LaSalle and Accumulata Real Estate Group are developing Munich’s first hybrid timber office building, Trí.

-

0%

operational carbon savings

-

0%

less regulated energy use

-

0%

lower embodied carbon than other sustainable buildings in Germany

-

0

DGNB Platinum pre-certification by the German Sustainable Building Council

Trí is designed to demonstrate the power of timber to deliver both environmental benefits and commercial value, with a much lower embodied carbon profile than conventional buildings and strong interest from occupiers. CBRE is acting as the lead leasing agent.

“This is an industry-leading and best-in-class project. The first of its kind in Munich, its design in accordance with circular economy principles and resource-conserving operation will serve as a benchmark in sustainable real estate. Located in one of the most sought-after office submarkets in Munich, we expect the property to be extremely well placed to meet the ever-evolving demands of future occupiers around sustainability, quality, amenities and infrastructure, while providing attractive long-term returns for our investors.”

-David Ironside, Fund Manager, LaSalle Investment Management

Converging needs are leading to more dialogue and transparency than ever before

Investors are wary about the economy. Companies are trying to attract people back to the office. Both camps are working toward their sustainability goals.

This all makes high-quality real estate – buildings that meet green specifications, or spaces that companies want to lease and where employees want to work – what everyone wants right now.

The convergence on quality is bringing about a major shift in the industry. The relationship between investors and occupiers has long been largely transactional, and at times even adversarial. But it’s increasingly becoming one of cooperation and partnership.

Beverley Kilbride, European COO of LaSalle Investment Management, and Andy Poppink, CEO of JLL EMEA Markets discuss the drivers behind this changing dynamic – and the state of real estate in general – on JLL’s website.

for wine and for real estate

The start of the grape harvest season calls to mind the similarities between winemaking and real estate. Real estate fund managers often borrow vineyard terminology to describe their actions. Seed capital is raised and invested, portfolios are pruned, proceeds are harvested, and funds are classified by their vintage year, meaning the year of fund formation.

Does the inception year for a fund matter in the same way a vintage year matters for wine? Our analysis of data from Preqin highlights that both the vintage year and risk style of a fund have been important determinants of performance over the last 30 year.

Does the inception year for a fund matter in the same way a vintage year matters for wine? Our analysis of data from Preqin highlights that both the vintage year and risk style of a fund have been important determinants of performance over the last 30 years (Page 5).

A wine vintage is shaped by external conditions like the weather. Stressful conditions like droughts can produce great wine. Likewise, macroeconomic conditions influence a fund’s risk and return characteristics. In the Mid-Year 2022 ISA, we noted how capital markets are experiencing a major regime shift. The macroeconomic environment has quickly moved from lower-for-longer to weaker growth (Page 33), high inflation (Page 14), and higher interest rates (Page 9), all of which affect real estate performance.

Vintage years characterized by major disruptions in macroeconomic conditions – like the dot-com crash or the global financial crisis – have been associated with modestly higher median returns compared to the prior period, but also a significantly higher dispersion of returns (Page 6). So, a stressful macro environment simultaneously creates higher volatility while it also slightly raises the odds of a stronger entry point for investing. Put differently, choosing a wine from a good vintage year is no guarantee that it will turn out to be a memorable bottle!

In wine-growing countries across the world, the summer has been dry and hot. Decades of historic data allow oenologists to draw inferences about the likely quality of the 2022 wine vintage. However, vintage year analysis for real estate funds is trickier. For one thing, the combination of macroeconomic conditions that the 2022 real estate fund vintage faces–weak growth, high inflation and rising interest rates–have not been seen in conjunction since the 1970s.

In addition, the repricing implied by public real estate markets (page 31) has not yet fully worked its way through private markets. On the one hand, capital that has been invested early in 2022 already might face valuation declines if the repricing continues. On the other hand, any private equity repricing in late 2022 offers an interesting entry point for funds with dry powder.

Even with plenty of data to review, it takes the passage of time to confirm the final quality of a wine vintage. We also expect that it will take several years for the true quality of the 2022 real estate fund vintage to be known. Nevertheless, the wine analogy (and our own research) shows that stress can still produce a strong vintage, for wine or for real estate.

An unrelenting wave of macro news amidst record-breaking heat has carried through all of 2022 to the start of August. With persistent high inflation readings (p.13), energy price volatility and supply disruption (p. 20), interest rate hikes (p. 4), bear equity markets (p. 8), heightened recession risk (p. 3), and VC capital slowing (p. 7) – the post-COVID recovery cycle is at risk.

