-

The future “steady state” of trade policy remains unknowable because it rests on a host of complex factors. Want to read more?

Two 90-day pauses, one on retaliatory tariffs with China and the other on the so-called “liberation day” tariffs, have not liberated markets from uncertainty. However, these course corrections have at least shown that the US administration has limits to its willingness to tolerate extreme market movements, particularly increases in Treasury yields, or severe outcomes for consumers such as product shortages1. They have also contributed to a more benign recent market environment than at the beginning of April.

That said, the future “steady state” of trade policy remains unknowable because it rests on a host of complex political, legal and diplomatic factors2. Even if it became clear where tariffs will settle, economic and real estate forecasting would still be challenging because the US administration has proposed a large and rapid change in the global trading system with little historical precedent3. Moreover, there is the additional variable of time — the longer uncertainty hangs over the economy, the greater the likely cost to investment and growth.4

What is a real estate investor to do? In our last ISA Briefing note, “Working backwards: Dealing with unprecedented policy uncertainty,” we cautioned against spending too much time or effort guessing exactly what comes next. Instead, we argued for pursuing strategies that are broadly prudent, aligned with long-term themes and likely to enhance the resilience of a portfolio, regardless of the state of the world. Our specific recommendations include seeking diversification and building a permanent allocation to real estate debt.

In this note, we take our analysis a step further to highlight three key relativities that we suspect are likely to hold, even as the absolute path of policy and the economy is unknown. These comparative assessments are rooted in our analysis of private real estate markets, confirmed by signals from public markets, and framed in the context of our Fair Value Analysis (FVA) approach. Even with all the uncertainty around absolutes, seeking conviction in key relativities can be helpful when making investment decisions.

1. Real estate relative to other asset classes

Real estate as an asset class does not exist in isolation. Although all assets face uncertainties due to trade turbulence, we believe real estate is relatively well positioned in today’s environment for three reasons. First, real estate has several attractive structural characteristics that should help it weather today’s stormy environment. Real estate values are underpinned by defensive, durable cash flows, backed in numerous sectors by long leases5, and supported in many cases by secular demographic drivers. In addition, the link between market rents and the cost of construction materials provides an indirect and imperfect, but meaningful, connection between inflation and property values6. Tariffs are likely to drive up the cost of construction in any country that raises tariffs on key construction inputs, and that pushes up the rents required to justify new development.

Second, these structural factors are reinforced by mostly healthy current real estate market conditions, as property markets today are not characterized by major imbalances. In our ISA Outlook 2025, we noted falling supply levels, a repricing process mostly in the rear-view mirror, and conservative overall leverage levels in most segments of the market. These factors continue to apply, despite new uncertainties around trade.

Third, real estate valuations appear less stretched than those of several other major asset classes, especially large-cap equities. As nominal rates rose and credit spreads fell over the past few years, real estate underperformed general equities, cumulatively underperforming by ~30% since the end of 2021 (see adjacent chart). As the environment has shifted, it is possible that real estate’s underperformance could reverse. From a relative valuation perspective, global REITs would need to outperform equities by around 15-20% as of April 30th to simply bring the historical earnings yield relationship back in line with its long-term average.7

2. Relative sector outlook

The trade war has the potential to impact virtually every assumption that goes into a Fair Value Analysis (see sidebar for more background on FVA). When the components of FVA are especially uncertain and volatile, as they are today, it helps to focus on the elements for which greater conviction is possible. Moreover, we recommend emphasizing relative assessments, which can be easier to build conviction around than absolute forecasts.

The channels by which tariffs impact real estate sectors can be classified as either direct and specific, or indirect and macro-related. In terms of trade-specific channels, we highlight that some sectors have unique dynamics that are directly shaped by barriers to the flow of goods. The poster child for this is industrial/logistics real estate. Given this property type literally houses the economy’s supply chains, it is clearly exposed to forces that are likely to disrupt and potentially reshape supply chains.

In the near term, decision-making by logistics occupiers is likely to slow.8 Markets and sub-markets exposed to trade, such as around major ports, may see reduced demand. It is worth noting that trade-related logistics demand generally tends to be greater nearer the points of import and consumption, rather than the points of manufacture and export. Thankfully, the long-term context of logistics real estate is one of positive structural growth, which means this impact takes the form of a downgrading, not a devastation, of the sector’s prospects. Moreover, in the long run, global economic fragmentation could lead to greater supply chain redundancy and therefore increased aggregate space demand.

