How will real estate respond?

June marks the transition from spring to summer in the Northern Hemisphere and fall to winter in the Southern Hemisphere. The changing seasons help mark the passage of time when many familiar routines have been disrupted by the pandemic. These inconveniences pale in comparison to those who have paid a much higher price – in lost lives, lost livelihoods and separations from friends and family. Never in the post-war history of the modern world have so many endured so many months filled with such uncertainty and trepidation as the first two quarters of 2020. So, the gradual re-opening of economies and the coming of the Northern Hemisphere summer should represent a huge relief.

The degree of containment success during Phase Two of the pandemic will have impacts on real estate performance.

Yet, the second phase of the pandemic has the defining characteristic that we still must live with COVID-19. While some countries, led by China, South Korea and Germany, are already several weeks into re-opening, others are just starting. The concern among some epidemiologists is that certain jurisdictions may be re-opening segments of their economy before tracing and testing is fully in place. The total number of COVID-19 cases is still rising in many countries, even though the rate of growth has tapered. Recurring infection spikes could force countries to lock down segments of their economy again. Successful re-opening will depend, in part, on how well each country follows prescribed social distancing and safety measures, as well as whether their healthcare system has the capacity to handle a second wave.

The degree of containment success during Phase Two of the pandemic will have impacts on real estate performance. The speed of retail sales recovery at brick-and-mortar stores is uncertain, but this month’s deck shows how we can track rising mobility and footfall at properties as re-opening gets underway. Closure of physical stores led to double-digit and in some cases triple-digit ecommerce sales increases. Some of this shift could be permanent, especially for stores that cannot easily adapt to social distancing or run profitably at highly controlled density levels. On the other hand, retailers that can more easily adapt to click-and-collect models, are already seeing sales recover. Office workers are expected to face a different world when re-opening occurs, including physical distancing for everything from elevators and washrooms to floor plan layouts. In May, some prominent tech office users, including Twitter and Facebook, announced that their employees will be able to work from home for the remainder of 2020, or in some cases, permanently. This has the potential to significantly reduce aggregate office demand if other firms follow suit. On the other hand, other office users may require more space to enable social distancing. The tug of war between these two forces will play out differently for each tenant; but we will be watching aggregate patterns that will determine what happens to overall office demand.

These are issues investors must take a view on, long before the answers are known. To help guide our colleagues and clients, in this month’s deck we examine:

- A comparison of the TomTom Traffic Index congestion levels for two cities at different phases of re opening: Shanghai and Toronto (slide 4)

- A status update of different countries in terms of re-opening and transitioning to Phase Two (slide 6)

- Revised GDP forecasts from Oxford Economics, which now surpass IMF forecasts from April in terms of degree of decline in 2020 and a sharper recovery in 2021. Global growth of -4.8% in 2020 is forecast, while several countries’ 2020 forecasts have declined by three to seven percentage points compared to Oxford’s forecasts in March and April. (slide 8)

- A forecast decline in global trade which is expected to surpass the sharp decline seen in the 2008-09 downturn (slide 9)

- The latest monthly readings of CPI Inflation moved negative in Canada, Sweden, Spain, Switzerland and Ireland, and has plunged in other countries as consumer prices fall amid the pandemic (slide 15)

- In May, the U.K. joined Japan, Germany and other European countries in selling negative yielding debt, reflecting the investor view that paying a modest amount to own bonds is safer than other investments in the midst of a global recession. It also indicates how central banks are using their QE powers to keep bond rates low or slightly negative. (slide 27)

What real estate investors should know

In recent years, many institutional investors have embraced the principles of responsible investing (PRI)(1) in order to shape a sustainable global financial system.

These principles seek explicit and measurable approaches to the adoption of sustainability standards in investment decisions and active ownership of assets. As a natural extension of the PRI, the field of “ethical investing” has grown quickly, as evidenced by rising capital allocations to vehicles that include ethical criteria [see Chart 1]. When these considerations are combined with financial criteria, the investment can be considered part of the growing universe known as “Impact investing”.

Impact investing refers to investments made with the specific intention to generate a measurable, beneficial social and/or environmental impact alongside a financial return. This rapidly evolving investment practice relies on the concepts of intentionality and additionality, the notion of generating a positive impact beyond what would otherwise have occurred. At its core, impact investing include procedures for reporting and accountability that ensure strategy and practice are aligned with both societal goals and financial objectives. Whilst impact investing is a natural progression from sustainability adoption [see Chart 2], we firmly believe that there should be a clear distinction between the two. Sustainability standards can be integrated into any investment process to ensure investments are socially, environmentally and ethically responsible. Impact investing goes one step further and includes the achievement of positive social and environmental outcomes as measures of success, in addition to financial criteria and meeting minimum standards for sustainability. Growing academic evidence supports the idea that “sustainability incorporation does not come at a cost”2. The academic literature on “impact investing” is still in its infancy, although financial economists have surveyed the definitions used by the first wave of “impact investing products” and found them to be remarkably consistent in terms of their emphasis on intentionality, financial returns, and impact measurement across a wide range of asset classes3.

[1] The PRI website introduces the principles for responsible investment here: https://www.unpri.org/

[2] See “What is the PRI?” https://www.unpri.org/

[3] Höchstädter, A.K, and Scheck, B. (2015) What’s in a Name: An Analysis of Impact Investing, Understandings by Academics and Practitioners. Journal of Business Ethics 132 (2), pp 449-475.

Download the report

Apartment investors sort through a new web of rules and prepare to be surprised again in 2020.

Apartment rent control initiatives surged in 2019, propelled by a combination of falling affordability in the most productive—and expensive—cities and in part by greater polarization in the policy views of legislators and voters. The strength of recent momentum toward stricter rent control policies took many by surprise, especially after California voters had defeated a ballot measure in November 2018 that would have allowed cities there to broaden their rent regulations. The share of US apartments subject to some form of rent control has been trending lower since the 1980s, but three major 2019 laws sharply reversed that pattern.

In February 2019, Oregon enacted the country’s first statewide apartment rent growth regulations. In June, New York became the second jurisdiction to pass statewide rent regulation. California then enacted new state rent regulations in October. Increased regulation of rent growth has been proposed in half a dozen additional states, from Massachusetts to Washington. And this trend is not isolated to the US: Berlin’s state government enacted a five-year rent freeze in June, sending German listed residential company share prices tumbling.

The flurry of activity on rent regulation raises questions for US apartment investors: How concerned should they be about negative impacts to cash flows and values for assets in their portfolios? How do the new laws change the risk-return profile of future apartment investments? And how will the new laws affect local apartment market dynamics?

Download the report

But a long journey lies ahead before this disease is contained.

Four months after the first diagnosis of the deadly COVID-19 virus, the headlines and images of its devastating effects are wearing on us all. A long journey lies ahead before this disease is contained. Yet, plans to develop effective treatments and vaccines are moving into high gear. As April turns to May, it is fitting that we look ahead to the second phase of the crisis, when partial and cautious re-opening of economies gets underway. Images of Chinese Peach Blossoms and a German Maibaum (maypole) symbolize a welcome change as LaSalle gradually re-opens offices in China, in Korea, and in Germany. Other countries will follow, but we can learn a great deal from the experiences of the cities that come back online first.

The pandemic demonstrated the ability of some countries to take drastic action when risks to public health become urgent and pressing. And it also showed the inability of others to respond as quickly and effectively.

