LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces the acquisition of a logistics development in western Germany on behalf of LaSalle E-REGI via LaSalle’s regulated platform in Germany. The asset has been acquired from the German logistics subsidiary of a Cologne-headquartered online retailer, in a sale-and-leaseback transaction.

The logistics property is a high-quality new-build development, which was completed in September 2019. It has a total area of over 44,000m2. The asset is currently single-let to a logistics subsidiary on a 10-year term and will serve as the tenant’s European logistics headquarters.

The property is located in Euskirchen in the greater Cologne region of North-Rhine-Westphalia, Germany’s largest state by population. It is situated 30km from Bonn, 40km from Cologne and 70km from Aachen and is well connected to the major A1, A61 and A565 highways which form an integral part of the regional motorway network.

Uwe Rempis, Fund Manager at LaSalle Investment Management, said: “We’ve been steadily increasing LaSalle E-REGI’s exposure to the logistics sector to capitalise on the strong tailwinds provided by the continued growth of e-commerce and online retailing. With the large population of the greater Cologne region served by a relatively low and constrained supply of modern logistics properties, this investment in a state-of-the-art facility in Euskirchen will offer our investors stable long-term returns and attractive yield.”

Andreas Wesner, Head of Acquisitions for Germany at LaSalle, said: “This is a very well-located asset in an area with scarcity of available logistics space. Due to its long-term lease structure and high flexibility in regards of third-party usability, this is an excellent fit for LaSalle’s pan-European fund and highlights our ability to source high-quality assets.”

LaSalle was advised by Pinsent Masons (legal), Gleeds (technical), Colliers (commercial) and Knight Frank (valuation).

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management is pleased to announce it has been named a Best Place to Work in Money Management for 2019 by Pensions & Investments (P&I).

The annual survey and recognition program hosted by P&I is dedicated to identifying, measuring and recognizing the best employers in the money management industry. This is LaSalle’s fourth-consecutive year being recognized. For a complete list of the 2019 winners, click here.

Jason Kern, LaSalle Americas CEO, said: “It is an honor to once again be recognized as a best place to work in our industry by P&I. This award demonstrates our emphasis on maintaining a collaborative atmosphere that ultimately benefits our clients and employees alike. We will continue to promote a culture that emphasizes performance and service for our clients, while ensuring our employees have the necessary resources for personal growth and development.”

Amy B. Resnick, P&I Editor, said: “This year’s winners stand out for their commitment to their people and the communities in which they operate. The pressures on asset managers and advisers are not going away. These firms know that their employees are the greatest assets they have to meeting those challenges, developing and maintaining a competitive advantage. Employees at these top-ranked firms most often cited, their colleagues, the firm’s culture and the benefits as the things that make it a great place to work.”

Pensions & Investments partnered with Best Companies Group, an independent research firm specializing in identifying great places to work, to conduct a two-part survey process of employers and their employees. The first portion consisted of evaluating each nominated company’s workplace policies, practices, philosophy, systems and demographics. This part of the process was worth approximately 25% of the total evaluation. The second portion consisted of an employee survey to measure the employee experience. This part of the process was worth approximately 75% of the total evaluation. The combined scores determined the top companies.

About Pensions & Investments

Pensions & Investments, owned by Crain Communications Inc., is the 47-year-old global news source of money management. P&I is written for executives at defined benefit and defined contribution retirement plans, endowments, foundations, and sovereign wealth funds, as well as those at investment management and other investment-related firms. Pensions & Investments provides timely and incisive coverage of events affecting the money management and retirement businesses. Visit us at www.pionline.com.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, is pleased to announce the launch of the LaSalle Japan Property Fund (the “Fund”), a private open-ended core real estate fund.

The Fund invests in core properties in Japan and launched with JPY 61 billion (US$560 million) of initial equity commitments from Japanese investors along with loans extended by major Japanese financial institutions.

The initial portfolio includes six assets that have been selected based on LaSalle’s Research and Strategy framework of Demographic, Technology and Urbanization (“DTU”), for a purchase price of JPY 105 billion (US$965 million). The Fund will invest mainly in the Japanese cities of Tokyo, Osaka, Nagoya and Fukuoka in diversified assets across the office, industrial, retail and multifamily sectors. The Fund aims to grow to JPY 200 billion (US$1.8 billion) in three years and JPY 300 billion (US$2.7 billion) in five years.

The Fund will leverage the established platform of LaSalle, one of the world’s leading dedicated real estate firms, with broad experience managing diversified open-ended core funds, including similar offerings in the US, Canada and Europe. The Fund held its initial closing with commitments from Japanese investors and will target capital from international investors in the future.

Mark Gabbay, CEO, LaSalle Asia Pacific, said: “We are excited to launch our first private open-ended core fund in Asia with a sizeable initial portfolio that, given its high asset quality, potential to generate strong recurring cash flows and desirable locations, directly aligns with the vehicle’s investment parameters. Japan’s large, transparent real estate market is one we know very well, providing us with a sustainable competitive advantage as we invest into core assets. This advances some of our global and Asia Pacific regional strategies which is to target core assets with stable income generation and to offer our global investors access to a suite of products comprising a diverse range of real estate investments.”

