us to mitigate potential risks and work to enhance returns for our investors.

Learn more below.

Want to read more?

Real estate debt has always been a valuable component of any portfolio; however, it is emerging as a viable solution to a wide array of investor concerns today. It’s a strategy that offers a range of benefits with attractive risk-adjusted returns across market cycles.

Read our six reasons why investors should consider adding it to their portfolios, and learn more about our capabilities in Europe and the United States below.

1. Attractive risk-adjusted returns: In today’s environment, the combination of elevated interest rates and attractive credit spreads mean that real estate debt offers compelling returns relative to other fixed income alternatives. The potential for achieving these higher yields, while maintaining a relatively conservative risk profile, is appealing to institutional investors looking to mitigate risk.

Real estate debt can offer different opportunities through the market cycle, with the ability to adjust advance rates during market downturns to minimize risk, while benefiting from cyclical recoveries.

2. Stable and predictable income: An allocation to real estate debt may allow investors to enhance their portfolio income returns. The coupon-like nature of interest payments from borrowers can provide consistent and stable cash flows for investors, with a significant portion of the total return being achieved through income returns.

3. Downside protection and capital preservation: Real estate debt offers the ability for investors to gain exposure to the same underlying real estate, but via a protected position in the capital structure, offering an often-significant equity cushion to buffer against potential value fluctuations.

Careful structuring can further enhance downside protections; these investments are typically collateralized by the physical underlying property, providing security that differs to some other forms of fixed income investments. In a default event, active asset management is critical, and managers who have the expertise to step in and manage the underlying asset can further protect against potential losses and in some instances create upside value.

Senior or unlevered whole loan lenders sit in the last-loss position, allowing investors to consider more actively managed business plans than they might be comfortable investing in via an equity commitment.

4. Diversification benefits: Real estate debt provides exposure to one of the largest segments of the real estate market, typically with lower volatility than real estate equity. And adding real estate debt to an institutional portfolio can enhance diversification, as it often has low correlation with traditional asset classes like stocks and bonds, which can help to improve overall risk-adjusted returns.

5. Regulatory efficiency and opportunity: For insurance companies, real estate debt is treated favorably under Solvency II and other similar regimes, making it a capital-efficient way to deploy assets and capture attractive relative returns. Additionally, enhanced regulation has led to retrenchment by traditional bank lenders, creating opportunities for investors working with non-bank alternative lenders, such as institutionally managed debt funds.

6. Inflation hedge: As inflation rises, so too do the interest rates central banks often use to combat it. Real estate debt investments, particularly those with floating-rate loans linked to central bank rates, can therefore offer some protection against inflation.

Want to read more?

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

A reader waking up from a quarter-long slumber on April 1, 2025 would be forgiven for confusing the headlines for an April Fools’ Day prank. They would scan the news and see stories about:

• large tariffs alternately announced, rescinded, delayed and reintroduced at a breakneck pace (see LaSalle Macro Quarterly, or LMQ, p. 4);

• US equities in correction territory as ex-US markets, including even China’s, outperform (LMQ p. 25);

• increasing calls that the risk of a US recession is rising (LMQ p. 20); and

• substantial upward revisions in forecasts of long-term European GDP growth (LMQ p. 21).

Each of these is at least partly (and in some cases completely) contrary to expectations from the beginning of this year. But the quick reversal in the economic narrative is no April 1st joke. The post-election consensus of a supercharged US economy pulling ahead of the rest of the world has clearly been challenged, if not upended.

In this period of elevated policy uncertainty, real estate investors should focus on what they can and should do amidst all the noise. At the risk of stating the obvious, we think it helps to take a step back and break down the analysis into three basic steps of incorporating news flow into investment strategy — the what, the so what, and action steps. But as we will discuss, the first two are characterized by so much uncertainty that it is also helpful to start from the end and work backwards, asking: What can investors do to improve their chances of successfully navigating this environment regardless of what happens?