This month’s macro deck lays out the three phases of this journey: 1) The Lockdown; 2) Partial Re-opening, or “Living with COVID”; and 3) The New Normal, when the virus is under control. It also charts the first leg of the journey and how real estate is reacting with a shorter lag time than is usually the case for the transmission of macro-economic forces into property’s financial performance. Highlights of the deck are as follows:

The steepest economic contraction in living memory: The International Monetary Fund (IMF) cut its 2020 global GDP growth forecast to negative 3% in 2020, before projecting a return to growth in 2021. These forecasts are the most severe re-rating of country-level, regional, and global GDP in the history of the IMF. The International Labour Organization estimates in April that nearly 1.25 billion people globally are at risk of being unemployed or furloughed. The collapse of oil prices is another indicator of the severity of the downturn.

Government policy responses: The amount of fiscal stimulus planned across the US and Europe exceeds that of the GFC. More fiscal stimulus is expected, given that countries accounting for half of the world’s GDP are in some form of lockdown. We believe the pandemic will leave developed nations deep in debt and force hard choices. For instance, Italy’s national debt is approaching unsustainable levels, putting pressure on the European Union to arrange a bailout. Some countries may try to carry enormous quantities of debt with a combination of higher taxes and inflation.

China’s response offers lessons for investors and occupiers: The COVID-19 outbreak has had a severe short-term impact on the Chinese economy and property market. However, headline indicators of business activity largely returned to pre-outbreak levels by the end of April. The Chinese government’s “coordinated approach” appears to have shielded the economy from a deep and prolonged downturn, while a range of measures introduced by owners and tenants have provided a foundation for a gradual property market revival.

Logistics as a net beneficiary in the long-run: Migration to online retail and fast-forwarded consolidation in the retail world accelerates demand in the logistics sector. Supply chain diversification has become a priority, and re-shoring of some manufacturing may start to happen in Europe and North America.

Pricing disconnect: Going into the crisis, investment activity in Europe and the US was holding up well in Q1 2020 compared to the same period one year ago. By contrast, investment activity in Asia Pacific dropped by 58% in Q1, as the lockdown affected the completion of transactions. This same interruption in transaction volume has now hit the West, even as it begins to ease in East Asia.

Public health response: In our view the pandemic demonstrated the ability of some countries to take drastic action when risks to public health become urgent and pressing. And it also showed the inability of others to respond as quickly and effectively. We believe these responses likely presage the willingness and ability of countries to engage in the collective action needed to address future challenges including a second wave of infections, global warming, a move to a carbon neutral society, and climate risk.

In the 27th edition of the Investment Strategy Annual, we address the themes that will shape the real estate investment environment for at least the next three years and likely longer.

The pandemic has simultaneously accelerated and interrupted these trends. Some assets and strategies amplify the effects of COVID-19, while others are much more insulated. In the coming year, investors should prepare for the COVID endgame.

Mastering the simultaneous need for fast/intuitive and slow/careful thinking becomes an important skill to develop in the speeding-up world of real estate. We review techniques to help investors determine portfolio objectives. We present our outlook for the property types and countries that are the most attractive. We share our best investment ideas.

Speeding up and slowing down all at once

Time has simultaneously sped up and slowed down in a surreal way as we all work from home. Economic forecasts issued last week are now woefully out of date. A recurring comment we hear: “Just three or four weeks ago, this would have been unimaginable.” Where “this” applies to COVID case counts, unemployment claims, counting the number of tenants NOT paying rent, or fiscal packages and central bank backstops worth 10% or more of a country’s GDP.

As far as the timing and duration of this downturn, there is still so much we do not know.

A new challenge is getting access to reliable data and forecasts. The digital transformation of our industry, currently well underway, should help us figure out what is going on. But it may not be as helpful in telling us where we will be a year or two from now. Sorting fact from fiction and spin is also getting harder. The public markets illustrate the spasms of fear and relief that wash through portfolios on a daily basis. In the words of author Max Brooks, “Panic can spread even faster than a virus.” Brooks teaches at West Point (The Modern War Institute) and is a consultant to government agencies and NGOs on disaster preparedness around the world. He says, “During any pandemic, we must practice excellent fact hygiene.” In that spirit, this month’s macro deck highlights both facts and fact-based opinions, but we are careful to distinguish between the two.

A sharp global recession is underway. Half of the world’s GDP is now under some kind of “stay at home” directive. As a result, the major economies of the world are undergoing a near-simultaneous demand-side shock, with supply-side and financial shocks also underway. Consumers and businesses have stopped spending on non-essential items. Transportation, leisure and construction have come to a standstill unprecedented in peacetime. Manufacturing was among the first industrial sectors hit as factories closed, but with robotics now prevalent and China getting back to work, interrupted supply chains may be able to get repaired. Goods and containers can move across borders, even if people cannot. By contrast, the services sector – especially hospitality and retail services – has been hit especially hard and is still in the early stages of coping with a demand shock that is existential for many small and large businesses.

The financial system is also now under enormous stress—both credit and equity flows. Unprecedented policy responses by governments will try to reduce the ripple effects. Monetary and fiscal actions of historic proportions are being rolled out. Ultimately, credit creation relies on trust, not governments alone. And trust is in short supply right now. Despite historic efforts, credit markets are tightening and investors have become excessively risk averse. Lenders now have record-low base rates provided by Central Banks; but borrowers may not get access to incredibly cheap debt, as spreads widen out. In short, we expect huge differences among property types and markets in terms of risk, resilience and liquidity to manifest themselves.

We first circulated a list of property types at risk six weeks ago, when it became clear that this coronavirus was jumping across borders. The ranking is based on REIT data and feedback from our portfolio and asset managers. (p.9) These lists are intended to give colleagues and clients a sense of where to expect trouble. A contrarian investor may be able to take advantage of overly pessimistic reactions to such lists in the years ahead. But, for now, these are also the sectors that are most likely to experience interrupted income streams and borrower defaults. The “best-insulated sectors” will not be immune and all property types will feel the impact of global recession.

As far as the timing and duration of this downturn, there is still so much we do not know. We do not know exactly what it will take to contain an outbreak, especially where containment measures were delayed or when testing has not been widely available. So, none of us knows exactly when “return to work” policies will be promulgated in each country or metropolitan area — although China is leading the way and could provide the world with an example to follow. We still need to find out what, if any, re-infection risk is associated with “return to work” and how quickly risk-taking, investment, trade and travel will resume to the point where the financial system can recover and function without government support. Underpinning our scenarios are multiple assumptions about when effective vaccines, treatment and testing will be widely available (p. 3 & 7). These “unknowables” lie at the heart of our assumptions and plans. Finally, we may all need to learn the skill of “time bending” to cope with the fast and slow pace of social and economic life in the months ahead.

ECONOMIC IMPACT

- Coronavirus pandemic has hit Europe particularly hard. Expect recession in most countries during 2020, possibly with U-shaped recovery in Q4 2020/Q1 2021.

- Approach to containment initially varied considerably between countries but most are now adopting similar messaging. The same is true for policy responses.

- Coronavirus impact may trigger a number of macro risks. Despite additional liquidity measures being provided, solvency now a widespread issue.

- Ability for UK and EU to progress trade agreement talks severely diminished. PM Johnson’s willingness to walk away rather than extend the transition period suggests WTO relationship may ensue.

- Recessions that trigger a credit collapse tend to generate illiquidity, forced sales, investor bifurcation, and tenant insolvencies. Severity of each depends on policy responses and duration of pandemic.

CAPITAL MARKETS IMPACT

- Expect stock market volatility to continue until there is demonstrable containment and flattening of new cases curve.

- Much lower equity prices will leave many investors overweight to real estate. This may curtail investment into real estate in short-term, and could lead to withdrawals from open-ended real estate funds that remain open.