Keith Fujii, CEO, LaSalle Japan, said: “The creation of the LaSalle Japan Property Fund following the launch of the publicly traded J-REIT in 2016- LaSalle Logiport REIT, enhances our products with core investment strategies in Japan. Along with our strength in opportunistic investments and asset development capabilities, we are strong believers in the long-term potential of the Japanese real estate market. We are an experienced team of professionals with a strong track-record of transactional execution, leasing, asset management and investment performance in the Japanese market and aim to build a high-quality portfolio of income-producing assets.”

Ryota Morioka, Fund Manager, LaSalle Japan Property Fund, said: “Strong market fundamentals across Japan, combined with transparent capital markets, depth of existing stock and high barriers-to-entry make the core real estate market a compelling strategy in the current environment. For LaSalle Japan Property Fund, we seek to leverage our existing relationships in the office, retail, industrial and multifamily sectors to create a high-quality, diversified portfolio of stabilized core assets.”

This release does not constitute an offer to sell or a solicitation of an offer to buy an interest in the Fund. A private offering of interests in the relevant Fund vehicle is being made only to certain qualified investors pursuant to the applicable confidential private placement memorandum. Within the European Economic Area (EEA), the Fund is only available to professional investors in EEA member states where marketing has been registered or authorized in accordance with local requirements. A full list of the relevant EEA member states is available from LaSalle on request.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company News and Events

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces the appointment of Petra Blazkova as Senior Strategist within its European Research & Strategy team, with responsibility for overseeing Continental European market analysis from the London office.

Petra joins LaSalle from Real Capital Analytics, where she had worked as Senior Director, Asia-Pacific Analytics, since 2015. Prior to that she was based in Singapore as Head of Asia Pacific Capital Markets Research at CBRE, having joined the company in 2011. From 2008 to 2010 she was Head of EMEA Capital Markets Research within the Capital Markets division of JLL, the commercial real estate services firm of which LaSalle is an independent subsidiary, where she executed research to inform the direct and indirect European real estate allocations of leading institutional clients. She previously held research roles focused on the European real estate market at King Sturge (now merged with JLL) and Colliers International.

In her role, Petra will report into the Head of Research and Strategy, Europe.

Jacques Gordon, Global Head of Research & Strategy at LaSalle, says: “Petra is a great addition to our European Research & Strategy team, and we are delighted to welcome her to LaSalle. She brings extensive experience in providing detailed insight into real estate markets and investment trends to a blue-chip client base of institutional investors, fund managers and developers. LaSalle is committed to providing our clients with market-leading analysis that allows them to tailor their real estate allocations and investment strategy to their specific needs and Petra’s appointment will further enhance our proprietary research and coverage of the European market.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) announced that its flagship core real estate fund in Canada, LaSalle Canada Property Fund (“LCPF” or “the fund”) along with its Custom Accounts group representing Frankfurt-based fund-servicing company Universal-Investment on behalf of Bayerische Versorgungskammer (BVK), and two managing owners, North American Development Group and Canderel, have acquired Edmonton City Centre (ECC). The property includes the Edmonton City Centre retail component, TD Tower, Oxford Tower and Centre Point Place spanning three city blocks in downtown Edmonton’s central business district.

Collectively, the office component, including TD Tower, Oxford Tower and Centre Point Place, combined with retail leasable areas represent nearly 1.4 million square feet in a mixed-use asset, complemented by four parking components with a total of 2,500 stalls. North American Development Group entities, including CentreCorp Management, will provide property management services and leasing for the ECC retail component, and Canderel entities, including Humford Management, will provide property management services and leasing for the office and non-retail components. Mortgage origination sourcing and placement for the acquisition was provided by an entity related to Forgestone Capital.

John McKinlay, LaSalle Canada CEO, said: “We are pleased to complete this transaction with our partners, as it represents a rare opportunity to own a landmark mixed-use asset with a strong tenant roster in the heart of Edmonton’s downtown core. This acquisition aligns well with LCPF’s objective to provide investors with immediate exposure to a diverse and mature portfolio of assets focused in Canada’s six major markets. We are pleased with the strong relative performance of the Fund and the sustained interest from multinational investment partners.”

Michael Cornelissen, Senior Vice President of Acquisitions for LaSalle Canada, added: “This transaction is emblematic of our ability to source world-class properties with industry-leading partners. We see tremendous potential in the ECC acquisition given the growth momentum of the adjacent Ice District, light rail transit connections that are supporting continued urban gentrification and population growth.”

Spanning three city blocks, ECC is situated at the epicenter of Edmonton’s financial core and is the major shopping centre downtown, with an evolving service, convenience, entertainment and food and beverage-focused offering. The retail and parking portions benefit from their Pedway connectivity and adjacency to the recent downtown Ice District development, Canada’s largest mixed-use sports and entertainment district with 180 events per year.

The Edmonton core has grown from a residential population of 10,000 in 2008 to approximately 15,000 in 2019, and is projected to have 18,000 residents by 2020. The dramatic increase in residential condominium and rental development has been driven by inbound urban migration, with 1,600 units recently completed, 1,400 residential units under construction, and an additional 3,100 units proposed in proximity to ECC.

Surrounding residential developments and recently completed office developments are driven by a strong urbanization trend in Edmonton. This trend will undoubtedly further increase the foot traffic coming to ECC beyond the traditional daytime office employee population.

About LaSalle in Canada

On an aggregate basis, LaSalle has executed more than C$6 billion in Canadian real estate since 2000, providing it with an in-depth understanding of the market. The formation of LCPF expanded LaSalle’s existing Canadian real estate product suite and investment vehicles, which include a series of closed-end commingled funds as well as separate accounts.