1. What’s happening?

Normally, the “what” of political developments and other events is the easy part. But since the US presidential inauguration, the Trump administration has made policy announcements — especially regarding trade and federal employment — at a rapid pace. Some of these seem to have taken even insiders by surprise. Widespread post-election expectations that actual policy would be more measured than campaign-trail rhetoric have proven incorrect.1 Reversals and postponements have also been a regular occurrence.

Adding to the news flow are announcements by other countries. These include the tit-for-tat of retaliatory tariff measures. But there have also been substantial structural shifts, most notably the German coalition agreement to spend more on infrastructure and defense. This news is arguably linked to a realization by European leaders that, given less collaboration with the US, Europe will have to forge its own path to generate economic growth and provide for its security.2 Aside from the break that this represents from the post-World War II order, this change is significant because it is a key driver of higher economic growth expectations for Europe.

The result of all this is a “layering” of announcements that is difficult to digest at once (see our attempt at a timeline at LMQ p. 4). It is even more of a challenge to roll-forward the news into reasonable predictions for subsequent weeks, let alone months. As a result, measures of economic policy uncertainty have risen to levels close to historic highs (LMQ p. 5). Indeed, the implications of the many recent developments on the growth and inflation outlook include first-order effects such as the direct impacts of lower government spending on GDP and higher prices on tariffed goods (LMQ p. 7), but also the second-order effects of broadly elevated uncertainty.

Uncertainty is the enemy of investment decision-making. This applies both to financial investment as well as spending by businesses in plant, property, equipment and digital tools. Empirical research has shown a clear negative relationship between uncertainty and investment.3 If businesses are unsure (as they are today) about the rules of the road — for example, around the basic terms of trade governing imports and exports — they may be hesitant to commit capital to long-horizon projects. At the same time, expectations of lower taxes and less regulation may push them back toward optimism.

Our analysis of recent events comes with a dose of humility. While LaSalle dedicates significant resources to tracking and analyzing the constant flow of indicators and news — as highlighted by the LaSalle Macro Quarterly (LMQ) — we do not purport to have a unique competitive advantage doing so. We would expect that our readers follow a range of news outlets, forecasters and other observers in staying abreast of the news flow and making sense of it.

2. What’s the real estate impact?

We do feel, by contrast, that our experience managing property and data from our portfolio puts us in a strong position to assess the likely impacts of policy developments on real estate. Even in the context of elevated overall uncertainty, we can make several observations with relative confidence.

First, we suspect that a key real estate impact of recent policy trends could be higher replacement costs. Tariffs on construction materials, such as steel, are likely to drive up their price. In addition, a lower level of migration into the US may reduce the supply of construction labor there. Increased European spending on infrastructure and defense could also contribute to higher global and regional materials costs. Higher replacement costs would mean that rents would have to rise more to justify new development, ultimately leading to higher net operating income (NOI) growth. This could counterbalance the impact of macro factors such as a potentially slower economy, as well as property type-specific impacts such as softer demand for housing in the context of muted household formation by immigrants. A simpler way to state this is that real estate can act as an inflation hedge.4

Second, we see value in undertaking granular research to identify potential winners and losers from the current policy environment. This approach can help investors identify real estate that is likely less exposed (or may even benefit from) current trends, while flagging potentially more-impacted market segments. Although the exact mix of government policies remains uncertain, the direction of travel is clear enough in some areas to make a few relative calls. For example, a move away from global free trade could weaken real estate demand related to import-export activities, for example in proximity to ports, while bolstering it in emerging near-shoring hubs.

These sorts of analyses can operate both at the national level, for example by identifying more and less trade-exposed countries (e.g., LMQ p. 9), and at the metro-area level, by examining city-level economic exposures (LMQ p. 10 and 11). One specific economic concentration worth mentioning is that of government employment in Washington, DC. Clearly, job cuts by the newly formed Department of Government Efficiency (DOGE)5 are a risk, but there are mitigating factors such as mandated in-person work; we predict a net negative effect for DC real estate demand, but we have not yet seen much impact on the ground or in the data.