- Economic shocks result in government bond yields falling in safe-haven countries. Germany bonds are now implied to be remain negative until 2022 and not even breach +0.5% within ten year horizon.

- In the short term, real estate could see valuation yields rise. Prime assets will remain relatively resilient and recover first, but secondary assets with no alternative use will be out-of-favour until after fundamentals have recovered.

- Once the crisis has passed, price discovery will begin. Given the generous risk-premium of real estate over bonds, stabilised real estate will seem attractive. Lower interest rates will support pricing for real estate.

REAL ESTATE IMPACT

- Pandemic hitting Italy and Spain particularly hard, and Italy’s healthcare systems is overloaded. Both have large reliance on tourism. But whereas Spain was an economic hotspot, Italy was already beset with challenges.

- Sectors most at risk are Retail, Hotels and Leisure. Speed and magnitude of eventual recovery will depend largely on duration of pandemic.

- Other sectors such as Logistics, Self-Storage and Offices (excluding co-working), will prove more resilient in short term but are not immune.

- Real estate capital flows are slowing considerably. This exposes markets driven by cross-border capital, such as London. Liability-matching assets used as bond substitutes are still transacting.

- Focus on preserving value through asset management. Leveraged investors need to manage liquidity, although debt levels are more manageable than during GFC. Opportunities will emerge but will depend on duration of the pandemic.

Download the report

MACROECONOMIC ENVIRONMENT

- Premature to determine the precise impact until the containment of the outbreak worldwide

- As long as the outbreak lasts,

- tourism, retail sales and supply chain disruptions are expected

- fiscal and monetary policies to offset some negative economic impact

- If the outbreak is prolonged, disruptions could be severe

REAL ESTATE MARKETS

- Expect weaknesses in occupier demand as long as the outbreak lasts, but potential impact varies by market/sector

- Retail, hotels, and serviced apartments to be the most impacted

- Asia Pacific logistics likely to be the relative winner, particularly temperature-controlled warehouses

- Markets/sectors with strong fundamentals pre-outbreak more resilient, e.g. China logistics, Japan RE (ex. retail)

- Markets/sectors with challenges pre-outbreak more vulnerable, e.g. Australian retail, Shanghai office, HK RE

- If the outbreak is prolonged, no real estate sector/market is immune

- Liquidity, covenant, and flexibility on asset strategies are increasingly important as uncertainty remains

INVESTMENT MARKETS

- Some investors could take a wait-and-see view

- The COVID-19 outbreak presents risk, but also potential opportunities

- Good time to look for distress among property owners with liquidity constraint, if available

- Flight-to-safety could widen pricing differences between assets with secured cash flow and those without

Download the report

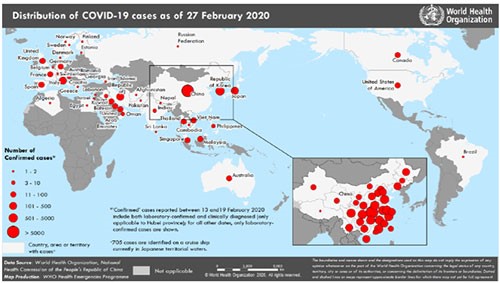

The COVID-19 epidemic has grown more severe by several orders of magnitude over the past month.

With more than 84,000 cases globally[1] ,it is now ten times larger than the SARS epidemic and has spread beyond China to more than 50 other countries. New cases have declined in recent days within China, but they have accelerated across the rest of the world. As the Chinese government and international health organizations on the front line have made clear, this global healthcare crisis is still growing, and the risks of underreacting are greater than the risks of overreacting.

The swift actions of courageous health care providers and the everyday sacrifices of people across Asia have helped to buy time for the rest of the world to be better prepared for the arrival of COVID-19 in their own countries.

In the highly interconnected society and economy of 2020, postponed travel, working from home rather than the office, and canceled in-person meetings and conferences are a small price for reducing the risk of a life-threatening, and still not fully understood, illness. For many across the Asia-Pacific region, the burden of containment has gone far beyond these inconveniences. Millions of households are experiencing economic hardship, coping with family separation, and enduring restricted freedom of movement in their own communities – all this before the toll of human suffering from the disease itself is taken into account. The swift actions of courageous health care providers and the everyday sacrifices of people across Asia have helped to buy time for the rest of the world to be better prepared for the arrival of COVID-19 in their own countries.

Economic impacts seem like a secondary concern at a time like this, but they are highly relevant for government leaders, policy makers, and investors who must first get through “crisis management” and then begin to make plans for the future. In China, which is now gradually loosening the largest quarantine in human history, the crisis is a simultaneous demand and supply-side shock. Several forecasters put a high likelihood on Chinese GDP contracting in year-over-year terms in the first quarter. At the same time, the Chinese government has already unleashed stimulus packages intended to help get business going again and to keep the financial system operating smoothly – and more stimulus announcements are expected. The governments of Singapore, Hong Kong and South Korea have recently announced their own stimulus packages, and other counties in Asia are likely to do the same.

This month’s macro deck summarizes the impact of the COVID-19 epidemic on global economic forecasts and on financial market prices. Beyond temporarily lost output, interrupted supply chains, a sharp decline in travel and tourism, and declining consumer confidence, the ripple effects have just begun spreading from Asia to Europe and North America. Property investments in China have seen direct impacts in the form of halted work at construction sites and retail rent moratoriums. Similar effects are likely in other intensely affected markets from South Korea to Northern Italy. Yet this is also a time when the durability of real estate income streams is likely to distinguish property as a stabilizer relative to other asset classes, as most leases are likely to generate income despite these temporary shocks.

The COVID-19 crisis is evolving daily. Although the first case was diagnosed on the last day of 2019, the impact will be felt far beyond the first quarter of 2020. The tumultuous end of February 2020 will go down in economic history as the week when the financial markets finally woke up to the warnings of the World Health Organization. Risk assets like stocks and high-yield bonds have entered “correction” territory in many countries. As we have pointed out before, fear tends to be self-reinforcing in economic decision making as people adjust consumption and investment decisions and perceptions quickly become realty. It is unknown how quickly the virus will be contained worldwide. Likewise, the longer-term impact on economic growth and real estate markets is highly uncertain. LaSalle’s investment teams expect to address the concerns of our tenants and clients through rapid-response communications and business-continuity plans; these actions have already commenced across our China portfolios. Real estate investors can draw some comfort from the insulating effect of real estate’s long-term contractual income and from the heavier weight of capital seeking stabilized income-generating assets as risk-free interest rates fall to all-time lows in several markets.

[1] See the World Health Organization website for continual updates: https://go.lasalle.com/e/579181/2020-02-29/vdxnmf/898126978?h=iIsAuG6NtoLc1mNbzDxqAasaTIIcyr1uQQt-Jkmi-n8

Thoughts on the Lunar New Year

The Lunar New Year ushers in the year of the “Metal Rat”, which combines the first animal (Rat) and the fourth element (Metal) of the Chinese astrological calendar. Together, they symbolize careful planning, wealth and vitality. Since the Rat is the first sign in the 12-animal cycle, 2020 represents a year of new beginnings. Just as investors were waving goodbye to a year of tremendous geo-political volatility and celebrating the 2019 rallies in the stock and bond markets, another exogenous shock has occurred—Novel Coronavirus. Since the first few cases were detected in Wuhan, China in December, more than 200 people have died and more than 10,000 are fighting the symptoms1. Thus far, the estimated fatality rate of Novel Coronavirus has been lower than that of SARS in 2002-03, but new cases have been spreading at a faster rate and have been detected in over 20 countries.

The outbreak of Novel Coronavirus reminds us how extraordinarily connected the world has become. It also highlights the importance of the Chinese economy on the world stage.