About LaSalle Canada Property Fund (LCPF)

LCPF is an open-ended fund targeting core properties in major markets across Canada. The Fund is targeting commitments from Canadian and global institutional investors seeking access to the Canadian real estate market through a diversified, income-oriented vehicle. Launched in 2017, the Fund aims to provide investors with immediate exposure to a diverse and mature portfolio comprised of office, industrial, mixed-use, retail and multifamily assets. Through its near-term pipeline of potential future investments, the Fund will seek to take advantage of mispriced assets as it continues to grow.

This release does not constitute an offer to sell or a solicitation of an offer to buy an interest in LCPF. A private offering of interests in the relevant Fund vehicle is being made only to certain qualified investors pursuant to the applicable confidential private placement memorandum. Within the European Economic Area (EEA), the Fund is only available to professional investors in EEA member states where marketing has been registered or authorized in accordance with local requirements. A full list of the relevant EEA member states is available from LaSalle on request.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $68 billion of assets in private and public real estate property and debt investments as of Q2 2019. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit http://www.lasalle.com, and LinkedIn.

About Bayerische Versorgungskammer (BVK)

Bayerische Versorgungskammer is the competence and service center for occupational and communal pension schemes and Germany´s largest pension scheme group under public law. As a public authority of the Bavarian Ministry of the Interior, it is the joint executive body of twelve liberal professions´ and communal pension schemes. Bayerische Versorgungskammer covers about 2.2 million insured persons in total, with contributions of € 4.4 billion and € 3.2 billion pension payments annually. It currently has € 69 billion assets under management and more than 1,200 employees. Visit https://www.versorgungskammer.de/ for more information.

About North American Development Group

Founded in 1977, North American Development Group (“NADG”) has been active in the development, acquisition, redevelopment and management of over 250 shopping centres as well as multi-family and mixed-use developments comprising well in excess of 35 million square feet. Today, NADG owns over 25 million square feet of existing retail GLA in Canada and the U.S., with an additional 3 million square feet in development or pre-development. NADG has 11 offices across North America, 6 in Canada and 5 in the United States, and a team of over 225 seasoned real estate professionals. The Company’s head office is in Toronto, Ontario with regional offices in Kelowna, Edmonton, Montreal, Ottawa and Halifax. In the U.S., NADG’s head office is in West Palm Beach, Florida with regional offices in Phoenix, Dallas, Nashville and Atlanta. For more information, please visit www.nadg.com.

About Canderel

Canderel is one of Canada’s leading real estate development and management firms with in excess of $15 billion in acquisitions, development and management projects over the past 45 years in markets across the country. This translates into more than 60 million square feet of owned, managed and developed properties in the office, industrial, mixed-use and retail sectors. Regardless of the space, our vision remains to ensure long-term investment value for our clients, partners and investors. For more information, please visit www.canderel.com.

About Universal-Investment

With fund assets of around EUR 471 billion under administration, thereof EUR 380 billion in own vehicles and around EUR 91 billion in, inter alia, insourcing, well over 1,400 mutual and special investment mandates and a workforce of around 700, Universal-Investment is the largest independent investment company in the German-speaking region. With the acquisition of UI labs in January 2019, the industry-leading IT data specialist now completes the Group’s service portfolio by adding front office and data solutions. The investment company is the central platform for independent asset management and unifies the investment know-how of portfolio managers, private banks, asset managers and investment boutiques. Founded in 1968, the Universal-Investment Group is headquartered in Frankfurt/Main and has subsidiaries, branches and holdings in Luxembourg, Poland and Austria. It is one of the pioneers of the investment industry and has meanwhile become the market leader in the areas of master-KVG and private label funds. According to the 2019 PwC ManCo Survey, Universal-Investment is the largest AIFM ManCo in Luxembourg; among the Third-Party-ManCos, Universal-Investment also ranks in first place (as of August 31, 2019). More information available at: www.universal-investment.com.

About LaSalle Investment Management

About LaSalle Investment

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

And what they can tell us

Sovereign bond yields and credit spreads are simultaneously the most watched and the most enigmatic of all macro indicators. For portfolio strategists, they signal risk-on and risk-off sentiment in the broader capital markets. For property investors, they anchor valuations—initial/exit yields and discount rates—as well as borrowing costs.

Bond yields have been on a persistently downward trend for several decades (p. 5), but short-term movements have often been surprising. No doubt trade tensions, divisive politics, civil unrest, wavering economic growth and central bankers’ actions will continue to make the bond needle flutter in November and December. The outcomes of geopolitical events can be especially hard to predict; with so much noise in the system, risk aversion is likely to remain high. Indeed, professional economists and financial markets alike have been notoriously poor at predicting the path for long-term interest rates (p 4). In our view, an underestimation of the linkages between demographic forces and savings behaviour could also be a contributing factor for the persistence of ultra-low interest rates. Ageing trends in many countries are a “meta” macro force that is easily overlooked behind the daily headlines of geopolitics, central bank announcements, and economic statistics.

UN projections show that the slowing and greying trends in the world’s population are likely to be maintained or increased over the next century.