Finally, we note that economic softness comes with mixed effects for real estate. As a long-duration, interest rate-sensitive asset class, it is quite possible that a mild or moderate economic slowdown that leads to lower long interest rates could, in fact, be a positive for real estate values in the aggregate. That said, there are likely to be winners and losers, depending on the relative sensitivity of an asset’s performance to interest rates versus sensitivity to economic growth.6

A bigger risk than a slowdown alone is that of stagflation: weak growth at the same time that sticky inflation keeps rates high. However, most economic research suggests that tariffs represent a one-time upward adjustment to the price level, rather than a driver of a sustained, self-reinforcing cycle of higher inflation;7 as such, central bankers may be more willing to ”look through” the impact of tariffs. So far, a recent softening in 10-year Treasury yields suggests that bond markets agree with that assessment (LMQ p. 26).

3. What should investors do about it?

All this points to avoiding excessive pessimism on the direction of values, while remaining cautious and selective. But being discriminating is not the only thing investors can do. We also advocate for turning the process of incorporating news flow into strategy on its head. Because we know so little about where the dust will settle on many of the policy shifts, let alone the impacts of those shifts, it is also prudent to ”work backwards” from the implementation step. Some of the most prudent actions an investor can take do not depend on the specific geopolitical or policy debate of the week.

A key recommendation in this regard is to build a globally diversified portfolio. That the market narrative has shifted quickly from one of US dominance of global growth, to a more balanced view with Europe gathering pace, reinforces that countries’ trajectories may exhibit lower correlations in a more fractured global economy. Rapid reversals of market narratives can generate significant market volatility, particularly when they are “priced to perfection” as the post-election optimism now appears to have been. Diversification should help to absorb that volatility, while avoiding being “left out” of unexpected positive shifts. A microcosm of this occurred recently in the public REIT market, where post-election euphoria led to what appeared to us a significant underpricing of European listed real estate.

Investors are also likely to benefit from diversification across the capital stack, which is why we recommend a permanent allocation to real estate debt. As we discussed in our ISA Focus report, “Investing in real estate debt,” debt investment provides low-correlation returns that are by definition not sensitive to volatility contained entirely within the first-loss equity position. While the risk of a recession in the next year is debatable but possibly rising, the risk of an eventual recession is always 100% in the long run. A debt allocation can help add stability and predictability to a portfolio’s return regardless of the exact path the economy takes.

LOOKING AHEAD >

• Investors should not get lost in the noise. Our view, expressed in the ISA Outlook 2025, is that we are at the ”dawn of a new real estate cycle.” This call is not dependent on a highly certain or favorable macro context, but rests on observations specific to real estate. These include pricing that has caught up with bond yields, valuations that have caught up with pricing, solid property fundamentals and substantially approved debt availability, among other factors. Neither a booming economy nor falling rates are necessary conditions for a revival in investment activity or the existence of attractive investment opportunities.

• There will likely be both winners and losers among specific real estate strategies. Granular analysis of risks and mitigants should inform revised assessments of relative value. To get these shifts right, investors must continue to ask: What is priced in? Overreactions are possible, which can create opportunities for investors to take advantage of volatility.

• Near-term uncertainty can distract from a longer-term picture that is arguably clearer. Over a horizon of years and decades, trends toward higher trade barriers and a more fragmented world seem likely to continue. Moving from a global economy where countries with a comparative advantage in producing a particular good do so and sell it to other countries, to one in which trade barriers create more siloed supply chains, would likely have complex effects. Classic economic theory suggests that transition could hinder productivity. But it could also spur real estate demand as productive capacity and inventories are un-pooled and duplicated. Correlations between real estate markets could also decrease. Investors should be ready to build portfolios with these dynamics in mind.

Footnotes

1 We made this mistake as well, saying that “legislative obstacles exist to enacting full campaign-trail rhetoric” in our November 11, 2024 ISA Briefing, “The ‘Red Sweep’ and real estate: has the outlook changed?”.