The outbreak of Novel Coronavirus reminds us how extraordinarily connected the world has become. It also highlights the importance of the Chinese economy on the world stage. China now accounts for approximately 20% of the world GDP, up from 7% twenty years ago (in PPP terms). Looking back, the SARS outbreak lasted six to eight months. The impact of SARS on global financial markets was negative in April 2003, yet within six months of the outbreak stock markets had more than made up their losses. The impact on retail sales and hotel occupancies varied across Asia Pacific, but generally recovered 3-6 months after the WHO announced that the virus was contained. Also, the impact on travel was much less severe in Europe and the Americas.

Nevertheless, the economic impact of the coronavirus outbreak poses another downside risk to China’s growth this year, when forecasters expected world growth to slow to its lowest level since 2009. It is far too early to say with any certainty whether the coronavirus will be a trigger for a downside scenario beyond the natural slowing growth rate of the global economy. The probability of a global recession has been reduced as populism de-escalates, or is contained, in various parts of the world – the signing of the U.S.-China Phase One deal, the reduction of tensions in the Middle East, and finally, the European Parliament’s blessing of the Brexit deal. On the other hand, these geo-political risks are not off the table permanently; to some extent, they are just beginning.

As long-term interest rates stay at historically low levels, real estate continues to attract investor capital. In particular, demand for core real estate is strong amid “risk-off” behavior and a flight to safety. Logistics and multifamily continue to be the darlings among core investors. Additionally, demand for value-add offices remain strong. Office rent growth is forecast to moderate over the next 3 years, yet still be positive in the world’s major office markets. Retail remains the least favorable sector due to structural challenges and the recent exogenous shock will not help.

The effectiveness of further monetary easing is much reduced compared to 2003. Central banks have less room to maneuver and so many are calling for fiscal policies to ramp up private consumption and economic growth in 2020. Wherever fiscal stimulus occurs, it will certainly spur real estate demand. In summary, real estate is likely to maintain strong support from asset allocators. This means that high valuations for core assets can be maintained indefinitely as long as risk-off sentiment and low interest rates persist. The coronavirus and heightened risks of a China slowdown exacerbate this “safe haven” mentality. The exercise wheel approach to 2020 may result in portfolio managers working hard to stay in one place…but they will be fitter for having done so.

[1] WHO, as of January 31 2020.

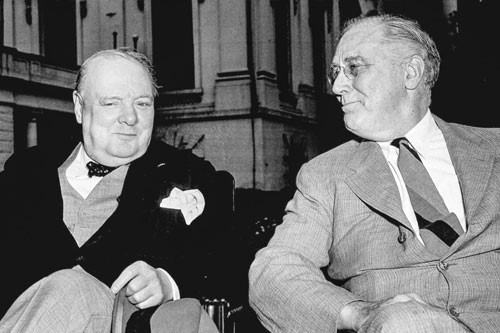

Examining the “special relationship” between the United Kingdom and the United States

The Special Relationship is an unofficial term often used to describe the political, diplomatic, cultural, economic, military, and historical relations between the United Kingdom and the United States. The term first came into popular usage after it was used in a 1946 speech by Winston Churchill. The two nations have been close allies during many conflicts in the 20th and 21st centuries, including World War I, World War II, the Korean War, the Cold War, the Gulf War, and the War on Terror. Both countries were special for the wrong reasons in 2019, as U.S. trade policy and Brexit drove financial and economic uncertainty to high levels. The U.S. engaged in trade skirmishes with many parts of the world, particularly China, raised its military profile in the Middle East, and generally obstructed globalization trends through actions on climate change, immigration and an exit from multi-lateral agreements replaced by unilateral negotiations. To close out the year, the U.S. House of Representatives voted to impeach the President, only the third time in history. The United Kingdom failed to follow through with Brexit for most of the year, leading to the resignation of Prime Minister May and a national election.

Looking ahead to 2020 and 2021, LaSalle’s Investment Strategy Annual forecasts another year in which the U.S. and U.K. play an outsized role in rocking the global boat.

While events in the Anglo-American sphere reflect falling trust in political leadership, the decisions of consumers, business, and investors, by contrast, showed confidence that both markets would eventually muddle through – and, in part, the closing events of the year proved them right. The U.K. is on a clearer Brexit path after a decisive December vote that should push the country to leave the European Economic Union in 2020. The U.S. Congress reached agreement on the USMCA trade agreement and stock indices hit record highs.

The misadventures of the U.S. and U.K. did not derail their long-lived economic expansions or spill over to affect the rest of the world. Global growth in 2019 was between 3 and 4%, and global equities had their best year since 2009 (28% total return). In the U.S., the S&P 500 was up by 31.5% in 2019, the second highest return of the past 23 years, while U.K. equities were up by a solid 18%.

While core private real estate returns were unspectacular in 2019 (6.2% in the U.S. and 2.0% in the U.K.), the story of the past decade is much more positive. Unleveraged core property returns averaged 10% over the past ten years in both countries, remarkably similar to returns from Global Stocks and Global REITs (11% – see p. 6), though with less volatility when looked at over rolling 10-year measurement periods. Canada and Australia – the other countries with long return histories – performed similarly, with trailing 10-year returns of 9% and 10%, respectively. Looking ahead to 2020 and 2021, LaSalle’s Investment Strategy Annual forecasts another year in which the U.S. and U.K. play an outsized role in rocking the global boat. LaSalle foresees a slowing global economy (p. 23), ongoing trade disagreements (p. 12), high asset valuations, and disruptive technology as headwinds to favorable real estate performance. However, many of these same forecasts are also linked to salutary tailwinds. Slow growth is linked to low interest rates (p. 18), which elevates values. High valuations are linked to momentum in capital markets, when investors increase allocations to real estate as a result of strong prior performance (p. 4-6), and disruptive technology is linked to higher productivity and innovation.

And what they can tell us

Sovereign bond yields and credit spreads are simultaneously the most watched and the most enigmatic of all macro indicators. For portfolio strategists, they signal risk-on and risk-off sentiment in the broader capital markets. For property investors, they anchor valuations—initial/exit yields and discount rates—as well as borrowing costs.

Bond yields have been on a persistently downward trend for several decades (p. 5), but short-term movements have often been surprising. No doubt trade tensions, divisive politics, civil unrest, wavering economic growth and central bankers’ actions will continue to make the bond needle flutter in November and December. The outcomes of geopolitical events can be especially hard to predict; with so much noise in the system, risk aversion is likely to remain high. Indeed, professional economists and financial markets alike have been notoriously poor at predicting the path for long-term interest rates (p 4). In our view, an underestimation of the linkages between demographic forces and savings behaviour could also be a contributing factor for the persistence of ultra-low interest rates. Ageing trends in many countries are a “meta” macro force that is easily overlooked behind the daily headlines of geopolitics, central bank announcements, and economic statistics.

UN projections show that the slowing and greying trends in the world’s population are likely to be maintained or increased over the next century.

The gradual decline in long-term interest rates is certainly linked to lower growth expectations. Weaker growth is generally consistent with less inflation, implying that bond investors require less inflation compensation. When productivity growth is low (as it is now), economic growth should be roughly proportional to working-age population growth across an entire business cycle. After a string of strong decades (1950-2000), demographic trends have moved from positive to neutral (2000-2020), and are now poised to turn negative in many countries. A recent study by the UK’s Office for National Statistics highlighted that their population projections had been too optimistic, as life expectancy gains have fallen back and fertility rates disappointed. Similar recent demographic trends are found in North America and Western Europe; demographics are already a net drag on national economic growth in Italy and Japan. Meanwhile, UN projections show that the slowing and greying trends in the world’s population are likely to be maintained or increased over the next century (p. 6). As such, economic growth, risk asset returns (stocks, corporate bonds and real estate) and inflation will all likely remain constrained. Post-Keynesian macroeconomic theory1 did not contemplate the uncoupling of the money supply, inflation and consumption/investment behaviour, so central bank remedies have been hard to identify. Recent announcements by Mario Draghi as he steps down from chairing the ECB, by Jerome Powell at the US Fed, and by Kuroda-san at the Bank of Japan all point to the limitations of monetary policy when short-term interest rates approach the zero bound.