The gradual decline in long-term interest rates is certainly linked to lower growth expectations. Weaker growth is generally consistent with less inflation, implying that bond investors require less inflation compensation. When productivity growth is low (as it is now), economic growth should be roughly proportional to working-age population growth across an entire business cycle. After a string of strong decades (1950-2000), demographic trends have moved from positive to neutral (2000-2020), and are now poised to turn negative in many countries. A recent study by the UK’s Office for National Statistics highlighted that their population projections had been too optimistic, as life expectancy gains have fallen back and fertility rates disappointed. Similar recent demographic trends are found in North America and Western Europe; demographics are already a net drag on national economic growth in Italy and Japan. Meanwhile, UN projections show that the slowing and greying trends in the world’s population are likely to be maintained or increased over the next century (p. 6). As such, economic growth, risk asset returns (stocks, corporate bonds and real estate) and inflation will all likely remain constrained. Post-Keynesian macroeconomic theory1 did not contemplate the uncoupling of the money supply, inflation and consumption/investment behaviour, so central bank remedies have been hard to identify. Recent announcements by Mario Draghi as he steps down from chairing the ECB, by Jerome Powell at the US Fed, and by Kuroda-san at the Bank of Japan all point to the limitations of monetary policy when short-term interest rates approach the zero bound.

As populations reach retirement age, they turn toward low-risk, liquid saving rather than higher-risk, illiquid investing, pushing sovereign bond yields lower. Data from the IMF show that the globe’s total savings has exceeded investment since the turn of the century; their forecasts suggest that this imbalance is likely to remain. Moreover, developing nations save a much larger share of their national income than developed ones (pg. 7), due in part to less mature pensions and weaker social safety nets for the elderly. So, when the rising middle class in China, India, Central Europe, and Latin America generate income in excess of their immediate needs, surplus savings are generated faster than growth in stock markets or domestic consumption. The GFC’s scars may also be evident as investing with a long horizon is dampened by fears that economic conditions tomorrow could be worse than today. Thus, ageing populations imply an increased need to focus on liability-matching, capital preservation, rising liquidity preferences, and ultimately, de-cumulation strategies.

Demographic forces are like giant container ships that move slowly but steadily across great oceans. They cannot pivot or come to a full stop quickly. The demographics of ageing are likely to remain in play for many years to come, so real estate investors should keep in mind the following:

- Demographic themes have a major influence on the resilience of assets, sectors and locations. One approach is to focus on properties and locations that cater to the growth of specific cohorts (e.g., ageing, active adult populations or younger millennials). A subtler approach is to examine how younger and older cohorts interact over time, and how the locational preferences of different cohorts affect each other.

- Demographics also have a “meta” effect on macro factors like capital markets. Persistent downward pressure on risk-free rates could mean that real estate yields will decline further and remain below their previous norms. Lower for longer can become lower forever in ageing societies. Real estate’s ability to generate income will continue to attract institutional capital, particularly as populations (and pension schemes) mature. When sovereign bond yields fall or go negative, pension administrators and individual households will both turn to alternatives like real estate to generate steady income.

- Demographic trends are linked to both the capital markets and the space markets. Unlike economic and political events, population shifts get fewer headlines and move more slowly. Their influence on real estate investment strategies is often underestimated and well worth our close attention.

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces the sale of a warehouse and distribution facility currently leased to Hobbycraft, the UK-based arts & crafts retailer, in Burton upon Trent for a further 8 years. The asset has been acquired by Cabot Properties, for £20 million.

The Hobbycraft facility is based in the Centrum 100 Business Park and comprises a total area of c.213,000 sq ft. Built in 2006, the asset is a modern and high-quality facility that conforms with institutional-grade specifications for industrial properties. LaSalle acquired the property in 2013.

Sophie Simmonds, Fund Manager at LaSalle Investment Management, said: “We’re pleased to have realised a highly competitive return for our client on this investment, driven by both capital growth and the stable rental income generated during the asset’s six-year hold period. Investor appetite for distribution and logistics properties remains strong and we will continue to capitalise on this buoyant market to focus our industrial investment in those assets that combine prime locations, strong transport connections and attractive supply-demand dynamics.”

LaSalle was advised on the sale by Savills.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $67 billion of assets in private and public real estate property and debt investments as of Q2 2019. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit https://www.lasalle.com, and LinkedIn.

Investing Today. For Tomorrow.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

About Cabot Properties

Formed in 1986, Cabot was founded with the vision of bringing together a collaborative team of experienced real estate professionals dedicated to creating portfolios of profitable investments through the execution of sound and disciplined strategies. The six senior principals have collectively spent 18 years together executing industrial real estate transactions in markets across the U.S. and Europe and through multiple real estate cycles. In its 30 plus year history, Cabot has invested $9.6 billion in 181 million sf of industrial real estate, of which $7.3 billion has been realized. During this time, Cabot has managed and operated over 1,390 buildings comprised of over 3,800 tenants.

Company news

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has advised its pan-European fund Encore+ on an acquisition of an urban logistics warehouse on the edge of Paris. The property is single let to a blue-chip tenant.

The property is located in Gonesse, a popular and well-established logistics submarket in the north of the city of Paris. It is ideally situated on the main distribution axis between north and south France, strategically located at the crossroads between the A1 and A3 motorways and close to both Paris-Le Bourget Airport and Charles De Gaulle Airport.

Gonesse’s thriving urban logistics market hosts globally renowned occupiers such as Amazon and the logistics group GEODIS. The area is also set for development as two new metro stations of the line 17 will be built in the vicinity of the property as part of the Grand Paris project. In addition, the €3bn EuropaCity project, a major retail, residential and cultural hub, is expected to be developed on the adjacent land plot.