What is Fair Value Analysis (FVA)?

Fair Value Analysis, or FVA, is central to LaSalle’s investment strategy process. We conduct FVA across a range of “slices” of the property market—that is, various combinations of sectors, sub-sectors, cities, sub-markets, quality grades and the like. The FVA methodology compares our assessment of expected and required returns:

• Expected Returns (ERs) represent the return expected for a given real estate slice, which is build-up of current real estate entry pricing, plus short and long-term income growth, minus an estimate of the capital expenditure needed to keep the property competitive.

• Required Returns (RRs) represent an appropriate risk-adjusted cost of capital for a given slice, starting with bond yields and applying sector- and market-appropriate risk premia.It is possible to extract both absolute and relative pricing indications from FVA. By comparing ERs and RRs, we can assess which slices appear attractively priced (ER>RR), fairly priced (ER≈RR) or overpriced (ER<RR). But implicit in this absolute analysis is a presumption that current bond yields are “correct;” its conclusions tend to be volatile in periods when bond markets are volatile. That is why is also helpful to simply rank order the ratio of ERs to RRs, which produces a relative sorting of attractiveness by slice. Relative assessments help steer investment toward the real estate most likely to outperform the broader property market.

Other examples of real estate sectors facing impacts directly tied to tariffs include US power centers exposed to discretionary expenditure on (largely) imported goods. There are also potential direct impacts on real estate from other Trump policies beyond tariffs, for example around reputational issues that seem to be suppressing inbound and outbound tourism, as well as changes to scientific research funding.9

To understand the broader macro channels of impact, it is useful to assesses real estate sectors and markets by their relative sensitivities to economic growth and to interest rates.10 Sectors with a high degree of economic sensitivity, such as hotels, are likely to see an outsized negative hit to their cash flows in the event of an economic downturn. Meanwhile, economic impacts should be muted on sectors with low fundamental sensitivity to GDP growth, such as medical office.

Relative impacts are potentially the reverse for sectors with a high degree of interest rate sensitivity. An economic downturn usually leads to lower interest rates – although recent market movements suggest that is not necessarily a given.11 The impact of lower rates on the more interest-rate sensitive parts of the real estate market could enable them to absorb some or even all the effect of softer demand. These property types are generally those with longer leases, such as the mainstream commercial sectors.