As populations reach retirement age, they turn toward low-risk, liquid saving rather than higher-risk, illiquid investing, pushing sovereign bond yields lower. Data from the IMF show that the globe’s total savings has exceeded investment since the turn of the century; their forecasts suggest that this imbalance is likely to remain. Moreover, developing nations save a much larger share of their national income than developed ones (pg. 7), due in part to less mature pensions and weaker social safety nets for the elderly. So, when the rising middle class in China, India, Central Europe, and Latin America generate income in excess of their immediate needs, surplus savings are generated faster than growth in stock markets or domestic consumption. The GFC’s scars may also be evident as investing with a long horizon is dampened by fears that economic conditions tomorrow could be worse than today. Thus, ageing populations imply an increased need to focus on liability-matching, capital preservation, rising liquidity preferences, and ultimately, de-cumulation strategies.

Demographic forces are like giant container ships that move slowly but steadily across great oceans. They cannot pivot or come to a full stop quickly. The demographics of ageing are likely to remain in play for many years to come, so real estate investors should keep in mind the following:

- Demographic themes have a major influence on the resilience of assets, sectors and locations. One approach is to focus on properties and locations that cater to the growth of specific cohorts (e.g., ageing, active adult populations or younger millennials). A subtler approach is to examine how younger and older cohorts interact over time, and how the locational preferences of different cohorts affect each other.

- Demographics also have a “meta” effect on macro factors like capital markets. Persistent downward pressure on risk-free rates could mean that real estate yields will decline further and remain below their previous norms. Lower for longer can become lower forever in ageing societies. Real estate’s ability to generate income will continue to attract institutional capital, particularly as populations (and pension schemes) mature. When sovereign bond yields fall or go negative, pension administrators and individual households will both turn to alternatives like real estate to generate steady income.

- Demographic trends are linked to both the capital markets and the space markets. Unlike economic and political events, population shifts get fewer headlines and move more slowly. Their influence on real estate investment strategies is often underestimated and well worth our close attention.

Political events dominate the headlines and are likely to contribute another round of risk aversion throughout the investment world.

Those who hoped that recent bouts of capital market volatility would be fleeting have been confounded by seismic political events. On one side of the Atlantic, the UK’s Supreme Court unanimously ruled that Prime Minister Johnson had over-reached on the matter of Brexit by suspending parliament. On the other side, the US Democratic Party announced the commencement of impeachment proceedings against President Trump. Across the Pacific, the Hong Kong democracy movement is also in the headlines. In all four of these political theatres – UK Parliament, the EU Council, the US Congress, and Hong Kong – resolutions are far from clear, adding to investor nervousness.

The slowly grinding gears of democratic institutions in Brussels, London, and Washington DC will be put under great pressure over the next few months.

The slowly grinding gears of democratic institutions in Brussels, London, and Washington DC will be put under great pressure over the next few months. An investor’s natural reaction to this uncertainty is anxiety and a flight to quality, which increasingly means low or negative interest rates in return for the security of sovereign debt. Investors will also have one eye trained on any response by other institutions, such as the Federal Reserve, the HKMA, and the Bank of England. These institutions, along with the European Central Bank, have recently employed strong stimulus measures designed to keep liquidity levels high. Whether Central Banks can use their influence to shake major economies out of secular stagnation remains to be seen. The next major tests will be the EU Council Summit on October 17th, the Brexit deadline of October 31st, and the formal inquiry in the US House of Representatives of President Trump.

October 1 represents the 70th Anniversary of the founding of the People’s Republic of China. Hong Kong democracy protesters are also competing for the world’s attention during this historic event. Another institution that struggles to remain relevant is the United Nations. It was rebuked last month by 16-year-old environmental activist Greta Thunberg. The International Youth Climate Movement is raising the social consciousness of governments and corporations, including companies wishing to employ young talent and retailers that wish to sell to them.

The global real estate industry has a major part to play in this unfolding story. Real estate owners are responding to requests from tenants, investors and regulators to improve sustainable practices for construction and building operations—but the speed of this response varies greatly. While the direction of travel toward sustainable practices is unmistakable, the Global Climate Strike could certainly accelerate the attention that building owners pay to a wide range of sustainability issues.

Here are some of the other trends we are watching closely:

- Retail values continue to plummet in the UK, an e-commerce-friendly market that is also a victim of tenant-friendly insolvency practices and legislation. Contrarian investors are circling the forced sellers which will emerge over the next six months as lenders enforce covenants. However, only the best stock will likely recover its value in an oversupplied market. Investors in other countries are watching the UK closely, as sentiment for retail properties turns sharply negative. The recent bankruptcy of Forever 21 shows that the US is hardly immune from retail disruption.

- Office landlords in New York, London, Chicago, and other gateway cities hold their breath as Adam Neumann’s exit adds to WeWork’s troubles. Ripple effects will likely affect the pace of leasing by WeWork and other operators (Knotel, Industrious, IWG) in the near term. Our view is that a positive long-term future for flexible offices and co-working remains intact, but the financial health of operators will remain a concern.

Office markets around the world are experiencing a rapid shift to a more flexible model that incorporates a broad group of important trends including: co-working, space as a service (SaaS), open play layouts, fewer fixed-desks and walled-in workspaces, higher allocations to amenity space, and risk-sharing between property owners and tenants.

Office owners have rarely been as innovative as many of their own tenants. Now, the time has come to adapt. Much has already been written about flexible office trends and co-working operators, but few of these reports describe the owner/investor’s perspective. That is our focus in a recently completed White Paper: The Rapid Growth of the Flexible Office.

In this paper, we describe how landlord and tenant relationships are changing and how property owners should respond. We analyze the economic trade-offs associated with co-working operators/risk-sharing versus traditional leases. We explore the implications for both cash flow and value changes, as well as how the capital markets are likely to react to flexible office arrangements. We conclude that the drivers of flexible offices are not a fad, but are likely to be a long-term trend, especially in industries with high labor costs and reliance on a younger workforce.

Download Full Report

Summer stereotypes don’t always ring true

Everyone is on vacation and nothing major happens until we all return to work in September. However, this slow season was incredibly busy in both political and economic realms in 2019.

The US and China trade war bubbled on, millions of people went to the streets in Hong Kong to protest, the G-7 leaders met in France, and the EU and UK digested the new leadership of Boris Johnson. The tumultuous political backdrop led investors to take a risk-off stance, manifested in plunging interest rates and an inversion of the yield curve.

The direction of real estate values will be based on the conflicting forces of lower base rates, higher risk premiums, and lower future cash flows.

The shifts charted in this month’s macro deck require real estate investors to take a view on conflicting signals: Lower interest rates (driving values up) and slowing economic growth (driving values down). Optimism about future economic growth has declined due to elevated uncertainty, which delays investments and erodes trade activity and manufacturing (p. 8 and 25). This leads investors to take a risk-off stance, causing interest rates to decline around the world. Meanwhile, Central Bankers don’t have much room to maneuver, with rates already low and balance sheets loaded up through QE (p.23). The result has been a deepening of negative interest rates in Germany, France, the Netherlands, and Japan. Also this summer the UK, Canada and the US joined the yield inversion club. Historically, inverted yield curves are a signal of slowing economic growth in the next 12-18 months [see p. 4 and 11 for analysis of how inverted yield curves have predicted future economic activity].