2 Source: Signum Global Advisors, Piper Sandler, Oxford Economics

3 According to analysis by Piper Sandler, there is an inverse correlation of -42% between a sustained upward shift in policy uncertainty (as measured by the US Economic Policy Uncertainty Index) and GDP growth; a doubling of uncertainty over a quarter is consistent with -1.5% real GDP growth over the following year. For academic work on this relationship, see Baker, Bloom and Davis, 2016

4 For more discussion of real estate’s role as an inflation hedge, see LaSalle’s ISA Portfolio View.

5 DOGE is seeking to quickly remodel the US government to be more effective at a lower cost. If successful, the project could contribute to the US economy’s productive capacity by reducing the crowding-out effect of government spending on private sector activity. Inconveniently, the prospects for reducing government spending face many constraints, not least the fact that a very large proportion of US government spending is committed to entitlement programs like Social Security, Medicare and Medicaid, which most politicians have pledged not to touch. Moreover, in the short term, reduced government employment and lower outlays would directly reduce GDP. Sources: Piper Sandler, Signum Global Advisors

6 In LaSalle’s ISA Outlook 2025, we highlighted our Portfolio Balance framework, which describes real estate market segments according to their historical sensitivities to economic growth and interest rates. The framework segments markets and sectors into four categories: growth-led, rate-led, stable, and reactive. We found that while short-leased, economically sensitive sectors like hotels may see values soften in a recession, other sectors may actually see values benefit if interest rates soften enough.

7 Source: Economic Policy Institute, Federal Reserve Bank of Boston, Piper Sandler

Important notice and disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

JLL (NYSE: JLL) has been recognized by Ethisphere, a global leader in defining and advancing the standards of ethical business practices, as one of the 2025 World’s Most Ethical Companies. For the 18th consecutive year, JLL has been honored for demonstrating exceptional leadership and a commitment to business integrity through best-in-class ethics, compliance and governance practices.

In 2025, 136 honorees were recognized spanning 19 countries and 44 industries.

LaSalle is a wholly owned subsidiary of JLL and is proud to share in this achievement.

Company news

No results found

Craig Oram, Portfolio Manager and President of LaSalle Debt Investors and Alexandra Levy, Head of Debt Capital Markets, Americas, discuss the reasons why investors are increasing allocations to US real estate debt.

How should institutional investors seek out reliable income in 2025 when the majority of outlooks – including ours – are expecting the volatility of recent years to continue?

One answer for many investors has been increasing allocations to private credit. Elevated interest rates and repriced assets have led to better lending conditions for providers of alternative funding, with higher yields at lower loan-to-value ratios.

Learn more below.

Want to read more?

This article first appeared in CREFC Europe.

In late January, leading figures from some of Europe’s foremost real estate lenders, sponsors, advisors and other market participants gathered at the heart of the UK’s political establishment, The House of Lords at the Palace of Westminster, to discuss the future of the UK real estate sector.

Set in the historic Attlee and Reid Room, the annual Real Estate Finance Forum was co-hosted by LaSalle Investment Management, CREFC Europe, and Regal, and sponsored by Lord Harrington of Watford. Lord Harrington is a seasoned real estate entrepreneur turned politician, and is the author of The Harrington Review of Foreign Direct Investment (FDI), which notably outlines wide recommendations to reorganise government with the intention of attracting more foreign investment into the UK, including within the real estate sector.

The forum opened with an engaging conversation between Lord Harrington and Liz Peace CBE, a highly respected adviser on real estate and policy. Their discussion, centred around Lord Harrington’s Review, examined UK policy and the most important requirements for attracting more global capital to the UK, particularly considering recent economic shifts. This was followed by a panel discussion that delved deeper into the themes raised, featuring David White, Head of LaSalle Real Estate Debt Strategies, Alison Lambert CFO and COO of Martley Capital (and Chair of CREFC Europe), Emma Huepfl, Chair of the Bank of England’s Commercial Property Forum, and Jonathan Seal, CEO of Regal. Participants in the room were encouraged to actively engage in the conversation, which ultimately led to a lively discussion covering a number of topics.