The property is fitted to a class A specification and offers close to 25,000m² of rental space, consisting of four storage cells, 26 docking bays and office space.

David Ironside, Fund Manager of Encore+, LaSalle Investment Management, said: “This is a great asset close to Paris in one of Europe’s fastest-growing logistics markets. Thanks to the significant growth of e-commerce in France – the online share of total retail sales in France is currently growing at a double-digit rate – the demand for urban logistics continues to increase. The development of the town of Gonesse will be a constraint on the supply of further logistics capacity in the area. This indicates that the asset will experience a positive supply-demand dynamic while delivering long-term secured income in the coming years.”

Beverley Shadbolt, Country Manager for France at LaSalle Investment Management adds: “After the acquisition and development of our logistics project in Tigery announced at the beginning of the year, this is another important acquisition for Encore+ that strengthens our position in the logistics sector in France. It once again proves our ability to seize excellent opportunities in France.”

LaSalle was advised by C&C (Notary), Baker McKenzie (Lawyers), Etypo (Technical) and KPMG (Tax).

The investment strategy for Encore+ focuses on improving assets and creating growth by seeking opportunities to actively manage assets to deliver superior income returns.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) announced its completion of the acquisition and leasing of Logiport West Anseong located in Anseong City, South Korea. The project’s gross floor area is 14,146 pyung (approximately 503,400 sq.ft.) and the construction was completed in December 2018.

Logiport West Anseong Highlights:

- High specification logistics facility with four-storeys of storage floors and a mezzanine floor for office use.

- 64% of gross floor area is dry storage compartments, 36% was designed for temperature-controlled storage.

- Project was significantly pre-leased from tenant demand prior to construction.

- Project has multi-tenants, anchored by the largest third-party logistics service provider (by revenue) in South Korea.

- Project has truck access to each floor without circular ramps or elevators for direct loading and unloading.

- Located in western Anseong, approximately 70 minutes from Gangnam Business District and directly near expressways for connectivity throughout Gyeonggi Province.

Steve Hyung Kim, LaSalle Investment Management Senior Managing Director, Head of Acquisition & Asset Management – South Korea commented, “We are pleased with the acquisition and leasing completion of Logiport West Anseong, LaSalle’s first warehouse investment with temperature-controlled storage capabilities in South Korea. We believe the growth in e-commerce and logistics service provider sectors will continue to drive occupier demand, especially for the higher quality modern warehouses in “last mile” locations. We plan to selectively develop and acquire additional logistics facilities going-forward.”

Se Hwan Oh, LaSalle Investment Management Senior Vice President, Development & Asset Management – South Korea said, “We are excited with the acquisition of Logiport West Anseong, a four-level modern mixed-use logistics property with truck access to all floors built to a high specification. With a healthy leasing market as well as the quality and location, it was significantly pre-leased with a well-diversified sector mix. We see continued demand for cold storage space in the market, and look forward to supporting the needs of our customers.”

As of today, LaSalle manages approximately US$3.9 billion AUM in industrial assets across the Asia Pacific region.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, has acquired a flexible-use warehouse fully let to the discount supermarket chain DIA. The asset, which is located near Zaragoza in Spain, has been acquired on behalf of LaSalle’s E-REGI fund for over €20 million.

DIA Logistics was completed in 2016 and has over 31,000m2 of rental space, around 200 parking spaces and more than 60 loading docks. The property is capable of supporting multi-tenant use, including over 13,000m2 of cold storage divided into six separate modules. DIA, the sole tenant, operates more than 7,000 stores internationally, making it one of Europe’s largest food sector franchises.

Zaragoza is located in one of the most attractive logistics markets in Spain, benefiting from its proximity to Madrid, Barcelona, Valencia and southern France. The city is a key freight corridor between the Mediterranean and Atlantic coasts, with transport infrastructure including Zaragoza Maritime International, the second biggest dry dock in Spain, and Zaragoza International Airport, the third largest cargo airport in Spain by volume.

Uwe Rempis, Fund Manager at LaSalle said: “This is an important acquisition for the E-REGI fund as it increases our investors’ exposure to logistics, one of our target sectors. Spain’s logistics market is particularly attractive as it has experienced strong occupier demand in recent years, largely thanks to the growth of e-ecommerce, which is deriving demand for strategically located, large logistics units than can serve the whole country. We expect this trend to continue and so are pleased that we have been able to advise on this acquisition.”

LaSalle E-REGI is an open-ended pan-European real estate fund that aims to generate stable income return from a diversified core portfolio (office, retail, logistics) in transparent markets. The investment strategy is based on a quantitative model, the European Regional Economic Growth Index (E-REGI), which has been developed by LaSalle since 1999 and identifies the cities and regions across Europe that have the greatest economic growth potential over the short to medium term. The Fund also includes additional screening filters such as JLL’s Global Real Estate Transparency Index and minimum market size.

LaSalle was advised by Hogan Lovells (legal); KPMG (tax) and Malcom Hollis (technology), RPEurope (Commercial)

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces that Richard Craddock has joined to the Debt & Special Situations team in Europe, headed by Amy Klein Aznar. Richard joins as Managing Director for its successful Whole Loan programme (LWLS I/II) which launched earlier this year with €600 million of initial commitments and invests in whole loans across Western Europe, with an initial focus on France, Benelux, Iberia, and Ireland.