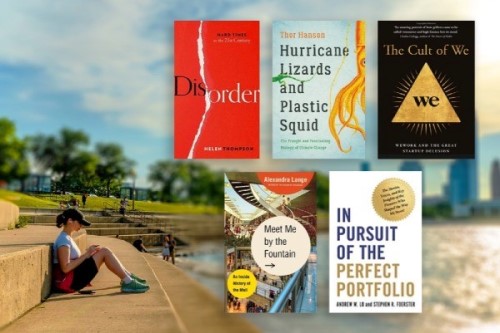

Recently published books that we’re reading – and recommending – this summer delve into energy geopolitics, climate change impacts, and the history of real estate and investments.

Yet August, with its summer festivals and family holidays for many, is a good month to put the frenetic pace of change into perspective. Many of the indices, prices, and events summarized in our macro indicators deck reveal just the tip of the iceberg, with a deeper, complex story hidden from view. Often only a longer form, like a book, can do justice to these stories.

Recently published books that we’re reading – and recommending – this summer delve into energy geopolitics, climate change impacts, and the history of real estate and investments. Helen Thompson’s Disorder: Hard Times in the 21st Century (Feb. 2022) traces how historic energy policy contributed to today’s geopolitical fractures, in Europe and beyond.In asimilar vein, Ian Bremmer’s Power of Crisis (May 2022) looks at how leaders are responding to three big crises facing the world: health emergencies, climate change, and the rise of artificial intelligence (AI). The UK, Central China, and Texas have sweltered through record temperatures over the last month and the continued backdrop of virulent COVID strains, like BA.5, continue to show how these crises are not mere abstractions but are a recurring part of modern life.

Concrete examples of climate impacts, like how reptiles are trying to cope with more frequent Caribbean storms, abound in Thor Hanson’s excellent book, Hurricane Lizards and Plastic Squid (Sept. 2021). Hansen delves into a new field of climate change biology. He describes the long sweep of natural time as one of “punctuated equilibrium.” This consists of “bursts of rapid activity (punctuations) followed by long periods of stability.” This pattern also aptly describes economic and real estate cycles, with current turmoil upsetting the post-GFC equilibrium.

Turning to real estate – and some quite recent history – The Cult of We (July 2021) by Eliot Brown and Maureen Farrell – lifts the curtain on the madcap history of WeWork’s founding by Adam Neumann. The writers focus on the hubris that led to the downfall of “We”, although the recent reset and rebound of many shared office concepts is beyond their scope. Alexandra Lange’s Meet Me by the Fountain focuses on the shopping mall – and how it “has changed and changed again” from futuristic, to ubiquitous, to pandemic-induced redevelopments (June 2022). In Land (Jan. 2021), Simon Winchester links a variety of tales on a theme of land as “the only thing on earth

that lasts.”

And, in a book tailored for investors, In Pursuit of the Perfect Portfolio (Aug. 2021), Lo and Foerster describe how the ideas of Markowitz, Bogle, Shiller, Siegel, and six other investment visionaries developed the frameworks that have taught us to build better portfolios.

We also invite you to read our Mid-Year ISA, released last month, laying out our global real estate investment recommendations at this inflection point, with a particular focus on inflation protection, strategies to weather shifting monetary policy, and the sustainability revolution in real estate. In addition, we have published a new white paper this month on the Demographics of Aging and its impact on real estate.

Shelter from the storm

More economic and geopolitical history unfolded in the first half of 2022 than typically occurs during the span of several “normal” years. The quaint concept of “normality” may itself prove to be an artifact of history. Yet, the mid-year ISA describes how real estate held up well despite all the tumult. Strategies we set out in 2021, performed as expected, or sometimes even better than expected. Strategy shifts recommended by LaSalle for the second half of the year are modest, despite a renewed focus on the changing macro environment.

Real estate generally provided shelter during the waves of volatility that swept through the securities markets in the first half of the year. In the second half, we foresee different dynamics unfolding as described in Chapter 1, and in the specific strategy shifts recommended in Chapter 2. The big change has been the end of ultra-low interest rates in Western countries. Finally, we revisit the role of real estate in a portfolio in Chapter 3, based on new research done with JLL for the bi-annual Transparency Index, as well as the most recent updates to the correlations with other asset classes.

The most important change in the macroeconomic outlook has been the regime shift from highly accommodative to tightening monetary policies by Western central banks. Many world events simultaneously contributed to this inflection point including: the re-opening of economies after COVID-19, Russia’s invasion of Ukraine, trade wars, and government stimulus spending. Although these pressures were building in 2021, there is no escaping the fact that the financial and commodity markets shifted sharply in the first half of 2022.