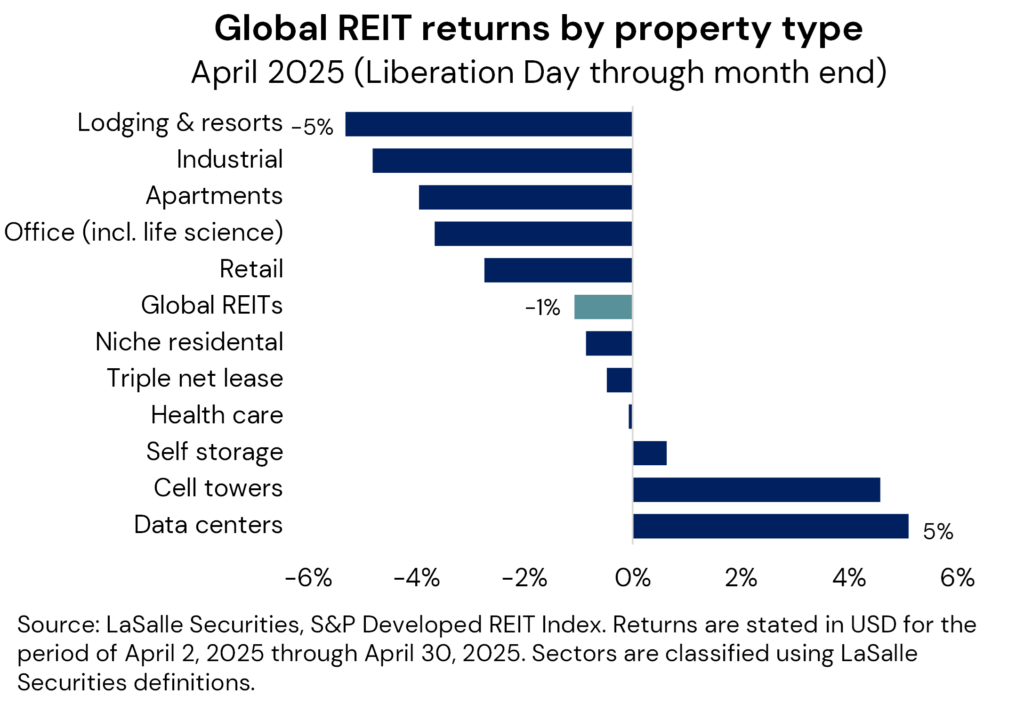

Relative listed real estate performance following “liberation day”, confirms these intuitive sector relativities. Despite an initial drawdown of nearly 10%, the overall listed REIT market was down only marginally for the rest of April, though the dispersion of property sector performance has been wide (see adjacent chart). Initial investor reactions have been most focused in property types which are most directly exposed to a potential trade war (e.g., industrial/ logistics) or those which are more economically sensitive in nature (lodging).

3. Relative global impacts

The same relative-value thinking can be applied to the relative prospects of countries and regions, which have been dynamic this year, to say the least. The economic narrative has quickly shifted from the post-election consensus of dominance by the US economy, to post-inauguration worries about fallout from US trade policy alongside a growth-positive break in European fiscal policy.12

Indeed, it seems likely that tariff-related worries may hit US real estate more than in many other countries, for two reasons. First, the strongest headwinds in many exporting nations will be largely contained to specific industries, compared to potentially generalized challenges in the US.13 A second is that the US Fed will have to balance risks of higher unemployment against those of higher prices, while in other countries, the short-term impact of tariffs could drive local goods prices lower. This may give ex-US central banks wiggle room to offset a weaker economy with policy easing.

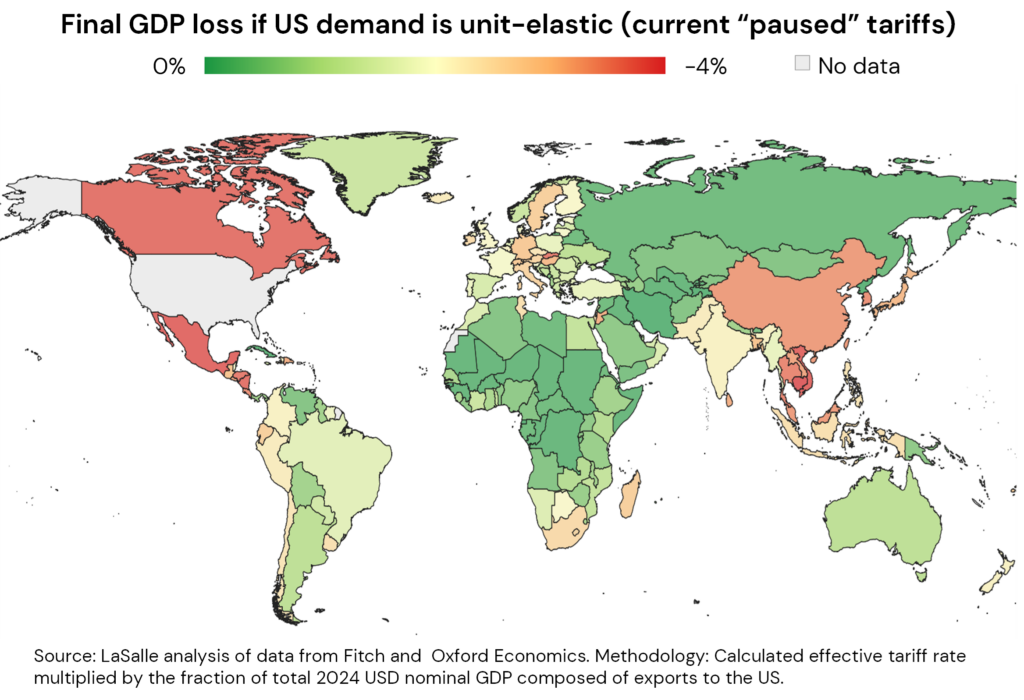

To separate relatively harder-hit from less-hit ex-US markets, we track the level of applied tariffs and a country’s exports to the US as a share of the exporting country’s GDP. On this basis, the map shows that China, Southeast Asia, Canada and Mexico may be more impacted, while Australia and Europe potentially could be less so. The nature of the exports themselves also matters. It may be difficult to find viable substitute suppliers for many complex, high-value goods (e.g., cutting-edge semiconductors), or for raw materials (rare earths). Countries whose exports have fewer substitutes may be more insulated from the trade war.