Richard has over 12 years of experience in the European real estate finance market and joins the team from Wells Fargo where he was a Director of Commercial Real Estate, supporting investors in originating and structuring financing solutions across a wide range of asset classes and funding structures.

Amy Klein Aznar, Head of Debt & Special Situations at LaSalle, says: “Richard is a great addition and strengthens our senior Debt and Special Sits team. I am delighted that Richard is joining to focus on our successful and growing Whole Loan debt strategies. Given the growth and heightened investment activity of our Debt and Special Situations business in recent years, we have made a number of strategic hires and grown the team to over 30 people and we are well placed to capture investment opportunities across Europe.

LaSalle’s Debt & Special Situations has raised €4.5 billion to date, providing borrowers with a wide range of financing solutions by actively investing through its four complementary investment strategies: LaSalle Real Estate Debt Strategies (LREDs), LaSalle Residential Finance (LRF), LaSalle Whole Loan Strategies (LWLS) and Special Sits. LaSalle provides whole loans, mezzanine, development finance, stretched senior loans, preferred / joint venture equity across the UK and Western Europe.

The Debt Investments & Special Situations team has a strong track record of developing strategic relationships with best-in-class borrowers, and has significant experience across various sectors, geographies, deal sizes, and capital structures. Since 2010, the team has committed €3.6 billion of investments across 72 individual transactions.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

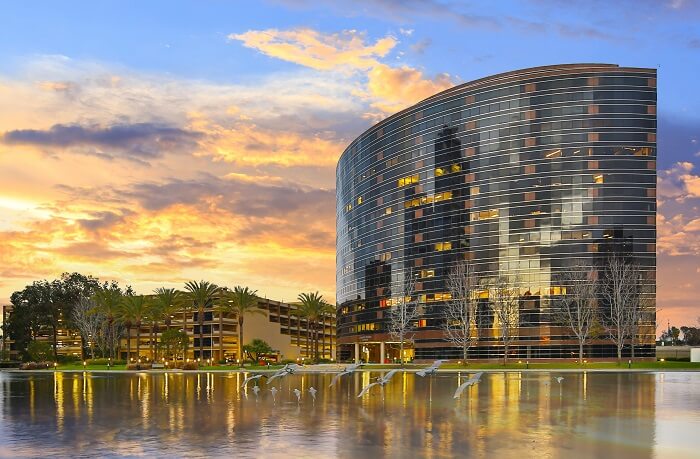

LaSalle Investment Management (“LaSalle”) announced that it has acquired partial interest in the world headquarters and life sciences campus of Illumina (Nasdaq: ILMN), a global leader in DNA sequencing and array-based technologies. LaSalle made the investment on behalf of its U.S. core open-end real estate fund, LaSalle Property Fund (“LPF”) with the property’s developer, an S&P 500® U.S. equity REIT. This transaction represents LaSalle’s first investment in the life sciences property sector.

Located in the heart of the coastal infill submarket of University Town Center in San Diego, California, the Class A property consists of 793,000 square feet spread across six, state-of-the-art office, lab, and accessory buildings on 44 acres. The property is 100% occupied by Illumina and is under a long-term lease agreement serving as their world headquarters. As part of the transaction, LPF will participate with other campus co-owners to invest in potential future projects that will expand and densify undeveloped land located on the campus site.

Jim Garvey, Portfolio Manager for LaSalle Property Fund, commented: “This acquisition is a strong fit for our portfolio and represents a continuation of our ability to source world-class properties that provide an attractive income return with the potential for significant appreciation. We are pleased to have entered the life sciences sector with a best-in-class partner in a leading life sciences submarket, University Town Center.”

Erick Paulson, Managing Director of Acquisitions at LaSalle, said: “We are excited to acquire this world-class property in a highly strategic location, as San Diego is one of the largest U.S. biotech hubs. The San Diego market is comprised of over 15 million square feet of life science space, supported by strong occupancy and rental fundamentals, and The University of California at San Diego registers as the single greatest source of graduates in biomedical and biological sciences in the nation.”

Steve Bolen, Head of U.S. Healthcare Real Estate at LaSalle, added: “This acquisition aligns LaSalle with a market-leading life sciences property that is uniquely positioned to thrive in the growing field of DNA sequencing and array-based technologies, serving end-users in the research, clinical and applied markets. In addition to its position as a strong life science submarket, University Town Center is widely regarded as the premier medical office submarket within San Diego, given its proximity to four of the MSA’s major hospital campuses, including UCSD Health Jacobs Medical Center, Scripps’ Memorial Hospital La Jolla, Scripps’ Green Hospital, and the VA San Diego Hospital System.

For more than 15 years, LaSalle has been one of the most active private equity investors in the medical office sector and we are excited to make our flagship investment in the life sciences field, with such a high-quality partner and irreplaceable property.”

About LaSalle Property Fund

LPF invests in and manages a diversified portfolio of high quality, stabilized real estate and real estate-related assets in the industrial, multifamily, office and retail sectors in top markets across the United States. Drawing from LaSalle Investment Management, Inc.’s 40-year record of accomplishment of core real estate investment on behalf of sophisticated institutional investors, LPF aims to provide attractive risk-adjusted income returns with the potential for superior long-term capital growth through an investment process and platform that leverages LaSalle’s industry-leading market research.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”), the global real estate investment manager, is pleased to announce that it has arranged over €200 million of mezzanine loans to refinance three portfolios of last mile logistics and industrial assets for real estate funds advised by Blackstone. The portfolios include 264 assets located in key urban locations throughout Germany, Netherlands, France and Denmark.

