-

Brian Klinksiek, Petra Blazkova and Hina Yamada discuss how energy prices are affecting real estate values. We property strategists are accustomed to working with traditional real estate variables such as net absorption, rental growth and vacancy rates. But in the early days of the COVID-19 pandemic, there was no choice but to go on a crash course in previously unfamiliar epidemiological concepts like positivity rates, R-naught¹ and vaccine effectiveness, as these suddenly became drivers of short-term real estate conditions. Over the past year, real estate researchers have likewise had to quickly scale a learning curve in understanding energy markets. For the first time ever, we produced charts denominated in once esoteric units of measurement like therms, MMBTUs and MWhs.²

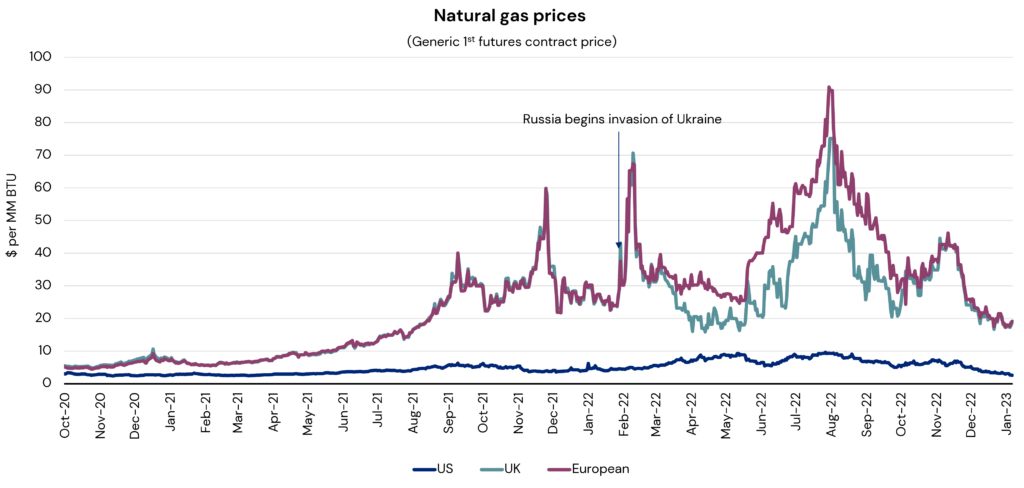

Gas, electricity and oil prices have long been linked to real estate outcomes—energy crises sparked 1970s inflation and have shaped real estate demand from Alberta to Texas and Scotland. But when supply is predictable and prices moderate, as in the years before the pandemic, those links can become dormant. They have awoken again in the past year. The recent dramatic but uneven volatility in energy prices has deeply influenced the economic and property market outlook—especially in Europe—and we expect it to continue to do so going forward.

Europe’s cold, dark winter turns brighter

One year on from Russia’s invasion of Ukraine in February 2022, European energy markets have proven adaptable, facing down a unique degree of energy disruption owing to the region’s dependence on pipeline links from Russia. After initially skyrocketing—European natural gas price at their peak were twelve-times higher relative to the ten-year, pre-conflict average—by mid-February 2023 prices it had fallen to a level only around two and a half times that long-term average.³ Government schemes to partially socialize the cost of higher energy, at the expected expense of massive government deficits and higher borrowing costs, now look a lot less extreme.

¹ R0 is the basic reproduction number, which describes the expected number of cases of an infectious disease directly generated by a single case, in a population where all individuals are susceptible to infection.

² 1 therm = 100,000 British thermal units (BTUs), a measure used in UK natural gas pricing. 1 MMBTU = 1,000,000 BTUs, which is used in US gas pricing. 1 MWh = 1,000,000 watts of electricity over one hour, used in European pricing of natural gas.

³ Refinitiv, Natural Gas TTF (Title Transfer Facility) historical front month futures as of 13 February 2023

Source: New York Mercantile Exchange and Intercontinental Exchange data via Bloomberg. As of 1 February 2023⁴

Relatively warm weather, cutbacks in consumption and alternative sources of energy, such as renewables and the global liquified natural gas (LNG) market, have contributed to unusually full gas storage reserves. German wind, solar, biomass, hydro, and other renewables generated 47% of the country’s electricity in 2022, a five-percentage point rise in mix.⁵ This allowed European energy prices to fall and has caused headline inflation to ease substantially, even if European core inflation remains stubbornly high. This has brightened the region’s economic prospects as well; our call in the ISA Outlook 2023 (published in December 2022) that a European recession was “almost certainly underway” now appears premature.