In this mid-year update, we focus on the ways that assets and portfolios can be positioned to weather a sustained period of high inflation. We acknowledge that each country is in a slightly different position in the transition from low to higher inflation and that each central bank will react differently to the mix of cost-push and demand-pull inflationary forces.

Other highlighted trends include the continuing competition and complementarity between virtual and physical space. Patterns that affect both asset and sector selection are now coming more clearly into view. Also, we point to the continued momentum of the sustainability revolution as investment managers commit to reducing the carbon footprint of their portfolios, while also grappling with climate risk forecast challenges, transition risks from new regulations, and social issues like housing affordability or health and well-being factors that affect tenants.

Want to continue reading?

Stellar private real estate returns continue; but poised to decelerate

US private real estate returns remained very strong in the first quarter of 2022, which brought trailing-year returns to levels not seen in 40 years. Industrial and apartment sectors continued to lead, while office and retail continued to lag. The 1Q returns do not reflect the rapid changes in the US macro-economic environment that started in the first half of 2022. It is almost certain returns will slow dramatically in the coming quarters, but the timing and magnitude of the shift to lower returns is highly uncertain.

This note provides some details on the performance of the NPI and ODCE indices, along with views on the outlook for US private real estate returns informed by LaSalle’s market activity, valuations, and the PREA Consensus forecast.

Highlights from the 1Q data releases include:

- Quarterly total returns appear to have peaked at the end of 2021. The NPI total return of 5.3% in the first quarter was down from 6.1% in the fourth quarter, but still the third consecutive quarter with a quarterly return over 5%. The trailing-year return is up to 21.9%, the highest since the first quarter of 1980 (another time when inflation was elevated).

- The quarterly income return of 0.99% was below 1% for the first time ever, bringing the trailing-year income return to 4.18%. Appreciation returns of 4.34% brought the trailing-year appreciation to 17.2%, the highest in the history of the NPI (dating to 1978).

- Property type trends remained consistent with past quarters, with industrial leading by a wide margin, apartments also delivering strong performance, while office and retail lagged significantly. This continues to highlight the importance of sector selection in driving relative performance.

- The ODCE quarterly gross total return of 7.37% was down 60 bps from the record level in the fourth quarter. This was comprised of a 0.93%income return and a 6.44% appreciation return. The trailing-year gross ODCE return is up to 28.5%; 27.3% on a net basis, both all-time highs.

- 1Q returns are based on income earned in the first quarter and appraisals completed over the course of the quarter. These returns do not reflect the negative macro news that started to emerge in the first half of 2022.

The transition from acute to chronic stress

Three months after the Russian invasion of the Ukraine, the fighting and destruction continues. Our March macro deck focused on the ensuing volatility of equity markets, consumer prices and energy costs. In June, there is no sign of the conflict abating, volatility in the capital markets remains high, and energy costs continue to edge upward. As the situation in Ukraine transforms from an acute conflict into a chronic state of affairs, it joins a string of other global stress points that remain ongoing and without closure. Among them are: COVID-19, rising inflation, supply-chain blockages, climate change, and geo-political tensions that exist far beyond Eastern Europe.

The progression from acute to chronic has another positive aspect. The transition allows investors to underwrite assets with the new risks accounted for.

The trade links between the world and the conflict zone in Ukraine are relatively small in aggregate terms. However, when combined with COVID-related snags and new sanctions on Russian exports, these blockages become severe all across Europe and beyond. Critical commodities such as energy, grains, and specific materials with direct implications for real estate (such as sheet metal and sprinklers used in warehouse buildings) are all affected. This contributes to higher levels of inflation in Europe and around the world. The macro deck shows that medium- and long-term inflation expectations remain subdued (pages 7,8,10). But, this comforting view does not alleviate the stress on major economies and construction pipelines in the short term.

Chronic inflation risk will likely be mitigated by real estate’s ability to work as a partial inflation hedge, although this ability is uneven across markets and sectors. This is because real estate has performed best as an inflation hedge when landlords have pricing power to push market rents. Today, this pricing power is in place for many property types favoured by investors. Moreover, this inflation hedging performs best when rising utility costs can be passed through to tenants via “triple net” leases, rental indexation and shorter lease terms. Inflation also contributes to higher construction costs, which means higher replacement costs, extended construction periods and slowdown of development pipelines. In the past, this has supported resilient values for standing assets during periods of elevated inflation. There are no guarantees that this resilience will occur, but the pieces are in place for a strong inflation hedge effect again.