A final factor to consider is that the economic sensitivity of property varies by sector and country, but real estate’s return beta is especially low in some market segments, such as the European living sectors.14 The degree to which a sector’s drivers are inward- or outward-facing can also matter. For example, we observe that real estate in Japan, with its large domestic market, tends to see robust investor and tenant demand that may be less susceptible to external forces.15

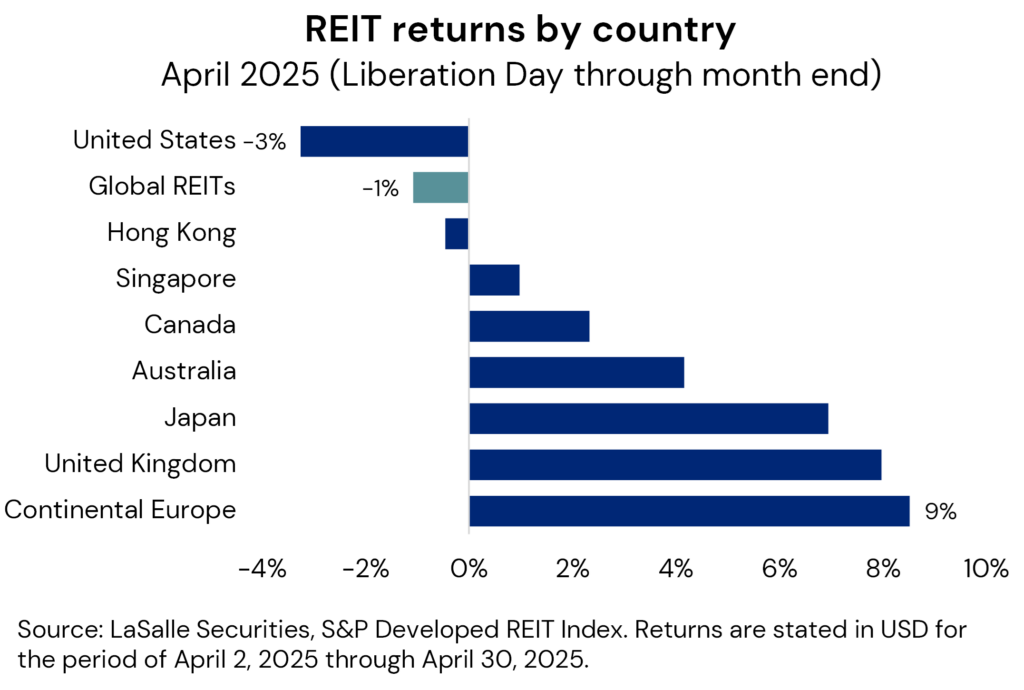

These relativities have been evident in the performance of US and ex-US listed real estate markets. The shift in US trade policy has led to the largest REIT share price declines being registered in the US (see adjacent chart). European REIT markets, including the UK, have been relative winners given the potential pro-growth developments in fiscal policy and a more limited direct impact from US trade policy. Asia Pacific REIT market performance has been more mixed in this period, with Japan and Australia notable outperformers.

LOOKING AHEAD >

- • In normal times, recession probabilities reference probabilistic models that draw on indicators of economic activity, relating current levels to the historical incidence of recessions. In today’s environment, recession probabilities are better thought of as the weighted odds of various trade policies being implemented. In the context of such uncertainty, we recommend focusing less on absolute forecasts, and more on relativities that we expect to hold no matter the ultimate outcome.

- • Fair value analysis (FVA) is our preferred tool for comparing, framing and debating investment strategy. It can also be a helpful framework for scenario modeling in uncertain times such as today. But quickly rebalancing real time private, direct real estate portfolios to take advantage of rapid changes in relative value is difficult if not impossible. We use FVA to inform portfolio additions and exits, as we incrementally migrate overall portfolio allocations toward the sectors and markets that are most attractively priced. We believe doing so can contribute to outperformance versus the overall market.