Want to read more?

BRISTOL (January 30, 2025) – LaSalle Investment Management (“LaSalle“), the global real estate investment manager together with its development partner Deeley Freed, has obtained outline planning permission for The Galleries Shopping Centre, Bristol.

The Galleries is situated in a prime location in Bristol’s city centre, adjacent to Castle Park, with excellent connectivity to public transport including Temple Meads station. The redevelopment will help unlock the Bristol City Council’s plans to regenerate the city centre. The surrounding infrastructure will undergo significant enhancements, becoming greener and more pedestrian-friendly. The redevelopment will support the Council’s sustainability goals, facilitating the delivery of a low-carbon District Heat Network and enhancing urban accessibility.

The proposed development includes plans for up to 450 new homes and 8,000 sq m of ground-floor space dedicated to retail, leisure, dining, health, and community facilities. In addition, the site will feature approximately 46,000 sq m of modern, sustainable employment space, the potential for a 240-room hotel or aparthotel, and up to 750 purpose-built student bedrooms. The development will also incorporate 1.5 acres of high-quality public realm which will look to bring Castle Park closer to the city centre.

A central feature of the project will be a new green transportation hub accessed via Fairfax Street, shifting the focus away from parking towards sustainable travel options. This regeneration project also aims to enliven Bristol’s nighttime economy, re-imagining the area as a vibrant city centre destination that will benefit residents and visitors. Additionally, the proposal reimagines public spaces – where the current Galleries site lack open areas, the new design will dedicate a third of the site to high-quality, welcoming public space. The redevelopment thoughtfully incorporates Bristol’s heritage by preserving the Merchant Almshouses and Greyhound Hotel, currently obscured by the Galleries structure, into the new design.

Tom Lewis, Fund Manager, UK Custom Accounts, LaSalle Investment Management said: “Following an extensive consultation process with local stakeholders, we’re delighted to have secured planning approval to transform Bristol city centre and provide the local community with new homes, commercial space, amenities, and green space. We’re committed to investing for the long term and this ambitious redevelopment scheme demonstrates our ability to create value and better meet the needs of future residents, occupiers and visitors.”

Max Freed, Director, from Bristol-based Deeley Freed, comments: “We’re delighted Bristol City Council has voted to support this redevelopment project. It is a once-in-a-generation chance to re-invent, revitalize and modernize such a large part of the city centre. Our vision involves completely transforming this 1980s shopping centre, making the site more diverse, safe and sustainable. The redevelopment of this site will bring more people to live and work in the city centre, accelerating the regeneration of the area.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

London (January 20, 2025) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, announces that it has provided a £100 million loan facility through its flagship LaSalle Real Estate Debt Strategies IV (LREDS IV) Fund to refinance the acquisition of Pavilion Court, a fully-leased 699-bed Purpose-Built Student Accommodation (PBSA) asset in Wembley, London, owned by Apollo-managed funds.

Located in the Wembley Park Masterplan residential development, Pavilion Court is a 10-minute walk from Wembley Park underground station with quick access into central London. Benefitting from one of Europe’s largest regeneration schemes, Wembley is home to the London Designer Outlet and the world-famous stadium. The area is an established residential neighbourhood which benefits from a wide range of food and beverage establishments. Its close proximity to several academic institutions such as the University of Westminster, UCL and Middlesex University, among others – positions the area favourably as a hub for student accommodation.

Completed in 2021, the 699-bed building sits across four blocks centred around a courtyard. It includes 89 studios and 610 en-suite rooms, alongside a gym, a games room, multiple study spaces, dining room and multimedia room, catering for both domestic and international students. Alongside this, Pavilion Court performs strongly against industry real estate sustainability standards and is accredited with a BREEAM ‘Very Good’ certification.