From an investor’s perspective, geo-political tensions would appear to represent a chronic malady of the post-globalization era. Examples of authoritarianism, geopolitical disputes, populism, and nationalism can be found across the world. Important measures to watch are: geopolitical risk (page 3), the health of democracy (page 13) and real estate transparency. According to EIU’s Democracy Index 2022, the scores have been falling in many countries, due to pandemic restrictions that meant many countries struggled to balance public health with personal freedom. On the bright side, JLL and LaSalle’s soon-to-be released Global Real Estate Transparency Index shows marked improvements in three categories: sustainability reporting, proptech adoption, and data tracking of alternative property types. Rising transparency may not counter all the negative effects of falling democracy; but data availability and strong property rights have historically underpinned the free movement of capital to real estate.

The progression from acute to chronic has another positive aspect. The transition allows investors to underwrite assets with the new risks accounted for. During the acute stage, investment decision-making can become paralyzed. In the chronic stage, investors can begin to make longer-term risk adjustments that anticipate the long-term trajectory of the situation.

The transition from pandemic to endemic

On March 11, 2020, the World Health Organization (WHO) declared COVID-19 a pandemic.

As the pandemic enters its third year, there is a growing consensus that COVID-19 variants are likely here to stay. The world will need to adapt to this endemic phase as new, milder variants are likely to continue to emerge. The decline in the number of reported new cases worldwide and the accelerated vaccination efforts have boosted public confidence. In February, Denmark became the first European Union member state to lift its COVID-19 measures. Other European countries and the United States have also eased restrictions. Last week, Ursula von der Leyen (the European Commission President) and Dr. Anthony Fauci (the US infectious disease expert) both declared that the acute phase of the pandemic phase may be over — at least for now.

As the pandemic enters its third year, there is a growing consensus that COVID-19 variants are likely here to stay. The world will need to adapt to this endemic phase as new, milder variants are likely to continue to emerge.

Similarly, many countries in the Asia Pacific region are also transitioning to living with COVID-19. The Asia Pacific region has been relatively successful in keeping the coronavirus at bay over the last two years. As a result, some countries in the region, like China, were able to restart their economies relatively quickly and limit the economic impact of the pandemic. However, the emergence of the highly contagious Omicron variant has pushed governments in the region to re-impose strict measures to give their healthcare system time to recalibrate and set the stage for living with COVID-19. While many countries in the Asia Pacific region are moving towards living with COVID-19, China has maintained a zero-COVID policy. Since March 2022, the Chinese government re-introduced mass PCR testing and lockdowns in “high risk” neighborhoods of several Chinese cities to curb the Omicron variant outbreak. In April 2022, the IMF and other economists gave China a modest downgrade on its growth outlook, although these revised estimates remain higher than any major European or North American economy. On April 28th, President Xi made a solid commitment to increase infrastructure spending to counter slowing growth. In addition, the People’s Bank of China’s has re-committed to easing monetary policies. These efforts are expected to offset some negative impacts from the zero-COVID policy. We expect the recovery of occupier markets in China to be delayed, but not detoured.

Australia, Singapore, and South Korea are among the leading countries in the Asia Pacific region that are making the transition to living with COVID-19, helped by their stabilizing infection rates, and rapid vaccination/booster rollout. As of the end of April 2022, Australia, Singapore, and South Korea have eased nearly all COVID-19 safety measures and re-opened their borders to fully-vaccinated foreign visitors without the need for quarantine. Japan is also moving toward living with COVID-19, albeit at a slower pace than Australia, Singapore, and South Korea, after its quasi-state of emergency was lifted on March 21, 2022.

The relaxation of public health measures and the transition to living with COVID-19 have been highly beneficial for real estate demand. In the Asia Pacific region, the relaxation of social distancing measures and the strong willingness to return to offices has supported the recovery of office demand, especially in countries leading the transition from pandemic to endemic. In this month’s deck we track work from home expectations around the world (see p.3). Office markets like the Sydney CBD and Seoul saw vacancy rate improvements since the height of the pandemic, while other office markets, such as the Singapore CBD, had a positive net effective rent growth. Although rents in the Tokyo Central office market continued to decline in the first quarter of 2022 due to the quasi-state of emergency, the average vacancy rate in the Tokyo Central office market remained the lowest among major office markets in the Asia Pacific region. Major office markets across Europe show a similar recovery, although North American office markets still lag and the recovery in the largest US office markets is tepid at best.

Looking ahead, the transition from the pandemic to the endemic stage is expected to continue to support the recovery in real estate demand. However, other macro forces are now taking center stage as Covid retreats. Russia’s invasion of Ukraine, rising inflation, and interest rate hikes could cast a shadow on the recovery. Therefore, as shown in this month’s deck, the pace of improving real estate fundamentals varies greatly in cities around the world. Investors will need to pay close attention to these cross currents when underwriting new investments and adjusting portfolios.