The deals are part of the latest fund in the LaSalle Real Estate Debt Strategies programme, LREDS III, which raised over £800 million of commitments in 2017. Through the LREDS III fund, LaSalle’s Debt Investments and Special Situations team invests across Western Europe, lending against assets which offer compelling risk-adjusted returns across mezzanine and whole loan investment opportunities. LREDS III is ahead in terms of its deployment schedule, having committed to over £360 million of loans to date in 2019. This accelerates the fundraising for the successor fund in the series, LREDS IV, which has a target capital raise of €1 billion and is set to launch later this year.

Ali Imraan, Managing Director, Debt Investments & Special Situations at LaSalle said: “We’re delighted to provide financing to Blackstone in the build-up of their strategic European last mile logistics portfolio, Mileway. These three mezzanine loans follow on from two previous financings of the same strategy that we have done for Blackstone in 2018 in the UK, Germany and Netherlands. It also undelines our ability to underwrite large pan-European portfolios, leveraging the breadth of our European business.”

Amy Klein Aznar, Head of Debt Investments & Special Situations at LaSalle said: “We have been large and consistent providers of debt in the European Logistic space and these latest investments are a continuation of our support for Blackstone, which started with the build-up of the Logicor logistics portfolio in 2012.

Overall, we have arranged over £700 million of financings over the past several years in European Logistics for our LREDS and Whole Loan series across all major Western European countries.”

The Debt Investments & Special Situations team has a strong track record of developing strategic relationships with best-in-class borrowers, and has significant experience across various sectors, geographies, deal sizes, and capital structures. Since 2010, the team has committed €3.6 billion of investments across 72 individual transactions.

LaSalle’s European debt series also includes the €1 billion LaSalle Residential Finance series (LRF III) which is active in residential, student housing, hotel, and healthcare development lending, throughout Western Europe and the UK and the €600 million LaSalle Whole Loan Strategies programme, launched in December 2018, whose strategy is to originate and hold whole loans with loan-to-values ranging from 70 per cent up to c.80 per cent across various asset types, and targets financings between €25 million and €100 million plus.

Eastdil acted as Debt Advisor to Blackstone.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Simon Marx, Investment Strategist, was interviewed by Dani Burger on Bloomberg Daybreak LIVE on Monday morning, discussing findings from the LaSalle E-REGI Index 2019 on European economic growth and the top European cities in which to invest. For 20 years, LaSalle has published its annual European Regional Economic Growth Index – or “E-REGI” – which identifies the European regions and cities with the best growth prospects. The index judges the relative strength of future occupier demand for commercial real estate and proves valuable as the basis of any real estate investment strategy.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

London tops Index for 11th time since 2000 Almost all cities in the UK improve in this year’s ranking Manchester overtakes Edinburgh to be the second-highest ranked UK city

For the third year running and the 11th time since 2000, London has retained the top spot on the European Regional Economic Growth Index (“E-REGI”), published today by LaSalle Investment Management (“LaSalle”), the global real estate investment manager. The Index recognises London’s medium-term economic growth prospects as the best in Europe and shows that despite Brexit uncertainty, the UK capital remains the continent’s leading market for future real estate occupier demand.

The E-REGI Index attaches a score to each European region based on its medium-term economic growth prospects, its level of human capital and wealth and the quality of the business environment, relative to the European average. Almost all UK cities improved in the ranking, with Manchester (33rd), Glasgow (51st) and Liverpool (58th) all rising more than 15 spots compared to other cities in Europe. This can be mainly attributed to an improved service employment outlook – for example, in Manchester strong expected employment growth in professional activities and administrative & support service activities has contributed significantly to the city overtaking Edinburgh (34th) as the second-highest ranked UK city.

Despite many of the UK’s cities closing the gap on the capital, London also improved its relative score and even extended its lead on Paris in second place, again primarily due to a more positive service employment outlook compared to last year. The ranking is based on an assumption that the UK will exit the EU with a deal by March 2020 and remain in a customs union with the EU for an extended period. LaSalle recognises that a no-deal Brexit would negatively impact the rankings of the UK’s cities, with London most exposed.

Simon Marx, Director of Research & Strategy at LaSalle said: “Much has changed during the 20-year history of the E-REGI Index, but London has always held a spot close to the top of the Index, despite numerous economic challenges in the past two decades, from the dotcom crash to the global financial crisis. While the outcome of Brexit will clearly have a significant impact on London’s ranking, the city has showed tremendous resilience over the last two decades and remains unparalleled in Europe in terms of the scale, flexibility and diversity of its workforce and skills base.”

He added: “The E-REGI Index identifies the European regions and cities with the best economic growth prospects, which when combined with detailed real estate knowledge, supply-side information and relative pricing has proved to be a valuable tool for portfolio construction, determining real estate market outperformance and investment strategy throughout its 20 year history.”

Other highlights of LaSalle’s 2019 E-REGI Index:

- Paris sits in second position for a third consecutive year, experiencing its highest score ever. The French capital leads the LaSalle European Human Capital Index, which drives part of the E-REGI Index score.

- Dublin falls into the late cycle category, whereby certain cities have peaked in their economic cycles, and suffers from lower growth prospects over the new forecast period 2019-23. As a result, Dublin fell three places but retained its top 10 status in 9th position.