For real estate investors, lower long-term interest rates imply lower borrowing rates, lower discount rates, and higher values. Slower economic growth, however, leads to uncertainty around future cash flows, raising the risk premium assigned to real estate and lowering forecast cash flows in a valuation model. The direction of real estate values will be based on the conflicting forces of lower base rates, higher risk premiums, and lower future cash flows.

So where are investors coming out today on these factors that push and pull on valuations? Borrowing costs are falling, but real estate prices do not price every shift in interest rates. Economic outlooks are lower; each investor takes a different view on how that will impact property cash flows. And there has not been a significant widening of CMBS, REIT Bond, or corporate bond spreads that would indicate risk premiums moving higher (p. 21).

The REIT market is showing value creation from lower interest rates rather than value loss from lower cash flow or higher risk spreads (p. 20). Anecdotal evidence supports private equity indices that show real estate values are flat to slightly higher this year in many countries. There are exceptions such as retail properties in many markets; and investors are becoming more selective in what qualifies as “core”, thus raising the risk premium on some properties. Given the time it takes to complete large real estate transactions, recent evidence is hard to come by; but as we move through a season of more active real estate trading, we should have a clearer answer in the next several months.

Interest Rates and Inversions are not the only topics discussed in the corridors of LaSalle and prompting emails to bounce around our firm:

- WeWork is moving closer to its IPO. Several commentators speculated how much magic this unicorn can bring to a market where some recent IPOs have not been well received (see p. 16-17). Information from the Prospectus has raised more questions than answers regarding the future of the company.

- The Larry Summers and Anna Stansbury piece about the eroding power of Central Bankers to guide the economy returns us to questions of Secular Stagnation and what it would take to really invigorate the global economy. These debates raise questions about the long-term outlook for real estate relative to other asset classes.

- Shopping center distress remains in the news, and we are trying to figure out which retail assets have value and where the islands of safety might be.

How will it change the retail landscape?

Rapid growth in online shopping is reshaping the retail landscape. Most observers believe that online shopping is eating brick-and-mortar retail’s lunch, with no end in sight.

This view is reinforced by headlines describing retailer bankruptcies, department store struggles, and half-empty malls. The combination of the changing retail landscape and consumer behaviour have also negatively affected commercial real estate investment performance. Before 2011, the retail sector posted an annualized total return of 8.7% based on the MSCI Global Annual Property Index. This is almost 200 basis points above the industrial sector. However, the retail sector has underperformed the industrial sector in recent years. This underperformance trend has been more pronounced in some countries than in others. As a result, many investors are avoiding or under-weighting retail until the future winners and losers become clearer.

In our view, the retail sector remains an essential part of the commercial real estate universe, and investors need to understand the disruption and respond to it.

In our view, the retail sector remains an essential part of the commercial real estate universe, and investors need to understand the disruption and respond to it. LaSalle has studied various retail markets, particularly in China, which has one of the highest online shopping penetration rates globally, to see how retailers react and how shopping centers evolve as they move through the disruption cycle. While there are many differences between retail markets around the world, we found that the broad trends are similar as the retail sector responds to e-commerce disruption.

Based on our framework, digital disruption occurs in four stages for a shopping center with a top tier catchment:

- Stage 1: Early Disruption

When the online shopping penetration rate reaches the 7 to 10% range (depending on the country), the first signs of disruption are evident. At this stage, shopping centers have a high concentration of product-selling tenants (in many countries it is about 50%), even after the first round of store closures, which focus on books/audio/music content. Real estate fundamentals are still healthy, but warning signs are evident through flat/falling apparel/fashion sales and declining foot traffic at department store anchors. Store closures are not a problem at first, because of the depth of demand from retailers for top-tier mall space. - Stage 2: Maximum Disruption

At this stage, the online shopping penetration rate increases rapidly to 10% or more of total retail sales. Shopping centers attempt to adjust their tenant mix towards still-thriving retail segments, and increase their entertainment, food, and beverage offerings. Some department stores become liabilities that require creative management. Real estate fundamentals deteriorate due to a combination of a weak retail environment and initiatives to optimize the tenant mix by infusions of capital expenses and discounted rent levels. The UK and China went through this stage in 2014-2016. Many other countries like the US, Canada and Germany are just entering this stage of maximum disruption. - Stage 3: Convergence: E-Commerce and Shopping Centers

The online shopping penetration rate continues to increase in Stage 3, but online shopping sales growth begins to moderate. Shopping centers continue to adjust their tenant mix toward experiential retail segments such as entertainment, food, wellness, and creative spaces for artists, musicians, or theatrical performances (~47%). The emergence of a holistic online and offline retail experience, as online retailers push for a brick-and-mortar presence and vice-versa from brick-and-mortar retailers. Real estate fundamentals begin to stabilize at late-Stage 3 as retailers/landlords adapt to the new retail landscape. Retailers use brick and mortar spaces as showrooms and fulfilment centers that offer guided tours of their product lines to complement, rather than compete with, their on-line presence. - Stage 4: Future Equilibrium

Eventually, a new retail landscape will emerge where online and offline shopping co-exist and reinforce each other. Brick and mortar centers establish their comparative advantages: for entertainment, socializing, community-building, experiential services, and tactile encounters with new products or services. On-line shopping continues to excel at convenience, value and comparison shopping. Real estate fundamentals stabilize as the disrupting influences gradually are absorbed into the new, omni-channel landscape. Landlords will undoubtedly be asked to help finance some of the new fit-outs for retailers and to help replace department stores with new entertainment anchors. Values of shopping centers stabilize and investors return to treating retail properties as a mainstream property type and an important part of a real estate portfolio.

Investors must recognize that the growth of online shopping is a secular trend that is here to stay. This digital disruption framework can help investors understand where a country’s on-line and off-line retail markets are in terms of their evolution. This can help countries like Australia, New Zealand or southern Europe to understand its potential future trajectory. With the understanding of what is to come, investors can draw up asset plans for their retail properties in their existing portfolio and refine their investment strategies for evaluating the future role of shopping centers in their portfolios.

The mid-year assessment of real estate investment markets contains insights and analysis from around the world.

Thus far in 2019, political headlines have dominated our investment committee discussions and research reports. Yet national economies, capital markets and property markets all continue to be relatively impervious to the geo-political noise. It’s as though businesses, consumers and investors are all wearing sound-canceling headphones.

As the second quarter closes, momentum has shifted downward. The triggers for “Slowbalisation” include aging societies, the rise of nationalism, and trade disruption. Yet, as our monthly macro decks have shown, the capital markets generally remain strong. Stock market indices have bounced back after taking losses when the U.S.-China trade wars escalated on May 10th. Debt is cheap and plentiful. Credit spreads are not gapping out anywhere. While we identify several problematic industries and potential ripple effects from trade interruptions, the general momentum in property markets is positive.

Political and structural uncertainty has kept interest rates low on sovereign debt. One fifth of all government bonds produce zero or negative interest rates. German bonds have hit a record low, negative yield in June. Investors remain starved for yield and real estate is one place they can still expect to earn positive dividends. At this stage of the property pricing cycle, we know that there are real estate sectors, like weaker shopping centers or disconnected office buildings, that already are, or soon will be, in serious financial trouble. Yet, price discovery can take several years as owners avoid selling and memorializing any losses. In the meantime, banks will still lend money to owners who contemplate property makeovers, not all of which will be entirely successful.