Is Europe out of the woods? Far from it. The winter is not yet over, and a cold snap could quickly deplete gas storage reserves. Going into next winter, the Russian supply that was used to partly fill those tanks last autumn will likely be completely unavailable. Meanwhile, Chinese demand for LNG, which was down by 20% in 2022 owing to the country’s zero-COVID policy⁶, is likely to rebound as its economy reopens, leading to more competition for tanker deliveries. Europe’s energy reorientation will probably be at least a decade-long process, which will not be reduced in scope, scale or difficulty by one fortuitously warm winter—though new LNG import capacity and suppliers have accelerated the shift in the past year. We expect that energy prices will continue to have deep impacts on Europe’s economy and real estate markets.

⁴ TTF future prices have been used as a benchmark for European natural gas prices due to being the most liquid gas trading hub in Europe

⁵ German Environment Agency (UBA), press release from 12 December 2022

⁶ International Energy Agency (IEA), report from November 2022Beyond Europe

While Europe’s historic reliance on Russian fossil fuels makes it uniquely exposed to energy risks, we see energy as a relevant, if variable, factor for global real estate. This is in part because energy markets operate at both global and regional scales. The Ukraine crisis caused an acute surge in European gas prices, but also a worldwide spike in the price of oil, which trades in a more globalized marketplace. It is worth noting that Canada and now the US are in aggregate net energy exporters, meaning increases in energy costs can be a net positive for economic growth in metro areas with concentrations of energy companies.

Energy and real estate

Going beyond the macro, the impact of energy costs on real estate varies greatly by building type. Data centers, cell towers, hotels, and cold storage are especially energy-hungry property types, and ones where operational business models mean landlords may be directly exposed to energy costs. Residential sectors vary widely, depending on the age and energy efficiency of the stock, the nature of building systems and leasing conventions. For example, the bulk of the older German residential inventory is heated by gas-fired boilers providing steam heat, and tenants pay “warm rents”—meaning the landlord is responsible paying for heat. Individually metered, modern multifamily product is more insulated—literally and figuratively—from energy prices.

Investments in commercial real estate sectors with net lease structures under which tenants pay energy bills directly, such as office and logistics, may appear shielded from energy volatility. But tenants in places where energy prices have surged have become painfully aware that these costs, historically a small portion of their total expense of occupancy, can suddenly become a significant burden. In our European portfolio, we have for the first time received requests from tenants to help lower their energy bills. Indeed, working with occupiers to improve efficiency and to generate on-site energy to reduce these bills has become an important way to retain them and maximize the affordability of the net rents they pay.

The limitations of electrical grids are also influencing property markets. The availability (or unavailability) of power is already shaping location decisions globally for energy-consumptive uses like data centers, and can be a constraining factor on building electrification, a key step in decarbonization. Weather events can intersect with the nuances of energy supply to cause blackouts, such as occurred in Texas in February 2021 and recently in parts of China, potentially putting a premium on buildings with backup sources of power.

These are just a few of the ways that energy risks have become closely intertwined with real estate investment outcomes. We expect to be following these issues more closely in the years ahead.

Looking ahead

- Real estate investors must begin to include energy factors in identifying target markets and sectors. For example, in Europe we have developed the LaSalle Energy Vulnerability Index (LEVI) which joins our European Cities Growth Index (ECGI) and other tools as an input to our market selection decisions. LEVI combines indicators such as the sources of energy by country, energy intensity, domestic energy consumption and import dependency, to assess countries’ relative susceptibility to energy shocks. LEVI is just an initial approach to assess energy risks. Because there is intuitively a strong correlation between climate transition risks and energy vulnerabilities, the approach we take in reflecting both sets of risks in our models may eventually converge into a unified approach.

- Expensive energy is a big additional incentive for installing on-site renewables such as solar and wind-generating capacity. Tenants are big beneficiaries of this because these initiatives tend to cut their gross occupancy costs. Landlords also capture some of this value by being able to charge a higher net rent, all else equal. This comes in addition to the premium we see the real estate capital markets placing on such building features, owing to their alignment with regulatory trends and the goal of decarbonization.

Apr 17, 2024

ISA Briefing: Climate risk in practice: Regional, market and asset-level views

Recognition has grown substantially in recent years that climate risk can shape real estate investment outcomes.