- • More immediate execution is available in listed real estate markets, allowing investors to capitalize on shorter-term mispricing and relative value shifts. Periods such as this trade war episode are great examples of times when having a public real estate allocation can provide maximum opportunity to benefit from volatility.

1 The April 9th reciprocal tariffs pause may have been in response to a meaningful increase in Treasury yields, to which the administration seems more reactive than equity markets. The April 12th China pause appears timed to preempt the expiration of “on water” exemptions for goods already en route. Sources: Piper Sandler and Signum Global Advisors.

2 Contributors to uncertainty include: legal challenges to presidential trade authority; negotiations between the US and other nations; potential Congressional action, especially after the mid-term elections; and of course, unilateral adjustments by the administration. Sources: Piper Sandler and Signum Global Advisors.

3 According to Goldman Sachs, the US average tariff rate has increased from ~3% to ~20% in the past few months, even before the paused tariffs. For comparison, the 1930 Smoot-Hawley tariffs represented a rate increase of only a few percentage points, off of already high levels. Moreover, trade is today roughly three times as large a share of the US economy as it was then. As such, there is no clear precedent for a tariff increase of this magnitude.

4 According to analysis by Piper Sandler and Baker, Bloom and Davis, 2016.

5 Leases are, in some sense, only as defensive as the revenues of the tenant. But crucially, they are mediated by the option to relet a building to another tenant. In essence, real estate is a layer of abstraction removed from the tenants’ businesses, just as the tenant is in turn a layer of abstraction higher than any specific product (because they may have multiple products). Just as products have widely varying success/failure profiles, companies are a kernel on products, so their success/failure rate is in turn smoothed, and real estate is a further kernel on businesses.

6 The cash flow characteristics of real estate, including its inflation pass-through potential, are discussed in greater depth in our ISA Portfolio View report.

7 LaSalle has tracked and compared the relationship of REIT AFFO yields to Equity earnings yields for the period of April 2006 through April 2025. Using this data series, we estimate that the relative performance of REITs that would be needed as of the latest data point to revert the relationship to the historical average, assuming all else equal.

8 The commentary in this paragraph is based on LaSalle analysis and that of Green Street Advisors and CBRE-EA.

9 We are monitoring hotel markets with a high share of international visitors; US student housing assets that are heavily exposed to international students (with European student housing potentially benefiting); and life sciences real estate.

10 LaSalle’s Portfolio Balance framework describes real estate market segments according to their sensitivities to economic growth and interest rates. It classifies markets and sectors into four categories: growth-led, rate-led, stable, and reactive. For a fuller discussion, see the ISA Outlook 2025.

11 Bond yields typically fall as economies go into recession because the market prices in central bank easing (rate cuts) and lower inflation. However, this is not always the case. Recent upward volatility in US 10-Year Treasury yields has been attributed to movement in the risk premium required for investing in dollar assets, given concerns that recent rapid changes in economic policy herald longer-term US policymaking instability. Sources: Piper Sandler and Oxford Economics.

12 For more discussion of this narrative shift, and the German debt Zeitenwende, see the ISA Briefing “Working backwards: Dealing with unprecedented policy uncertainty” and the accompanying LaSalle Macro Quarterly.

13 For example, LaSalle estimates the impact of US tariffs on the German automotive industry to represent just 0.04% of European GDP, using data from Oxford Economics. We derive this by dividing the $25.5bn German auto exports to the US by the eurozone’s $15.9tn GDP, multiplied by 25% tariffs (assuming unit elasticity and no export redirection).

14 European residential markets have seen strong rental growth in recent years, even as GDP growth was weak, owing to long-term structural supply shortages. Source: LaSalle analysis of data from PMA and Green Street.

15 According to analysis by LaSalle of data from JLL REIS and MSCI Real Capital Analytics.

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment. With reference to the graphs included in this publication, note that no assurances are given that trends shown therein will continue or materialize as expected. Nothing herein constitutes a guarantee or prediction of future events or results and accordingly the information is subject to a high degree of uncertainty. LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance. By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2025. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Jun 24, 2025

The European market view: Does uncertainty reign?

Today’s European market view is of a picture scarcely imaginable a few years ago.