As the year has unfolded, the space between real estate’s winners and losers is getting wider, as we predicted it would. Investors are putting record-high valuations on logistics properties all over the world, while investors shy away from retail properties and older offices that lack strong urban or suburban networks. The office sector has been propped up by co-working absorption and momentum in life sciences, healthcare and technology; but the costs of leasing to many tech tenants is high. The amenities they demand are expensive. Rental residential markets are generally faring well in many cities, but they are beset by new policy initiatives that may hurt their values in the future.

We maintain our recommendation for investors to pursue both “low beta” and “positive alpha” strategies. The core strategies will withstand volatility in other asset classes best. A “positive alpha” strategy, takes carefully calibrated risks and gets rewarded for doing so. As volatility rises and global growth begins to slow, income stability plays an important part in an investment portfolio. The second goal (positive Alpha) seeks specific assets and sectors within real estate capable of contributing to out-performance relative to the steady erosion of core property indices in many countries.

Two documents are included in this update: The Mid-Year ISA Update Report, and the July 2019 Mid-Year Macro Deck, which includes a summary of our much-requested report “The Investable Universe”.

Download Full Report

LaSalle has looked at the likely macroeconomic costs of increased barriers to trade and their potential consequences for European real estate markets.

Until recently, free trade seemed to be a crucial ingredient to the dominant political and economic narrative. After several rounds of trade liberalisation, and except for the immediate aftermath of Lehman Brothers’ collapse in 2008, the world economy enjoyed virtually seven decades of uninterrupted growth in export volumes. Global tariffs dropped tenfold from 40% fifty years ago to just 4% currently. Rapid evolution of supply chains was facilitated by the removal of trade barriers that followed the completion of the Uruguay Round in 1994 and the creation of the WTO, plus the integration of China and the Soviet Union. Over that period global trade growth outstripped economic growth by nearly a factor of two resulting in world trade (imports + exports of goods and services) accounting for nearly 45% of world GDP growth since 1990.

Download Full Report

Tariffs and the rise of protectionism

International trade has been steadily rising at a faster rate than global economic growth since the end of World War II. Yet, 2019 marks the end of this 75-year trend–the equivalent of a massive container ship slowing to a crawl.

Cross-border trade represented 6% of world GDP in 1946; it rose to 23% last year, and in 2019 this ratio is falling. New trade policies initiated by the world’s largest importer of hard goods (the US), together with tariff retaliation and the rise of nationalism and protectionism in several other countries—these are the driving factors behind the end of a seven-decade trend.

If trade continues to stay stalled, the impacts on global economic growth rates could be significant, albeit with meaningful variation by country.

After signaling progress toward resolving the China/US trade dispute, President Trump surprised markets by raising the tariff rate on $200B of Chinese imports to the US from 10% to 25%, effective May 10, and reiterated the potential to extend 25% tariffs to the remaining $325B of imports not currently subject to taxation. This latest increase is in addition to the $50B of imports previously subject to a 25% duty. Moreover, on May 15, the US further raised stakes by issuing an executive order effectively banning US companies from doing business with Huawei, the world’s second largest smartphone maker. And on May 30, the US issued another tariff threat for Mexican imports.

Markets reacted negatively, with the US S&P 500 declining 6.6% and the Shanghai Composite declining 5.8% in May (see page 7). The US yield curve has also inverted (page 12). Unsurprisingly, China retaliated with tariffs on an additional $60 billion of US imports effective June 1 and has threatened to curtail exports of rare earth elements, a key industrial input.

If trade continues to stay stalled, the impacts on global economic growth rates could be significant, albeit with meaningful variation by country. The theory of comparative advantage is among the oldest and best established in classical economics – developed by David Ricardo in 1817. It states that producing goods based on local strengths and resources and trading for other products produces higher global production and wealth. Many economists also acknowledge that the benefits of free trade can be uneven and subject to manipulation by some countries. In other words, unfettered free trade increases the size of the global economic pie—but it does not necessarily lead to larger pie slices for all.

Oxford Economics expects global trade growth to slow to 1.8% in 2019, down from 5% in 2018 and down from an average of 7% annual growth in the last two decades. Although the direct dispute has mainly involved the US and China, many other countries and technology firms will be affected as they export intermediate goods to China, which China will curtail due to declining exports. Countries most exposed to the global trade slowdown include Korea, Taiwan and Germany, while less open economies, such as the US, Brazil and India, are better insulated.

How should real estate investors react to the recent trade news?

- Core real estate, consistent with its low beta profile, will likely be less impacted than most sectors of the economy, as operating buildings have little or no imported inputs. Harsher treatment of off-shore real estate investors vs domestic capital could be a retaliatory risk, but has not yet risen to the top of the saber rattling list.

- Real estate demand will suffer to the extent that GDP and jobs are impacted. Current forecasts are for modest impact on GDP in most countries — erosion of 50bps (or less) growth. A further escalation of the trade war would worsen the impact.

- Tariffs on materials (especially) will modestly increase the cost to deliver new buildings and upgrade existing ones. At the margin, this will reduce new construction and increase the value of existing buildings, although the impact can be muted by currency moves, lower developer profits and lower land costs.

- The warehouse/logistics sector will experience the greatest impact among property types to the extent that tariffs reduce imports of retail products and business equipment. Supply chains will be interrupted if/when the UK leaves the EU or as import substitution occurs in the US as goods from Korea, Japan, Vietnam and Mexico take the place of Chinese-made imports subject to tariffs.

- The cost savings from e-commerce and other technological improvements may offset the rise of tariffs, so that consumers and businesses are not slammed by higher costs, causing final demand to plummet. Within China and India, the fast-growing domestic economies and lack of modern logistics buildings should support the growth of the warehouse sector for the foreseeable future.

In summary, the current US/China trade dispute is a reversal of many decades of free and growing trade between countries. A few observers expect that the dispute will be resolved by the end of the year, although recent actions and remarks by both the US and China create doubts about that outcome. The impact on real estate demand and values should be modest compared to other sectors, although unforeseen consequences are certainly possible.

In addition to this month’s Macro Deck, LaSalle’s Research & Strategy team published four new briefing notes over the last month:

- Completion Strategies for Real Estate: Bringing together authors from LaSalle’s public and private real estate investment team’s, this paper illustrates how institutional investors can use publicly traded real estate securities to efficiently “complete” their real estate allocations by adding niche property types.

- Urbanization Reimagined: In this note, we look beyond the simple story of more tenant demand in urban places and consider how land prices and rents will change in different parts of the metro area going forward.

- Proptech and Predictive Data Analytics are Changing Real Estate Investment: This note expands on our 2019 ISA, examining how predictive data analytics tools and proptech companies could change how we invest, as well as how we seek to see through the hype that surrounds the growing proptech sector.

- The 2018-19 Investable Universe Update (forthcoming): This is LaSalle’s annual review of the size of the professionally-managed stock of investment real estate, whether held by a listed company, a REIT, or a private equity investment pool. Using new estimation techniques, we also rank the top 40 metros in the world in terms of the total value of their income-earning real estate.

Canadian real estate provides domestic and foreign investors with attractive long-term returns, low volatility and high transparency. Canada also offers a diverse economy with a stable, sophisticated and well-regulated banking and lending environment, all of which are beneficial to real estate investing.

Private real estate in Canada has generated attractive absolute and relative returns over short, medium and long time horizons and it is expected to continue to do so over the long term.

This backdrop is favourable to both core and value-add investing strategies. LaSalle published a report on core real estate investing (Investing in Canadian Real Estate, January 2017) and in this paper we turn our attention to value-add investing. This report starts with an overview of the benefits of investing in Canadian real estate, followed by value-add strategies that are attractive in the current environment.