David White, Head of LaSalle Real Estate Debt Strategies, said: “This large-scale refinancing demonstrates the strength of our Debt Investments platform and maintains our strong pace of deployment, positioning our business as one of the most active real estate debt providers in Europe. We are delighted to be able to offer Apollo Global Management a bespoke and creative capital solution to support this acquisition. The building is in prime position to attract domestic and international students looking for high-quality, amenity-rich and centrally located accommodation that provide quick access to universities. We look forward to expanding our footprint in this segment of the market.”

Apollo Partner Samuele Cappelletti, added: “We are pleased to have worked with an institutional party like LaSalle in the financing of this landmark asset for which we continue to see multiple value creation levers to be implemented over the life of our business plan.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

London (January 9, 2025) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, announces that it has provided a £68.7 million green loan to Vita Group to finance the delivery of a new 540-bed purpose-built student accommodation (PBSA) scheme in central Birmingham.

Located on Gough Street in Birmingham city centre, the asset will benefit from excellent rail, bus and tram links. The scheme will help address the undersupply of specialist accommodation in the UK’s second largest student market, with five universities and c.80,000 students based in the Birmingham Metropolitan Area. Planning permission was secured and construction work, led by MRP, commenced in 2023, with completion set for August 2026.

The 105,000-sq-ft scheme will comprise two tower blocks, of 10 and 29 stories respectively, with amenities including private dining rooms, a vibrant hub space for socialising and studying, a state-of-the-art gym, an outdoor basketball court, outdoor terraces and shared cycle storage. The building is designed to be highly sustainable, targeting BREAAM ‘Excellent’ certification, with LaSalle’s green loan structured under the Loan Market Association’s green loan framework.

David White, Head of LaSalle Real Estate Debt Strategies, said: “This latest development loan completed by our Debt Investments platform maintains our strong pace of deployment, positioning our business as one of the most active real estate debt providers in Europe. In Vita Group and MRP, we are working with two firms with best-in-class reputations for providing high-calibre, well-amenitized student accommodation and for successfully delivering large-scale PBSA schemes. Our investment in the Gough Street development provides our investors with exposure to a high-quality asset, supported by the strong fundamentals of Birmingham’s structurally undersupplied student market.”

Max Bielby, Chief Operating Officer for Vita Group, added: “We’re delighted to be working with trusted partner LaSalle to deliver this best-in-class student accommodation to the heart of Birmingham. The delivery of this building is well underway and will raise the standards of what students should and can expect from their accommodation experience in the city centre. We look forward to welcoming students from September 2026.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing US$10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

Chicago (January 6, 2025) – LaSalle Investment Management (LaSalle) announced today the acquisition of Tempe Commerce Park, a five-building industrial complex totaling 536,122 square feet in Tempe, Arizona. The acquisition was made on behalf of LaSalle Property Fund (LPF), the firm’s US core open-ended fund.

The property, situated on 36.79 acres, features 24-foot clear heights, dock-high and grade-level doors, and ample parking. The complex is 92% leased to eight diverse tenants, including McKesson, Genuine Cable Group and Rivian. Located at 7340-7360 South Kyrene Road and 7333-7343 South Hardy Drive, Tempe Commerce Park benefits from its position in one of Metro Phoenix’s most sought-after submarkets, offering excellent accessibility to major transportation routes.

Jim Garvey, President and Portfolio Manager, LaSalle Property Fund said: “This acquisition aligns with our strategy to increase the Fund’s industrial allocation in high-growth metropolitan markets. Tempe Commerce Park is an excellent addition to our portfolio, offering exposure to a prime infill submarket.”

Matt Bogovich, Vice President of Transactions added: “We’re excited to acquire this high-quality industrial complex in Tempe, a key submarket within Metro Phoenix. The property’s strategic location, diverse tenant mix, and recent improvements position it well to capitalize on the area’s strong industrial fundamentals and continued growth.”

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.8 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news