- Amsterdam continued its upward trajectory to reach 16th position, its highest rank since 2006. The large concentration of high value-added sectors adds to the city’s higher-than-average productivity, while the city’s vibrant quality of life attracts foreign talent and tech start-ups, driving competitiveness further.

- Nordic cities continue to feature in the top-end of the ranking due to strong human capital and wealth scores, with three in the top ten (Stockholm, Oslo and Copenhagen-Malmö).

- Istanbul replaces Stockholm in third place thanks to strong GDP and employment scores, and it has also seen a large improvement in its employment growth prospects and human capital.

- German cities were generally slightly weaker in the Index as a struggling industrial sector amid weak global trade and elevated uncertainty weakened the country’s economic overall outlook, with only Munich (5th) remaining in the top 10.

- Of all European cities, Bucharest, a popular IT outsourcing location, and Moscow, whose employment prospects have been boosted by pension reform, made the most progress in the ranking this year, jumping to 45th (+40) and 49th (+48) respectively.

Looking ahead, there are also factors which are not currently captured by the E-REGI Index and that are becoming increasingly important to the success and ultimately real estate performance of cities. Factors such as sustainability, urban density, liveability and wellbeing, climate change resilience and accessibility are becoming increasingly important and data availability enabling the measurement and comparability of these factors across geographies is improving. Looking ahead at the next 20 years the E-REGI Index will attempt to systematically capture features such as environmental quality including air quality, housing affordability, the quality of transport, the quality of social infrastructure, the presence of innovation industries and the widespread lack of mixed-use assets.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle is pleased to announce that its German business, LaSalle Investment Management Kapitalverwaltungsgesellschaft mbH (KVG), has appointed Roberto Carrera to the role of Managing Director. The KVG was founded in 2010. The KVG manages €4.8 billion in AUM as of June 30th 2019.

The Board of Managing Directors of the KVG now consists of the following three Managing Directors: Roberto Carrera, Uwe Rempis and Stefan Pelkofer. These responsibilities, in turn, are divided as follows; Uwe Rempis is responsible for overseeing all matters relating to Fund Management and Investment; Stefan oversees Finance, Risk Management, Compliance and HR matters and Roberto will oversee Asset Management, Financing and Public Relations.

Roberto is the European Head of Financing, based in Munich, having been with LaSalle since 2012. Since then, he has overseen €6.7 billion of borrowing and debt arrangements for LaSalle across multiple European jurisdictions, several asset classes and investment styles. He has over 20 years of experience in corporate and commercial real estate finance across Europe, having worked in Paris, Madrid and Munich.

Jamie Lyon, the Chairman KVG Supervisory Board at LaSalle, said: “I am delighted to announce that Roberto has joined the Board of the KVG. His experience across multiple European jurisdictions will be invaluable to the business and underlines LaSalle’s commitment to its KVG business and its importance within our European platform.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Long-term leased asset for the open-ended pan-European real estate fund LaSalle E-REGI KONTOR is part of the development project “Wirtschaftswunder” in central location

LaSalle has acquired the KONTOR office building in Berlin on behalf of LaSalle E-REGI. The seller is PW Real Estate Fund III, a real estate fund affiliated with Aermont Capital.

KONTOR is centrally located in Berlin-Schöneberg between Potsdamer Platz and City West and is leased on a long-term basis to the agricultural seed producer KWS. The building is part of the commercial ensemble “Im Wirtschaftswunder” by Aermont Capital in collaboration with Pecan Development. The building offers almost 10,000m² of leasable space over seven floors and two roof terraces. The KONTOR is currently undergoing fundamental renovation with completion scheduled for the end of 2019. After the renovation, all rented spaces will meet industry standards for high-quality building technology.

“Im Wirtschaftswunder” is being created as construction and revitalization project with c. 33,000 sqm leasable space at the former Commerzbank property at Potsdamer Straße. In addition to KONTOR the ensemble comprises also FORUM and the new building ZENTRALE, which shall function as the new German headquarters of Sony Music Entertainment.

The Berlin office market is the fastest developing office market in Germany. It has grown by more than 15 per cent since 2012. The demand for such properties is robust and is expected to further develop positively in the coming years. The vacancy rate has been declining for at least a decade and is currently at an all-time low of 1.4 per cent.

Uwe Rempis, Fund Manager of LaSalle E-REGI, says: “The Berlin office market is likely to remain friendly to long-term investors. Despite intensive construction and development activity, the total number of space is predicted to rise by 2 per cent in 2019 alone and we see no signs of easing. Therefore, we also expect a positive development in rental income for our investors. The property thus fits perfectly into our strategy, which focuses on investments in core locations in major European cities and capitals”.

LaSalle E-REGI is an open-ended pan-European real estate fund that aims to generate stable income return from a diversified core portfolio (office, retail, logistics) in transparent markets. The investment strategy is based on a quantitative model, the European Regional Economic Growth Index (E-REGI), which has been developed by LaSalle since 1999 and identifies the cities and regions across Europe that have the greatest economic growth potential over the short to medium term. The Fund also includes additional screening filters such as JLL`s Global Real Estate Transparency Index and minimum market size.

LaSalle was advised by Mayer Brown LLP (legal); Gleeds (Technical); Howden (insurance broker); Liberty (Insurance for W&I); Knight Frank (valuation) and Savills (buy-side). Aermont and Pecan were advised by Greenberg Traurig Germany LLP. BNP and Colliers have acted as transaction brokers in the process.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found