Download Full Report

Technology tools designed for commercial real estate — collectively referred to as CRE tech or proptech — have leapt from a niche sector dominated by a few dozen well-established companies into a hive of creative startups, led by experienced tech entrepreneurs and venture capital firms. The new entrants claim to offer investment managers products and services capable of increasing revenue, reducing expenses, and predicting the future.

Since 2017, global proptech companies raised $27 billion of capital, far more than raised in all previous years combined, fueled by exponential growth in digital data, low-cost sensors, and a growing interest by the venture capital industry.1 In the 2019 edition of the ISA, we shared a brief overview of LaSalle’s approach to predictive data analytics and examples of specific analytics tools we’ve developed. This year, we examine how these tools, and proptech companies, could change how we invest, as well as some of the limitations behind the hype.

Download Full Report

The largest institutional investors access core real estate through private investments — typically separate accounts or comingled funds. In most of the world, private real estate investment strategies have typically focused on major property sectors, such as office, retail, and industrial, with residential and hotel assets also included in core portfolios in some countries. Consequently, institutional investors often have little exposure to less traditional or niche property sectors.

In recent years, there has been a significant growth in the universe of niche property types as well as increased investor interest. Both the private and public real estate sectors have benefited from this trend, although it has been more pronounced in the publicly traded real estate universe. Returns of niche property types have been strong in both the public and private sectors, generally exceeding overall property indices over the past decade. Many of the niche sectors also out-performed traditional property types during the Global Financial Crisis (GFC) due to factors such as counter-cyclical demand drivers and/or limited supply due to fewer qualified developers.

Management of niche property types often requires specialized knowledge and resources, differing from typical core real estate investment and management practices. While there are qualified and experienced managers for privately held niche sectors, gaining access to these private operators and managers is typically difficult due to fewer options and smaller funds. Conversely, the opportunity set to access these niche property sectors in the public real estate securities universe is significantly larger and more available, while also offering some of the best in class operators in these property types.

As discussed in the full report, niche property sectors have become an increasingly significant component of the investment universe, putting most institutions in an underweight position relative to those sectors. Therefore, institutional investors should consider publicly traded real estate securities as an efficient means to “complete” their real estate allocations and help align the property type weightings with the true investable universe.

Download Full Report

Increasing and changing urban density continues to shape real estate markets, as anticipated by LaSalle’s DTU+E framework of secular drivers. In this short white paper, we look beyond the simple story of more tenant demand in urban places and consider how its repercussions on land prices and rents will change metropolitan areas in the future – and our investments in them.

The interaction of more demand for urban places and limited space – which varies based on each market’s regulations, existing buildings, and natural barriers – has driven up rents and land values in city centers to varying degrees.

The developed world’s gateway cities in particular have become much less affordable, relative to prior decades, especially to first-time job seekers. In the city of San Francisco, the median home sales price increased 59% in just the last five years, to USD1.3 million. In Hong Kong, home prices have surged by 232% since 2008. Faced with being priced out of their location of choice, residents, corporate occupiers, and retailers are reacting in a variety of different ways.

Download Full Report

April showers and May … flowers?

The weather is now ideal for a May stroll, or even a random walk, as April showers fade from our macro view. Positive news on the Chinese and US economies, a buoyant equities market, and a Brexit extension have all brought more sunshine into the outlook. Our macro deck is filled with financial data series – and many real estate metrics – that appear to be random walks. Global stock market indices, bond markets, and even property prices do not always revert to a stable long-run average. Nobel prize-winning financial economist, Eugene Fama, described such time series as “having no memory.” This makes them inherently unpredictable using even the most advanced econometrics.

Our macro deck is filled with financial data series – and many real estate metrics – that appear to be random walks.

Fortunately, this does not mean it is impossible to predict real estate prices or rents, thanks in part to the special case when random walks are cointegrated with each other. Think of this like going for a ramble with your dog. The path you take might be random, but it would be a safe bet that you and your dog would stay close to each other along that unpredictable path, albeit with variations depending on whether you are using a leash. Cointegrated time series behave much this way. For example, while recently listed Lyft and Pinterest’s stock prices (see page 13) are a random walk, analysts can price information on New York exchanges to predict the price movement of Rakuten shares in Tokyo, which has stakes in both companies. If market prices do not reflect this, then it can create an opportunity for arbitrage.

For real estate investors, the key cointegrated pair of time series are real estate values in the public and private markets: page 3 in this month’s deck. The difference between these series – the NAV premium or discount – has varied significantly over time, but has been near parity over the long-run. However, since October 2016, the implied value of real estate based on public REIT and real estate security pricing has been below the values implied by transactions in the private real estate market. This significant global NAV discount had some observers wondering if this particular “leash” had snapped entirely in two, especially for office and mall REITs.

LaSalle’s conviction that public and private real estate values must be similar over the long run – based on their cointegrated relationship – has been borne out so far in 2019. In early April 2019, the NAV gap – based on the EPRA/NAREIT global index – reached its narrowest level in 31 months. The way the gap has been resolved is meaningful. Private values did not decline to meet the public market, albeit with some exceptions, such as for US mall retail. Nor did public and private meet in the middle. Instead, public values have recovered and the gap has been resolved largely in favor of private real estate values. Underneath these headline figures, there continues to be significant variation in NAV discounts and premiums across individual countries and sectors – leaving many opportunities for LaSalle’s Securities team to make accurate, high conviction predictions of relative value changes.

We recommend that investors focus their forecasting efforts on three key areas where high conviction predictions are possible: cointegrated data series like those described above, data series that are not random walks but are mean-reverting (like the vacancy rates shown on page 23 of this month’s deck), and real-time information predictive of the near future – such as when competitive projects are scheduled to break ground. Technology and improved data frequency is changing how we do these kinds of forecasts. Not unlike taking a Fitbit or smart watch on our next ramble, real estate investors benefit from the collection of more granular and geolocated data.

China’s logistics sector is anchored by the country’s large population and economic base, and its domestic long-term fundamental growth drivers, despite the rise of global trade protectionism.

China’s economy is expected to grow at a slower pace going forward. This reflects the expected trend of slower growth rates as a country’s economy matures, and is the most likely scenario, despite the threat of the U.S.-China trade war. Even if China’s GDP only grows at 5-6% per annum, it would still be one of the fastest growing large economies in the world. China is the largest economy in Asia Pacific and the second largest economy in the world. Based on LaSalle’s estimate, the incremental GDP value that China is projected to create from the end of 2018 to 2019 is equivalent to the overall GDP of Australia, if the Chinese economy grows by 6% in 2019; and twice of Sweden’s GDP if the Chinese economy grows by 5% in 2019. In other words, China will be adding the equivalent of one Australia or two Swedens from the end of 2018 to 2019, if the economy grows by 5- 6% in 2019.

Domestic consumption is the dominant driver of economic growth, and this trend is expected to continue in the medium and long term. LaSalle believes that the solid domestic fundamentals and structural changes that are underway in China provide a favorable risk-adjusted return profile to invest in and develop modern warehouse facilities. Key themes for modern warehouse investment opportunities in China include the following:

- Domestic long-term growth drivers;

- Supportive government policy;

- Limited modern warehouse facilities; and

- Market selection

Download Full Report

Despite many months of negotiation, debate, and fervent speculation, the uncertainty surrounding the UK’s future relationship with the EU has yet to be put to rest.

After failing to ratify the proposed Withdrawl Agreement ahead of the original deadline, the UK may still leave the EU with no guidance as to its future relationship.